“A journalist who has sworn to tell the good AND the bad – brings an extra level of legitimacy.” – Equity Guru principal Chris Parry.

“The cannabis bubble is not yet bursting, but the likelihood that it will go by the time you read this is high,” stated Parry in an August 28, 2019 midnight missive.

Isn’t Parry biting the hand that feeds him?

Shouldn’t he be sunny and positive 100% of the time?

Ex-colleagues working for traditional stock market news outlets frequently ask me: “How the fuck does Parry get away with it?”

The honest answer is: I don’t know.

Like a peacock’s plume.

Parry just is.

Before stumbling out of the office at 1 a.m., Parry posted a note on our intra-company back channel (Discorder):

Writer challenge: “Go digging into the weed portfolio, find yourself a company doing things you like, at a valuation that makes sense, with a chart that is either holding against the tide, or oversold. Then make your case. Clients or not.”

Challenge accepted.

Background: In the gold rush of 1840s, a German immigrant named Levi Strauss got rich supplying miners with denim overalls. Investment historians insist that equipment suppliers (picks & shovels co’s) made more money from the California gold rush than the miners.

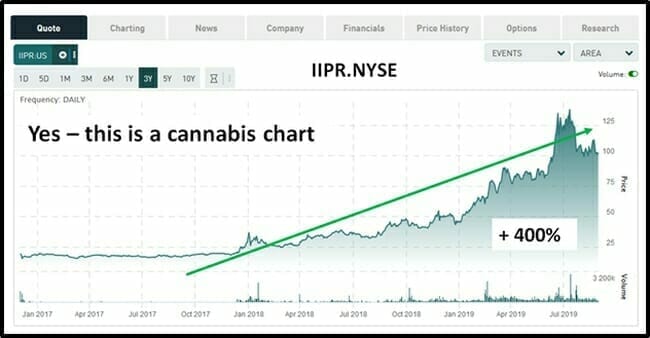

Innovative Industrial Properties (IIPR.NYSE) is a “picks and shovels” cannabis play.

i.e. it does not farm, run dispensaries, extract CBD, sell tincture or vape pens.

IIPR is a REIT that acquires freestanding industrial and retail properties from state-licensed medical-use cannabis operators. The properties are then leased back under long-term, absolute net lease agreements.

REITs operate under unusual regulatory guidelines. Every REIT is required – by law – to distribute profits to shareholders.

IIPR’s payout has increased 135% this year (2.3% dividend yield) as it locked a dozen new tenants into 15-year leases with built-in annual rent increases.

“If we’re using ‘adjusted operating income’ as a guide, and you’ll probably find plenty of balance sheet wonks suggesting we shouldn’t, seven companies currently have positive figures in that column,” wrote Parry on July 5, 2019, including Innovative Industrial Properties (IIPR.NYSE) which boasts $3.4 million on $6.8 million in sales.”

IIPR focuses on well-capitalized companies that have been granted a license in the state where the property is located.

We act as a source of capital to these state-licensed operators by acquiring and leasing back their real estate. This allows for the opportunity to redeploy the proceeds into core operations, yielding a higher return than they would otherwise get from owning real estate.

IIPR works with cultivators, processors, distributors and retailers.

IIPR Biz Model Template:

- · Targeted deal size – $5 million to $30 + million

- · Additional expansion capital available

- · Lease term – 10 to 20 years

- · Initial base rent – 10% to 16% on total investment

- · Annual base rent increases – 3% to 4.5%

On August 7, 2019 IIPR announced fiscal results for the quarter ended June 30, 2019.

Q2, 2019 IIPR Highlights:

- Rental revenues of about $8.3 million – a 155% increase from Q2, 2018.

- Net income available to common stockholders of $3.1 million

- Quarterly dividend of $0.60 per share on July 15, 2019 to common stockholders – a 140% bump from Q2, 2018.

On August 12, 2019 IIPR announced a long-term lease and development agreement with a subsidiary of PharmaCann, for a 23,000-square-foot industrial facility and an approximately 31,000-square-foot greenhouse facility on the property.

IIP’s total investment in the property will be $30 million (excluding transaction costs). PharmaCann is a multi-state cannabis operator with licenses in Illinois, Maryland, Massachusetts, New York, Pennsylvania, Ohio and Virginia.

This acquisition and lease marks IIPR’s fourth transaction with PharmaCann.

“Innovative Industrial Properties has been our real estate partner since 2016,” stated Teddy Scott, CEO of PharmaCann. “We are focused on the development of this property, and look forward to bringing our expertise and standard of product quality to patients throughout the state.”

As of August 12, 2019, IIPR owned 27 properties located in Arizona, California, Colorado, Illinois, Maryland, Massachusetts, Michigan, Minnesota, New York, Nevada, Ohio and Pennsylvania, totaling approximately 2.1 million rentable square feet.

IIP’s average current yield on invested capital is about 14.5% for these 27 properties.

“I went largely into cash, selling most of my weed investments, in February of this year, and did so publicly,” stated Parry in the August 28, 2019 article.

Parry has reinvented the rules of “sponsored coverage”.

For the decade I’ve been in the capital markets, the mantra has always been: “Whoever writes the cheque, has editorial control.”

That wasn’t a guideline.

It was an edict.

Break it, you get fired.

CFOs, Communication Directors and IR specialists are not trained to be literary editors.

Vibrant story-telling was often reverse-engineered back into a press release.

End result: frustrated writers, frustrated clients, skeptical readers.

“Of course, I’m not protected from the crappy markets,” confessed Parry, “I’m still sitting on some deals that are under trade halts and some crazy low-priced deals that have since gone crazy lower still. Even the prepared can be caught unprepared if the hurricane is blowing hard enough, and this one, she’s a puffing.”

If all IIPR’s tenants go bankrupt, so will they.

But so far, the buildings and the business model appear to be hurricane-proof.

– Lukas Kane

Full Disclosure: Equity Guru has no financial relationship with the companies mentioned in this article.

Leave a Reply