The headline numbers in Defense Metals (DEFN.V) October 31st press release mark an auspicious beginning for drill hole newsflow out of the company’s Wicheeda Rare Earth Element (REE) Project.

Wicheeda is a 1,708-hectare chunk of geologically prospective terra firma located in the infrastructure-rich Prince George region of northern British Columbia.

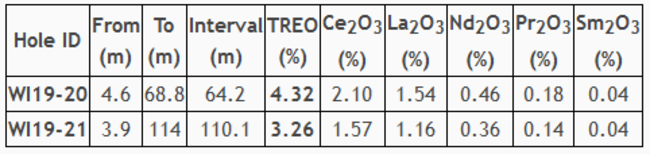

The assays

Drill hole WI19-20 tagged 4.32% Total Rare Earth Oxide (TREO being cerium, lanthanum, neodymium, praseodymium, and samarium oxides) over a core length of 64 meters, beginning at surface.

That’s a good hole, especially when you consider the rock is worth between US$360.00 to $500.00 per tonne (REE values are difficult to peg as prices are set in China and would appear to trade, to this humble observer, by appointment only’).

The second hole from this recently concluded 2,005-meter drilling campaign—drill hole WI19-21 collared from the same drill pad as 19-21—tagged an equally impressive 3.26% TREO over 110 meters. Again, this mineralization was intersected only a few meters from surface (near-surface deposits hold numerous advantages over those buried at depth).

This second hole expands the southwestern drill defined edge of Wicheeda a distance of 25 meters beyond the limit of the current resource.

The above-noted resource currently sits at 11,370,000 tonnes averaging 1.96% LREE (Light Rare Earth Elements) at a cut-off grade of 1.0% (sum of cerium, lanthanum, neodymium and samarium percentages).

Based on the values demonstrated in these first two holes, considering every hole in the 13-hole program intersected broad lengths of mineralization, it wouldn’t be a shock to see Wicheeda’s resource grow, perhaps significantly so.

In case you’re wondering, NO, the company did not single out this core and usher it to the front of the line at the lab. Holes 19-20 and 19-2121 were the first drilled, the first split, the first delivered, the first assayed. The remaining 11 holes could deliver equally impressive (or better) values.

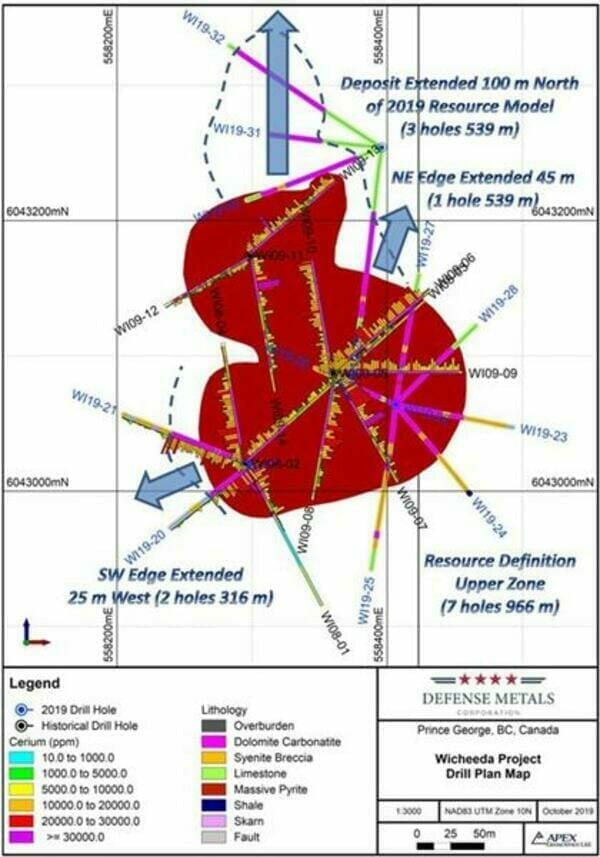

Example: the final hole of the 2019 program—drill hole WI19-32—tagged 130 meters of visible REE dolomite-carbonatite. This hole opens up the potential for continued (significant) resource expansion to the north.

Note this expansion potential below:

The blue arrows in the above map show where the deposit is open.

Craig Taylor, CEO and president of Defense Metals:

We are extremely pleased to see extensive REE mineralization in the core from the first two drill holes of our 2019 resource definition program at Wicheeda. The assay results confirm Defense Metals’ exploration strategy of adding value to the Wicheeda REE Deposit by focusing on expansion and further delineation of relatively higher-grade, near surface REE mineralized carbonatite. With the intercept grade of WI19-20 being more than twice the average grade of the current Wicheeda REE Deposit mineral resource estimate it’s clear these results could have a positive impact on a future revised mineral resource estimate. We believe the new drill results, together with our recently released positive metallurgical recoveries and high concentrate grades, have excellent potential to positively influence future economic studies. We eagerly await results from the remaining 11 drill holes.

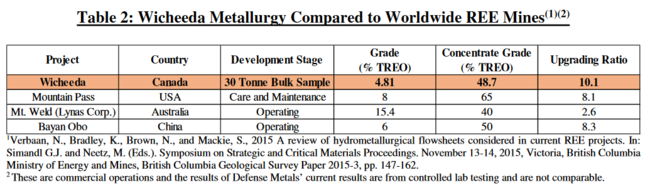

The REE grades at Wicheeda are good. The metallurgy—without a doubt THE most important consideration in an REE deposit—is very, very good.

Last week, we emphasized the significance of the company’s final metallurgical test results released on October 24th.

We noted that REE deposits are not rare. But what is rare—exceedingly rare—is finding a deposit with good metallurgical characteristics.

Keeping in mind that the company had optimistically targeted a total rare earth oxide (TREO) metallurgical recovery rate of 80%, and a TREO high-grade concentrate of 40%, the numbers reported last week speak volumes:

- a TREO metallurgical recovery rate of 85.7%

- a 48.7% TREO high-grade concentrate of cerium, lanthanum neodymium, and praseodymium oxides (Ce2O3+La2O3+Nd2O3+ Pr2O3)

This testing phase also produced:

- a 10.1 times upgrading ratio from a head grade of 4.81% TREO

- an 8.2% concentrate mass yield

Wicheeda’s metallurgy firmly positions Defense among the best of the best. Compare the results with the top three deposits in the REE arena:

The fundamentals are beginning to stack up here.

The company has the REE grades it needs, they’ve demonstrated good metallurgy (the ability to separate the valuable metals from the surrounding host rock to produce a high-grade concentrate), and now there are clear indications that the resource at Wicheeda will see an upward revision once all the assays are tabled.

A revised resource estimate is due in Q1 of 2020, btw.

Company management envisions a high-grade, low tonnage—2,000 to 3,000 tonnes per day—production scenario. The region is rich in infrastructure. Future economic studies could show very favorable dynamics.

In speaking with the company in recent days, I learned that Dale Wallster (Defense’s strategic advisor) will be traveling to Kuala Lumpur Malaysia for an REE conference next week.

The Malaysia show is a big REE show.

Based on the strength of the company’s rapidly evolving fundamentals, Wallaster may succeed in attracting an End User during his visit.

Snagging an End User would be a significant development—a hugely beneficial development for both miner and manufacturer.

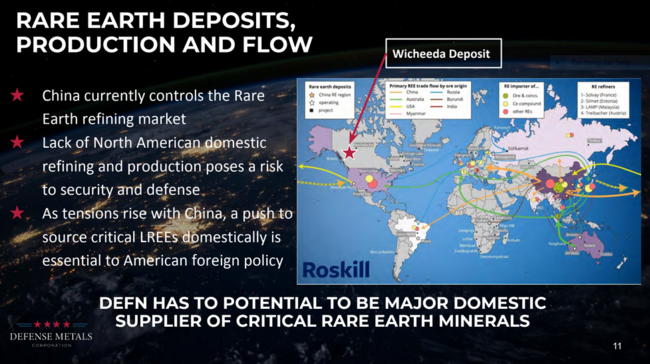

In the event you’re out-of-the-loop, roughly 85% of all REEs produced around the globe are processed in China.

That is a problem for a culture that demands a steady, uninterrupted supply of metals essential in the production of everything from EV batteries, to control rods in nuclear reactors, to flat-screen TVs.

In a previous Guru offering, we grumbled:

“Exacerbating the situation, the US has only one producing REE mine—the Mountain Pass mine in California operated by MP Materials. And get this: MP sends its ore across the pond to China for processing—that’s just the way the system was setup years back. It’s the way it works (MP says it will begin its own processing operation by the end of 2020 and will produce approx 5,000 tonnes of Neodymium (Nd) and Praseodymium (Pr) annually).”

Despite rants to the contrary courtesy of the Trump Twitter gun, the US and China are still in the midst of a heated trade war that could impact the flow of REEs to the West.

Greater insights

Gaalen Engen, our man behind the mic here at Equity Guru, caught up with CEO Taylor last week in a very informative and thought-provoking delve into the company’s fundamentals:

To get the skinny on everything else you might want to know about the company, the team, the project, REEs and their innumerable applications, enter ‘Defense Metals’ into the search function of our beautifully revamped, redesigned site.

Defense has a current market cap of $3.17M based on its 30.18 million outstanding shares and recent trading patterns. That valuation strikes me as a tad modest, especially when you consider the value of the commodity(s) held subsurface and recent positive developments.

Additional assays will likely drop next week.

We stand to watch.

END

—Greg Nolan

Full disclosure: Defense Metals is an Equity Guru marketing client.

Leave a Reply