A translation of this article is available in Chinese at our content partner NAI500 here.

Every living thing is part of its own ecosystem. It feeds, it grows, then it’s fed on by others which in turn grow themselves and become food for something else, which eventually dies and becomes carrion for the smallest end of the system, which repeats the process.

That’s how it’s supposed to go, anyway. When there’s balance, life is a cycle. We all flourish, some of us die, and that death fuels the next flourish.

But sometimes the high end creatures of those ecosystems outgrow the capacity of those cycles and instead devour everything in their path, bringing imbalance and, eventually, the collapse of the entire system.

Welcome to 2019, the year the cannabis ecosystem was taken over by apex predators, and 2020, where the system will collapse.

Like the corporate wildlife of an industrial Savannah, North American cannabis companies have grown heavy feasting on regular ‘no questions asked’ financing since 2014, while you smaller animals had happily feasted on the fertilizer they’ve left behind during that time. It had seemed like paradise because everyone was growing, but few realized they were actually being fattened up by the kings of the jungle, who were simply sitting, waiting for their chance to devour everything.

This year, the retail investors had their guts ripped out.

If you’re one of the few that didn’t, and you’re still out there among what’s left of the herd, running for your life, you should know you’re on borrowed time.

Like the old Twilight Zone episode where helpful aliens leave behind a book called ‘To Serve Man’, only for us to find out later it’s a cookbook, investors were welcomed and fattened up nicely as they unwittingly awaited their slaughter.

It’s not over.

Leaving the metaphors behind, a lot of you find yourselves down 50%, 80%, even 95% right now, which leaves you hoping for one of three things:

- A comeback, which is unlikely to hit the levels seen previously, if it shows up at all

- Acquisitions, which are unlikely given the lack of good financing options available and the strong likelihood weed stocks will get cheaper still, which kills the potential for ‘all stock deals’

- Liquidation, where the ‘true value’ of what your holdings own will be revealed, which is also unlikely given how much of those holdings are being used as collateral against heavy loans

In short, we’re a long way from the turnaround. The carnage continues.

“Hey Equity.Guru!” I hear you yelling at your monitor… “We know. We see it. Shouldn’t you guys have been telling us about this carnage before today?”

To that I answer, “Yeah, man. We have. It’s just that not too many folks have been listening.”

It’s no overstatement to say, every single time we’ve come out and told you about a terrible deal or a company lying to you or an inevitable stock collapse, we’ve taken a lot of loud shit for it, sometimes with legal threats to boot.

For every one of you who’ll say, “Hey thanks for showing us how terrible Wayland Group (WAYL.C) or ICC International (WRLD.U) was, glad I listened and got out,” we’ll have ten more yelling that we’re part of some shady cabal looking to intentionally hurt a great company (WAYL’s former CEO is still in hiding as it liquidates, and WRLD.U is now looking to de-list, but okay), and assuring us that they’re averaging down out of spite.

As late as last week, we were still getting ‘nyah-nahs’ from MedMen (MMEN.C) investors who, on the back of a three day run, were telling us how great it felt to not be us, despite being down 92% from their high. Those same investors have lost almost the entirety of their gains in the week since. Reminder: We warned about that company being a shitshow on its first day as a public company, and they warned they’d sue us for half a billion dollars for saying so, before changing their executive compensation structure as we demanded.

We were right about Namaste (N.V) being smoke and mirrors, about Aphria (APHA.T) overpaying for things the former CEO was selling to his own company, about Canopy Growth Corp (WEED.T) being years from break even.

All of that led to Equity.Guru making a big exit call in February – our third in as many years – suggesting we’d like to see everyone get out of everything, and predicting that cash would be your best investment for 2019.

That wasn’t a genius pick. It was the obvious pick.

Valuations had been dotcom era heavy, losses likewise, government rules were still hampering the operations side of any cannabis business and ensuring slow revenues, even more than they had in the past. For us, getting out of the weed business for all but the most undervalued or over-cashed just made sense. As it turned out, the downward tidal pull was so hard even those undervalued kids went underwater. We didn’t avoid the vacuum entirely, but we were affected far less than most.

Oh sure, there were still blue light specials out there, occasional trend buckers or momentary opportunities… and we took plenty of crap from those who’d landed on those lucky squares, at least for the few days they stayed up.

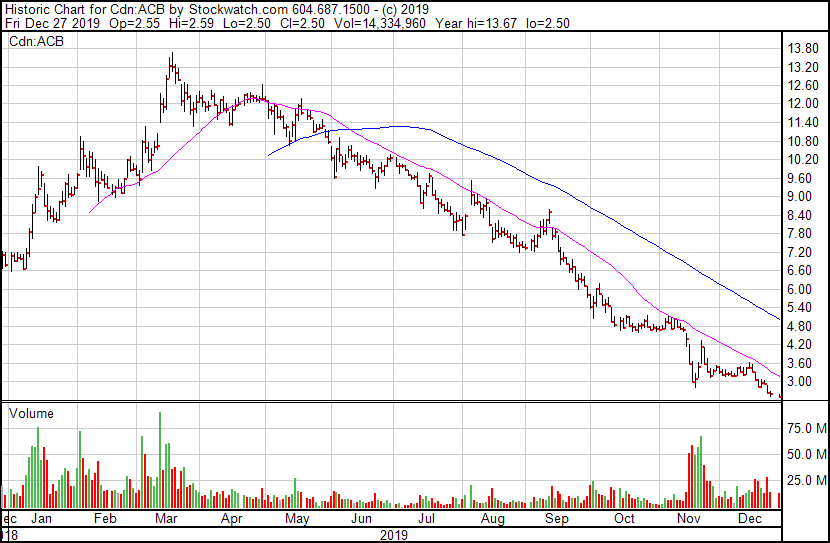

Folks made money on rumour, then lost on reality (what’s up, CannTrust (TRST.T)), they made money on promotion, and lost on the end of that promotion (sup Liberty Leaf (LIB.C)), they made money believing they could buy bullshit cheap and lost money when it became clear bullshit is never cheap (sup MedMen), they made money on shorts, then lost on the interest charged by brokers to maintain those shorts (sup every broker), they lost money they’d made in previous years when it became clear what was being sold as gold from 2015 to 2018 didn’t make operational sense in 2019 (sup Aurora (ACB.T)), and they made money on financials worded to seem better than they were, only to lose when folks read between the lines and saw actual losses instead of profits (sup Aphria).

This was a year when the roulette ball dropped on green every second spin, when the biggest winners were those taking your bets and not those making them, where the game wasn’t exactly rigged, but access to it was reserved for those with more money than you, and where the things folks said for YEARS as reasons to be cautious – finally landed as gospel.

If you’re looking for a shorter version; the guys whose money propped y’all up since 2015 decided to let shit die in 2019 while they shorted it all.

Shorter still: You were never as smart as you thought you were.

This article is less about me poking you guys in your own chests and calling you assholes than it is a cautionary tale, because it’s happened several times over the last few years. The cycle has always been ‘yes, the market is down, but it’ll come back soon, just wait’, which fed optimism to folks that they’d never really have losses, if they just waited long enough.

This year, that became bad strategy.

There’s an amazing podcast called Cautionary Tales that I wish everyone would listen to, because it is a constant reminder that we, as a species, are notable only for our undying belief in ourselves as being geniuses, only for the gods to take great joy in reminding us that we’re not.

The most recent episode offers grist for the mill for investors who take solace in telling themselves, ‘who could have seen this coming?’ The answer is, everyone, if you just know how to interpret what you’re looking at:

More than two and a half thousand years ago – so the story goes – King Croesus of Lydia consulted the Oracle at Delphi. The Oracle assured him that if he went to war against Persia, he would destroy a mighty empire. Reassured, Croesus launched his war and was defeated. The oracle had been correct, but the mighty empire that Croesus destroyed was his own.

A balance sheet doesn’t lie, but what we see on that balance sheet depends on our own translation and bias and focus. A GPS can be absolutely correct in showing you the fastest way to a place that you’ll die in getting to. And a company can be a great success on the stock chart while building toward a cataclysmic death spiral.

2019 was all of the above for cannabis investors. The only way to win was to either get out while the going was good, or not play at all, and those of us who followed that advice are a number massively dwarfed by everyone else who, let’s face it, figured they were smart enough to see the lions coming.

This isn’t a rare event. Resource investors know it well. Some years you’re a winner no matter what mining stock you pick, others you couldn’t pick a win with Jesus Christ himself reading you the form guide and, more often than not, the folks on either side of that conclusion were on the same stock.

Recently, folks who want to poke a finger in my chest will go to Golden Leaf Holdings (GLH.C), a stock I got out of several years ago and which did terribly for almost everyone involved, insiders included. But before it went dog shit, it rose 30%. After it went dog shit, it lifted 30% several times more. Taken as a three year hold, the thing was a nightmare, but those who get in and out of a stock quickly, who take their 30% and run for the hills instead of hoping 30% will roll to 50%, could have made out like bandits many times.

Supreme Cannabis (FIRE.T), which is crazy cheap right now at $0.60, has been a horror show since we last covered it as ‘crazy cheap’ at $1.20, and ‘crazy cheap’ at $1.50 before that. I maintain both calls were right – it was always ‘crazy cheap’ – but we were also wrong because it’ll get crazy cheaper before it turns around.

Here’s the main reason all of the above is true: Everyone is right, and everyone is wrong – depending on your frame of reference.

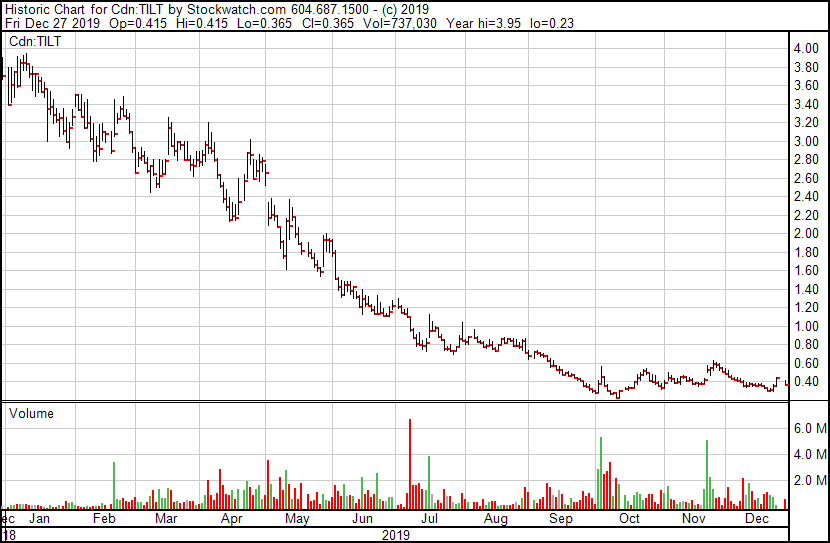

Let’s take TILT Holdings (TILT.C), a complete mess of a stock over the last year with a chart that looks like the ski slopes at Whistler when the moguls are in.

If you bought that stock a year ago and held on to it for 12 months, you’re terrible at investing and lost 89% of your money and you’d say it was a horrible stock.

But if you jumped in and out of that stock at just the right times, you could also have doubled your money in days, several times, and you’d say TILT was a godsend.

Here are the notable upswings on TILT for 2019 and, yes, you’ll find them all on that horrible chart slide shown above:

| Month | Buy – Sell | % profit |

|---|---|---|

| January | $3.40-$3.90 | 13% |

| January | $3.00-$3.50 | 15% |

| February | $2.80-$3.50 | 20% |

| March | $2.40-$3.20 | 25% |

| March | $2.60-$3.20 | 19% |

| April | $2.10-$3.00 | 30% |

| May | $1.60-$2.40 | 50% |

| May | $1.60-$2.00 | 25% |

| July | $0.80-$1.10 | 37.5% |

| July | $0.80-$1.10 | 37.5% |

| October | $0.30-$0.60 | 100% |

| October | $0.20-$0.50 | 150% |

| November | $0.40-$0.60 | 50% |

| December | $0.30-$0.45 | 50% |

If you’d predicted all of those entry and exit points on this trainwreck of a stock, you could have mathematically made a return of 120,258.85%, turning $1000 into $120 million inside a year.

Of course, few could have accurately predicted any of those rises, let alone all of them, hidden in amongst an ongoing collapse of the stock taken across 12 months of hell, but if you look at the chart (and those rises) carefully you’ll find a few things interesting.

- The rises actually came with some regularity, generally twice a month with two to three weeks between them.

- The rises almost always came over a week, not a day, and the subsequent falls matched that timing.

- The volume needed to raise the stock was a lot less than the volume needed to crash it.

- The ongoing slaughter of long term bagholders never stopped those bagholders from believing the final turnaround was afoot, and being left holding the bag.

What this all tells me is, that entire year of trading on TILT was not ‘the volatility of the market’, but rather it was manipulated bullshit. Those with a lot of (cheap) stock were selling regularly, but would occasionally juice the market with a few days of buying that you guys would follow because, ‘OMG it’s going up!’

They’d then sell into the last few days of that rise, getting a great return as Joe Retail continued to believe in the spike. By the time it was clear the spike was over, the early guys would let the ensuing downswing roll for three weeks til you all forgot what had happened last time, then repeat the same buy/sell routine, and you guys would fall for it again. And again.

And again.

While those richer guys were cashing in, you guys were averaging down, believing promo, not questioning your own lying eyes, convinced that it couldn’t possibly go down much further than it had already.

“Look at the volume!”

“Here comes the run!”

“It’s shorts covering!”

It was none of those things. Your small bets were never affecting the stock as much as their large bets were. You had the illusion of control, of a school of sharks working together, but you were actually krill.

This has always been the way. Even when you little guys were making money, it was because the big guys were letting it happen, because they were making MORE, getting in on cheap financings and expensive loans, bringing companies public and papering the walls with stock certs bought for nothing – or close to nothing. If they tripled or quadrupled their money, you didn’t mind because you were doubling yours. Everyone was part of the same ecosystem and natural balance was working, but nobody was really looking too deep at what it had all become in the meantime.

That is, you’d become so use to ‘the comeback’ that the idea of no comeback was unthinkable. The pastures would always be green. Everyone would always be getting fat. Winter would always yield to spring.

Because this is how it had ALWAYS been.

We’d been through down cycles before – so many times in fact that we’d taken to calling them ‘cycles’ and not crashes. Sure, weed stocks would drop, generally at the end of the year, but then they’d return. We knew this because it had always been that way.

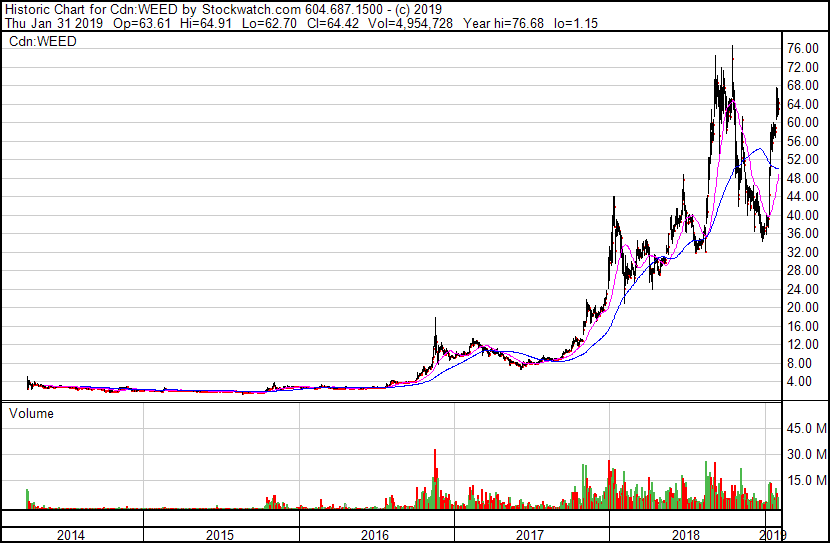

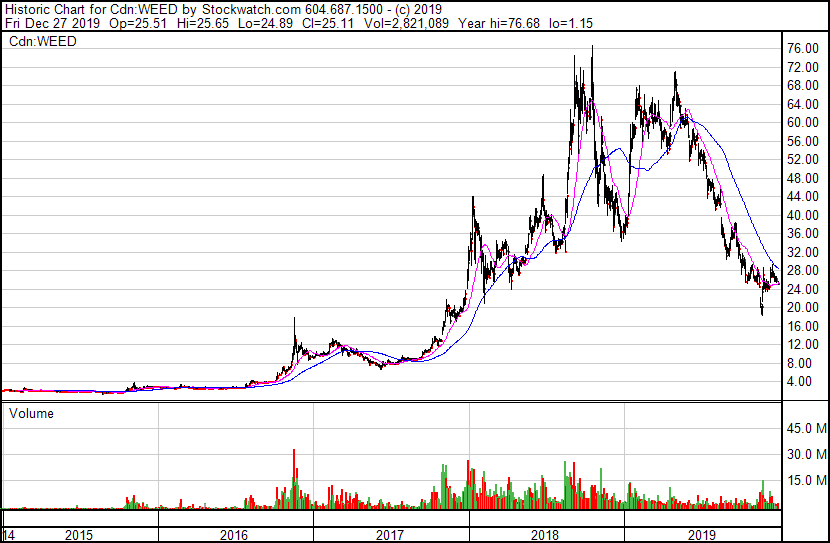

I’ve shown you this chart before:

This is the stock chart for Canopy Growth Corp (WEED.T), the largest weed company and a decent harbinger for what the rest of the market was doing at any one time. When Canopy was running, everyone was running. When canopy was falling, so was everyone else. And you can see (though the scale of the later years makes the earlier year jumps harder to see) that every year end saw a jump, every early part of the year saw a drop, the majority of the year saw a leveling off, and then it all just ran up again the next year end.

Until this year. Because this year’s drop didn’t end.

Oof.

We told you all year why this one was different – it marked the end of cheap money. Too many companies had used that money to run their share price and NOT build real sustainable businesses, and that meant the financing was going to dry up for everyone when the big boys started losing too much money.

And it did. The market moved from PPs at market price, to cheap PPs, to cheap PPs with generous warrants, to debentures, to high interest debentures, to high interest loans with floating convert prices and, finally, assets used as collateral.

That last pairing is known as a death spiral, but the death spirals rightly began years ago, when companies like Aurora borrowed to build assets that the retail cannabis market didn’t actually need but the retail investor market overpaid for.

What the weed industry doesn’t need:

- Massive grows in a market already at capacity

- Grows in places that cost a lot to heat

- Grows that aren’t tuned to quality product

- Debt so heavy you have to take more debt to keep up

- Oversupply so heavy you have to shut your large grows down to save money

Aurora Cannabis hits all of those marks right now, as we’ve long said they would, and that’s why analysts have taken to giving it a $0 buy rating.

That’s a horror show, but it still holds a market cap of $2.8 billion which seems to me to be more than it should be.

And yet, still, there are folks on social media talking about buying ACB as a ‘value pick.’

They may be right in that there may yet be a few market spikes left in ACB yet, but eventually they’ll be wrong and it’ll fold like a cheap tent. Who you are on that spectrum comes down to your frame of reference.

Real talk: We recently let an Equity.Guru exec go because he was trading our portfolio in ways he saw as perfectly legit but which were, in actual fact, terrible.

His main glitch; that he saw Tesla (TSLA.Q) as a terrible company bound to collapse in a financial pile, and which he was shorting heavily (at $280 – it’s now $420) as a result.

He’s not wrong that Tesla is a financial catastrophe in the making.

But that doesn’t make him right because a lot of soccer moms are getting Teslas for Christmas, and because a lot of people and funds who want to invest in sustainable issues buy Tesla stock regardless of its price, and because grandpa puts it in his RRSP because he’s heard of it before, and because it’s been going higher and, because even if it couldn’t cover wages on a given month, a Ford or a GM or an Uber or a venture capitalist would swoop in and buy the thing just for the prestige.

To short Tesla is a correct move with dire consequences, massive short fees, lots of margin covering, and on ongoing battle with emotional forces far richer than ours that will make that bet take years to pay off. Our guy couldn’t see that, though he was right, he was also wrong, and expensively so.

But don’t point at our former guy as the big loser, because the entire cannabis investor base makes that SAME BET every single day. You buy something that you just can’t fathom could stay cheap, even as it gets cheaper by the day. You’ll be right eventually, but you’re COMPLETELY WRONG now, tomorrow, and for some time to come.

Because you’re too small to dictate the terms. You’re background noise. You’re out there cheering for your guys and taking a dump on folks like me as I show you’re wrong and as your pick goes down down down, “It’s market manipulation!” or “it’s weak hands!” or “It’s the sector pulling us down!” or “those guys are just shorters.”

It’s none of those things, in reality. This is simply the end of the last cannabis cycle. From here, it’s down to who starves last.

The value of your cannabis pick is not what it owns, or what it grows, or what its branding is.

It’s whether it can survive long enough to be worth acquiring by whoever is left.

— Chris Parry

FULL DISCLOSURE: No commercial interest in any company mentioned. Happy Holidays. Be well. Head on a swivel. And if I’m wrong about you being down, nice work.

Leave a Reply