New data from Statisics Canada reveals that 102,000 Canadians filed for insolvency in the first three quarters of 2019.

That’s more insolvencies in three quarters than we’ve seen since “The Great Financial Crisis” a decade ago.

Some financial pundits are blaming rising interest rates.

“There’s a close correlation between interest rates and insolvencies,” stated Grant Christensen, president of a Canadian Insolvency Advisory Group, “Because rates rose from 2017 to 2018, we’re seeing the impact now.”

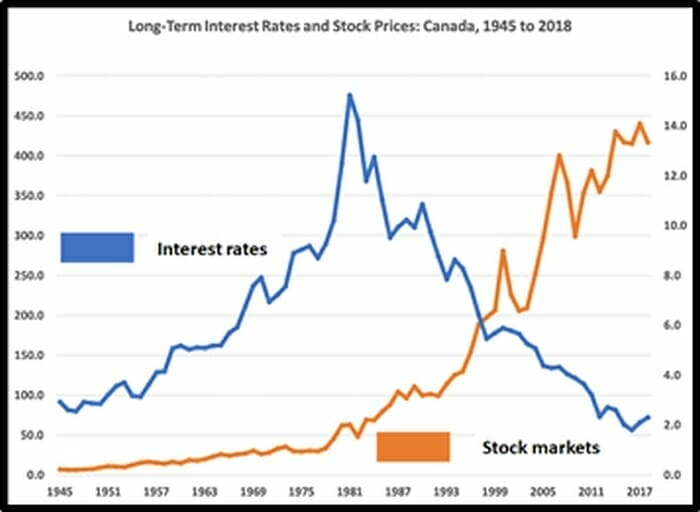

Benchmark interest rates rose 300% from July 2017 to October 2018 (from 0.5 to 1.75%), but the current rate (still 1.75%) remains at a historic low.

Interest rates have been falling steadily since 1981, when interest rates were 14%. Despite that, insolvency rates are 300% higher now then they were in 1981.

Blaming rising interest rates for high insolvency is like blaming the neighbourhood bakery for obesity – despite the fact the sugar content of the cookies has been decreasing for 40 years.

“Another factor in the rising number of insolvencies is the growing number of Canadians who are self-employed, including many working in the so-called gig economy,” reported The Toronto Star.

“There are more and more self-employed people,” confirmed one tax analyst, “And they might not realize all the deductions they need to make.”

Approximately 50% of individuals who formally claim insolvency end up filing for bankruptcy.

A high bankruptcy rate may intuitively seem like a bad thing, but straight-faced “financial experts” argue that bankruptcies are a proxy for imaginative risk-taking – and therefore a good thing.

“The majority of new ventures fail, and many end in bankruptcy,” states Strategy Business, “A country that has a risk-averse culture is more likely to have bankruptcy laws that increase the cost of entrepreneurial failure”.

We have found a link between “friendly” bankruptcy laws and increased entrepreneurship. In Silicon Valley, this is known as the motto of ‘fail fast, fail cheap, and move on.’

Five benefits of filing bankruptcy in Canada:

- Stops creditors from enforcing a court action without the express permission of the Bankruptcy Court. If your wages are being garnisheed by a creditor the garnishee must immediately stop.

- Your creditors don’t have the right to “opt out”. A creditor cannot simply decide to ignore the process and try to collect their debt.

- The rules are created by the federal government – bankruptcy is the same if you file in Nova Scotia or British Columbia.

- A first bankruptcy is discharged in either 9 or 21 months, depending how much money is owed.

- For most low-income Canadians, bankruptcy costs are about $1,800.

“The decision to file for bankruptcy is empowering,” promises one tax attorney, “Instead of your creditors ruining your life, you put a plan in place to deal with the problem!”

Canada’s lenient bankruptcy system is gaining traction.

“A staggering number of Canadians are washing themselves of their debt by re-using a bankruptcy system meant to rehabilitate honest but unfortunate debtors,” determined an excellent joint investigation by The Toronto Star and La Presse.

“Kenneth Nantel seemed unbothered by his bankruptcy,” states the article, “It was his fourth in 10 years, during which time he had relied on Canada’s insolvency system to rid him of more than $100,000 in debts.”

“He’s shown no reluctance of using bankruptcy to be freed from his debts,” the judge wrote in a 2012 decision. “His past conduct demonstrates a contempt for the rights of his creditors.”

The Canadian judge denied Nantel of his fourth bankruptcy.

In 2016 – four years later – Nantel “went before a different registrar and received a discharge from that same bankruptcy. Eight days after that, Nantel declared bankruptcy for a fifth time, owing more than $37,000 in new debts.”

One in five Canadians who filed bankruptcy in 2018 was doing it for at least the second time. That works out to 11,500 debtors who filed their second, third, fourth or even fifth bankruptcy, according to data obtained from the Office of the Superintendent of Bankruptcy.

A recent survey determined that 46% of Canadians are just $200 away from financial insolvency while the number of debt relief applications is increasing 5% year-over-year.

A rising interest rate is not the root cause of the dramatic surge in Canadian insolvency.

It’s easy money + lenient bankruptcy laws.

Unless the money gets harder to borrow, and the insolvency disincentives get harsher, expect the trend to continue.

This article by Greg Nolan explains how to play the trend.

– Lukas Kane

Leave a Reply