Dionymed Brands (DYME.C) is – sorry, was – the low hanging fruit of the cannabis bubble burst. It was always a goner for anyone who looked hard enough, but in a market where aspiration was rewarded more than perspiration, Dionymed sent out all the right news releases to keep the joke going longer than it should.

If you still hold Dionymed stock, enjoy your tax write-off because it ain’t coming back, and what it owns isn’t going to cover what it owes.

But DYME can still be valuable to non-investors, being as its news flow from the last year reads like a ‘choose your own adventure’ book, where a CEO has clearly chosen ‘spend money you don’t have and borrow more at whatever price it’s being offered’ as his preferred path.

Dionymed is dogshit, but it’s not like it’s the only weed company fertilizing your lawn. There are dozens of other cannabis companies that have walked willingly into oncoming traffic over the last year, believing they could borrow forever and it would be fine because who wouldn’t want to lend more money to a company that doesn’t make any?

As an investor, when something collapses, it the smart move to figure out why it happened, because we can use that information to spot future disasters, and see the signs of them coming elsewhere.

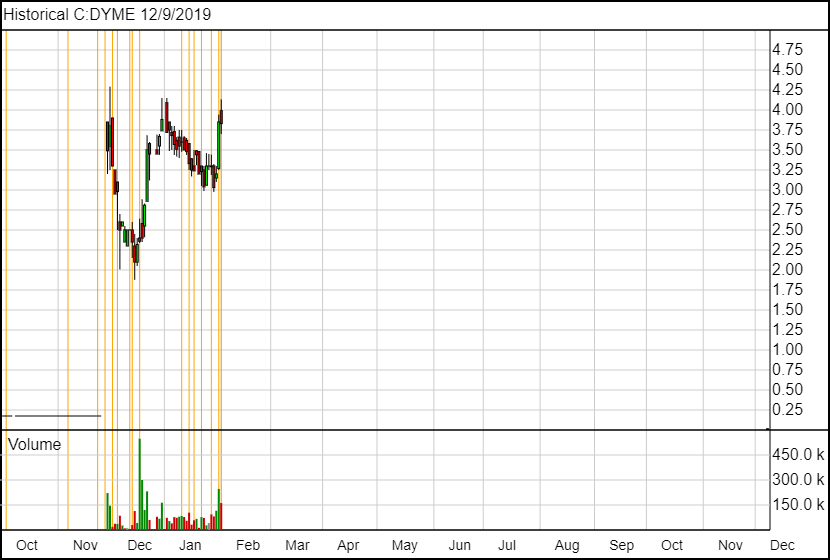

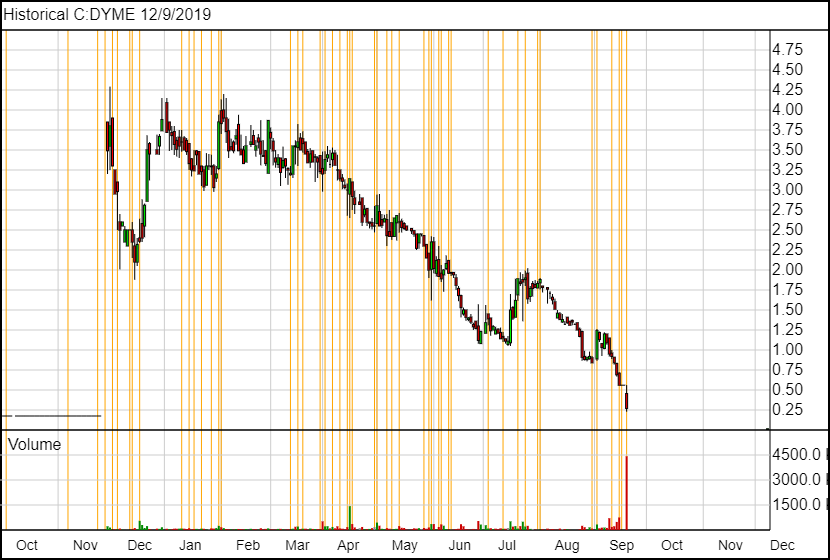

How did DYME go from stock market darling to implosion at a sewage plant? Here’s the map:

Let’s go back a year, when DYME’s deal was to be a complete cannabis concierge to Californians.

It all started so well when the company announced it was buying a California cannabis company.

THE ACQUISITION:

Dionymed Brands Inc. has completed its previously announced acquisition of HomeTown Heart, expanding the company’s direct-to-consumer delivery platform in California. The purchase price of $18-million (U.S.) comprises approximately $6-million (U.S.) paid upon closing of the transaction and a performance based earnout of up to $12-million (U.S.), to be paid in a combination of cash and stock.

Cool. Of course, this sort of service wasn’t actually legal across California at the time, but:

Jeff Morgen, CEO of HomeTown Heart, commented: “The acquisition of HomeTown Heart by Dionymed is well timed as California’s final draft regulations are expected to enable direct-to-consumer cannabis deliveries statewide. This is a significant milestone for the largest cannabis market in the world supporting consumers in the municipalities that have banned physical storefronts.” [emphasis mine]

What were they buying? Well, technically an illegal operation.

HomeTown Heart, based in Oakland, Calif., is a direct-to-consumer, non-retail storefront delivery dispensary serving the San Francisco Bay Area. It has completed more than 800,000 on-line and mobile orders since its inception in 2015 and today completes over 1,500 deliveries daily in the Bay Area alone.

Red flag, but it’s late 2018 and rules don’t matter when everyone is getting rich, so let’s keep moving.

THE HYPE:

That purchase was followed by a bullshit distribution deal which DYME worked hard to make sound like money would be coming in from it. Read between the lines and you see it was purely a stock market play.

Dionymed Brands Inc. has signed a strategic partnership agreement with Acres Cannabis, a vertically integrated cannabis retailer, based in Las Vegas, Nev. The partnership grants Dionymed’s brands and services immediate access to the highly coveted Nevada market, which services more than 43 million tourists each year, and represents another significant step in Dionymed’s national expansion plans.

ZOMG! Wows! So amaze!

Only it wasn’t a ‘distribution’ deal at all. It was a white label licensing agreement.

As part of the partnership agreement, Dionymed’s infused products and edible brands, including its award-winning Winberry Farms, will be manufactured in Acres’ facilities and sold statewide, providing Dionymed with a scalable platform to penetrate the Nevada market.

What DYME had done was go to an existing Nevada weed company and say, ‘hey, put our name on some of your shit’, and the other company was all, ‘okay, whatever [shrug]’, and DYME called it ‘immediate access to the highly coveted Nevada market.’ This allowed them to call themselves a ‘multi-state’ company, which they did at every opportunity going forward, and do to this day.

Meanwhile, that illegal pot delivery service they bought in California was, shock! Horror! – more illegal than they thought?

Dionymed Brands Inc.’s Hometown Heart, a licensed California delivery service managed by Dionymed, has terminated its relationship with customer acquisition provider Eaze Technologies, Inc., formerly Eaze Solutions, Inc. Following a review of certain of Eaze’s business practices, the company was unable to confirm that Eaze’s credit card payment processing methodology met regulatory compliance requirements.

DYME would ultimately have to take Eaze to court to disengage with them fully and would accuse them of financial misdealings, because Eaze decided to keep acquiring customers through its app after DYME opted to make it’s own app. In court, Dionymed insisted their former partners were ‘a scheme to defraud credit card companies and financial institutions into processing cannabis transactions in violation of a host of criminal laws’ and engaging in ‘unfair competition.’

THE BORROWING:

Dionymed raised $40m in January 2019, which sounds great until you dig in deeper. It wasn’t an equity raise but, rather, a loan backed against assets.

Why this matters is because, if a company sells stock to raise money, shareholders have some security in the event of a strategic review some time down the line, that there will be assets that can be sold to cover losses.

But when a lender comes in and offers money that is secured by those assets, now you’re increasing risk a lot and potentially ending up in a place where lenders get first dibs on everything while investors wait to see what’s left over at the end.

Dionymed Brands Inc. has signed a definitive agreement for a two-year, up to $40-million (U.S.) senior secured credit facility from a syndicate of investors. The credit facility consists of a $15-million (U.S.) term loan facility and a $25-million (U.S.) asset-backed loan facility. Dionymed will draw $13-million (U.S.) following the completion of certain conditions to the satisfaction of the investors. Currently, the syndicate of investors has committed to provide $13-million (U.S.) of the credit facility. Future commitments from existing or future lenders are expected for the full amount. Amounts drawn under the facility will be guaranteed by Dionymed and its subsidiaries and will be secured by all assets of Dionymed and each subsidiary, including inventory, trade receivables and real property.

That’s not to say companies can’t be responsible and still borrow money. If there’s an opportunity there that would see a prompt return on the loan, maybe even multiple returns. why not take the bridge financing? After all, taking out a mortgage on property is a valid financing option for anyone. This, however, wasn’t a mortgage. It was more like a car loan for folks with bad credit.

The facility will bear interest at a rate of LIBOR (London interbank offered rate) plus 8 per cent with a commitment fee, an arrangement fee and an annual fee.

When directors at Dionymed look back at this loan, they’ll see it as the salad days, before sky went dark and the machines took over.

THE DELUSION:

“An efficient capital structure is an essential part of Dionymed’s strategic plan as we continue our growth trajectory and further scale our operations. Building upon our capital raise in November, 2018, of $35-million, this credit facility provides non-dilutive capital to help us further achieve our aggressive growth goals, which focus on advancing our deal pipeline and building upon our existing cannabis to consumer platform. The cannabis industry will continue to consolidate at an increasing rate and Dionymed is strongly positioned to play a leading role in this stage of the industry’s rapid growth,” said Ed Fields, CEO.

It’s ironic that Fields thought he was going to take advantage of the cannabis industry consolidation, when he turned out to be one of its first victims.

At the time, the stock price was doing okay, considering the downward pressure on the market in general. So, of course, DYME borrowed more money. And kept borrowing until they couldn’t anymore.

MORE BORROWING:

Dionymed would take another $10.5m in financing a few months later, announcing the deal at a discounted $2.75 per share, as much as $0.75 below the market price of the time, and right in the midst of a shopping spree for more assets.

If the cheap raise wasn’t a red flag that something was amiss, what followed was a virtual neon warning sign.

Even as investors were committing to that raise, Dionymed found it couldn’t get its financials audited, what with that Hometown Heart deal to sort out and this kind of accounting practice being better than that kind of accounting practice and, don’t worry about it, you wouldn’t understand.

The stock slid quickly, passing the cheap $2.75 level along the way, and with DYME’s new financiers stuck in a trading hold for the next four months, there would be nothing they could do to escape the stock freefall that had already begun.

By the time the financing was closed, the stock was sitting on $2.50. A month later, when the financials were finally posted, it reached $1.60.

This was a problem for Fields, because he was running significant losses and needed ongoing financing to stay afloat. As the stock slid to new lows, future financings would get more expensive and come with provisos that were more and more daunting.

When Fields managed to get another $32m offered to the company, this time by Alumina Partners, the terms of that deal were usurious at best.

The price per share of the Subordinate Voting Shares purchased by Alumina in each issuance of units under the Agreement shall be priced at a discount of 15% to 20% the Market Price, subject to the maximum aggregate discount cap mandated by the Exchange in relation to the then-prevailing price per share.

There are a lot of lessons here, mostly about looking at all of a company’s news flow and not just the most recent news release, to ensure you have the complete picture about a company before you buy in. By itself, a $32m financing shows confidence in a public company, but the details, where regular investors are unable to get stock for the same price as the guy coming in, tell a different story. The conversion discount shows a company so eager to get financing they’re prepared to do it at almost any cost, even if it undercuts their share price by 25%.

It wouldn’t be the last such deal, but it would be the last big one. As Dionymed kept on buying things, and kept losing money, and kept restating earlier financials back into deep 2018, they borrowed another $2m from Green Gotham. With higher interest still.

The note bears interest from the date of issue at LIBOR (London interbank offered rate) plus 12.5 per cent per annum.

If that seems like a small amount to borrow considering what the company was losing ($9m per quarter) and borrowing to that point, consider $2m was likely all they could get.

That’s probably a good thing, if you’re Gotham Green.

The ink wasn’t dry before this news was announced:

Trading of Dionymed Brands Inc.’s shares was halted on Sept. 16, 2019, pending an agreement for a restructuring of its debt facility. The company expects to provide details of such restructuring very shortly.

Six weeks after they loaned $2m to Dionymed, Gotham Green was demanding its money back.

THE EXECUTION:

1: The company is also announcing that Gotham Green has issued a request for repayment of its outstanding balance of $2.2-million (U.S.) representing the credit advance made on July 30, 2019, plus accrued and unpaid interest.

2: Flow Capital Corp. has commenced legal proceedings against Dionymed Brands Inc. as DionyMed is in default under the company’s royalty agreement. The claim is for the minimum sum of $2,698,116 which is made up of the investment balance, past-due royalty payments and late payment fees.

3: GLAS USA LLC and GLAS America LLC, as https://equity.guru/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative agent and collateral agent under Dionymed Brands Inc.’s credit agreement dated Jan. 16, 2019 (as amended, supplemented or otherwise modified from time to time), respectively, have provided the company with notice of default under the credit agreement and demand for immediate payment of the amount of $24,810,682.80 (U.S.) plus any additional interest, fees and expenses.

Ed Fields saw the writing on the wall and bailed just prior to GLAS calling in their debt and sending the company into receivership. He did not stick around to help with the clean-up, and he’ll likely receive no penalty for driving around $85m in loans and raises off a cliff.

Edward Fields, Dionymed Brands Inc.’s chief executive officer, and Mark Zinselmeier, the company’s interim chief operating officer, have both resigned effective immediately. Mr. Fields also resigned as a director of the company and as an officer of the subsidiaries of the company. The rest of the company’s executive team remains unchanged.

Those borrowers will pick the bones clean and shareholders will likely get nothing but a big red blot on their portfolios that they’ll never be able to sell on.

SO WHAT HAVE WE LEARNED?

There are warning signs for this kind of mess and they’re not difficult to spot. By themselves, one item on this checklist doesn’t make for a near death experience, but a collection of them should make investors feel nervous and, at the very least, compel them to set stop losses on their trading platform.

- Large borrowing with high interest, cheap conversion prices, and/or the ability for the lender to ‘borrow’ (AKA short) the stock

- Constant financing, specifically for purchases that aren’t cashflow positive, specifically for a price that is below the market price

- Late financials: CFO’s, you have one job…

- Any acquisition that does business in an area that is technically illegal

- Acquisitions that don’t close in a fair turnaround time

- Share counts that keep running up by tens or hundreds of millions

- Financings being announced right before a trade halt – the company knows when it’s about to be halted most of the time, if they’re taking money right before that, chances are those buying in are furious

- Directorial resignations in any number more than one at a time

- Lawsuits – any kind of lawsuits, both in the name of and against the company

Dionymed hit all of these red flags over the course of a year in which a lot of people saw the downward chart and thought, ‘it’s gonna come back soon, gotta get it while it’s cheap.’ Those people are now far poorer than before.

So now, with DYME ‘s bow taking on water and the captain rowing away in a lifeboat, leaving shareholders behind, we move to waters new to see who else is in trouble.

How you doing, Invictus MD Strategies (GENE.V)?

The TSX Venture Exchange has accepted for filing an omnibus settlement and termination agreement dated Oct. 16, 2019, between the company and ABG-HMX, a Delaware limited liability company, whereby both parties have terminated their licence agreement dated June 1, 2018. Pursuant to the termination agreement, ABG-HMX has released the company from further obligations under the licence agreement in exchange for the following consideration: (i) $312,500 (U.S.) in cash consideration (paid); (ii) $2-million (U.S.) payable at the discretion of the company in cash or shares on or before Jan. 7, 2020; and (iii) $2-million (U.S.) payable at the discretion of the company in cash or shares on or before July 7, 2020.

Seems harmless enough. Invictus did a deal with Authentic Brands several CEOs ago to use some of the licensed names and brands under the ABG roof to launch cannabis brands. They never actually managed to do that because, well, celebrity endorsements aren’t legal in Canada. Which is part of why their deal to make Gene Simmons a spokesperson for the company [and a ticker symbol], with a side deal to buy his supposed strain company ‘Gene-etics’, came to zero.

But, the kicker:

If the company chooses to issue consideration shares in satisfaction of the consideration outlined in (ii) and (iii) above and ABG disposes of some or all of the consideration shares issued in respect of the payment obligation: (a) prior to July 7, 2020, and payment obligation, or (b) prior to Feb. 7, 2021, for less than their issue price, the company agrees to pay ABG the difference between the issue price and the sale price in cash or consideration shares at the discretion of the company.

Allow me to translate: Invictus can only spare a bit over $300k in cash to end this deal, so the rest is going in stock set at $0.12 per share (it was trading at $0.15 when the deal was announced), and if ABG sells that stock for less than they paid for it, Invictus will have to give them more stock or cash to make up the difference.

This is the sort of ‘deal’ you get from loan sharks at the docks. If the stock drops over the course of the next seven months, ABG charges Invictus for the difference. If it goes up, they make profit on the rise. They literally can’t lose, but bagholders get the pleasure of watching them profit from the sidelines, as their own investments drown.

The Gene-etics IP, which it paid heftily for and which, frankly, I doubt ever really existed since Gene Simmons was a noted anti-drug voice before there was money in it to switch sides, was a big loss.

From the MD&A:

The Company recognized $4,615,003 of impairment charges related to the Gene-Etics IP intangible asset. The Company no longer has an advantageous management contract with Gene Simmons, nor is it going to utilize Gene Simmons’ brand name.

Shocker.

Additionally, during this period, the Company incurred $7 million of one-time costs expensed to sales and marketing ($6.7 million of which was non-cash) related to the acquisition of Gene-Etics Strains Co. and related intangibles.

SELLING FOR SCRAP:

Canandia was a nice licensed grow that Invictus once bragged about, but they never had the dough to expand it beyond its initial 4k sq. ft and eventually flipped it for some much needed cash in the door – or, rather, less cash out.

Effective July 31, 2019, the Company sold its wholly owned subsidiary, Canandia. As a result, the Company has de-recognized Canandia from its books and recorded a net loss from disposition of $4,383,315. In addition, the Company has classified Canandia’s operation as a “discontinued operation” with a total loss of $648,702.

Invictus owed Canandia $105k and couldn’t/wouldn’t/didn’t wanna pay, so Canandia’s CEO released Invictus from the $3.3m it was still due to pay as part of the initial acquisition, and the cash owing, and got his license, facility, and crop back.

For Invictus it was a loss, but that loss was better than the prospect of continuing losses supporting the operation that it couldn’t conceive of properly building out.

One area of Invictus that hasn’t been a loss was its initial deal, from way back in the day, when they bought into Future Harvest, an Alberta store that did a roaring trade in the fertilizer, lights, and hydroponics business. It made $790k in revs a quarter in June, which was lovely and had been lovely for quite some time… before Invictus flipped it to its CEO in return for $1m and an agreement to cover an outstanding $425k shareholder loan within the year. Not exactly a burning hot deal for GENE.V.

These deals all seem to be similar, in that they were big deals back in the day that Invictus couldn’t nail down when the big cash was due later, and ended up with monies owing, loans having to be covered, and dreams dashed.

WHAT’S LEFT:

Acreage Farms and AB Labs remain under the Invictus umbrella, and there’s not much wrong with those. But there’s work to be done. Acreage is building out to an 80k sq. ft Phase III which it paid for in part with $25m in debt financing in 2018.

That financing came from ATB Financial at prime plus 2%. WE LIKE THIS.

But a followup $6m loan from Trichome Financial in mid-2019 reflected a change in fortunes for both the company and the sector, rocking prime plus 10%. WE LIKE TRICHOME’S SIDE OF THIS.

And then:

As of July 31, 2019, the Company has a shareholder loan of $380,000 from the President and CEO of Acreage Pharms, recorded in accounts payable and accrued liabilities.

Invictus is betting the farm (literally) on Acreage, so it might want to square away the deal with that CEO lest he call it in.

A significant amount of cash has been spent on, and forwarded to, and loaned to, AB Labs, which is a real investment with 16k sq ft working currently. Worth remembering on that front, however – Invictus only owns half of that facility currently.

WHERE ARE WE NOW?

The object of this exercise is not to try to tell you that Invictus will suffer a Dionymed-like fate. While DYME kept spinning the roulette wheel, respect should be paid to Invictus for doing the adult thing and SELLING ASSETS, even if sometimes those sales were less about making cash and more about stopping the bleeding.

But there is significant bleeding and the jury is out on whether it can be properly staunched. Clearly management has figured out that LPs barely run a profit, so having three of them isn’t a smart move.

Now they’re running out of assets to sell. How bad is the cost-cutting?

Decrease in general and https://equity.guru/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative (“G&A”) expense by 11% primarily due to https://equity.guru/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistration staff in Acreage Pharms working in the cultivation facility, thus reducing overhead cost.

You’re reading that right: Acreage has the office staff out trimming buds.

And the directorial stepdowns have already happened:

- On May 31, 2019, the Board of Directors accepted Mr. George E. Kveton’s resignation as CEO of the Company.

- On June 3, 2019, Mr. Aaron Bowden resigned as a Director and will continue to serve the Company as an advisor.

- Invictus MD Strategies Corp.’s Paul Sparkes and Keith Stein have resigned from the board of directors of the company, effective Dec. 5, 2019.

This is not a great scene for GENE (Jesus Christ, I hate typing that ticker symbol), but I don’t mind the fact that the company is actively looking to rectify the stupidity and hubris that came before this management team currently in place.

For a few years, we did marketing for Invictus, and though that was a time of stock price accretion and asset purchases, we stopped renewing contracts some time ago as the company appeared to be running on fumes, refusing to tell its story well, and not getting the pieces they’d purchased to work well together.

For several years, Invictus just didn’t have a plan. Where they veered away from being Dionymed v2.0 is, it appears they’re trying to be responsible adults now. A new ticker symbol, flipping AB Labs, and a few months without fleeing directors would be a good sign for shareholders, but the jury is out on whether they have enough cash to get that far.

We’re happy to keep a close watch on proceedings as we rumble into tax loss selling season, but if you see another one of those nutty financing deals drop, or the stock price drops far below the $0.12 that ABG is turning their debt into shares at – treat Invictus like cholera. At just a $12m market cap, the end is nearer than it should be.

— Chris Parry

FULL DISCLOSURE: No commercial relationship.

Leave a Reply