Cresco Labs (CL.C) and Origin House (OH.C) have updated the terms of their $1.1B acquisition, repricing the all-stock transaction to match declining share prices since the deal’s announcement in April.

Pursuant to the Amendment, the consideration payable under the Arrangement will be reduced from 0.8428 of a subordinate voting share of Cresco Labs (a “Cresco Share”) for each Common Share and 84.28 Cresco Shares for each class A compressed share of Origin House (a “Class A Share”), to 0.7031 of a Cresco Share for each Common Share and 70.31 Cresco Shares for each Class A Share.

Cresco was originally to pay $12.68 per Origin House share based on the company’s share price on the last trading day prior to the deal’s announcement.

Origin House now has a market cap of $568M, roughly half of the initially agreed upon price.

Origin House is now currently trading at $4.70, and Cresco Labs is trading at $7.85. Although priced at only 70% of Cresco Labs shares, Origin House shareholders are looking at a 19% increase in value at current levels if the deal goes through, less than the “Implied premium of 25.9% to Origin House’s 30-day VWAP ending March 29, 2019” originally touted.

Both companies have also announced a non-brokered financing, fully subscribed, issuing 9,705,882 common shares of Origin House at a price of $4.08 for gross proceeds of $39.6M.

The funds will be held in escrow pending the closing of the deal, and will be sorely needed when Origin’s debts come due in late December.

According to the company’s latest financials, the delayed close of the acquisition, and cash used to expand operations in California and Canada, “have led to decreased liquidity compared to the Company’s historical levels.”

Origin’s debts are also an issue which the financing will help address.

On June 27, 2019 the Company entered into a loan agreement with Opaskwayak Cree Nation (“OCN”) whereby OCN would loan the Company $12.0 million in two advances each evidenced by an unsecured promissory note of $3.5 million and $8.5 million respectively. The loan will be due and payable in full on December 31, 2019 and attracts an annual interest rate of 10% per annum compounded monthly in addition to a commitment fee of $600,000 payable monthly in six equal installments of $100,000.

As of June 2019 the first promissory note of $3.5 million was paid.

Some Cresco shareholders may be a bit miffed with the conversion rate being applied here, especially given the drastic slide in Origin House’s share price since the deal’s announcement.

Further dilution, in December when the acquisition is expected to close, will result from some of the 205 million Cresco shares coming off lockup on Dec. 3, 2019 with the rest unlocking on June 3, 2020.

The U.S. MSO play

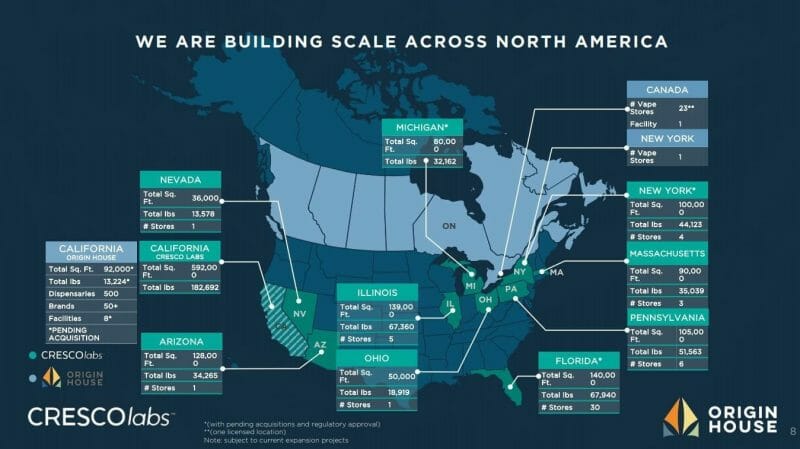

Although Origin House has a Canadian facility to its credit, the focus has always been the California market.

“Win California, Win the World” is the company’s strategy when it comes to capturing market share in a crowded multi-state operator (MSO) space.

California is the biggest cannabis market in the world, and it’s also the most competitive. Still, Origin House claims to have approximately 60% storefront dispensary penetration in the state.

Cresco Labs has much broader American penetration, with interests or proposed interests in 11 U.S. states.

Combined, both companies purport to tout over 56 brands, 725 dispensary partners, 51 retail licenses for dispensary locations and a total addressable market of 185 million in Canada and the U.S.

With a population 10 times that of Canada, American MSOs have been posed for some time now as the eventual inheritors of the cannabis stock enthusiasm which has dissipated since March.

But the MSOs at-large have also largely disappointed, suffering from the same slides in share price which have plagued Cresco Labs and Origin House.

MedMen Enterprised (MMEN.C) is down to $1.35 from its year-high of $6.48 and had to terminate an acquisition of its own.

Blamed on regulatory hurdles, the all-stock acquisition of PharmaCann was terminated on Oct. 8, 2019.

Cannabis laws, at the state level, seem to be evolving, however: Illinois, where Cresco Labs has three cultivation facilities, will legalize cannabis for recreational use goes into effect Jan. 1, 2020.

Updates to banking legislation have recently been passed, allowing cannabis companies to access financial institutions they have been historically barred from.

President Donald Trump has said he will continue to allow states to decide on the legality of cannabis, but a number of prominent Democratic presidential candidates have voiced their support for federal legalization.

Freedman & Koski project the revenue range for cannabis in Illinois as falling somewhere between $1.69B to $2.57B. New Frontier Data projects the legal cannabis market in the U.S. to be $13.6.

–Ethan Reyes

Leave a Reply