Beleaguered Canadian cannabis company Beleave (BE.C) just posted financials after the close of trading on a Friday, which is, as we well know, ‘Friday news dump’ time.

True to form for a company that’s never posted good news to my recollection, these financials are absolute toilet.

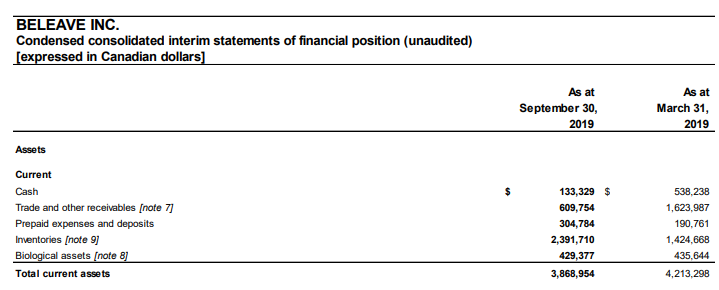

As of September 30, 2019, Beleave had $133,000 to its name.

That low cash position isn’t new for Beleave. The quarter before it had $366k, the quarter before that $538k.

So, like, they’re flat out of money.

They also have:

- $4m in trade and other payables, up from $3m last quarter

- $8.7m in borrowings, up from $8.2m last quarter

- $780k in revenue, down from $800k last quarter

- $2.8m net loss, up from $1.5m last quarter

Inventories and biological assets are both down this quarter, so it’s not like they’re just vaulting all their weed to sell some time later, they just have less weed, are selling less weed, are losing more money in doing so, and have less cash than ever.

So, like, NBD.

That’s exactly the sort of fuckery I’d expect from this management team, which went to the Bridgemark boys for money twice, even though the first time they raised money through that scam club it basically halved BE’s share price, a result that happened again on the second go-round.

The Globe and Mail reports in its Friday edition that Beleave has admitted to participating in a scam that saw it shuffle $7.5-million into the pockets of “consultants.” The Globe’s Mark Rendell writes that between April and June, 2018, Beleave claimed to have raised $10-million in two private placements. In fact, it had already paid $7.5-million in “consulting fees” to individuals and firms investing in its private placements. The “consultants” did no actual consulting work. The details of the scheme were outlined in a settlement agreement between Beleave and the British Columbia Securities Commission. […]

The BCSC alleges these companies “paid most of the private placement funds back and kept very little of the money raised,” while members of the BridgeMark Group sold the securities in the market below private-placement acquisition cost.

Twice.

This is also the company that infamously decided to roll their stock forward, to get a big PR push happening.

The [Financial] Post’s guest columnist Peter Hodson writes that in November, Beleave split its stock, seven-for-one. Most investors like stock splits. However, Mr. Hodson says this one was highly unusual. Instead of wanting a higher stock price, Beleave wanted a penny stock for some reason. The stock, in the $1.50 range before, was taken down to 22 cents with the split. Sure, trading liquidity improved, but practically every other company in the world does not want a penny stock, but Beleave did. Now the stock is down 75 per cent on the year. Mr. Hodson says he is not sure who was advising the company on this one, but common sense would have been better here.

They recently brought on a new CEO, Jeannette Vandermarel, who I went to bat for not long ago when rumours were afoot that her previous company, 48North (NRTH.V), was struggling with an outdoor crop gone to seed.

The company was projecting 40k kg of crop would be brought in and claiming the naysayers had it all wrong.

They managed to bring in just 12k kg, and a load of excuses as to why that may have been a good thing.

It was Health Canada’s fault, apparently, for not licensing more processing space for them. Also, they’ll be bringing in others to grow for them soon.

Also, they ‘learned a lot.’

“While the Company was not able to dry the full capacity at Good:Farm due to licensed drying capacity,” has to be the Cannabis equivalent of “The dog ate my homework.” $NRTH

— Alex (@AlexLTrading) November 26, 2019

NRTH has been a big disappointment, and none were more disappointed than me, having got behind someone I saw as being unfairly targeted.

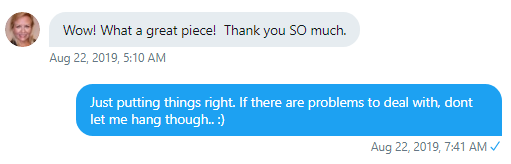

I’m not one to publish private correspondence, but ours ended with this:

There were indeed problems to deal with, and rather than be honest about them, Vandermarel Scoooby Dooed out of the room and let me hang.

“Thanks Chris, rumors are untrue. We just don’t feed trolls,” she told me.

Yeah? Do you feed your clones?

When NRTH had to come clean about their misgivings, Vandermarel wasn’t around to take the heat. After telling me privately how wrong the rumour mill was, and how she had ‘tons of pictures – but don’t share them‘, she then left that job to go be CEO at Beleave, which is less a step up and more a step into warm dogshit.

Beleave is the cannabis equivalent of a WorldstarHipHop video. You know you shouldn’t spend time on it, you know someone’s going to be left bleeding in a drunken heap by the end, but that scrawny kid is going to take a tire iron to the jaw any minute…

Management’s view is that the success of the Company is dependent upon financing the remaining portion of its capital requirements and repayment of existing debt. The Company will require additional financing in order to conduct its planned business operations, meet its ongoing levels of corporate overhead and discharge its liabilities and commitments as they come due, indicating a material uncertainty exists that casts significant doubt upon the Company’s ability to continue as a going concern.

Repay existing debt? Not a hope in hell.

They can’t even keep up with their payments to Auxly (XLY.V), which loaned them $5 million, which was supposed to be paid as follows:

Until the D.O.P.E. Note is repaid in full, the proceeds from 85% of all Grams sold by Beleave will be delivered to Auxly as payment against the outstanding principal of the D.O.P.E. Note. The sales of Grams are subject to certain wholesale and retail floors of $6 and $7 per Gram, respectively

So Auxly CAN’T sell enough weed to keep its lights on, because 85% of the grams they sell have to go to Auxly to repay their debt.

And they haven’t been doing that, so Auxly has called the debt in.

Auxly has provided the Company with notice that it is in default under the provisions of the D.O.P.E. note agreement dated October 5, 2017. As a result, the entire balance of the note payable of $6,445,854 is due on demand and classified as a current liability and the unwinding of the previously recorded discount has been included in change in fair value of note payable and interest expenses in operations.

That’s not the only liability.

In May 2019, the Company entered into a loan and referral fee agreement with a Lender for $567,409. The loan was used to purchase inventory from a Licensed Producer and to extract the entire purchased inventory into oils which will subsequently be sold to provincial retailers for the recreational market. This loan bears no interest and matures when the oils produced have been sold. It is expected that all the oils will be sold within the fiscal year. As a result, the entire balance of the unsecured loan of $567,409 is classified as a current liability.

That’d be demonstrative that they were out of money not last quarter, but the quarter before, and that those oils haven’t sold yet.

Or they have, but they needed to keep the money and not pay back the debt.

Hell, pay back the debt? They haven’t even paid the finder’s fee.

As a result of the referral fee agreement, the Company owes the Lender a finder’s fee of $25,000 and a commission based on 10% of net profits derived from the sale of the oils from the purchased inventory. The Company is presently in default over the loan, with a 3% penalty due as consequence and a mortgage agreement to be executed against the London facility. As a result, the entire balance of the loan agreement of $509,722 is due on demand and classified as a current liability.

Beleave staff party live-cam footage:

The words “a mortgage agreement to be executed against the London facility” should put shivers up the spine of anyone still involved in this thing, because now we’re into the divvying up of assets to cover the debts.

Is that it?

As at September 30, 2019, there was $84,626 (March 31, 2019 – $6,000) outstanding payables to related parties owing to an officer and a former officer of the Company, included in accounts payable and accrued liabilities. This amount is unsecured, non-interest bearing and due on demand.

Christ on a bike, how do these people survive the day without walking into walls and falling out windows?

Beleave is dead. If it’s not officially bankrupt yet, it will be any day now.

There are 500 million shares outstanding and the stock is at $0.03, which means every half cent it falls takes $2.5 million off its current $15 million market cap. At any point in time, Auxly or their oil money lender or the mystery exec that left with money owing could wind this thing up and hang it into liquidation, but they likely won’t because they wouldn’t cover the vig in a fire sale.

This is a collection of vague and unsuccessful assets looking for someone to dig out of a ditch.

Don’t be the last guy in the room.

— Chris Parry

FULL DISCLOSURE: No commercial connection, thank christ.

Leave a Reply