I recently met an electrical engineer in Chengdu China I’ll call “Mr. Kin”. He’s 53 years old, works for a private utility company. He’s been a member of the Communist Party of China since he was 18 years old.

Mr. Kin is not rich, but he’s not poverty-stricken either. His daughter is studying psychology at The University of Western Australia. He and his wife traveled to Cambodia last winter to tour the Angkor Wat Temple.

In China – as in the U.S. – the “U.S.-China Trade War” dominates the financial news cycle.

Trump claimed that taxes on Chinese goods will allow the US to pay down “large amounts” of the US’s $21 trillion debt. The actual raise is about $21 billion (0.1 percent of the total debt). Trump has added about $1.6 trillion to the debt since taking office.

So Trump’s debt reduction agenda is stumbling out of the gate.

Meanwhile in China, Trump’s tariffs have not brought the Chinese to their knees.

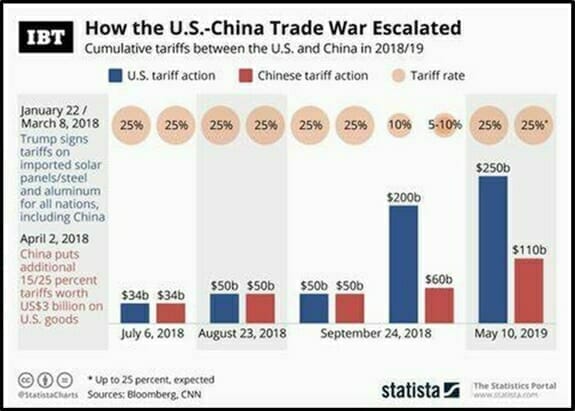

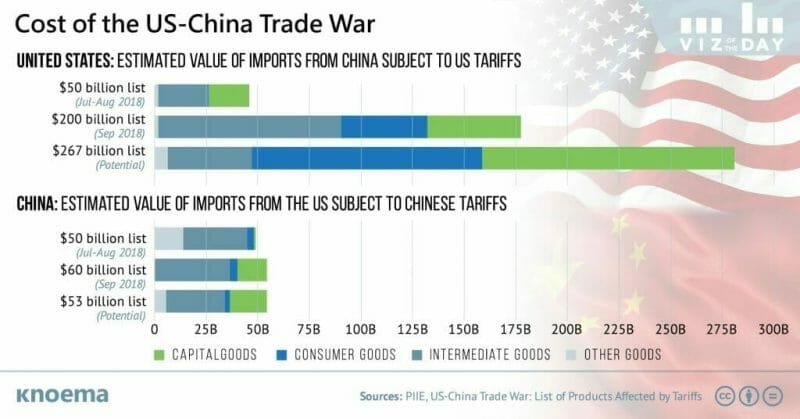

The outcome of the trade-war will affect interest rates, the yield curve, the price of gold and the direction of the Dow Jones Industrial Average.

Investors have a significant stake in how this trade war is going to play out.

Although China’s President Xi is not facing a 2020 election, to some extent his survival depends on the goodwill of the Chinese populace.

With that in mind, I asked Mr. Kin to share his insights into China and the current U.S.-China trade war.

During the interview, I launched the questions in crude Mandarin. Mr. Kin speaks fast, using slang, in a northern dialect. Well beyond my comprehension abilities. Mr. Kin’s answers were recorded, translated professionally, edited for brevity.

Equity Guru: How has China Changed over the course of your life?

Mr. Kin: During childhood I ate meat once a year. After high school, I have meat every month, and fish and fruit. When I was 20, I purchased my first appliance, an electric stove.

The standard of living improved by leaps and bounds. Bought a car, a house. National self-confidence greatly enhanced. Through the internet, young people’s intelligence is expanded.

Equity Guru: Is communism a good political system for China now?

Mr. Kin: The Communist Party of China aims to “serve the people”. In a typical family, the parents worry about the children. How to make their lives better. China is the family. The Communist Party has a parental role. It gives us a sense of security and pride.

Equity Guru: What advantages does communism have over democracy?

Mr. Kin: This question betrays a misunderstanding. Communism and democracy are not contradictory. Communism is a belief, a philosophy, a way of thinking. Democracy is a form of government. Two different things, that can’t meaningfully be compared.

Equity Guru: Can democracy can work in China?

Mr. Kin: China is a multi-ethnic, multi-cultural, multi-religious country, social problems are complex. Promoting democracy is a gradual process. If too hasty, it will bring instability. [Editor’s note: see Russia – Mr. Kin may have a point]. We can create our own style of democracy in China. But it can not be done overnight.

Equity Guru: Who is your favorite American president?

Mr. Kin: Obama, because he is young, handsome and a little bit sexy.

Equity Guru: What do you think of President Trump?

Mr. Kin: He helps the Americans relieve stress. He does not understand our country, our people, our leadership, the way we think. Can’t accept that we are getting stronger while America is getting weaker.

Equity Guru: Describe the previous trade deal between the U.S. and China.

Mr. Kin: Under this agreement, China slowly catches up to the U.S. in terms of technology, sophistication and wealth. If the agreement needs to be changed, then the two sides must sit down to re-develop this agreement with good intentions.

Equity Guru: Why did President Trump start a trade war with China?

Mr. Kin: Because he wants to restrict China’s economic growth.

Equity Guru: Does China steal intellectual property from the US?

Mr. Kin: When did “knowledge” turn into a commodity? Knowledge belongs to the inventor. Did China to steal anything from the U.S.? Complainants need proof. So far, it’s just slander. Only weak powerless people think of themselves as victims.

Equity Guru: What is President Trump trying to achieve with this trade war?

Mr. Kin: He wants to defeat the China’s economy and crush China’s confidence. This will give the U.S. has a chance to breathe. Trump believes that defeating China will make the U.S. stronger. We will find out. In the mean time, China is doing its own thing.

Equity Guru: Can President Trump win this trade war?

Mr. Kin: Ha. There is no chance. The U.S. economy is not strong. Chinese people save money. American’s spend it. Chinese have a phrase called “The Shift”. It means changing strategy, changing tactics. If Trump wants to win the trade war, he will have to shift.

Equity Guru: Are you willing to suffer economically to win the trade war?

Mr. Kin: The trade war is a zero-sum game. It’s upside down. Trade, not war, is the game. Of course, if we need to suffer, we will suffer.

Equity Guru: What is your opinion about the U.S. position on the world stage?

Mr. Kin: An open, intelligent, sophisticated, arrogant, narcissistic, country in decline. But we can learn from them. Culture, politics, financial engineering, we need to study their systems.

Equity Guru: What is America’s biggest strength?

Mr. Kin: The Big Mac.

Equity Guru: What is America’s biggest weakness?

Mr. Kin: Their enemies.

Equity Guru: What is China’s biggest strength?

Mr. Kin: Large population and one mind.

Equity Guru: What is China’s biggest weakness?

Mr. Kin: Decades of feudal rule have weakened economic structures. Education must get deeper and wider. Technological development is too slow. Hardware must be upgraded.

Equity Guru: What do you think about of the pro-democracy protests in Hong Kong?

Mr. Kin: In 100 years of colonial rule, Hong Kong has deviated from Chinese culture. Young people do not understand history. This violence. What are the consequences to the motherland? The Hong Kong protestors are like spoiled children yelling at their parents.

Equity Guru: If President Xi gave in to Trump’s tariffs, what would the Chinese people think?

Mr. Kin: Trump must also accept China’s tariffs.

Equity Guru: How has this trade war affected you personally?

Mr. Kin: It hasn’t.

U.S. retail sales rose 0.4% in August, 2019. China’s retail sales are rising 1,800% faster than the U.S.

More than 160 American industry groups declared opposition to Trump’s tariffs.

President Xi would love for China’s economy to boom now. But he is more focused on his legacy.

The concept of “legacy” for President Xi, does not mean “What will the pundits say in 2023?” – it means, “What will they write about me in 500 years?”

If your investment portfolio is constructed on the assumption that the U.S. will “win the trade war”, the attitude of regular communists to their beloved leader may give you pause.

President Xi’s counter-tariffs against the U.S. have signalled that he will not capitulate to U.S. bully tactics.

Of course, Xi could be bluffing.

And Mr. Kin might be an unwitting mouthpiece for that bluff.

But given the upbeat hustle-bustle on the streets of China, I wouldn’t count on it.

– Lukas Kane

Full Disclosure: The writer is married to a member of the Chinese Communist Party.

Leave a Reply