If pressed, if forced to name names and cough-up a list of some of the better values I see in the junior exploration arena, Azincourt Energy (AAZ.V) would be a no-brainer Top-Five pick.

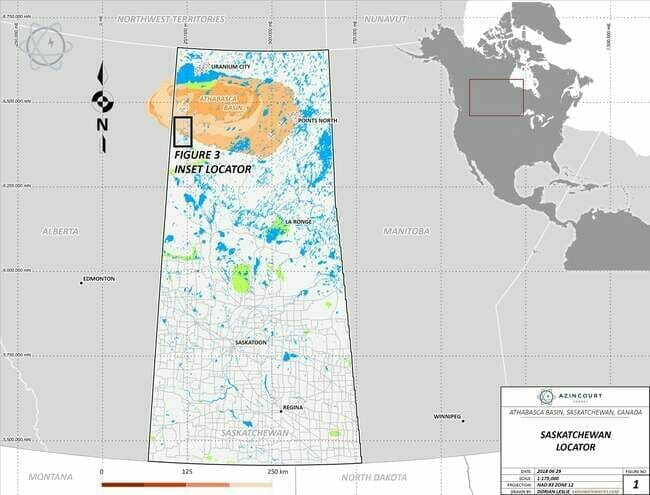

The sentiment for uranium ExplorerCos isn’t exactly percolating at this juncture in what has been a grueling multi-year bear market, but this sub $4M company is about to ramp things up with a fully funded 2,000-plus-meter diamond drill program in the mother of all uranium jurisdictions—the Athabasca Basin of northern Saskatchewan.

It’s fair to say that the Athabasca Basin (the Basin from hereon) is to uranium what Nevada’s Carlin Trend is to gold.

The Basin boasts the largest, highest-grade U308 deposits on the planet, sporting grades that are up to 100 times the world average.

The Basin is also a safe place for a miner to do business—a hugely important consideration in this current environment of geopolitical uncertainty.

The esteemed folk at the Fraser Institute rank Saskatchewan in the Top Three global mining jurisdictions as per their Investment Attractiveness Index.

Decades of U308 production history validate the Basin’s top-shelf status.

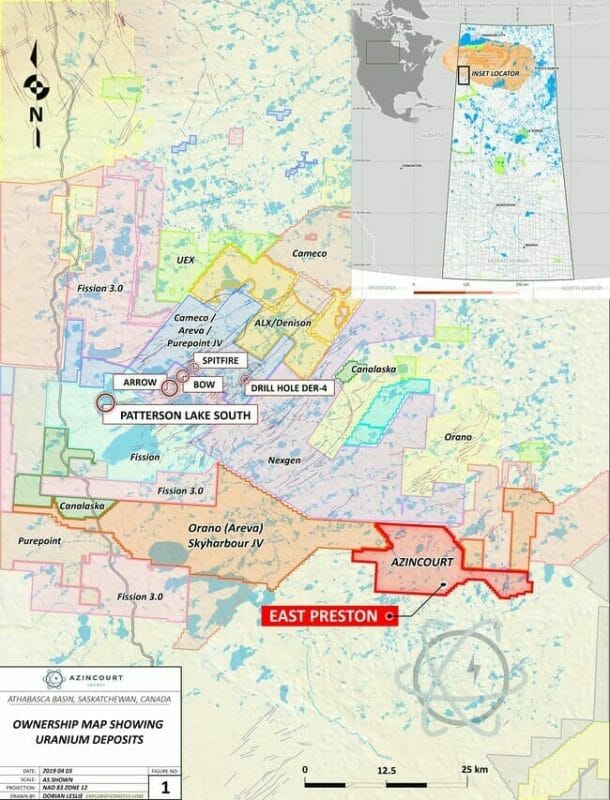

The company’s flagship project—East Preston—consists of some 25,000 geologically prospective hectares where they are earning a 70% interest as part of a joint venture agreement with Skyharbour Resources (TSX.V: SYH), and Clean Commodities Corp (TSX.V: CLE).

I covered Azincourt with a fair bit of detail earlier this summer:

Read: Azincourt Energy (AAZ.V) righteously positioned for the inevitable uranium turn

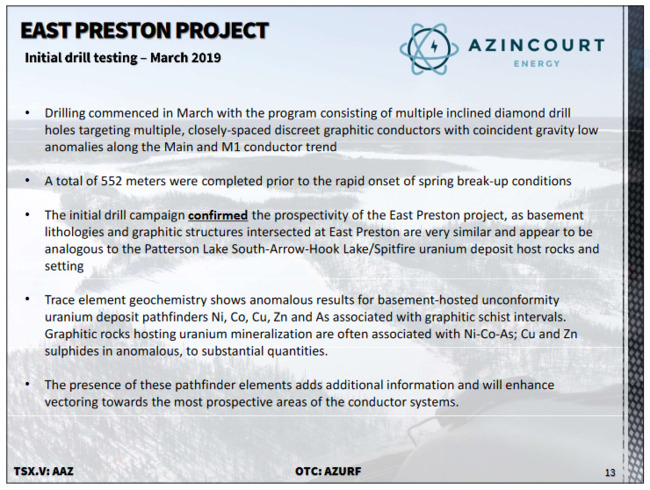

A phase one drilling campaign at East Preston, the results released back in June, failed to ignite the market. But what the market fails to appreciate is where the current opportunity lies.

First of all, homing in on a significant discovery in the Basin requires multiple layers of good science and heaps of drilling. The McArthur River discovery, an Athabasca U308 standout, required 210 drill holes to uncover.

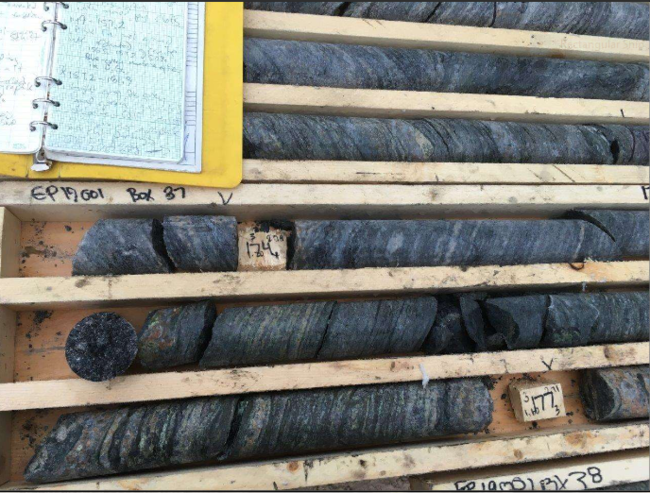

What Azincourt did manage to tag with this abbreviated 3-hole campaign was the right host rock matrix—the same rock, the same graphitic content, the same pathfinder elements as NexGen’s (NXE.T) Arrow deposit further to the north-west. This is what the market fails to appreciate.

Btw, NexGen has a current market-cap north of $655M.

Further…

The East Preston uranium project targets basement-hosted unconformity related uranium deposits similar to NexGen’s Arrow deposit and Cameco’s Eagle Point mine. East Preston is located near the southern edge of the western Athabasca Basin, where the relatively shallow exploration targets have no Athabasca sandstone cover, but this deposit style can have great depth extent when discovered. The project ground is located along a parallel conductive trend between the PLS-Arrow trend and Cameco’s Centennial deposit (Virgin River-Dufferin Lake trend).

Geologically speaking, things appear to be lining up. And the Smart Money seems to agree.

The Funds

A non-brokered private placement (PP) announced earlier this year brought several large uranium funds to the table.

The company doesn’t name names as these fund managers prefer to keep things on the down-low. Par for the course. Fair enough.

What I do know is that one of these funds is based in South America and was looking to deploy capital. East Preston was viewed as a highly prospective project and this fund manager had no problem taking down $400K of the $2M raise.

If you examine the press releases relating to this PP—Feb 12th and Feb 26th—you’ll note that the warrant terms were adjusted to accommodate this fund manager:

The original 3-year warrants priced at $0.075 were extended to 5-years with a $0.07 strike.

It might be helpful (and accurate) to view this new arrangement as a marriage contract.

Yes, the adjusted warrant terms are friendlier to the holder, but what this does is put a term on the relationship, locking in the fund manager with a long term commitment in mind.

This fund manager is not thinking short term—he’s not thinking ‘drill and kill’. He understands that the Basin requires patience, and potentially a boatload of drill holes to tag this elusive quarry. Again, McArthur River took 210 holes.

I like Azincourt’s arrangement with these large uranium funds (institutional investors hold 18% of AAZ common).

Note that not a single share was sold by any of these fund managers after phase one drill results hit the market. That speaks volumes.

Azincourt’s current status

The company has $1.6M in the bank.

A 15-hole, 2,000 to 2,500-meter diamond drill program is on deck.

This drilling campaign is fully funded.

Permitting is ahead of schedule.

The driller is booked.

Drill target selection is being prioritized.

Roads are being pushed into the target areas as I type.

On the subject of drill targets, two dozen are ranked A-List targets. A similar number are rated B-List.

Data stacking—geophysics, geochemical, surface sampling—dictate target status and drilling priority.

Example: if the target has exceptional geophiz, geochem, and surface signatures, it gets an A-List rating. If the only two of the above criteria line up, B-List.

It goes without saying that the majority of the targets on the company’s hit list for this next phase of drilling are A-List.

Azincourts secret weapon

If you ask CEO Klenman what advantages his company has over others, aside from their great address in the Basin, he’ll point to Ted O’Connor without hesitation.

Ted O’Connor P.Geo., M.Sc., B.Sc. is a Professional Geoscientist with over 25 years of experience, predominantly in the uranium exploration industry. He spent 19 years with Cameco, one of the world’s largest uranium producers. He was a Director of Cameco’s Corporate Development group where he was responsible for evaluating, directing and exploring for uranium deposits throughout North America, Australia, South America and Africa. Mr. O’Connor successfully led new project generation from early exploration through to discovery on multiple unconformity uranium projects. Mr. O’Connor was also responsible for opportunity evaluation, acquisition and for managing Cameco’s exploration partnerships aimed at growing and diversifying Cameco’s exploration portfolio in new jurisdictions and other uranium model types. Most recently Mr. O’Connor was CEO of Plateau Energy Metals (TSX.V: PLU), where he oversaw the development of the Macusani uranium and lithium deposits, and is now a Director and Technical Advisor to the company.

O’Connor, characterized by Klenman as his “secret weapon”, will be overseeing target selection and drilling.

On deck…

Permitting news is next.

Drill rig mobilization news should follow.

The company is focusing all of its efforts on East Preston. In a press release dated Oct 22nd, the company announced they had successfully managed to amend an option agreement involving a series of uranium-lithium projects located in the Picotani volcanic field of southeastern Peru.

CEO Klenman:

“The preliminary work we did in Peru late last year showed these are indeed compelling exploration targets that deserve follow up work. But right now, our priority is East Preston and with the Athabasca drill season approaching fast it is important we allocate our time and resources there. This agreement allows us to keep the Peruvian projects in good standing as we pursue critical development at East Preston.”

The Athabasca drilling season is indeed fast approaching.

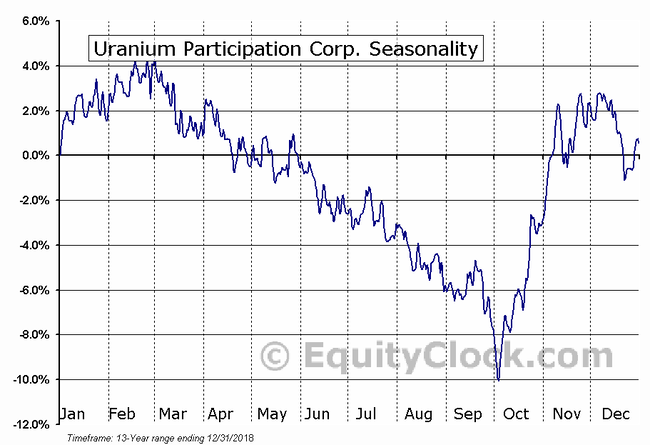

Azincourt’s timing could be very good as the seasonals for uranium have turned positive.

Supporting uraniums medium to longer-term outlook, this positive piece of news dropped a few months back:

Read: Statement on U.S. announcement regarding Section 232 uranium investigation

What this means is that large utility companies based out of the US, unable to negotiate long term U308 contracts due to Section 232, can now do so. This could spark some serious demand pressure in the not-too-distant future.

Final thoughts

Is Azincourt a high-risk stock? Absolutely. But the risk is mitigated by the company’s $0.025 share price and $3.59M valuation.

Also, the fact that the company is bankrolled by smart institutional money negates any need or notion of a share rollback while there are still targets to be drilled in the Basin.

Here’s the thing: should Azincourt tap serious radioactivity during this next round of drilling, these two-and-a-half cent shares could go on a wild ride.

We stand to watch.

END

—Greg Nolan

Full disclosure: Azincourt is an Equity Guru marketing client.

Leave a Reply