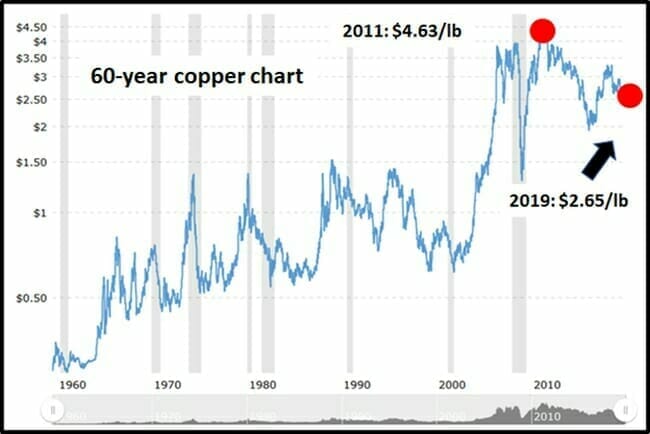

Something dramatic just happened in the copper markets.

It’s worth noting because the funds making these copper bets have teams of geologists and economists on staff.

According to the most recent Commitments of Traders Report, three months ago there were about 74,000 collective short copper positions (betting that the price of copper will go down).

That was a historic high for negative copper bets.

Last month, net short positions plummeted to about 17,000 contracts on the CME copper market.

That is a stunning 80% reduction in negative copper bets.

In the last month, long copper positions (betting that the price of copper will go up), have spiked from about 40,000 to 62,000.

What’s going on with copper?

In this podcast, Gianni Kovacevic – the Director and CEO of CopperBank Resources (CBK.C) spoke with Equity.Guru’s Guy Bennett about copper’s underlying value, and the wealth-creation opportunity in “the electrification of everything.”

Bennett states that “Gianni is the most deeply informed metal-CEO he has ever interviewed.”

CopperBank currently controls four copper projects: Copper Creek, in Arizona, the Contact Copper Project located in Elko Nevada, the Pyramid project on the Alaska Peninsula and San Diego Bay, also in Alaska.

Three weeks ago, CBK announced a plan to augment this portfolio of established copper projects by diversifying into a royalty model, launched with two royalty assets:

- Contact Copper Project located in Nevada

- Copper Creek Project located in Arizona

“The royalty business model is a proven, cost effective way to significantly grow shareholder value in the natural resource space,” stated Kovacevic.

“Segregating these two royalty assets into CopperBank Royalties affords us a near zero cost basis opportunity to unlock tremendous shareholder value,” stated Kovacevic who is considering “spinning out the securities of CopperBank Royalties to shareholders and listing the resulting entity on a Canadian stock exchange.”

“Copper, specifically the ExplorerCos boasting billions of pounds in the ground, could be the sleeper trade of our generation,” wrote Equity Guru’s Greg Nolan in an August 14, 2019 article.

In July, 2019, the International Copper Study Group stated that copper demand has exceeded supply by 155,000 metric tons in the first four months of this year.

Sixty-five percent of the copper that is mined is used in electrical equipment, 25% is used in industrial machinery and the balance is used in construction.

China consumes 200% more copper than the rest of Asia and more than 400% more than the U.S. – so the driver of copper prices is largely about China.

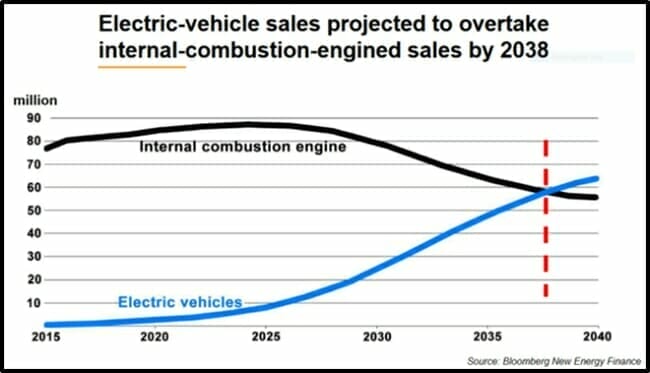

But it’s also about green energy.

“Copper has some extremely compelling supply-demand dynamics when viewed from a distance,” stated Equity Guru’s Greg Nolan.

“Electric vehicles (EVs), for example, require roughly 183 lbs of the stuff (electric buses require between 500 and 800 lbs),” continued Nolan, “Even the charging stations that keep these vehicles in motion require copper—heaps of it:”

EV sector will need 250% more copper by 2030 just for charging stations

More examples of the role copper will play in a greener world:

- Flywheels (pumped hydro) will require .3 to 4 tonnes of Cu per megawatt (MW).

- Wind turbines will require 3.6 tonnes of Cu per MW.

- Solar panels will require 4 to 5 tonnes of Cu per MW.

According to the International Energy Agency, worldwide demand for air conditioning is expected to triple over the next 30 years:

- 52 lbs of Cu will go into each cool air unit.

- 8 billion cool air units are expected to be in use worldwide by 2050.

- China, India, and Indonesia will account for roughly half of this global increase in electricity demand.

Kovacevic isn’t the only metal-CEO eye-balling copper.

“Where we have opportunities to secure or expand our copper footprint, we will,” Barrick Gold’s (ABX.T) CEO Mark Bristow told the Financial Times this week.

Copper “is more strategic than cobalt, more strategic than lithium. You can’t replace copper on conductivity. It is a modern metal,”, stated Bristow, “It’s processing characteristics are identical to gold. “You can leach it, you can concentrate it, you can smelt it. It is a very uncomplicated process. It’s the same as gold and it comes with gold.”

Barrick owns copper projects in Zambia, Chile and a Saudi Arabian.

For the first nine months in 2019, Barrick produced about 142,000 tonnes of copper, which makes them a pretty small copper player on the world stage. Chile’s Codelco produces about that much every month.

If Barrick is looking to expand that production profile, it has the financial resources.

“We have $2.1 billion of cash and a $3 billion revolving credit facility,” Bristow told the Financial Times, “That’s $5 billion of available liquidity.

“Shifts in positioning on both CME and the LME suggest the financial community is turning more positive on copper,” stated an excellent Reuters article.

JPMorgan analysts, summarising their takeaways from this year’s LME Week, noted that “in our meetings we found copper to be the favorite long across base metals among financial market participants”.

Despite 2019’s weak copper price, there hasn’t been much build up in inventories. Global inventories of copper were 438,000 tonnes at the end of October, 2019, up just 2% from October 2018.

If the money managers making bullish bets on copper are correct, companies like CopperBank are positioned to benefit.

Full Disclosure: CopperBank is an Equity Guru marketing client.

Leave a Reply