Kushco Holdings (KSHB.Q) saw its stock drop 37% today, and although nobody knows why for certain, it’s clear there’s a sickness here somewhere.

To set the scene, Kushco Holdings is cannabis-related company, and they just announced a new financing. Normally, there’s nothing spectacular about that (for better or worse) but the story goes deeper.

Kushco is selling vaporizers at a time when the Center for Disease Control and Prevention has reported the number of lung sickness and deaths related to vaping has reached 805 confirmed cases across 46 states and the Virgin Islands.

Kushco, to its credit, does more than sell vapes, and the vaporizer hardware and technology it offers is for cannabis related products, but the initial reports of vaping-related sickness placed the blame with black market THC products.

But the blowback is agnostic in terms of tobacco or cannabis: On Sept. 11, 2019, the Trump White House announced its plan to ban nicotene-containing flavoured electronic cigarettes as a means of protecting teenagers from this sickness, a demographic which accounts for a considerable portion of market share for companies like Juul.

With a mounting death toll and increasing political pressure, Juul’s CEO, Kevin Burns, stepped down yesterday, and the company will suspend all U.S. advertising.

This resignation, immeditately followed by the announcement tobacco-giants Altria (MO.NYSE) and Phillip Morris (PM.NYSE) cancelled their merger, has meant considerable uncertainty surrounding the near-term regulatory environment for the tobacco and cannabis industries.

What does this have to do with Kushco?

Good question. The company’s financing was announced on the same day it tanked. Did one cause the other?

That’s impossible to determine, but it’s possible that the company’s shaky outlook combined with the macro events described above prompted a massive selloff.

Everything in red is insiders dumping shares, and they’ve been dumping them for a long time, implying they knew something we didn’t.

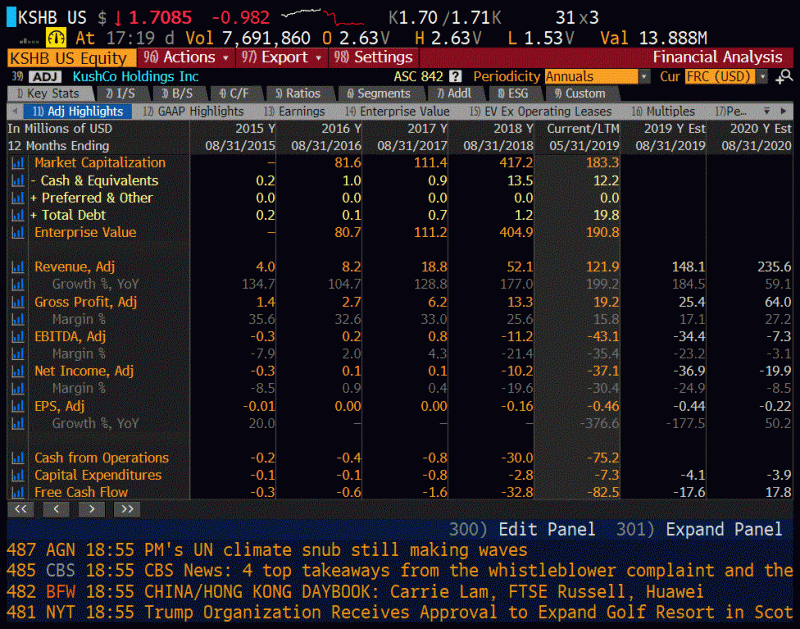

Kushco’s revenue is growing, but gross profit margins and free cash flow are down while debt has grown substantially since 2018. The company reported having just over USD$12M in cash at the end of Q2.

Additionally, inventory is up to $52.2M from $11.8M at the end of Q3 2018, meaning the company is having a tough time moving product, despite increasing revenues.

Today, the company announced it was trying to raise $30.1M through a private placement. The units were priced at $1.75 and came with one share and a warrant to purchase half a share at an exercise price of $2.25.

The company’s stock opened at $2.63, and soon came crashing down to $1.70 at market close.

Our view? Insiders and retail traders alike are betting against companies involved in the vaping space, likely due to expectations of increased regulation in the industry.

The takeaway is that:

- The company is raising money for “working capital and for other general corporate purposes,” which is another way of saying they’re broke;

- Investors who got in on this financing have seen the company’s stock price now so below strike price that it’s uncertain if they’ll ever be able to convert their warrants;

- The company is broken from an operational standpoint.

Tilt Holdings (TILT.C), another company in the vaping space, was also down 5.6% by market close to its all-time low of $0.34, while Vapen MJ (VAPN.C) was down 5.3% to $0.90.

It’s unclear what the future holds for companies in the vaping space, but it’s likely the stocks won’t stop dropping until the bodies do.

–Ethan Reyes

Leave a Reply