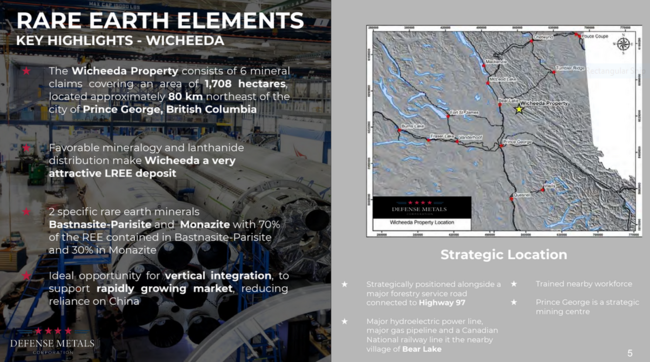

Without skipping a beat, Defense Metals (DEFN.V) extended its winning streak delivering exceptional REE values from their Wicheeda Rare Earth Element (REE) Project in the Prince George region of mining-friendly British Columbia.

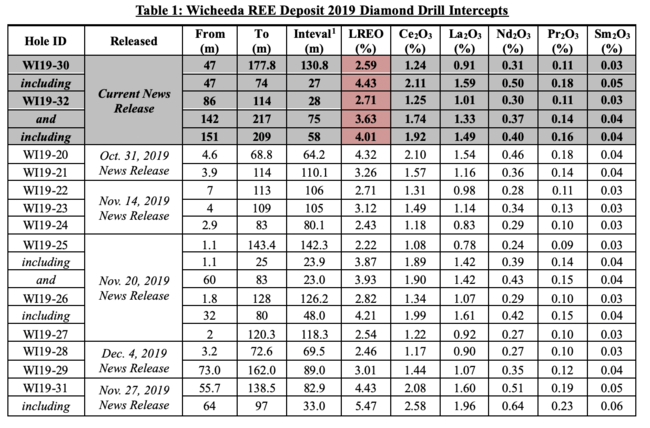

The final two holes from their 2019 drilling campaign boast the following assays:

- Drill hole WI19-30 intersected a broad zone of mineralization returning 2.59% Light Rare Earth Oxide (LREO being cerium, lanthanum, neodymium, praseodymium, and samarium oxides) over a core length of 130.8 meters (including 4.43% LREO over 27 meters).

- Drill hole WI19-32 tagged an impressive 4.01% LREO over a length of 58 meters within a broader zone of mineralization assaying 3.63% LREO over 75 meters. This hole also cut a shallower intercept of 2.71% LREO over 28 meters.

Have you ever heard of Efficient Market Theory? It doesn’t apply here. Not. One. Bit.

These results are nothing short of outstanding.

The market’s apathy and the company’s current low valuation could be a setup for one of the better trades going into 2020.

REEs

If you’re still unclear as to what REEs are and why they’re so damn important, this was my take a few weeks back:

REEs are everywhere.

They’re in satellites orbiting our planet. They’re in electric vehicles (EVs) hogging our passing lanes. They’re in your pocket right now “keeping your Candy Crush scores updated.”

Their properties are so unique, so unequalled, there’s no replacing them, and we’d likely be right-screwed without them.

The development push – metallurgy

This company is all about creating shareholder value with the drill bit, while simultaneously maintaining a keen focus on metallurgy—the science of extracting valuable metals from their ores and modifying said metals for their intended use.

Experienced resource investors know metallurgy is everything when it comes to developing an orebody, particularly where REEs are concerned.

On October 24, the company dropped metallurgical news that exceeded its own lofty expectations—news that ranks Wicheeda among the very best REE deposits on the planet.

We jumped on that hugely important development post haste.

The assays

Back in September, the company announced the conclusion of a 2,000-meter drilling campaign at Wicheeda, stating that ALL 13 drill holes intersected significant intercepts of visibly REE element mineralized dolomite-carbonatite rocks.

Visible mineralization: I’ve been around the junior sector long enough to know that these ‘visual cues’ rarely live up to the hype. But when Defense began releasing assays results in late October, it was clear the company’s onsite geologist knew his rocks.

Note the LREO grades and widths in the above table. These are fat results. They certainly exceeded my expectations.

Craig Taylor, CEO and President of Defense Metals:

With the release of our last two holes of the 2019 Wicheeda REE Deposit drill campaign we continue to establish the potential for expansion of the Wicheeda REE Deposit. Significant REE mineralization occurs within WI19-32 our northernmost drill hole completed on the Project to date, which is both open north and at depth.

The resource expansion potential

Adding an element of intrigue to these pending assays, the final hole of the program—drill hole WI19-32—tagged 130 meters of visible REEs, opening up the possibility of further resource expansion to the north.

We now have the numbers for that bit of intrigue, and it does indeed set up an interesting dynamic.

Wicheeda currently has an Inferred resource of some 11,370,000 tonnes averaging 1.96% LREOs.

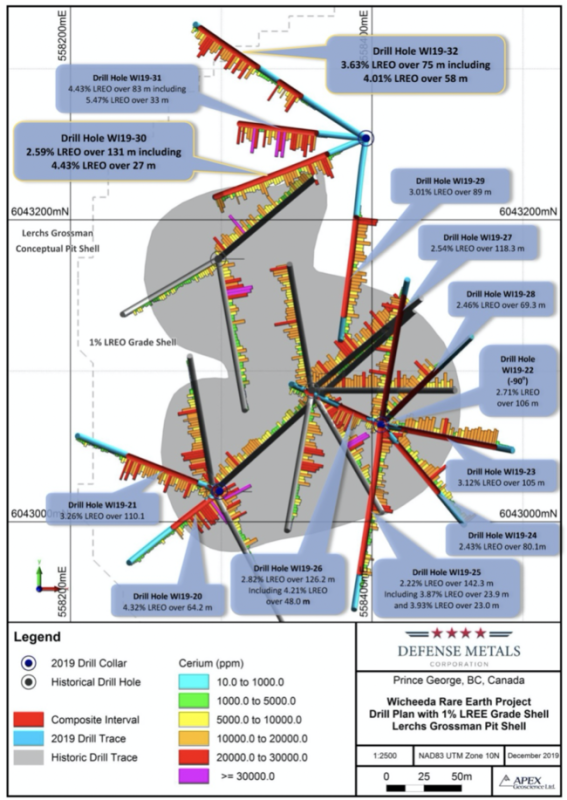

This beautiful graphic shows the outline of the Wicheeda resource in grey, and the position/angle of all 13 (recent) drill holes.

Note how holes WI19-32 and WI19-31 (top of the map) stepout to the north from the previously defined limits of the deposit.

Not only are these significant stepouts, they’re high-grade stepouts.

Studying the map further, holes WI19-21 and WI19-23 expand Wicheeda’s mineralization further to the southwest and east, respectively.

You don’t need a degree in higher mathematics to see the resource expansion potential here.

High-grade stepouts in multiple directions will add tonnage—Wicheeda will likely grow, perhaps significantly so.

A resource update is expected in Q1 of 2020.

The value potential

Bob Moriarty of 321Gold fame very recently calculated that a 1% LREO grade is worth roughly $121 USD.

If you accept $121 being the value of 1% LREOs and you do the math, you will realize their old 43-101 showed a gross metal value in the ground of just short of $2.7 billion USD. The entire market cap of DEFN today, after brilliant drill results, is less than 1/10th of 1% of that. I’d call that pretty cheap.

A company with a market cap that is 1/10th of 1% of the gross metal value of its resource—a resource that will likely see an upward revision in both tonnage and grade—is cheap alright. Damn cheap.

Drawing comparisons between WI19-32’s REE values and a gold hit, Moriarty went on to state:

But the 58 meters of 4.01% LREO is worth $484 USD in the ground. That’s about the same as 10 g/t gold over 58 meters. Any company drilling in Canada with those numbers would have a spurt of buying and probably double. But no one understands REOs so the stock price snores.

This is a useful comparison that drives home what the market simply does not understand. Yet.

The catalysts short and medium-term

Drill hole assays are now a wrap. But the company has plans big for H1 of 2020. There are a number of catalysts in the offing that could drive shareholder value.

1) The end of tax-loss selling pressure. I can’t help but think that January will restore some sanity to the company’s current valuation.

2) As noted above, a 43-101 Wicheeda deposit resource update is scheduled for Q1 of 2020. Drill hole assays have successfully expanded REE mineralization in multiple directions. The impact should be positive.

3) Bench-scale test results. This will augment the metallurgical test work performed earlier this year and allow the company to develop a robust, environmentally sustainable flowsheet. The stage will then be set for a pilot plant.

4) The company, along with SGS Canada, plans to build a pilot plant that will process the remainder of the 30-tonne bulk sample extracted last winter. This is the next step along the development curve, one that will validate the metallurgy process, generate design-quality data for engineering, and produce REE product samples for potential offtake partners.

5) A spring/summer drilling campaign, one designed to expand the resource and test other areas along the 1,708-hectare property.

6) A new bull market in all things mining related. Just a hunch on my part, but a reversal in the junior exploration sector is waaaaay past due.

7) A greater appreciation of REEs and the challenges of securing supply in mining-friendly climes.

Reuters, two days ago:

The U.S. Army plans to fund construction of rare earths processing facilities, part of an urgent push by Washington to secure domestic supply of the minerals used to make military weapons and electronics, according to a government document seen by Reuters.

Stoking the coffers

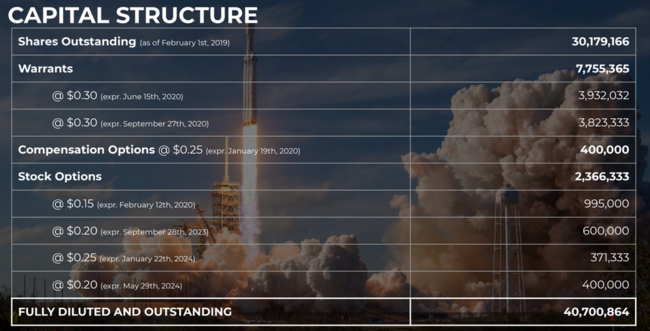

This company strikes me as highly protective of its tight share structure. Expect a modest raise—a private placement (PP)—somewhere in the neighborhood of $1M in the not-too-distant future.

The company has 7.75 million $0.30 warrants expiring in June and September of 2020. If the resource sector snaps out of its funk and begins assigning a more realistic value for what the company holds in its subsurface layers, these warrants should go in-the-money (ITM) prompting their exercise, adding another $2.3M to the coffers, reducing the need to raise additional funds.

Final thoughts

With a strategic high-grade REE deposit, a super-tight share structure, and a current market cap of $3.02M, Defense may evolve into one of the better stories in the junior exploration arena over the coming weeks and months.

We stand to watch.

END

—Greg Nolan

Full disclosure: Defense Metals is an Equity Guru marketing client.

Leave a Reply