I can think of at least a half a dozen reasons why companies like Defense Metals (DEFN.V) deserve more than a cursory once-over, and a shot at your sidelined cash.

Investing, speculating in particular, is all about timing.

If you scored big in the cannabis arena over the past few years, your success probably had a lot to do with timing. There’s nothing more satisfying than recognizing a trend in its early stages, before the herd clues in and becomes enamored with the price chart trajectory.

I see an early-stage (timing) opportunity—a ground floor opp if you will—developing in the resource sector among some of the better-positioned exploration-development companies, like Defense.

Of course, you can’t just take my word for it. You need to conduct your own due diligence as part of a disciplined approach to speculating in these high-risk / high-reward arenas. It’s best to view my role as an ‘ideas guy’—ideas requiring a healthy measure of skepticism, scrutiny, and if you think my insights hold H2O, some serious follow-up.

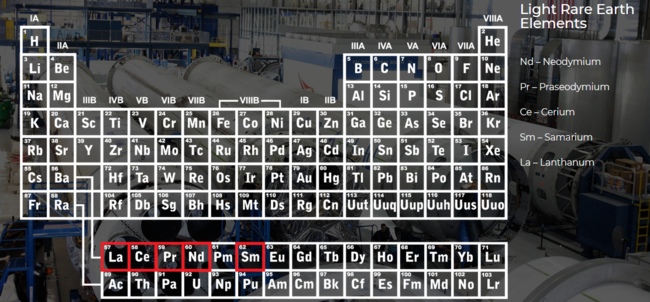

Defense is all about Rare Earth Elements (REEs).

Should you care about REEs (atomic numbers 57 thru 71 on the periodic table)?

You should. The role REEs play in this rapidly evolving digital age is far-reaching.

Dispensed in small quantities, they are often hailed as the “vitamins of chemistry”.

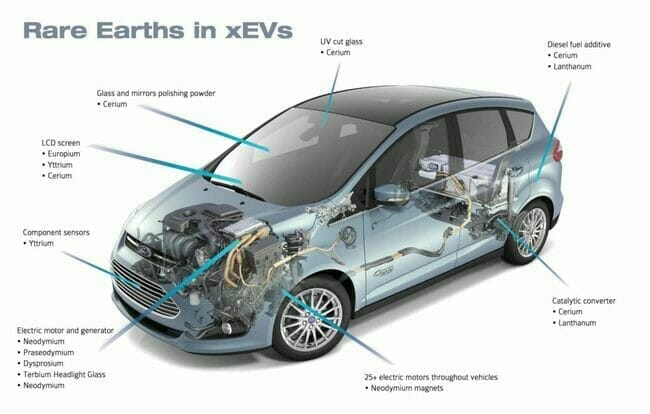

Exhibiting an extraordinary range of electronic, optical and magnetic properties, they make our TV screens glow brighter, our batteries last longer, our electronic gadgets more mesmerizing (sigh), our electric motors, generators, and appliances more efficient. They can even make our paper money less prone to forgery. They are an essential ingredient in everything from night vision camera lenses, to medical imagining technologies, to control rods in nuclear reactors.

In a world that is making greater demands on clean, renewable, and zero-emission energy sources, they find their way into electric vehicles (EVs) in more ways than one…

The list goes on… and on.

A potential supply shock on the horizon

Cut off our REE supply chain and we turn back our clocks, what… a century? Probably not, but the tech sector would rightly panic.

I ponder this chilling script for one reason: China controls roughly 85% of the world’s REE supply.

And in case you haven’t noticed, Trump and Xi Jinping are embroiled in a trade war that could interrupt the flow of critical commodities like REEs.

Should Trump end up vexing China sufficiently with an ill-timed tantrum, it’s conceivable Xi Jinping could slap a ban on REE exports.

Chinese state media has acknowledged as much in recent months referring to its domination of the REE supply chain as “an ace in Beijing’s hand.”

A chilling script alright.

REEs are not exactly rare…

… but finding them in significant, near-surface concentrations is.

Rarer still is finding significant concentrations in a geological setting where they’re not hopelessly bonded to other compounds and minerals.

You can dig REEs out of the ground, but, more often than not, separating them from their host rock is like trying to pry a giant rainbow lolly outta the hand of a kiddo with a serious sugar habit.

Not gonna happen.

This separation procress is called metallurgy—the science (some prefer ‘art’) of extracting valuable metals from their ores and modifying said metals for their intended use. In the case with most REE deposits scattered across the globe, there is a dangerous and toxic aftermath to this process.

Defense Metals appears to have it all

With China’s domination of REEs s and the possibility of an escalation in trade tensions, the West needs a stable pipeline of REE projects.

Defense appears to have all the boxes checked with Wicheeda.

The company’s Wicheeda Project is strategically located in a super-safe mining jurisdiction—the Prince George region of British Columbia.

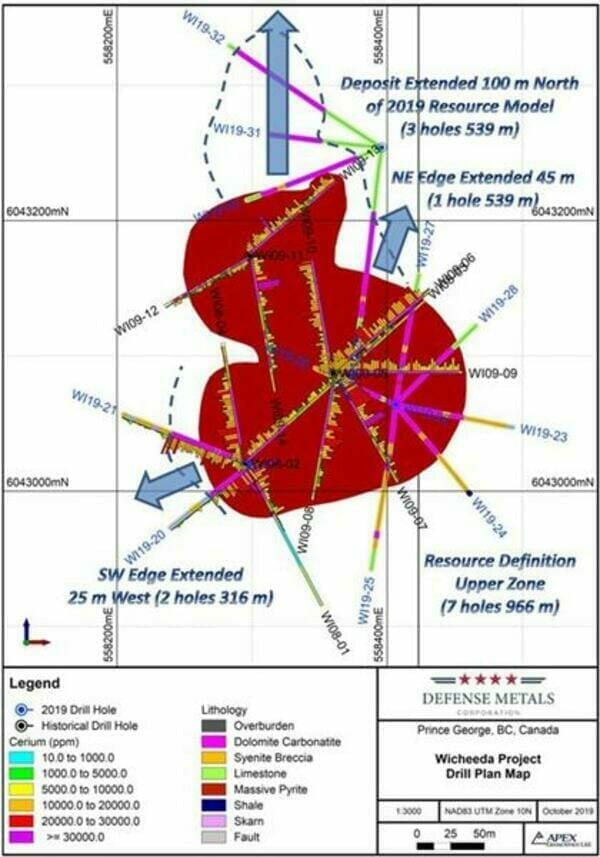

Surrounded by all of the key infrastructure a Miner could ever want—road, rail, hydroelectric power, a major gas pipeline—the company is sitting on an Inferred Mineral Resource of some 11,370,000 tonnes averaging 1.96% LREEs.

Here’s the thing: this resource is destined to grow.

Results from a recently concluded 13 hole drilling program at the property are beginning to flow.

Significant values have been received from the first two holes (note the grades in these intercepts versus the 1.96% resource):

- Drill hole WI19-20 tagged an impressive 4.32% Total Rare Earth Oxide (TREO) over a core length of 64 meters, beginning at surface.

- Drill hole WI19-21 tagged an equally impressive 3.26% TREO over 110 meters, beginning near surface. (near-surface deposits hold numerous economic advantages over those buried at depth).

This is rich rock. Based on my calculations, it’s worth somewhere in the neighborhood of $500.00 per tonne (precise REE values are difficult to peg as prices are set in China and would appear to trade by appointment only).

These early results do indeed suggest a much larger, and perhaps richer, resource at Wicheeda.

Adding further validity to this optimistic view: all 13 holes from this 2,005-meter program hit significant intercepts of visible REEs (some of these holes represent serious step-outs).

The final hole of the program—drill hole WI19-32—tagged 130 meters of visible REEs, opening up the potential for continued (significant) expansion to the north.

The arrows on the following map show where Wicheeda is open for expansion:

So… we have a significant REE deposit in a super-safe mining jurisdiction, surrounded by key infrastructure, with every indication that things will get bigger on the resource end.

“Cool beans, but what about the metallurgy you were blathering about further up the page?”

Glad you asked.

On October 24th, the company dropped a weighty piece of news addressing that very subject.

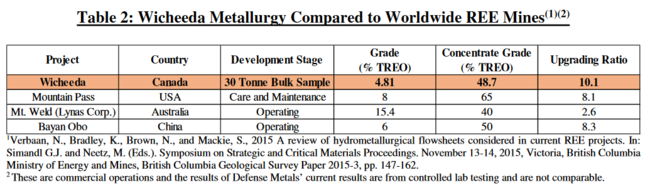

In order to break down and make sense of the numbers reported in this news release, it’s helpful to know that the company was optimistically targeting a total rare earth oxide (TREO) metallurgical recovery rate of 80%, and a TREO high-grade concentrate of 40%.

The (final) metallurgical test results showed:

- a TREO metallurgical recovery rate of 85.7%

- a 48.7% TREO high-grade concentrate of cerium, lanthanum neodymium, and praseodymium oxides (Ce2O3+La2O3+Nd2O3+ Pr2O3)

The 85.7% recovery rate is excellent. Taking a 4.81% head grade and achieving a 10.1 times concentrate of 48.7% concentrate is also excellent… most excellent.

These met-test numbers exceeded company expectations by a healthy margin.

Though these results were produced in a controlled lab and may not be entirely indicative of a full-scale processing scenario, they suggest Wicheeda’s metallurgy ranks among the very best REE deposits in the world.

It’s important to understand that producing a concentrate 10-times the 4.81% head grade will greatly reduce shipping costs.

Shipping is a big cost driver. These numbers should reflect positively in future economic studies.

So, there you have it. To summarize the extremely positive fundamentals underlying the Wicheeda deposit, we have:

- a safe and friendly mining jurisdiction

- all the right access and infrastructure advantages

- a significant LREE resource that appears to want to grow, perhaps substantially so

- superior metallurgy comparable to the very best deposits on Earth

What’s next?

There are still 11 holes from the summer drilling campaign yet to be reported. Keep in mind, all 13 holes in the program tagged significant intercepts of visible REEs.

Q1 should usher in an updated resource estimate for Wicheeda, one which factors in all 13 holes from the summer drilling campaign (expect to see the Inferred REEs upgraded to the Indicated category).

A 30-tonne bulk sample extracted earlier this year from Wicheeda—part of which provided the material used in these metallurgical tests—will go on to feed a pilot plant the company plans to build together with SGS Canada this coming winter.

The pilot plant will cost roughly $600K—expect a modest PP to be announced as part of the company’s short to medium term newsflow. We should learn more about this important milestone in the coming weeks.

All of the above puts Defense and its Wicheeda project in a strategic and enviable position. The only question is: when will the market catch on?

A final thought

Would it be unreasonable to expect that with so much at stake, with China holding most of the cards at the REE table, that Trump would approach these trade negotiations with a modicum of tact?

Trump Says China Wants a Deal With U.S. ‘Much More Than I Do’

I’m sure there are people out there thinking, “C’mon… Trump has everything under control.”

Sure he does.

END

—Greg Nolan

Full disclosure: Defense Metals is an Equity Guru marketing client.

Leave a Reply