At the beginning of this year, and several times since, we covered numerous exploration plays on both sides of the Ontario-Quebec border—ExplorerCos kicking rocks and probing the subsurface of prolific geological settings like the Abitibi Greenstone Belt.

Only the gold fields of South Africa have outproduced the Abitibi where more than 200 million ounces of gold have been hauled to surface since the first deposits were discovered just over a century ago.

The Abitibi provinces represent two of the safest mining jurisdictions on the planet. This is an important consideration when conducting due diligence on an exploration vehicle.

A twitchy landlord, one who suddenly decides he needs a geology lesson, visiting your project with an armed escort only days after your company announces a significant new mineral discovery, can be a hugely destabilizing event. I have stories.

The Fraser Institute publishes an annual survey that ranks mining jurisdictions. They take into consideration a region’s mineral endowments along with public policy factors such as taxation and regulatory uncertainty—factors that affect the flow of exploration dollars.

Quebec ranks firmly in Fraser’s Top Ten. Ontario was there last year but has since slid a little further down the list.

Aside from the whopping 200 million ounce-count noted above, the Abitibi has surrendered some 654 million oz’s of silver, 16 billion lbs of copper, and 34 billion lbs of zinc.

Geology lesson

The genesis of Abitibi’s fabulously rich orebodies lie in its Archean Age geology:

2.6 billion years ago, the Abitibi region was probably the last place you’d wanna lay down a picnic blanket.

Erupting volcanoes puked huge volumes of mafic and felsic lava—flows which laid the foundation for a vast assemblage of volcanic, sedimentary, and intrusive rocks.

It’s estimated there were seven periods of volcanic activity in the region. There was also extreme compression brought on by the violent interplay of the earths plates as they met and jostled for position.

Ultimately, heat, pressure, and time did a number on these volcanic and sedimentary rocks. The impact: low grade metamorphism. The benefit: über–rich mineral deposits.

Structural breaks like the Porcupine-Destor and Cadillac-Larder Lake faults are home to some of the richest deposits along the Abitibi Greenstone Belt.

Deposit types common to the Abitibi include shear-hosted quartz-carbonate vein deposits, porphyries, iron-formation hosted deposits, volcanic-hosted massive sulfide (VMS) deposits and orogenic type deposits.

Though the Abitibi is our primary focus here, we’re including settings outside that prolific greenstone belt (how could we not venture into Red Lake?)

The Gold Camps

- The Timmins-Porcupine Gold Camp of Northern Ontario, home of the Dome, McIntyre and Hollinger gold mines.

- The Kirkland Lake Gold Camp, a Mile of Gold sporting no less than seven high-grade mines all chipping away at one single orebody.

- The Red Lake Mining District aka “the high-grade gold capital of the world”.

- The Hemlo Gold Camp – a staking rush which rivaled the Klondike, setting up the rich Page Williams, Golden Giant and David Bell Mine gold mines.

- The Malartic Gold Camp, home of Quebec’s largest gold mine at 500,000-plus ounces per year.

It’s said that the best place to find gold is in the shadow of the headframe of an old mine—the Abitibi landscape is peppered with such headframes.

We cast a fairly wide net when we first compiled our list of Abitibi ExplorerCos back in early January of this year.

Some of our offerings fell flat but are still in the game (general sector weakness has taken a toll), some tacked on decent gains, one tacked on truly spectacular gains.

For those new to the junior exploration arena, a company’s shares can represent better value AFTER they’ve made a solid push higher—after they’ve doubled or tripled in price. I’ll show you what I mean a little further down the page.

For the purpose of keeping this article tight, we’ll focus only on those companies from our previous list that are currently active in the region.

The ExplorerCos

Chibougamau Independent Mines (CBG.V)

- 46.7 million shares outstanding

- $4.44M market cap based on its recent $0.095 closing price

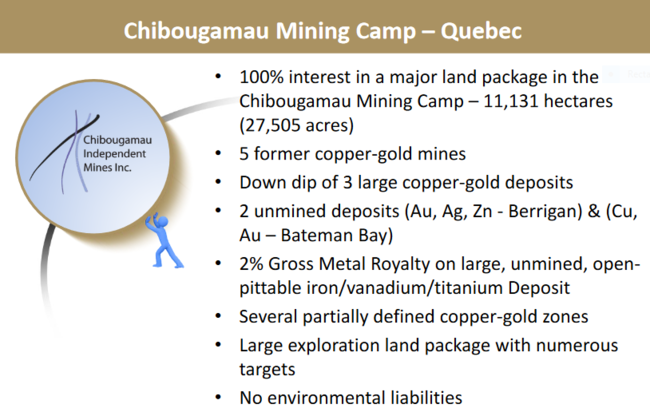

CBG is based in the Chibougamau region of Quebec along the northeastern Abitibi, an area that has served up over 6.7 million ounces of historical gold production.

The company boasts multiple projects with the potential to convert historic resources (non NI 43-101 compliant) into NI 43-1012 compliant numbers.

We’re talking about roughly 3.3 million tonnes at an average grade of 1.78% Cu and 2.92 g/t Au.

This slide from the company’s Aug 2019 i-deck summarizes some key company fundamentals…

Since our coverage last spring, the Bateman Bay Property, a wholly-owned project located in McKenzie township east of Chibougamau, has been the company’s primary focus.

Drilling on the project was designed to follow up on significant results from the C-3 Copper-Gold zone earlier in the year:

- Hole BJ-19-17 intersected 4.33% copper (Cu), 3.69 g/t gold (Au), and 19.62 g/t silver (Ag) over a 22 meter core length

- Hole BJ-19-18 intersected 7.70% Cu, 3.58 g/t Au, and 33.25 g/t Ag over a 9.2 meter core length

- Hole BJ-19-21 intersected 3.06 Cu, 2.96 g/t Au, and 13.04 g/t Ag over a 15.68 meter core length

- Hole BJ-19-22 intersected 3.02% Cu, 0.48 g/t Au, and 20.20 g/t Ag over a 45.40 meter core length (15.6 meters true width)

Additional results reported on August 8th (intervals from above and below hole BJ-19-22):

- 1.44% Cu, 0.36 g/t Au, and 5.55 g/t Ag over an additional true width of 1.34 meters (4 metres above and adjoining the previously reported intersection in hole BJ-19-22)

- 1.66% Cu, 2.01 g/t Au, and 5.7 g/t Ag over 11 meters for a true width of 3.70 meters (11.6 meters below the previously reported intersection in hole BJ-19-22)

“Drilling to date indicates that the zone is open to the northwest and southeast at depth as well as to the southeast towards the surface.”

Then, on Aug 20th, the company dropped news that it had idled the rig at C-3 in order to conserve capital.

Management intends to return to the project in the winter to test the southeastern strike of the zone from the ice as “drilling from a barge would be very costly.”

The company went on to add:

“Core from the last holes is currently being bound onto pallets and will be moved to our Rouyn-Noranda coreshack where final logging and core splitting will take place and samples sent for analysis.

Immediately after terminating the C-3 drilling, the drill was moved to our 100% owned Copper Cliff property to test a perceived plunge direction of historical gold mineralization. This core is also being transported to Rouyn-Noranda for detailed logging, splitting and assaying.”

Obviously, the market found no joy in this press release. Newsflow is what drives interest in an ExplorerCo. The market will have to wait until winter sets in and the lake is iced over enough to support the weight of a drill rig.

This current weakness might represent an opportunity.

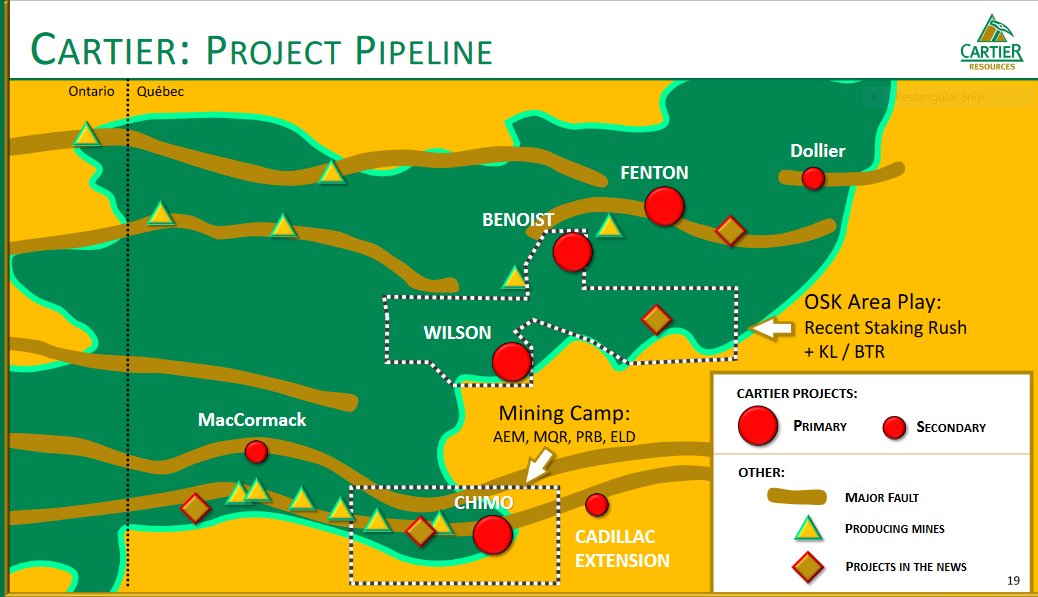

Cartier Resources (ECR.V)

- 177.1 million shares outstanding

- $26.57M market cap based on its recent $0.15 closing price

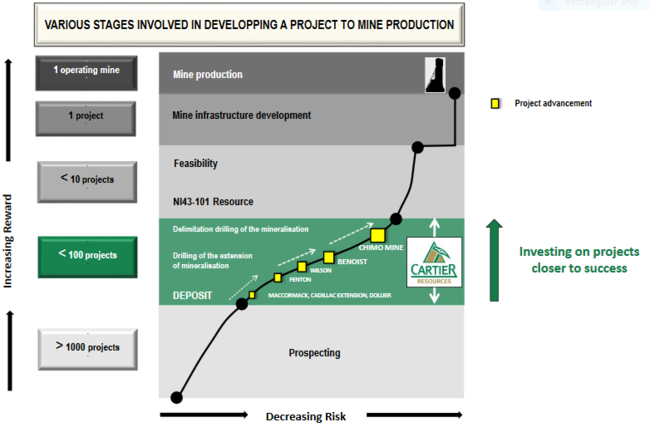

The team behind Cartier is on a mission to build shareholder value.

Management’s strategy: acquire and assemble a robust pipeline of brownfield projects for pennies on the dollar, designate a flagship asset, de-risk and drive development with the drill bit, option or monetize the asset, repeat the process (move on down the line to the next best development project).

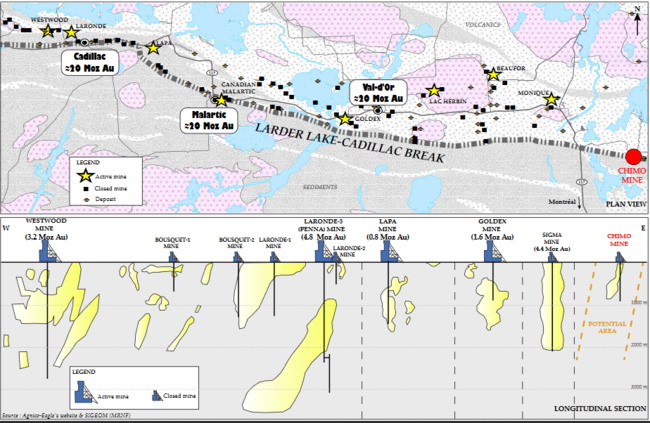

The company’s 100% owned flagship project – CHIMO – is a past producer credited with giving up 379K ounces of gold from 14 zones between 1964 to 1997.

The company is drilling off a potentially substantial resource, one bound to attract the interest of a resource hungry producer (there are a number of mines and mills in the region that will require additional feed).

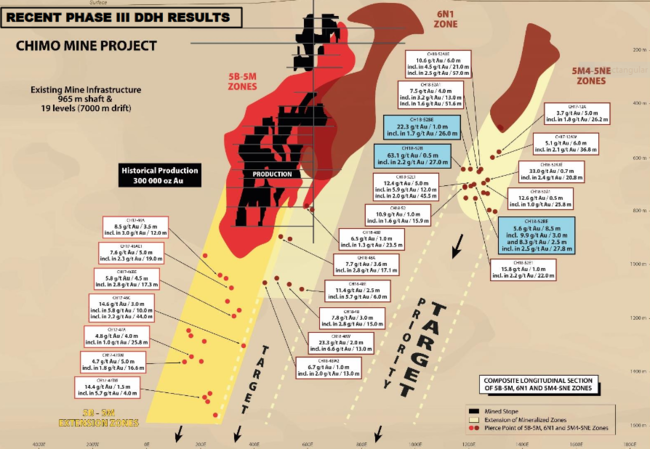

Recent work at Chimo is focused on:

- drilling and delineating the extensions of 18 gold zones;

- exploration drilling of a dozen targets with good discovery potential.

“The program takes into account the depth of the gold zones that will be accessible via an existing shaft once it is returned to working order following the installation of surface infrastructure and the completion of shaft dewatering operation.”

Mine infrastructure consists of a 7-kilometer network of drifts distributed over 19 levels connected by a 965-meter deep, 3-compartment shaft. The headframe and surface facilities were dismantled in 2008 but the electrical line and sand pit are still intact.

“Phases I II and III, carried out by Cartier on the Chimo Mine project, consisted of 109 holes for a total of 49,251 m. This work demonstrated the continuity of the main 5B and 5M gold zones beneath the existing mining infrastructures, explored the extensions of 19 gold zones peripheral to the main zones and further explored the extensions of the 7 prioritized gold zones; which led to the discovery of Zone 5NE as well as to expand the potential of Zones 6N1 and 5M4. These three zones offer excellent potential for additional discovery.”

We like Chimo as a potential takeover target. To that end, the company dropped the following piece of news a few weeks back:

Read: Cartier Awards Mandate for NI 43-101 Resource Estimate on Chimo Mine Project

This resource estimate could represent a significant share price catalyst going forward.

Cartier is looking to monetize this project, but it won’t go cheap. If you peruse company press releases over the past few years you’ll discover volumes of positive drill hole data related to Chimo—drill hole data that should support a substantial 43-101 resource.

There’s also tremendous latent potential underlying Cartier’s project pipeline.

The Benoist Project is drill ready. A historic resource of some 531,428 tonnes grading 5.51 g/t Au, 12.10 g/t Ag, and .27% Cu lies within a large mineralized evelope with extensive alteration.

Cartier has plans to drill 20,000-meters at Benoist.

In other news, the company is in the process of topping up its treasury with a $3M private placement.

“The gross proceeds of the Offered Flow-Through Shares sold under the Offering will be used to explore the Company’s Chimo Mine project.”

Chipping away at this one on weakness could pay off handsomely when all is said and done.

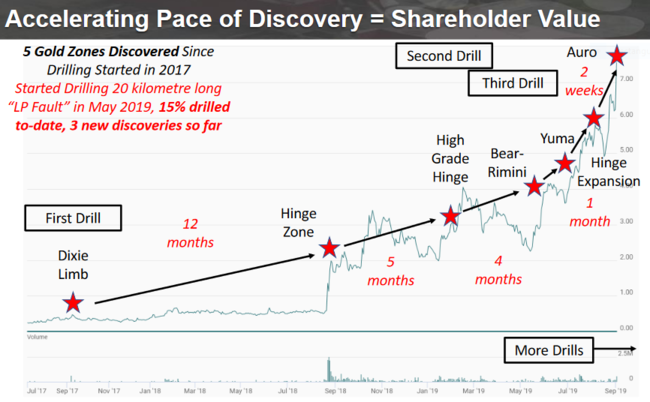

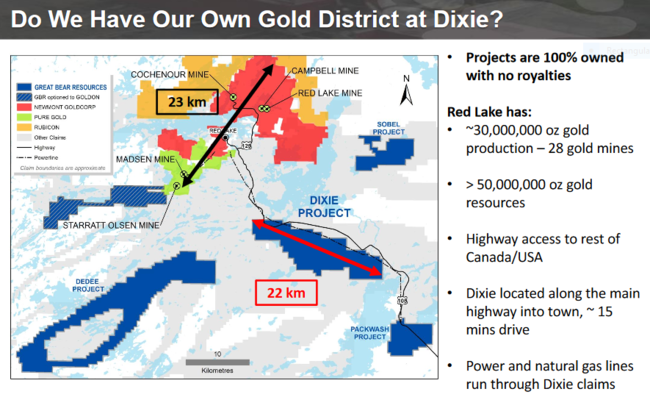

Great Bear Resources (GBR.V)

- 41.94 million shares outstanding

- $272.61M market cap based on its recent close at $6.50

Great Bear could have been purchased just over a year ago in the $0.50 range. Note the price and volume surge in late August of 2018—momentum triggered by a significant new discovery in the Red Lake region of Ontario, the mother of all high-grade mining camps.

The next chart shows exactly where, when and how when the value was created.

This is a prime example of a company’s shares representing great value, even after multi-bagger gains. Those who held the stock pre-discovery and sold into the first flurry of post discovery strength left A LOT of money on the table.

In some situations, particularly where mineral discoveries are concerned, ‘buying strength’ makes a whole lotta sense.

So does sitting tight.

We first featured Great Bear in our coverage at the beginning of the year when the shares were trading in the $2.00 range.

Those early price gains were fueled by uber high-grade hits at the company’s Dixie Project, specifically the (South) Limb and Hinge zones.

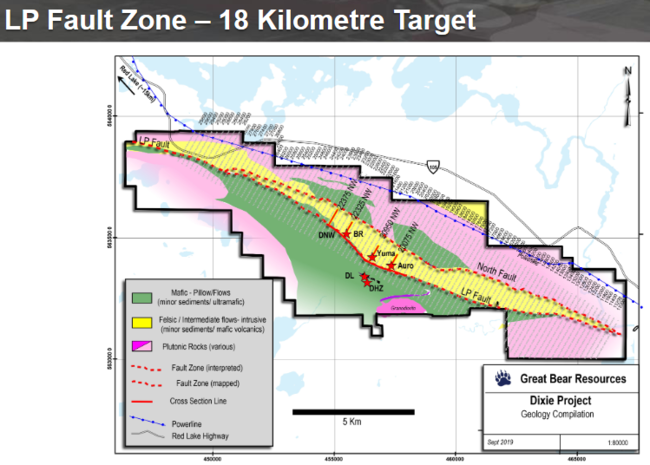

The high-grade zones are significant for their potential grow resource ounces, but the real potential may lie in the scale of the mineralized system as a whole, along the 18-kilometer long LP Fault Zone where broader, lower to moderate grade zones could pile on the resource ounces in short order.

Recent press releases demonstrate the resource building potential at Dixie (rarely do you see headlines this long, but there’s much to highlight here):

and…

Adding to the intrigue, the company is in the midst of a 90,000-meter drilling campaign utlilizing multiple rigs.

90,000 meters + multiple rigs = big ass’d newsflow.

Drill results will be substantial over the balance of the year and well into next.

Current shareholders are likely thinking ‘takeover offer’ (TO).

Resource hungry predators are likely eyeing this one with growing interest.

If Great Bear succeeds in demonstrating the scale many expect, it could be fat city for loyal shareholders.

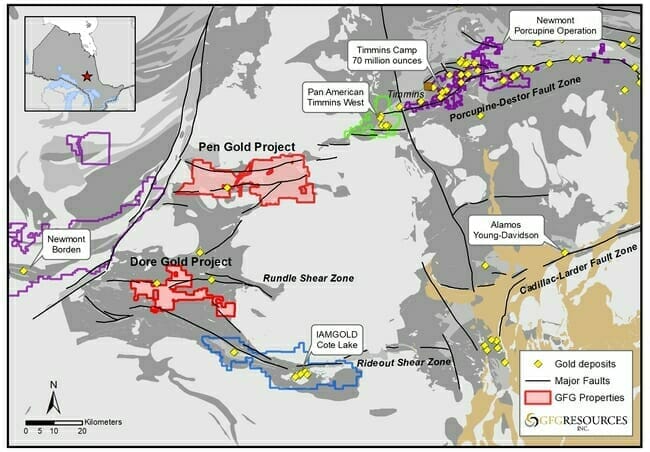

GFG Resources (GFG.V)

- 92.81 million shares outstanding

- $15.31M market cap based on its recent close at $0.165

GFG saw some modest share price appreciation earlier this year, but the company was unable to build on that strength.

Recent drilling at the company’s 100% owned Pen Gold Project west of Timmins Ontario returned intercepts that are best characterized as ‘encouraging’.

The company intends to take another swipe at Pen having recently announced a private placement of $3.7M.

A press release earlier this year suggested a phase two drilling campaign of some 3,500 meters. This will follow up on a comprehensive summer field program that included regional till sampling, ground geophysics, prospecting, and mapping.

This management team has a lot of depth. Hopefully this disciplined approach to ground work will lead to a significant new discovery with the drill bit.

While we’re waiting for a drill rig to be mobilized back to Pen, results from their Rattlesnake Project in Wyoming, a joint venture with Newcrest Mining, should begin to flow in the coming weeks.

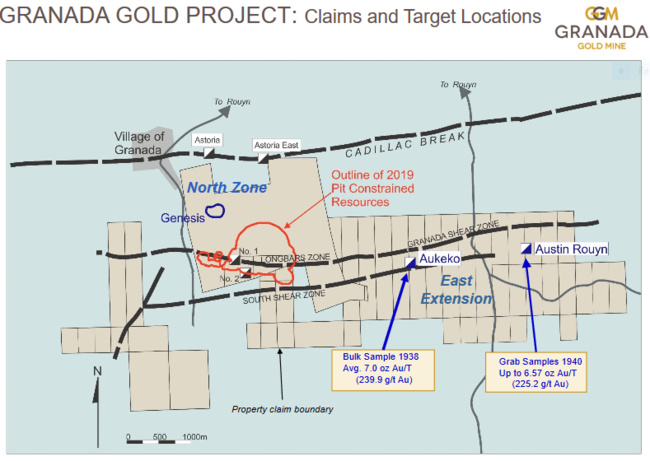

Granada Gold (GGM.V)

- 71.31 million shares outstanding

- $8.91M market cap based on its recent close at $0.125

I continue to follow Granada and its Granada Gold Project on the Cadillac Break due to its upscale address, its resource, and its exploration upside.

Exploration success along the company’s 5.5-kilometer long, east-west-trending mineralized footprint could generate a lot of excitement, especially in a rising gold price environment.

On Aug 19th, the company announced the commencement of a drilling program designed to test near-surface mineralization within the two-kilometer extended Long Bars zone. This news release shed no light on the extent or size of the drilling campaign.

On Sep 27th, the company announced the closing of a private placement of $925K.

While the pace of work at the project has been too slow for some, I appreciate that management prefers modest raises during these periods of sector-wide weaklness, rather than blowing out their share structures with little regard for the small guy. Kudos to management for their disciplined approach.

Current depressed prices could represent an opportunity to position oneself ahead of a new discovery.

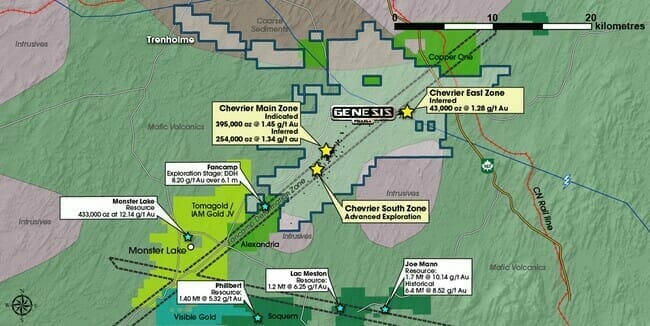

Genesis Metals (GIS.V)

- 107.02 million shares outstanding

- $5.89M market cap based on its recent $0.055 closing price

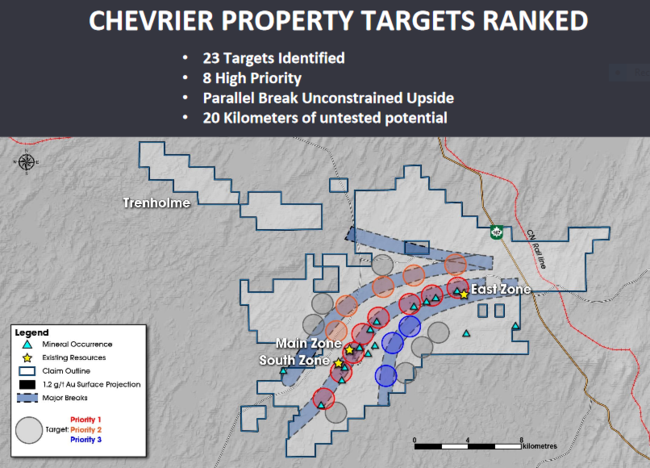

Genesis is exploring its 100% owned Chevrier Gold Property located in the Chibougamau region of Quebec.

This is another Abitibi ExplorerCo that prefers the slow dance when the resource arena is quiet. While this strategy may appear uninspired and tedious to some, company management is using good science – (new age) till sampling analysis, geological mapping, trenching, and geophysics (magnetics and induced polarization) – to methodically prioritize targets for future drilling campaigns.

On Sep 26th, the company released the following exploration update:

Till Sampling Campaign Results Identify New High Priority Targets at Chevrier Gold Project, Quebec

Genesis CEO, Jeff Sundar:

“These robust gold-in-till sampling results indicate that there is potential within the Chevrier property to discover new zones of gold mineralization. Our technical team and consultants are using the best exploration methods currently available. They are executing a disciplined, cost-effective, iterative exploration program to assess prioritized targets which we hope will lead to a new a gold discovery.”

Again, buying during these protracted periods of weakness could pay off handsomely in the medium to long term. Genesis deserves better than a cursory peek under the hood as significant newsflow is likely in the coming months.

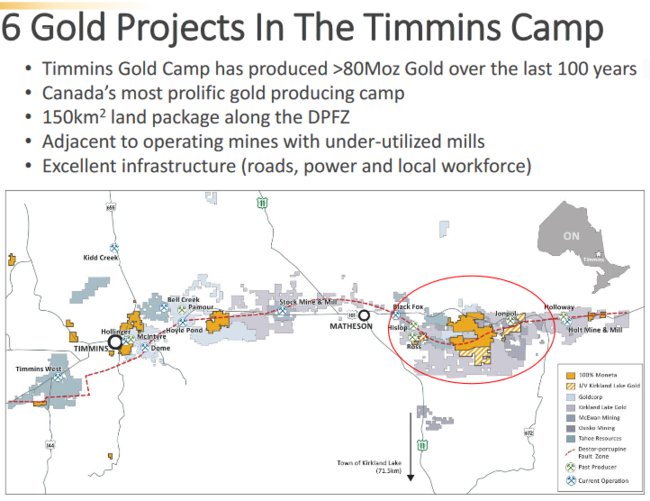

Moneta Porcupine (ME.T)

- 311.21 million shares outstanding

- $31.12M market cap based on its recent dime closing price

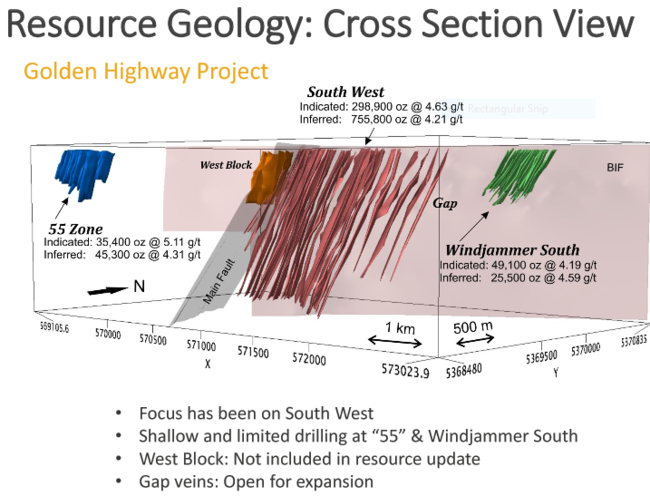

Moneta’s wholly-owned Golden Highway Project is located along the Destor Porcupine Fault of the Timmins Gold Camp in northeastern Ontario.

The company is looking to grow its current resource of 383,400 oonces indicated (2.6Mt @ 4.61 g/t), and 873,200 ounces inferred (6.5Mt @ 4.21 g/t).

A drilling campaign earlier this year, one designed to drill out extensions of a number of prospective zones, was met with varying degrees of success.

Aug 8th exploration news:

Gary O’Connor, CEO & Chief Geologist:

“We are encouraged by the ongoing success of the 2019 program which has shown significant extensions to both the Windjammer South and “55” deposits outside of the current resources at both deposits. New drilling at “55” and sampling of newly identified veining at Windjammer South has shown that we have the potential to readily expand the resources of both these deposits. The “55” and Windjammer South deposits are located 1.5 km west and 1 km east respectively of the South West deposit. The 2019 drill program has been successful at drilling potential extensions to the current resources. We are now in the process of updating the South West resource to include the 2019 drill results.“

Worth noting, Eric Sprott recently increased his holdings in Moneta to the tune of 27,870,455 shares, or 9.0% of the total shares outstanding.

With roughly 4 kilometers of untested Destor Porcupine Fault yet to be tested with the drill bit, not to mention the potential that may lie hidden at depth, Moneta bears watching.

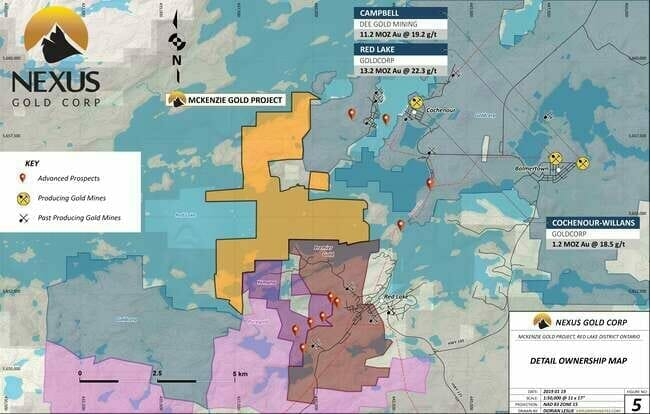

Nexus Gold (NXS.V)

- 76.97 million shares outstanding

- $6.54 market cap based on its recent close at $0.085

Nexus is an well run, jurisdictionally diversified ExplorerCo with projects on two continents: West Africa and Canada.

The company’s flagship 1,300 hectare McKenzie Gold Project is located in the heart of the prolific Red Lake Mining Camp.

McKenzie is flanked by active projects operated by the likes of Newmont-Goldcorp (NGT.T), Yamana (YRI.T), Pure Gold (PGM.V) and Premier Gold (PG.T).

This is a project we’ll be hearing more and more about in the coming weeks and months. With the share price trajectory Grear Bear experienced at their Dixie project over the past 14 months, the market will be watching developments at McKenzie closely.

I wouldn’t be surprised to see these shares begin to ramp up in anticipation of a drill rig being mobilized to the project.

Adding to the intrigue, on Friday Oct 11th, Nexus dropped a chunky news release highlighting a new set of significant (historic) high-grade values.

This new information was a welcome surprise.

“Additional high-grade historical grab samples previously unknown to the Company and now revealed in the Rimini summary include 142.49 g/t Au, 115.2 g/t Au, 114.57 g/t Au, 93.71 g/t Au, 68.03 g/t Au, 53.01 g/t Au, and 16.65 g/t Au from areas located on McKenzie Island (north block).”

“There has also been limited drilling on the property, as noted in the report, with historical intercepts obtained on the southern section, including 7.49 g/t Au over 8.2 meters, 2.1 g/t Au over 5.5 meters, 15.54 g/t Au over 0.8 meters, and 17.02 g/t Au over 0.5 meters. Historical intercepts reported on the northern section include 1.89 g/t Au over 1.3 meters, 1.97 g/t Au over 1.0 meters, 5.56 g/t Au over 0.4 meters, and 2.3 g/t Au over 0.75 meters.”

Nexus president and CEO, Alex Klenman:

“The additional data received from Rimini gives us a much greater understanding of McKenzie island property will aid us immensely in determining drill targets. The abundance of high-grade historic samples and limited historic drill results clearly indicate there is high-grade mineralization present in multiple locations. Determining drill targets is a priority for us, and we will continue to aggressively push the development of the McKenzie Gold Project forward.“

I’ll have more to say re McKenzie, Red Lake and Nexus in the coming days.

Pelangio Exploration (PX.V)

- 40.13 million shares outstanding

- $5.62M market cap based on its recent $0.14 close

Pelangio is an Abitibi ExplorerCo that ramped up nicely immediately after we began our coverage in early January only to surrender those gains in subsequent months.

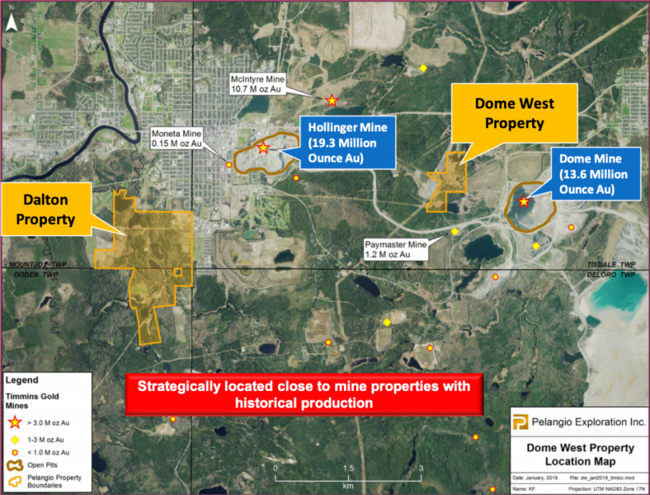

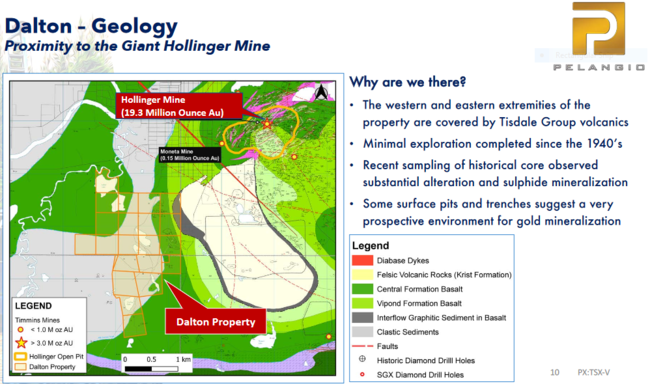

The last time we checked in with the company, they were busy at their recently acquired Dalton and Dome West projects located in the heart of the Timmins camp.

Dome West drill results returned on June 13th were encouraging, but weren’t enough to rouse the market.

Between August 15th and September 20th, the company updated shareholders with details regarding future drilling plans for Dalton, Grenfell, and Dome West.

Drilling at Dalton may have already begun. The following map should get the speculative juices flowing. Yes it’s a small property, but check out the address…

Drilling at Grenfell (located 10 kilometers northwest of the town of Kirkland Lake) is set to begin this winter.

Drilling at West Dome is scheduled to commence in April 2020.

The company is also doing groundwork at its recent Hailstone Property acquisition in Northern Saskatchewan.

This is a company run by an experienced team with a number of prospective irons in the fire.

Prosper Gold (PGX.V)

Project page (no investor presentation)

- 80.41 million shares outstanding

- $5.23M market cap based on its recent $0.065 closing price

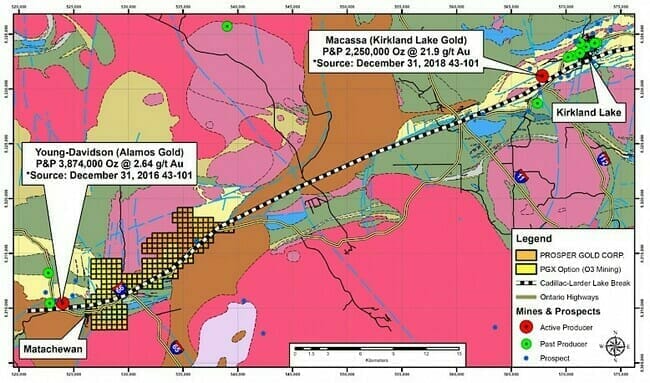

I was tempted to give this one a pass, but recent focus on the company’s Matachewan Project covering 15 kilometers of the prolific Cadillac-Larder Lake Break could usher in a significant new discovery.

Sep 11th news:

Prosper Gold Corp. Commences Initial Drill Program at the Matachewan Gold Project – Northern Ontario

Drilling campaign highlights:

- Large prospective area (3,860 hectares) of mineral and patent claims covering 15 kilometers of the prolific Cadillac-Larder Lake Break (CLLB)

- First time this large section of the CLLB has been amalgamated

- Claim block is between 3 and 16 kilometers east of Alamos Gold’s Young Davidson Mine along the CLLB

- Young-Davidson gold occurs in syenite—a number of syenite bodies are known on the claims

- Two styles of gold targets: high-grade gold veins and bulk gold in syenite

Just a few days back, the company provided the following update:

Seven diamond drill holes totaling 2,111 meters have been completed at the Middleton target.

Regarding the drill core visuals, Peter Bernier, CEO:

“We have outlined a large anomalous area with coincident gold and copper mineralization along the Cadillac-Larder Lake Break. We are encouraged by the potassically altered syenite we have seen in the core and on surface. With more than half the holes already in the lab we eagerly await assay results.”

Higher up on the foodchain

There are a handful of companies I follow that are much further along the development curve than the ExplorerCos featured above.

Hart Gold (HRT.T)

- 673.76 million shares outstandings

- $158.33M market cap based on its recent close at $0.235

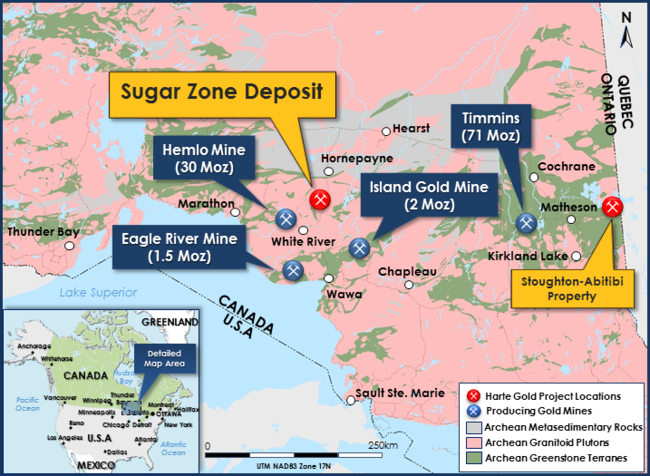

According to the company website, Harte is the new kid on the block (Ontario’s newest gold producer) with its Sugar Zone deposit.

Using a 3 g/t gold cut-off, Harte has 1,108,00 ounces of Au in the Indicated category (4,243,000 tonnes grading 8.12 g/t Au), and 558,000 oz’s in the Inferred category (2,954,000 tonnes, grading 5.88 g/t Au).

With control of over 83K hectares of prospective greenstone belt, exploration upside here has to be considered excellent.

Sugar’s economics are outlined in the following link:

Technical Report & Feasibility Study on the Sugar Zone Operation – May 2, 2019

Q2 production results were released on Aug 14th.

Harte Gold Reports Q2 Production Increase Of 42% Over Q1, Ramp Up Continues To 800 TPD

Osisko Mining (OSK.T)

- 274 million shares outstanding

- $860.36M market cap based on its recent $3.14 closing price

There’s a reason this ExplorerCo is pushing a $1B market cap.

The company’s assets include:

- A 100% interest in the high-grade Windfall Lake gold deposit located between Val-d’Or and Chibougamau, Québec.

- A 100% undivided interest in a large area of claims surrounding the Urban-Barry area and nearby Quevillon area (over 3,300 square kilometres).

- A 100% interest in the Marban project located in the heart of the Abitibi.

- Properties in the Larder Lake Mining Division in northeast Ontario.

- Interests and options on a number of properties in northern Québec and Ontario.

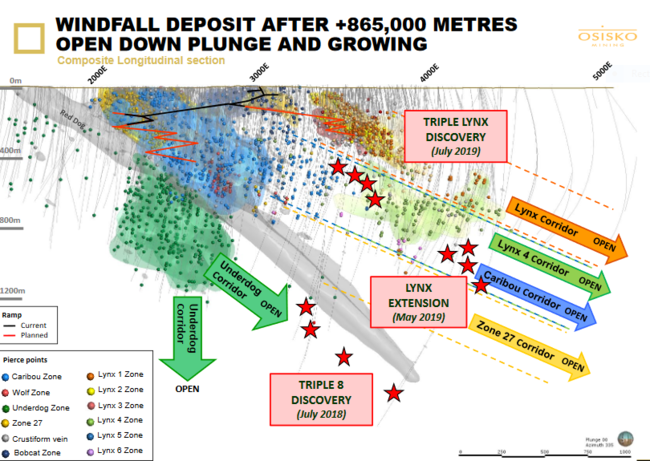

Osisko may hold the record for the most meters drilled on a single project in Canada (in the shortest amount of time).

For those challeged by conversion tables, the company has drilled over 865 kilometers into Windfall’s various subsurface gold zones.

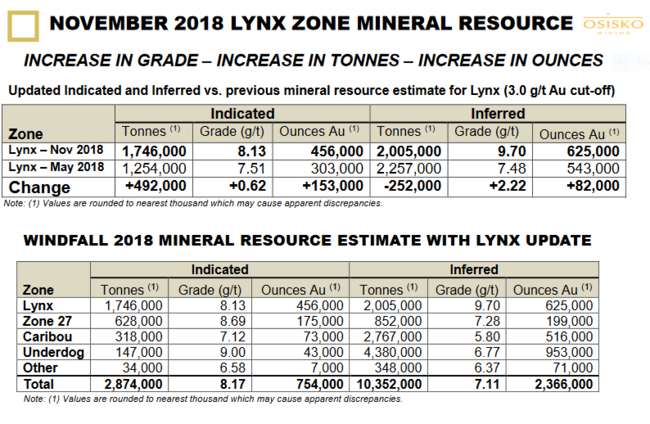

Current resources are as follows (obviously these numbers are set to grow with the aggressive pace the company has set for itself)…

A 5,500-tonne bulk sample from the WINDFALL ZONE 27 demonstrated a grade of 8.53 g/t Au, some 26% higher than the values tabled in the resource model. This bodes extremely well for future production scenarios.

A July 2018 scoping study—slide 15 on their corp presentation—shows an after tax NPV (5% discount ) of $413.2M and an IRR of 32.7% (base case = $1,300 for gold and $17.00 for silver).

I could go on, but you get the idea.

Pure Gold (PGM.T)

361.35 million shares outstanding.

$205.97M market cap based on its recent $0.57 close.

Pure Gold is a fully funded soon-to-be Red Lake producer. The first gold pour at the company’s flagship Madsen Project is set for late 2020.

The Madsen Red Lake ore body is an exceptional foundation on which to build a gold mining company. With Probable Mineral Reserves of 3.5 Mt at 9.0 g/t containing 1.0 million ounces of gold included in a Mineral Resource of 7,196,000 Indicated tonnes grading 8.9 g/t gold for 2,063,000 ounces of gold and 1,880,000 Inferred tonnes grading 7.7 g/t gold for 467,000 ounces of gold, the Madsen Red Lake Gold Project is the highest grade development stage gold deposit in Canada and will be in the top 8 percentile globally when in production.

Madsen’s economics look good.

FEASIBILITY STUDY HIGHLIGHTS

Base case parameters assume a gold price of US$1,275/oz and an exchange rate (C$ to US$) of 0.75.

- Probable Mineral Reserves of 3.5 Mt at 9.0 g/t containing 1.0 million ounces of gold;

- Low initial capital requirement of $95 million including a 9% contingency;

- Mine life of 12.2 years with a 13 month pre-production period;

- Peak annual production of approximately 125,000 ounces with average annual gold production in years 3 through 7 of approximately 102,000 ounces;

- Life of mine (“LOM”) direct operating cash cost estimated at US$607 per ounce of gold recovered;

- LOM all in sustaining cash cost (“AISC”) estimated at US$787 per ounce of gold recovered;

- Pre-tax NPV5% and IRR of $353 million and 43% respectively with a 3.0 year payback of initial capital;

- After-tax NPV5% and IRR of $247 million and 36% respectively with a 3.4 year payback of initial capital

Note that a very conservative $1,275.00 gold price anchors this study (gold is currently bouncing around both sides of $1,500.00).

Also note that Madsen’s Capex is a mere $95M. That’s extraordinary for a 100K ounce producer. Obviously, the existing infrastrucure surrounding the project factored in large.

Final thoughts

It’s getting late in the year and gold is currently in correction mode. In an earlier offering we suggested that a retracement back to the $1,400 to $1,450 level was a possibility. We could still see the low end of that range, especially with the COT Report showing Commercial Traders (often referred to as the ‘smart money’) holding near record short positions in the metal. But the underlying fundamentals supporting gold have never been more compelling imo.This price correction will run its course. It’s my guess that Q1 of 2020 will usher in the next significant leg-up in the metal.

If you’re underweighted in gold and are looking for exposure in the junior exploration arena, my best advice is to pick your spots carefully, and buy weakness.

We stand to watch.

END

—Greg Nolan

Full disclosue: of the companies featured above, only Nexus is an Equity.Guru marketing client.

Leave a Reply