The Institute of Supply Management (ISM) U.S. manufacturing survey was released yesterday and, boy, did it ever raise alarms.

Estimations of the ongoing U.S.-China trade war have been on a piecemeal basis up until now: It is common knowledge American soybean farmers are struggling, but calculating the material effects on U.S. business as a whole has proven difficult.

Bloomberg economists Dan Hanson and Tom Orlik predict the trade war will shrink the global GDP by $600B in 2021, while the ISM’s most recent report shows the toll trade tensions have taken on American industry.

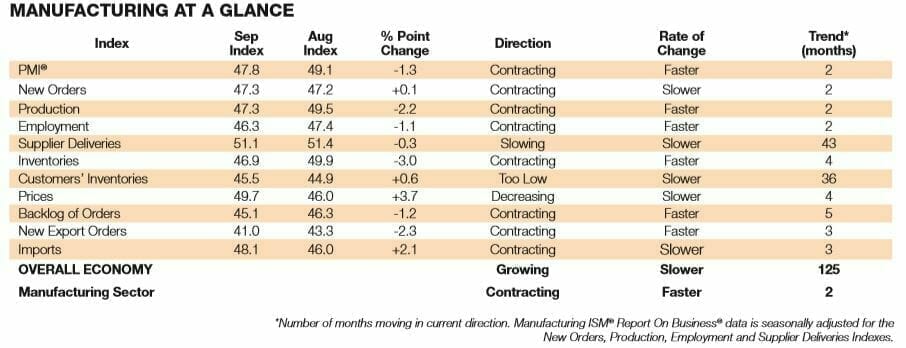

To recap, the ISM’s report compiles data on American businesses and releasing the information via two separate reports on the manufacturing and non-manufacturing sectors.

The Institute’s Business Survey Committee, a group made up of more than 300 purchasing and supply executives from across the country, provides the data. Members of the committee respond anonymously and confidentially to a monthly questionnaire about changes in production, new orders, new export orders, imports, employment, inventories, prices, lead times, and the timeliness of supplier deliveries in their companies comparing the current month to the previous month.

In terms of manufacturing, the Purchasing Manager’s Index (PMI) slipped to 47.8% in September, a 10-year low and marking the second consecutive month of contraction.

A PMI is not only useful to industry players in terms of supply chain management and production targets, but it also acts as a bellwether for the broader economic outlook worldwide.

The U.S. isn’t the only country with a lagging PMI. China, Russia, Germany, and the U.K. are just a sample of developed nations sitting with a negative index ratio.

Global manufacturing, according to JPMorgan, rests at 50.90, only marginally better than the previous month which came in at 50.70.

Historically, when production slows down, economies tend to follow into recessional territory. China’s predicament could lead to a massive string of credit defaults when $63 billion dollars in Chinese corporate debt comes due during the fist half of the 2020.

Should we be worried?

In August 2019, global PMI registered at 51.3 and came close to a three-year low with job growth beginning to stagnate and business sentiment in the toilet.

The U.S./China trade war isn’t helping. The rounds of rising tariffs are hurting exporters, agriculture, manufacturing in both countries, but there are serious knock-on effects to their continued struggle.

Other countries not directly involved will still be impacted with decreased demand for their exports as well as supply chain issues.

Bloomberg predicts Taiwan, South Korea Malaysia and numerous other Southeast Asian countries would feel the blowback of decreased exports from China to the U.S.

After the U.S., Canada, Mexico and Ireland stand to lose the most from decreased American exports to China.

IHS Markit has stated that economic global economic growth in 2019 and 2020 was only nominally better than the agency’s 2% threshold for a world recession.

The Official NBS Manufacturing PMI in China edged up slightly to 49.8 in September from 49.5 in August, beating market expectations but is still in contraction.

Trump has promised new tariffs by October 15 if both countries are unable to resolve the dispute. Another round of penalties will be the fiscal equivalent to a punch to the throat and may put China on a spiral, though international markets are sure to feel the effects as well.

The International Monetary Fund forecasts the tariff war could cut global growth from 3.2% to 3.5% between 2019 and 2020.

Where does an investor turn in the coming storm?

Tech is a minefield at the moment. Cryptocurrency is losing momentum, blockchain is still five years off and Silicon Valley venture capitalists have lost their collective mind.

Speaking of which, after bringing loss-making dogs like Uber (NYSE.UBER), Peloton (NASDAQ.PTON) and Lyft to (NASDAQ.LYFT) market. These very same financiers are getting together at a conference to figure out how to make direct listing the IPO standard. Silicon Valley VC firm officials accuse big banks of “mispricing” IPOs for decades. Slack is trading about four dollars less than its reference price, and it was a direct listing. Pot meet kettle meet shorting opportunity.

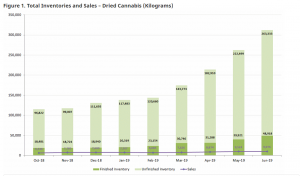

Canadian cannabis stinks right now, supplies far outstrip sales, there will be a bloodletting as the sector figures out not everybody is going to toke up and if they did, they wouldn’t pay $70 for an over-packaged embarrassingly dry eighth. There is a market for legal weed, but the smoke still has to clear as emphasized by the following graph from Health Canada. Needless to say, lots of shorts, lots of consolidation.

Endo (NASDAQ.ENDP), J&J (NYSE.JNJ), Teva Pharmaceutical Industries (TLV.TEVA), Allergan (NYSE.AGN) and Mallinckrodt (NYSE.MNK) are running scared as Purdue is in Chapter 11 over its hand in the opioid crisis. These other firms are seeking to shield their liability through Purdue’s bankruptcy. What a snakey way to escape liability. Don’t know if they will be able to convince a judge to let them do it as it would be setting some serious precedent. Short the shirt off these people just out of spite?

Price security in oil still hasn’t materialized for either the industry or the commodity. Shale oil production in mature fields like Eagle Ford has pretty well peaked. The advances in extraction technologies combined with everybody and their dog drilling a well over the last decade, has sapped supplies and it isn’t going to get better.

This means projections will be off, wells won’t be as productive and as the majors get dug in districts like the Permian basin, junior explorers to mid-tier producers in American shale are going to feel the squeeze, especially if financing remains tight and crude prices stay where they are.

Also, the Yemeni drone attack is a faded headline now that Aramco is back up to full capacity. As a result, WTI crude continues to slip below $54 a barrel. Near-term shorting opportunity in unconventional junior explorer stock options or oil futures, perhaps?

Silver and gold are great long options. Not just the futures but the metals themselves. Buying silver is better than no interest in a chequing account and it’s an asset that you can easily spend. Think about that. Gold is also way better than no interest in a chequing account, but it’s harder to get into, harder to store and more difficult to exchange.

Another long option is one of the tech’s actual performers – Match.com (NASDAQ.MTCH). Admittedly, the FTC is suing the company for allegedly sending false romantic invite advertisements to users, but if there is a decision against Match it would only be about 3% of the company’s total revenue. They wouldn’t feel a thing. If you’re still not convinced, you should check out their financials.

So even though we may be slipping into the deepest recession since the depression, there are options for you as an investor if you are diligent in your research and strong in your resolve. Work out your plan with your investment adviser and you too could learn to live with shrinking PMIs.

–Gaalen Engen with files from Ethan Reyes

Leave a Reply