Pre-dawn drone attacks on two major Saudi Arabian oil facilities over the weekend sent shock waves across the planet.

These weaponized drones hit their mark with savage accuracy, lighting up the gated processing community of Abqaiq, ratcheting up tensions in a region already considered volatile.

“One official said there were 19 points of impact on the targets and the attacks had come from a west-north-west direction – not Houthi-controlled territory in Yemen, which lies to the south-west of the Saudi oil facilities”, stated unnamed US officials.

This alarmingly precise aerial attack took 5.7 million barrels of oil out of circulation—more than half of Saudi Arabia’s daily output set for export. This figure represents more than 5% of the worlds daily crude oil consumption.

Earlier in the year we speculated that the Middle East was bound to generate a severe price shock. We questioned the lack of a risk premium built into the price of oil at the time:

“Another weighty consideration: oil is probably the most geopolitically sensitive commodity there is. Brian Williamson, Jericho Oil’s (JCO.V) CEO, in a recent thought-provoking interview with Equity.Guru’s Chris Parry, reminded us of the fact that we haven’t experienced a serious geopolitical shock in over a decade. Conflict is inevitable. If war breaks out and threatens any one of our major shipping channels, the price at the pumps might force you to keep it parked.”

Risk premiums may be on the verge of making a serious comeback…

Soaring prices

When trading resumed overseas on Sunday night, the October WTI futures contract surged as high as 19%, THE biggest single session price gain since the 1991 US invasion of Iraq.

Predictably, there are a lot of theories regarding WHO is behind this brazen winged assault. A quick google search produced multiple fingers pointed at Iran, the usual (convienient) suspect.

Read: Evidence indicates Iranian arms used in Saudi attack, Riyadh says

“Saudi Arabia said on Monday that the attack on its oil facilities was carried out with Iranian weapons, according to a preliminary investigation, but stopped short of directly blaming regional foe Iran.”

Of course, Trump had to chime with his predictable, hackneyed war metaphors:

“Locked and loaded”… Putz!

Tehran dismissed the U.S. accusations as “unacceptable” and said it was ready for a “full-fledged war.”

There are other spins on this event. Some believe Israel was behind the attack.

Conspiracy chatter on some of the online chat sites suggests it was an inside job—that the Saudi’s themselves took out their own facilities in a scheme designed to goose oil higher.

One thing’s for sure: the Saudi’s need higher oil.

Ryan Fitzmaurice, energy strategist at Rabobank:

“The Saudis are inevitably frustrated. They have gone above and beyond” to lift prices.

They need crude in the range of $80 to $85.00 according to one IMF official, in order to balance their budget this year.

But there’s more at stake than balanced spending. Waaay more…

There is a colossal IPO in the works involving Saudi-Aramco—the worlds largest oil producer with an estimated 270 billion barrels in reserves and USD 355.9 billion in annual revenues (2018 figures). Crown Prince Mohammed bin Salman’s plans to IPO 5% of this behemoth in a deal valued at $2 trillion. This may be the largest IPO ever, but higher crude prices are needed to make it happen.

Michael Tran, director of global energy strategy at RBC Capital Markets:

“Clearly they need high prices for the IPO and on a fiscal basis to support military plans and social programs. The entire country is intertwined with oil prices.”

Read: Saudi Arabia is in a rush to boost oil prices as it gears up for Aramco IPO ‘very soon’

Question: when will the Saudis restore full production to the facilities? And perhaps even more pressing, who will ultimately be blamed for the attacks and what form will the retaliation take?

Ron Paul, American author, physician, and retired politician:

“What is remarkable is that all of Washington’s warmongers are ready for war over what is actually a retaliatory strike by a country that is the victim of Saudi aggression, not the aggressor itself. #Yemen did not attack Saudi Arabia in 2015. It was the other way around. If you start a war and the other country fights back, you should not be entitled to complain about how unfair the whole thing is.”

“The neocons want a US war on Iran at any cost.”

Read: Will Trump Take Neocon Bait and Attack Iran Over Saudi Strike?

Clearly, these are dangerous times. But as the Chinese are oft heard to say, ‘a time of danger also presents a time of opportunity’.

A time of opportunity

With this historic price spike in oil and the possibility of a risk premium developing, and sticking, junior oils—producers and developers on the low end of the food chain—could begin catching a serious bid.

Our Jericho coverage has been extensive over the past ten months, and for good reason. The slack in the junior oil arena since our coverage began had nothing to do with the quality of the company’s assets. It had everything to do with investor sentiment and the lack of institutional funds flowing into the sector. That may be about to change.

Investors new to this arena need to understand that historically, exposure to high-quality, asset rich O&G companies have generated enormous profits for shareholders. And that these profits have produced many a retirement nest eggs over the decades.

The smarter junior oil companies, like Jericho, have been biding their time, riding out the current weakness in the sector, waiting for sentiment to turn positive. When funds begin flowing back into these high-quality juniors, companies like Jericho will resume their journey along the development curve.

A prudent strategy

Things have been quiet on the Jericho news front in recent months, for the reasons explained above.

The horizontal wells the company plans to drill are extremely sensitive to spot prices due to the huge volumes produced in the first six months. It makes sense to hold off development until oil prices are in the zone—at a level that will give both company and stockholder the biggest bang for their buck.

“But doesn’t all this waiting come at a cost?” Fair question.

Jericho’s acres are all held by production (HBP), meaning, they have no punitive clock ticking down forcing their hand. Management can sit tight and wait for the opportune time to sink the bit back into the ground. HBP acres are held in perpetuity, as long as there is some form of production on the property.

A review of what they’ve got

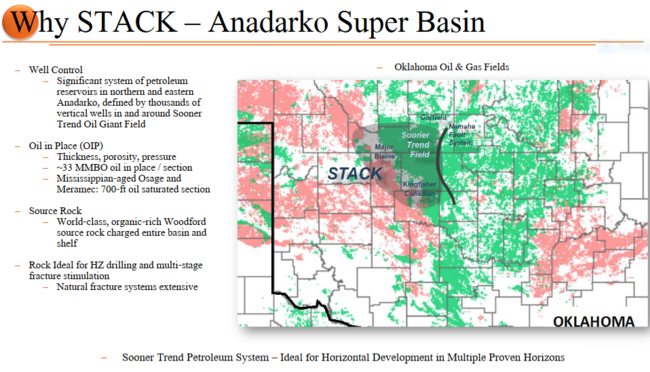

Jericho boasts an enviable land position of some 55,000 acres, including 16,000 acres in the Anadarko basin STACK play of Oklahoma. Incidentally, the Fraser Institute ranked Oklahoma THE best O&G destination on the entire planet.

Named after the counties of Sooner, Trend, Anadarko, Canadian, and Kingfisher, the STACK has evolved into a premier North American horizontal development play.

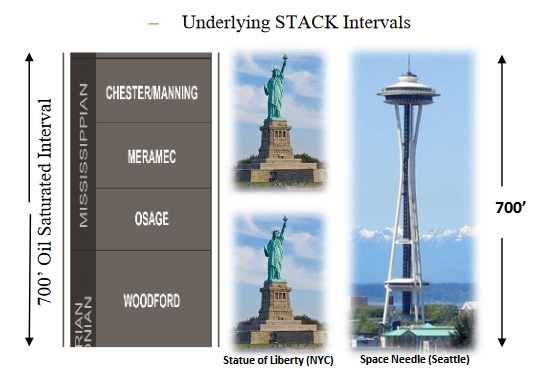

The acronym is also apt as multiple, stacked, productive formations are present in the area: Chestermanning, Meramec, Osage, and Woodford.

This a prolific hydrocarbon system. The STACK’s hallmark: high oil and liquids-rich natural gas content, multiple horizontal target horizons, extensive production history, and historically high drilling success rates.

A coveted address

The region is dominated by a handful of large producers—Encana, Continental, Devon, Marathon Oil, Alta Mesa, and a few others. These companies have poured billions of dollars into developing their STACK assets.

Jericho is strategically positioned in a land of giants.

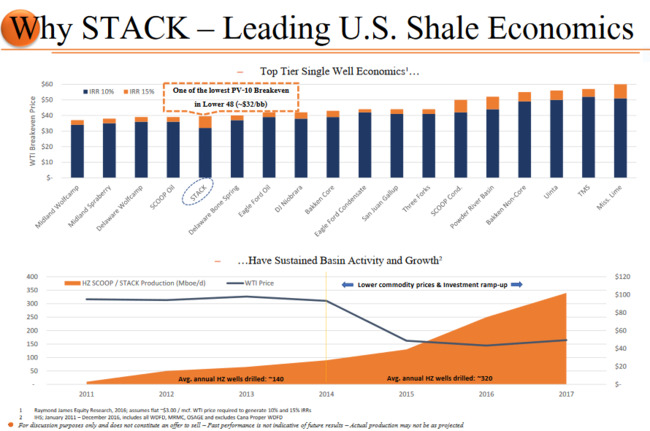

The STACK is among the lowest cost basins on the entire continent. The region is flush with infrastructure. The area has good takeaway capacity—there are good pipes in the ground.

Good takeaway capacity means exacting the best possible price for extracted oil.

A typical 1-mile horizontal well produces approximately 500,000 to 1,000,000 barrels of oil equivalent with rates of return greater than 75%. These are very respectable numbers.

Final thoughts

Though news has been light of late, earlier this year the company announced 33% total production growth in 2018—a record high—and a 30% reduction in operating expenses.

But the real value creation will come when the company decides it’s time to resume drilling. That decision may not be too far off.

Checking my live streaming futures charts, oil is holding on to the bulk its gains overseas as the investment world, rattled by these recent events, waits for the other shoe to drop. There can be little debate that oil is currently the most geopolitically price-sensitive commodity going.

Jericho, with 128.62 million shares outstanding and a $0.30 price tag, has a market cap of $38.58M.

With multiple development opportunities in a rising oil price environment, the company is in a prime position to create significant shareholder value.

END

—Greg Nolan

Full disclosure: Jericho Oil is an Equity.Guru marketing client.

Leave a Reply