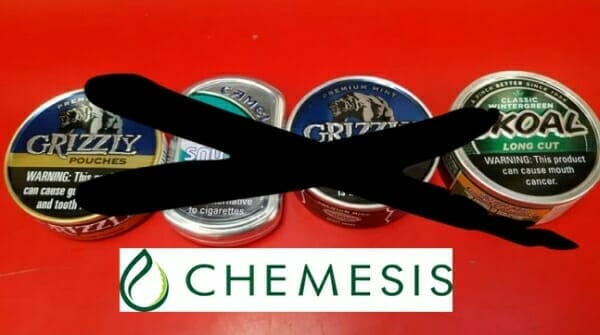

On August 12, 2019 Chemesis International (CSI.C) announced that it will start manufacturing, packaging and distributing its own line of tobacco-free smokeless cannabis and hemp-derived chew in Puerto Rico and Canada and the U.S.

A recent Equity Guru article described Chemesis as, “the Ichiro Suzuki of cannabis companies”. Suzuki seldom hit home runs, but was a specialist in short, sharp, surgical swings that put him on base and in a position to advance (4,367 career-total base hits).

Chemesis has been advancing rapidly around the bases, building a portfolio of proprietary and patented delivery methods for cannabinoids, including THC and CBD.

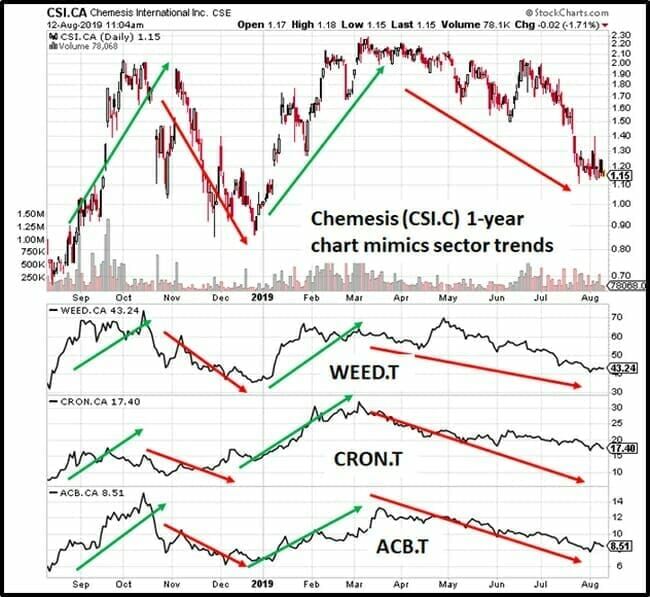

In an ideal world, every publicly traded company would be rewarded and punished purely for its own accomplishments and failures.

That never happens.

Each sector (precious metals, bio-tech, entertainment, cannabis etc.) is bullied by the ambient “market sentiment” towards that sector.

Aurora (ACB.T), Cronos (CRON.T) and Canopy (WEED.T) have a combined market cap of $29 billion. They have different challenges, debt structures and acquisition strategies than base-hitting Chemesis with a market cap of $107 million.

Yet, over the last year, the share price of the four companies have been waltzing more-or-less in harmony.

Following CSI’s recent “binding share exchange agreement” to up its position in GSRX to about 66%. , the “tobacco-free smokeless chew” now has a platform to launch from, and a pipe-line to sell through.

Upon acquiring a controlling interest in GSRX, Chemesis will effectively be a fully vertically-integrated, multi-state operator with assets in six states which includes California, Tennessee, Arizona, Michigan, Texas, and Puerto Rico, with significantly-enhanced consolidated gross revenue projections, estimated to be approximately $75,000,000 USD for the 2020 calendar year (on a fully consolidated basis).

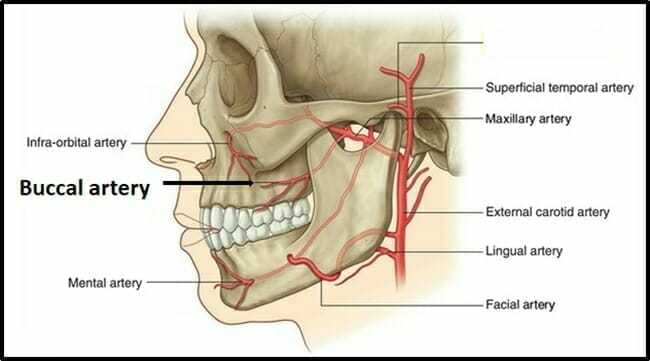

Chemesis’ new product will provide consumers a convenient, discrete, smoke-free alternative, offering quick onset through absorption via oral lining directly to the buccal artery, a delivery method that bypasses the liver, in addition to providing users a fast onset.

“Buccal https://equity.guru/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistration is intended for delivering drugs within/through the buccal mucosa in order to achieve a local or systemic effect,” states Science Direct, “This route is particularly attractive since substances absorbed through the buccal mucosa bypass gastrointestinal enzymatic degradation and the hepatic first-pass effect.”

In layman’s terms, the “cannabis and hemp-derived chew” will be delivered with maximum speed, strength and purity.

The new hemp derived chew product, which is non-psychoactive, will be available in multiple flavors and is expected to represent a healthier alternative to the tobacco-based chews in the marketplace today.

Outside the world of professional baseball, tobacco-chewing may seem like an obscure fringe cult equivalent to Melissophila (being sexually aroused by bee-stings) – but it’s actually a large, growing trend.

Key players in the chewing tobacco market are Altria Group, British American Tobacco, Imperial Brands, Japan Tobacco, Swedish Match AB, Swisher Int., MacBaren Tobacco Company, JMJ Group, Manikchand, Reynolds American and Skoal.

Grand View Market Research values the chewing tobacco market at USD $13.6 billion, with an expectation that it will grow about 7% per year in the next 6 years.

Chemesis will initially install manufacturing equipment in its California and Puerto Rico licensed facilities.

The National Institute of Health states that “CBD, a non‐intoxicating cannabinoid found in cannabis, may be a promising novel smoking cessation treatment.”

“Chemesis has put significant efforts into building a wide and differentiated product portfolio,” stated Chemesis CEO, Edgar Montero, “Aligning and symbiotic with our focus on building out our retail dispensary footprint.”

In July, 2019 the California operations processed over 3,000 lbs of trim as CSI ramps up production at its extraction facilities.

CSI also increased its THC-infused product portfolio in 2019, with a focus on beverages, edibles and topicals, and received a USD$4,000,000 minimum purchase order from Happy Tea to manufacture and distribute products.

Chemesis is prepping to plant its first 13 acres of hemp in Michigan under the previously announced cultivation license, and Desert Zen is expanding its reach to additional dispensaries in central and southern California.

The company’s Arizona CBD manufacturing facility is providing third-party manufacturing services as it works towards GMP certification.

In a May 2019 podcast, Montero spoke with Equity.Guru’s Guy Bennett about the personal catalyst that propelled him into the cannabis industry, and how CSI cross-pollinates innovation between its international operations.

Customers can expect the “tobacco-free smokeless cannabis and hemp-derived chew” to be available for purchase by early Q4 2019.

Full Disclosure: Chemesis is an Equity Guru marketing client.

Leave a Reply