Junior exploration companies—ExplorerCos, if you will—are high-risk propositions. It can take up to 1,000 grassroots projects to generate 100 targets worthy of a probe with the drill bit. Of those, perhaps five or ten will evolve into development projects. And of that small group, only one will become an actual (profitable) mine.

Not great odds. So why do we speculate in these high-risk arenas—what’s the point?

Indulge me for a minute or two…

It was the mid-2000s. Down to the last few dollars in its treasury, Ecuadorian ExplorerCo Aurelian Resources made a bold move and mobilized a drill rig to an exploration target they ignored during an earlier round of drilling. It was a gamble, but geophysics had identified a subsurface anomaly lending a degree of validity to the (blind) target.

What the company tagged with this ‘river card’ far exceeded even the most optimistic expectations of those involved—a 237 meter core interval grading 4.14 grams per tonne gold and 8.5 g/t silver.

The project was called Fruta del Norte (FDN).

That monster of a hole was followed by 205 meters grading 8.4 g/t Au (uncut)—another impressive hit.

Then came 189 meters of 24 g/t Au (uncut)—a truly staggering hit.

Aurelian’s stock price soared from a mere $0.40 to over $40.00. In 2008, Kinross acquired Aurelian for 1.2 Billion dollars.

There’s your reason why…

End games

I limit my search in this sector to companies helmed by smart men and women who know their rocks. Exploration is a capital-intensive game. An experienced crew will spend their funds wisely, using good science—geochemical and geophysical—to increase the odds of success before a drill rig is mobilized to the project.

If an ExplorerCo is successful in tagging a significant new discovery, it will attract interest. If the discovery is world-class, it’s likely to provoke a predatory response from one or more resource-hungry predators.

It’s important to understand that every day a gold miner digs ore out of the ground—every day the company is in business—it reduces its mineral inventory (its reserve base).

The brutal bear market over the past eight years forced producing companies to dramatically scale-back exploration spending. As a result, their pipeline of new projects may be a little on the lean side.

This sets up an interesting dynamic—an end game—for shareholders positioned in new discoveries.

A FAT takeover offer from a resource-hungry producer is the ultimate reward… the ultimate end game.

Peak Gold

South Africa used to be the world’s largest producer by a wide margin. Today it ranks number eight, and according to African Statistics Day, the once-dominant gold nation will completely run out of gold reserves in less than 40 years.

All of our large, near-surface orebodies have already been discovered—that’s the theory.

‘We’re right at peak gold’: All major deposits have been discovered, declares Goldcorp chairman

That doesn’t mean that the earth’s crust is completely tapped out. It simply means all of the low-hanging fruit has been picked.

We need to go deeper…

The Mponeng Gold Mine in South Africa is mining ore in excess of four kilometers below the surface.

As these large, near-surface ore bodies enter the final phase of their production cycles, we will need to go deeper… much deeper.

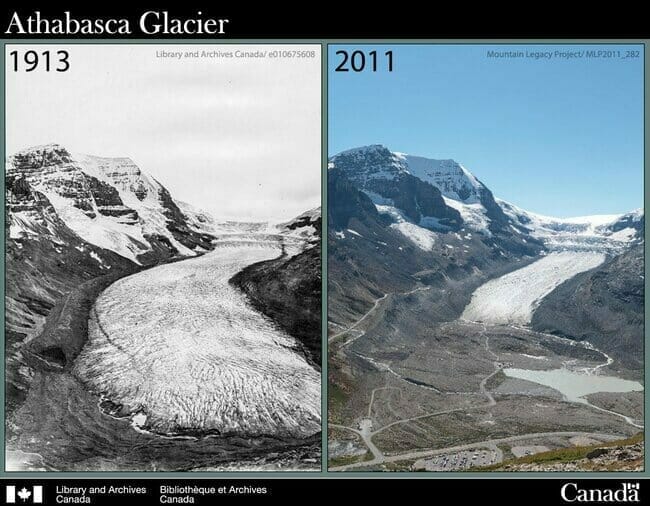

And in some cases, we need to go higher, to probe ground that was inaccessible, until now…

Retreating glaciers—an unsettling ‘now you see it, now you don’t’ phenomenon—foreshadow imminent environmental catastrophe for some. But for others, it’s a blessing.

Today, geologists are kicking rocks that haven’t been exposed to sunlight since forever.

Have you ever wondered just how far we will go to find gold deposits closer to home?

“Quit using the rig fence as a goal net Billy!”

End game potential in British Columbia’s Golden Triangle

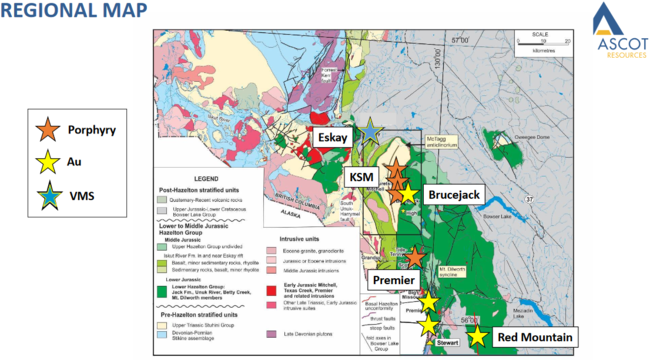

In previous offerings on the subject, we highlighted geologically prospective jurisdictions like the Abitibi Greenstone Belt of Ontario and Quebec, the prolific gold trends of Nevada, and the unglaciated terrain of Canada’s Yukon. For the remainder of this piece, we’ll focus on the Golden Triangle of British Columbia aka The Triangle aka The Gldn-Tri.

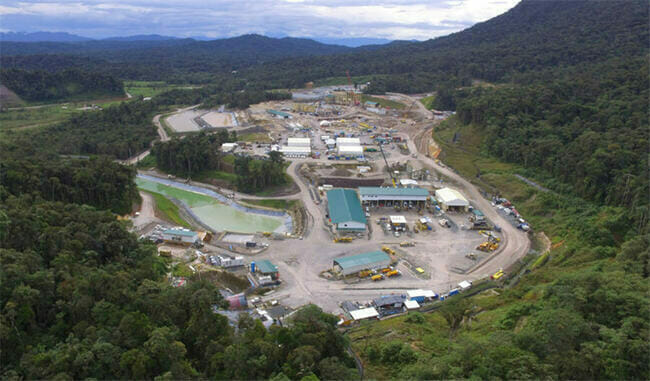

The Golden Triangle of northern British Columbia is truly a world-class destination for precious and base metals. The region hosts some of the largest (and richest) mineral deposits on the planet.

The Triangle is monster country:

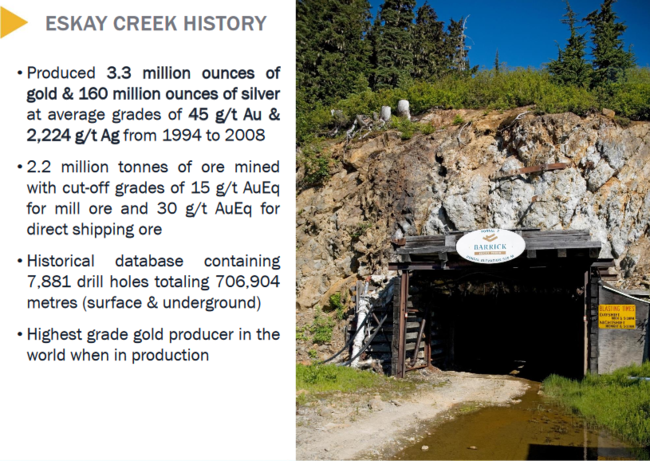

- Eskay Creek – 3.3 million ounces of gold (Au) and 160 million ounces of silver (Ag) mined at average grades of 45 g/t Au and 2,224 g/t Ag.

- Brucejack – a relatively new mine in the Triangle sporting bonanza grade reserves of some 8.7 million ounces.

- KSM – one of the world’s largest undeveloped gold deposits boasting well over 100 million ounces in all three resource categories. It also boasts massive copper, silver, and moly values.

- Red Chris – with 13 billion pounds of copper, nearly 20 million ounces of gold, and 64 million ounces of silver, Australia’s Newcrest Mining Limited (NCM.ASX) was sufficiently impressed by its prospects, recently taking down a majority interest for USD$806.5 million in cash.

- Schaft Creek – proven and probable reserves of 5.6 billion pounds of copper, 6 million ounces of gold, 372 million pounds of molybdenum, and 52 million ounces of silver.

The list goes on.

And significant discovery potential remains.

A wild n beautiful Gldn-Tri anecdote from times past…

One of my first forays into the junior exploration arena was during the Eskay Creek Gold Rush—a discovery that lit of the Vancouver Stock Exchange (VSE) like the 4th of July.

Back in 1932, a prospector named Tom Mackay staked the Eskay Creek property after spotting an tantalizing rock outcrop from the air.

“This will become one of the greatest mines in BC”, Mackay was oft heard to say.

A boulder Mackay discovered on the property assayed out at a spectacular five ounces of gold per tonne, firming the man’s resolve, prompting him to drill the immediate area of the find.

What Mackay didn’t realize at the time was that the gold-rich boulder had broken free from its source, rolling over a dozen meters down a slope.

According to Ron Netolitzky, Eskay Creek explorer and geologist extraordinaire, “They were so close they could taste it”.

Years passed. Decades went by. Tom MacKay worked the property for over half a century, but finding the source of that gold-rich boulder proved too elusive. He died trying…

Mackay’s wife, Marguerite, clung to her husband’s legacy, taking over control of his company, Consolidated Stikine Resources.

It was a struggle for Marguerite. Funds were low. Her board of directors were well past retirement age and lacked the skillsets of a newer, younger generation of prospectors.

Her days of maintaining control of Eskay Creek were numbered. Her 200,000 Consolidated Stikine common shares were near worthless, trading below a nickel, on the rare day they traded at all.

Then, in early 1988, geologists John Toffman and Ron Netolitzsky entered the fray—they liked what they saw in the widow Mackay’s Golden Triangle property.

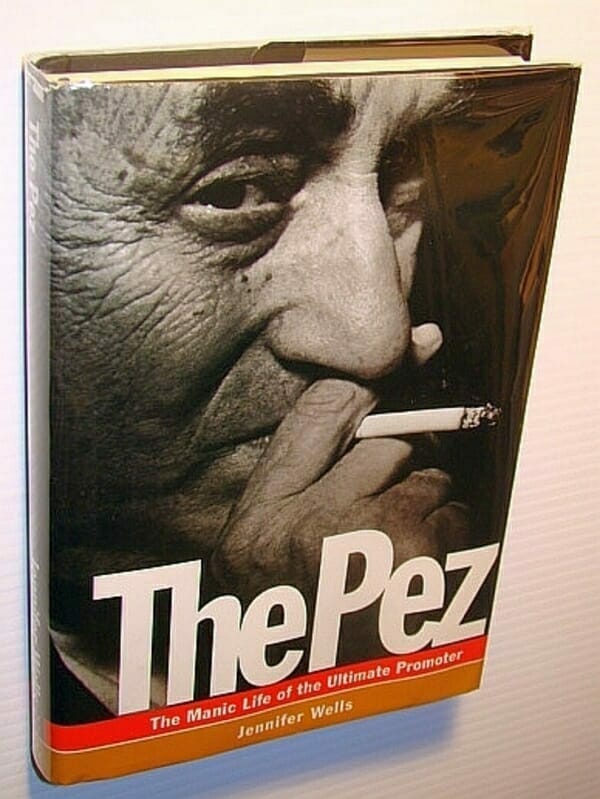

A short time later, the colorful, brash, and often outrageous Murray Pezim was brought in to help move the project forward.

It was in the Fall of 1989 when Consolidated Stikine and Pezim’s Calpine Resources hit pay dirt.

Tearing up their exploration budget, they drilled straight on through the brutal northern BC winter.

In the summer of 1990, after drilling a total of 108 holes, each one better than the last, they hit a fault. The orebody disappeared. Its location had shifted somewhere else along the mountain.

Chet Idziszek, Pezim’s onsite geologist, was stumped. He had no idea where to drag the drill rig next. All he could do was guess.

After studying his maps and scoping out the steep terrain, Idziszek—a rock whisperer if there ever was one— settled on a spot 350 meters away from his last drilled hole. That’s where he sunk hole 109.

Hole 109 goes down in history as one of the greats, a genuine monster: 27.2 grams per tonne gold and 30.2 grams per tonne silver over 208 meters.

Hole 109 caused such a stir, so much commotion, it triggered a wave of claim jumping forcing BC’s chief gold commissioner to invoke a staking freeze until the disputes, some of which were stacked seven deep, could be sorted out.

The VSE became a madhouse. Howe Street brokers’ were pushed to the brink of physical and mental exhaustion as a tidal wave of buy orders poured in.

Long story short: Calpine shares, which had sunk to a low of six pennies pre-discovery, rose to $9.75 after the news of hole 109 dropped.

In the end, Marguerite Mackay’s 200,000 Consolidated Stikine shares—stock that traded for mere pennies only two years earlier—were valued at $67.00 per share after an intense bidding war ground to an end.

A must-read…

Gold, Greed and Glory – How the gold fields of B.C. made poor men rich, and rich men enemies

Eskay Creek produced over 3 million ounces of gold and 160 million ounces of silver in its day.

Though the mine was closed in 2008, the Eskay Creek story is not over, not by a long shot (more below).

The Gldn-Tri companies

Without a doubt, if news of another hole 109 were to drop tomorrow, it would likely trigger more than a few massive coronaries. I have 911 on speed dial, just in case.

It’s important to understand that the exploration window in this prolific mining region is generally, depending on the elevation, four to five months.

The rest of the year, except for the most hardcore and intrepid prospector, the Triangle’s subsurface riches are in winter lockdown.

With the region currently in the grip of winter and tax-loss selling exacting a toll on companies that fail to exceed expectations, NOW may be an opportune time to size things up from an ounces-in-the-ground point of view… to seek out bargains in advance of the 2020 exploration season and the potential for a raging bull market in all things gold.

Before we dive into the individual companies, a reminder from a previous Guru offering:

Of course, you can’t just take my word for it. You need to conduct your own due diligence as part of a disciplined approach to speculating in these high-risk / high-reward arenas. It’s best to view my role as an ‘ideas guy’—ideas requiring a healthy measure of skepticism, scrutiny, and if you think my insights hold H2O, some serious follow-up.

Skeena Resources (SKE.V)

- 115.29 million shares outstanding

- $69.17M market cap based on its recent $0.60 close

We gave you a broad stroke of the Skeena story back in April of this year. Much has happened since then, and it’s all about Eskay Creek.

Skeena optioned the original Eskay Creek claims from the previous operator of the project, Barrick Gold (ABX.T), back in 2017.

The previous operation was an underground mining scenario—the grades took center stage.

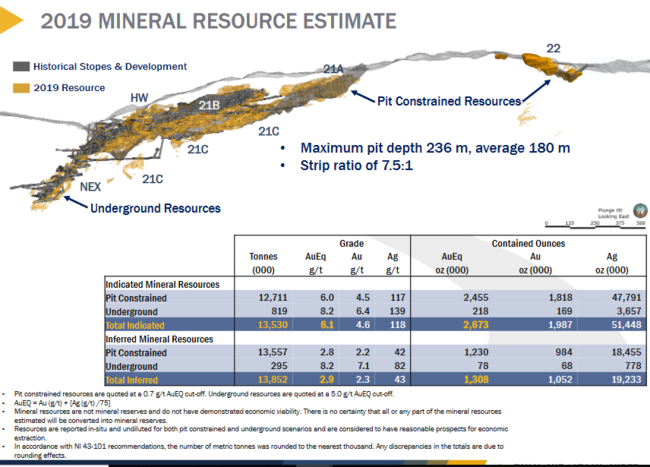

Though the mine closed over a decade ago, a substantial gold resource remains—nearly 4 million gold equivalent ounces (AuEq), most of which lies near-surface, and can be extracted via open-pit.

Note the grades underlying the Indicated ‘pit constrained‘ resource.

Open-pit mines are typically low-grade scenarios, often less than one gram per tonne (g/t). There are open-pit mines in production today—profitable open-pit mines—producing from sub 0.5 g/t material.

Skeena’s AuEq grade runs roughly 6.0 g/t. This is especially significant as the resource is located close to the surface (maximum pit depth = 236 meters).

There are precious few companies in this arena boasting these kinds of open-pit grades. Sabina Gold (SBB.T) and their Back River Project have company.

The Eskay PEA

On November 7th, the company delivered a preliminary economic assessment (PEA) for Eskay Creek, the results of which knocked my socks off.

“Robust project economics”? Understatement. I can’t remember the last time I saw an after-tax internal rate of return (IRR) this fat.

(It’s important to understand that a PEA is a first pass economic study, one which captures the basic fundamentals of a mineral deposit—resource, scale, logistics, etc. Preliminary in nature, it sets the stage for a more advanced examination of a project’s economics)

Eskay Creek 2019 PEA Highlights:

- High-grade open-pit averaging 3.23 g/t Au, 78 g/t Ag (4.17 g/t AuEq) (diluted);

- After-tax NPV5% of C$638M (US$491M) and 51% IRR at US$1,325/oz Au and US$16/oz Ag;

- After-tax payback period of 1.2 years;

- Pre-production capital expenditures (CAPEX) of C$303M (US$233M);

- After-tax NPV: CAPEX Ratio of 2.1:1;

- Life of Mine (“LOM”) average annual production of 236,000 oz Au, 5,812,000 oz Ag (306,000 oz AuEq);

- LOM all-in sustaining costs (AISC) of C$983/oz (US$757/oz) AuEq recovered;

- LOM cash costs of C$949/oz (US$731/oz) AuEq recovered;

- 6,850 tonne per day (TPD) mill and flotation plant producing saleable concentrate.

Note that the price assumptions used in this scoping study are conservative—$1,325 gold and $16.00 silver (gold is currently trading north of $1,450 – silver $17.00).

“A $300 million CapEx for a project that will produce in the order of 300,000 ounces per year is superb.

“A phenomenal capital intensity ratio”

Here, Tommy Humphreys discusses this milestone with Skeena CEO, Walt Coles:

This is an excellent interview. Questions raised touch on metallurgy, smelters, exploration upside, Barrick’s back-in option, and future catalysts.

There’s a lot more to the Skeena-Eskay Creek story. I’d recommend a closer look.

Tudor Gold (TUD.V)

- 133.04 million shares outstanding.

- $65.19M market cap based on its recent $0.49 close.

- 336.03 million shares outstanding

- $21.84M market cap based on its $0.065 share price

- 43.27 million shares outstanding

- $12.33M market cap based on its narrow, $0.30 trading range.

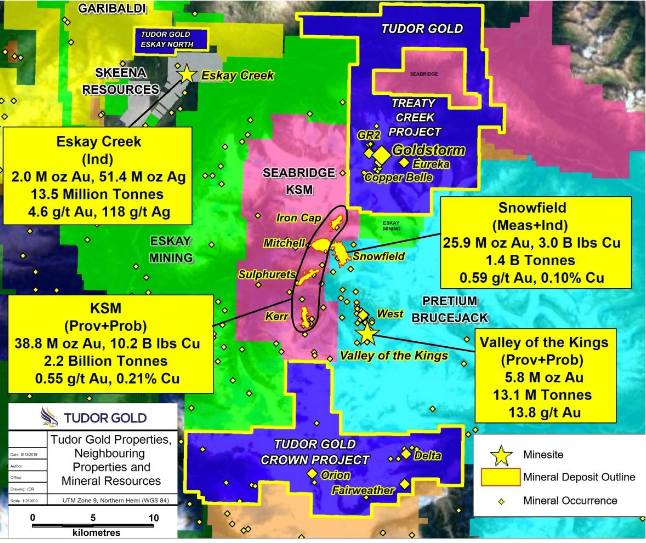

All three of these companies are partnered together, exploring a potentially colossal gold resource in a very upscale neighborhood.

The project’s name is Treaty Creek.

The joint venture has Tudor with 60%, Teuton with 20%, and American Creek with the remaining 20%.

Though Treaty Creek does not have a 43-101 resource, there is every indication that this project has considerable scale.

On July 30th of this year, we were enamored by the following headline out of the Goldstorm Zone:

That was a fat hit, both in grade and length. And significantly, it was a bold 150-meter stepout hole.

On September 23rd, the joint venture partners released results from another 150-meter stepout tagging 0.589 g/t Au over 1081.5 meters including an upper interval of 0.828 g/t Au over 301.5 meters and a lower interval of 0.930 g/t Au over 207 meters.

The stocks sold off on this news. The market was looking for more. But the entire sector was beginning to correct, consolidating gains registered earlier in the summer.

This lack of appreciation does not negate the significance of this late summer hit.

Then, on October 24th, the partners released final assays from their 2019 Treaty Creek drilling campaign with the following meaty headline:

Summarizing the 2019 Goldstorm headline numbers (ALL 150-meter stepouts):

- Hole GS-19-42 – 0.683 g/t Au over 780 meters including 1.095 g/t Au over 370 meters near-surface;

- Hole GS-19-47 – 0.589 g/t Au over 1081.5 meters (yes, that’s over one kilometer in length) including 0.828 g/t Au over 301.5 meters near-surface;

- Hole GS-19-48 – 0.725 g/t Au over 838.5 meters;

- Hole GS-19-52 – 2.006 g/t Au over 87 meters within 336 meters averaging 1.004 g/t Au near-surface.

I see no mention of a NI 43-101 resource estimate in the offing. It doesn’t mean that the company isn’t planning one.

I suspect a resource estimate would represent a potentially significant share price catalyst, should one drop before they mobilize a drill rig back to the project next June.

All three of these companies might be considered good value at this juncture. At the very least, they are worth exploring in greater detail.

Ascot Resources (AOT.T)

- 232.48 million shares outstanding

- $132.51M market cap based on recent trading patterns

Ascot is an explorer, developer, and Golden Triangle consolidator looking to transition into producer, focusing their energy on re-starting the past producing Premier gold mine.

This project is steeped in mining history.

Hailed as one of THE greatest gold and silver mines on the planet in its day, Premier began production back in 1918, hitting its peak during the Great Depression.

Ascot’s 100% owned 3,082-hectare Premier-Dilworth Project is divided into two separate properties – Northern Dilworth and Southern Premier.

Hundreds of thousands of meters in over 6,000 drill holes have targeted the Premier mine, the Big Missouri mine, the Martha Ellen, and Dilworth zones on the property to date.

The target here is high-grade gold hosted in “quartz breccias, quartz veins and associated stockwork around breccia zones within an envelope of quartz-sericite-pyrite alteration.”

Significantly, one in 10 holes drilled on the project to date has tagged over one oz of gold per tonne.

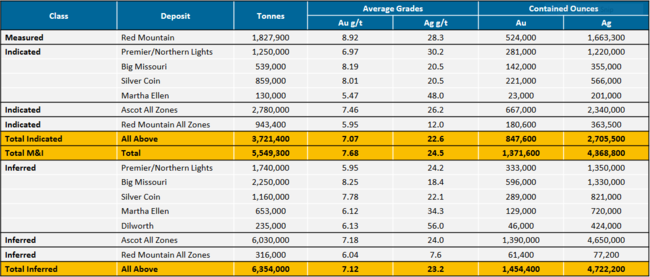

Earlier this year, the company took out Rob McLeod’s IDM Mining and its 17,125-hectare high-grade Red Mountain project, further consolidating strategic resources in the region.

Red Mountain’s positive 2017 feasibility study presents a near term high-grade production option for Ascot.

Current resources spanning all projects and zones within the company portfolio are as follows (note the grades and ounce-count):

With a reduced snowpack this year, the company was able to launch an early, aggressive exploration campaign consisting of both infill and stepout drilling.

The goal is to grow ounces along known mineralized zones and upgrade resources in high-priority areas of the property.

Select highlights from this campaign include the following high-grade hits:

- 66.30g/t Au over 1.0 meter in hole P19-1891 at Big Missouri;

- 56.80g/t Au over 1.65 meters in hole P19-1911 at Big Missouri;

- 320g/t Au over 1.0 meter in hole P19-1949 at Big Missouri (included in 5 meters averaging 66.3 g/t Au);

- 48.9g/t Au over 1.0 meter in hole P19-1954 at Big Missouri (included in 4 meters averaging 12.8 g/t Au);

- 30.00g/t Au over 1.25 meters in hole P19-1956 at Big Missouri;

- 20.60g/t Au over 2.0 meters in hole P19-1964 at Big Missouri;

- 69.00g/t Au over 0.85 meters in hole P19-1981 at Big Missouri.

Just yesterday, November 18th, the company released the following assays from their high-grade Prew zone:

- 37.95g/t Au over 5.03 meters in hole P19-2153;

- 8.14g/t Au over 13.03 meters in hole P19-2156;

- 8.39g/t Au over 8.75 meters in hole P19-2151.

Ascot has completed roughly 52,400 meters of drilling this year and has reported results from just over 60% of the holes drilled to date.

A lot more assays are pending.

Seabridge Gold (SEA.T)

- 63.28 million shares outstanding.

- $1.05B market cap based on its recent $16.65 close

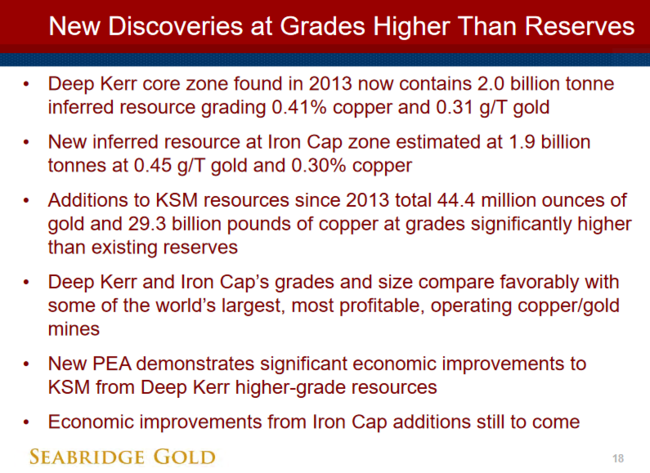

Seabridge’s KSM Project, a quartet of deposits known as Kerr, Sulphurets, Michell and Iron Cap, represents one of the largest untapped resources of gold and copper on the planet.

Current Measured and Indicated resources ring in at 49,694,000 ounces of gold.

Inferred resources = 56,330,000 ounces.

All told, the company boasts 106 million ounces of gold in all categories, plus a massive amount of copper, silver, and moly.

KSM’s Proven and Probable reserves stand at an eye-popping 38.8 million ounces of gold, plus significant copper, silver and moly credits.

What’s holding back the development of KSM?

A PEA and PFS conducted several years back demonstrate only modest economics. CapEx for a project this monstrous will run into the billions.

What will it take to overcome these obstacles? Very simply, higher gold and copper prices.

When both metals make their moves to claim higher ground, KSM will likely be pushed further along the development curve.

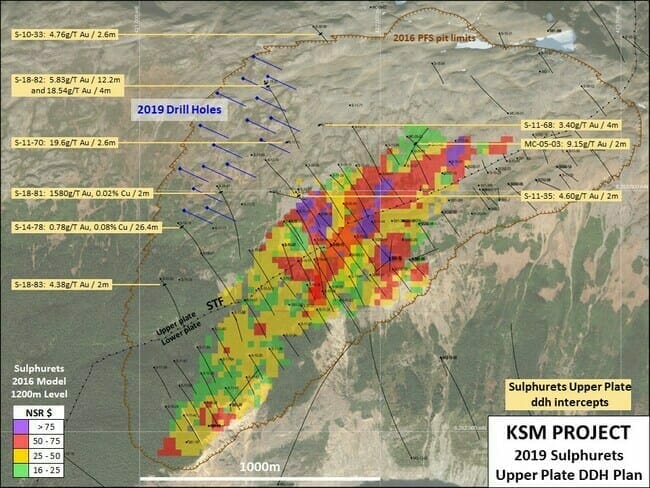

In the meantime, the company is targetting higher grade zones within the broader resource areas.

In late August of this year, the company announced it had begun a 4,000-meter drilling program designed to test an area within the Sulpherts pit limits where a 2018 drill hole tagged a shallow intercept of 2.0 meters grading 1580.0 g/t Au (>50 oz/tonne) and 209.0 g/t Ag.

That’s a fat hit for rock that was once thought to be barren.

Assays from this program are pending.

SEA shares, and their leverage to a rising gold price, could be viewed as a long term Call option on gold… a Call option with no expiry date.

GT Gold (GTT.V)

- 116.31 million shares outstanding

- $90.72M market cap based on its recent close at $0.78

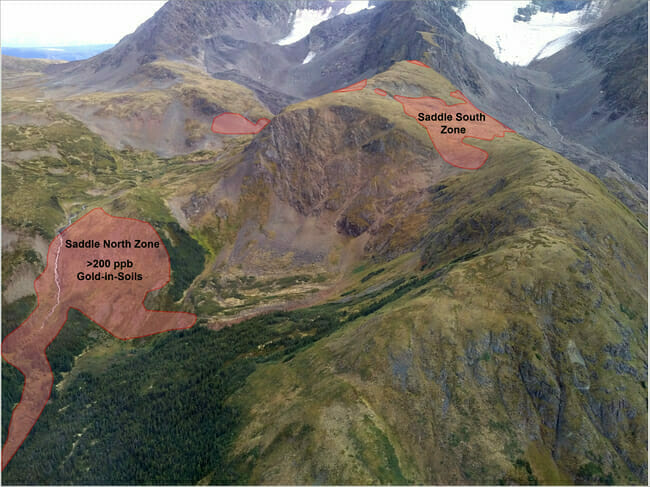

GT Gold’s 100% owned Tatogga Property is the location of new gold-copper-silver porphyry discovery called Saddle North.

The company was off to a great start this year, first with a strategic investment by Newmont-Goldcorp (NGT.T) in early May, followed by a solid hit in the early going from the Saddle North Project:

- 500 Metres of 0.91 g/t Au, 0.55 % Cu, 1.34 g/t Ag (1.23 % CuEq; 1.67 g/t AuEq).

Soon after, the company mobilized a third rig to the project.

Charles Greig, Vice President of Exploration:

“The 2019 season is off to an excellent start. The third drill gives us flexibility to test additional targets on the large Tatogga property while maintaining our focus on what’s most important, Saddle North.”

Sentiment is still very poor in the junior exploration sector. If drill hole assays do not exceed expectations, or at the very least, beat previous results, the market can unforgiving.

On September 4th, the company delivered a set of assays that open up the known higher-grade mineralization by approx 100 meters along strike to the southeast at depth, and by approx 200 meters along strike to the northwest near surface.

The highlight of this round of assays was in Hole TTD126:

- 0.57 g/t Au, 0.26% Cu, 0.96 g/t Ag (0.94 g/t AuEq) over 1,206 meters from 18 to 1,224 meters.

More recently, on October 16th, GT released results from five holes additional holes designed to test the extent of the mineralization (mineralization that remains open in most directions, particularly at depth).

Highlights from this round of assays include:

- Hole TTD128 – 635.00 meters @ 0.40 g/t Au, 0.31% Cu, 0.93 g/t Ag (0.61 % CuEq; 0.83 g/t AuEq) from 696 to 1,331 meters, including 225.39 meters @ 0.74 g/t Au, 0.46 % Cu, 1.57 g/t Ag (1.01% CuEq; 1.39 g/t AuEq) from 1,083.81 to 1,309.20 meters.

- Hole TTD132 – 137.78 meters @ 1.71 g/t Au, 0.77% Cu, 2.36 g/t Ag (2.04% CuEq; 2.79 g/t AuEq) from 476.00 meters to 613.78 metres within 378.71 metres @ 1.00 g/t Au, 0.52% Cu, 1.42 g/t Ag (1.26% CuEq; 1.72 g/t AuEq) from 270.00 to 648.71 meter.

Interestingly, drill hole TTD128 returned a number of significant high-grade gold intersections including 4.11 metres @ 25.42 g/t Au from 529.20 metres, 15.70 metres @ 6.21 g/t Au from 1,506.00 metres and 5.00 metres @ 16.13 g/t Au from 1,515.61 metres.

CEO Paul Harbidge:

“It is great to see a set of strong drill results which is providing further delineation to this large-scale gold rich porphyry Cu system. It is very encouraging to see the continuity of the high-grade core drill hole to drill hole and section to section, especially with the results of TTD132 and the fact that the system remains open to depth and targets remain untested along trend.”

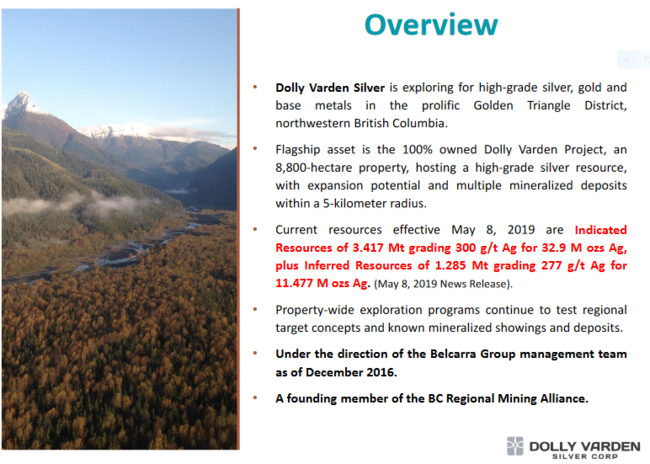

Dolly Varden Silver (DV.V)

- 77.75 million shares outstanding

- $20.21M million market cap based on its recent $0.26 close

I’m including Dolly here because I don’t believe it’s getting the respect it deserves.

The company was given the ol ‘What For’ when it dropped an updated resource estimate for its Dolly Varden Silver Property last May.

Our comments at the time:

“Apparently, the market wasn’t impressed with the numbers. But it’s important to understand that management chose to go conservative when it tabled these numbers (conservative cut-off numbers were applied here).”

Since then, the company released positive metallurgical test results on composite samples from the Dolly Varden and Torbrit deposits.

On the drilling front, the company released several updates with the following headline values:

And then, today, November 19th, the company released the following update:

Dolly’s current share price may represent good value.

Final thoughts

To prevent this one from turning into War and Peace, I limited the list to the advanced-stage plays.

We’ll be watching the Triangle closely over the coming weeks as news continues to flow.

END

—Greg Nolan

Full disclosure: none of the companies featured above are Equity Guru marketing clients.

Leave a Reply