I’ve been to about a decade of Vancouver Resource Investment Conferences, the big Cambridge House BC mining convention that runs every year around this time and, for much of that decade, the mood has been fairly dour.

There’s always hope that something is going to light up the industry the way LithiumX (LIX.V) did in 2015/2016 when it sparked a serious lithium run, or the 2016/2017 cobalt run that followed that, but for the last five years, cannabis has stolen the thunder of the resource business almost entirely. To make money in mining, you had to be really good, or really lucky, while weed wins were almost handed out like party favours.

Until this year.

It’s safe to say, I’ve yet to see a VRIC that looks as primed for war as the one happening this weekend at the Vancouver Convention Centre.

With a thick roster of nearly 350 exhibitors, speakers, and sponsors, VRIC 2020 appears to be exactly what hopeful resource CEOs have been waiting for ever since weed became a thing.

I get it if weed has long been your jam because “OMG the profits”, right?

But I’m going to show you a handful of stock charts that should give you reason to reconsider your mindset.

CANOPY GROWTH CORP (WEED.T), 2019:

Woof.

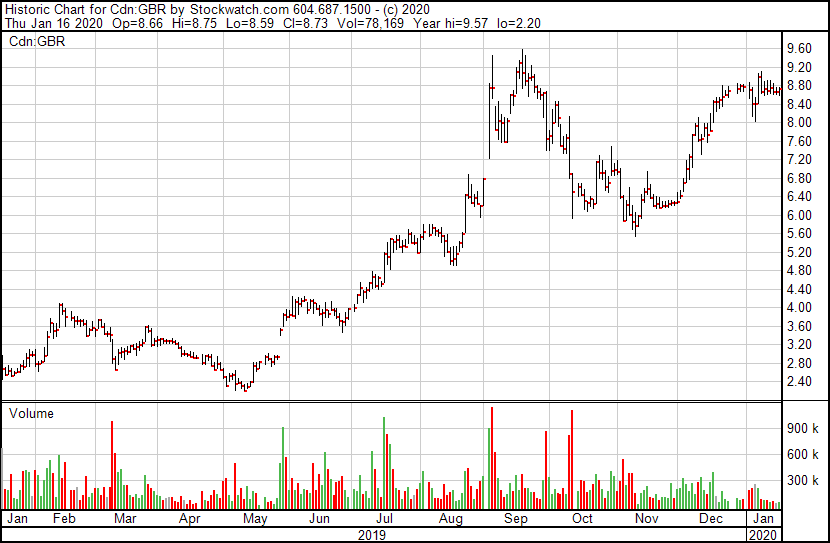

Compare and contrast that with GREAT BEAR RESOURCES (GBR.V), 2019:

Or maybe METALLA ROYALTY AND STREAMING (MTA.V), 2019:

Now, obviously not every mining stock has been a Great Bear or a Metalla, but those that have caught on have caught on hard, partly because a hearty band of mining investors have been waiting like coiled springs to get back into the game, partly because there’s been so much cannabis money parked on the sidelines looking for something to do, but also partly because a lot of metals are in primo territory for a sustained run, with new miners thin on the ground and certain metals suddenly in vogue.

If you think Donald Trump is a madman/criminal/going to send us all to war, and many do, and you think the public markets have had it good for too long and the bubble may burst soon, gold is a popular safehaven.

Here’s Blackrock Gold (BRC.V), which fell off a little over the last few months but was nearly a ten-bagger before that dip, and still pokes out like a Baywatch background actor compared to any weed stock you can name.

And here’s GoldON (GLD.V), which has one of the smallest share floats I’ve seen.

Maybe you like the developing world: Here’s Gran Colombia Gold (GCM.T), 2019:

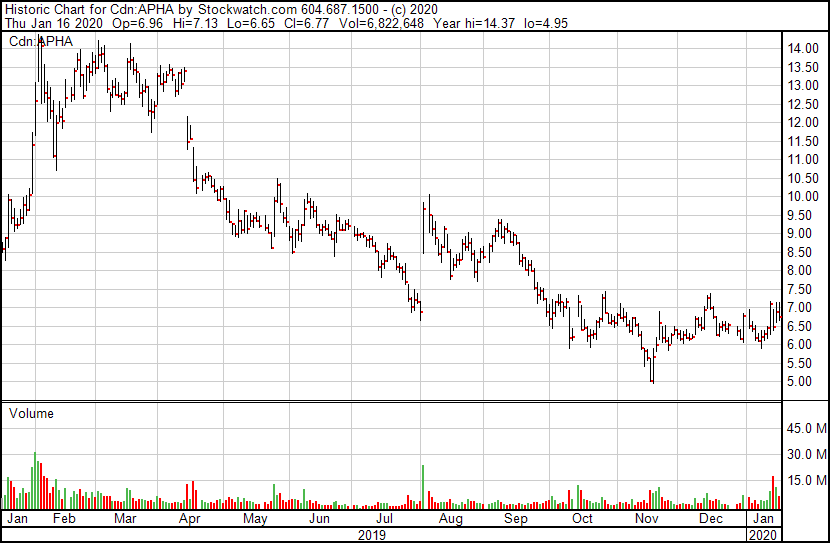

You may be one of the many who believe, after the last two days of positive cannabis chart movement, that we’re about to have another weed run.

OK millennial. Cool story. But it’s one we’ve heard at least a dozen times in the last year and, need I remind you, it hasn’t happened yet.

In the meantime, here’s Aphria (APHA.T), 2019:

I want to put it to you, young cannabis investor, that today is the day you should spread your wings and learn about resource investing, because it is having a long overdue moment and I expect that moment to kick on in 2020.

Here’s why:

- Trump is a madman/criminal/going to get us in war. And even if you think he isn’t, you’ll acknowledge he’s being impeached and Iran and China and Syria and Iraq continue to be countries that pose a threat to the status quo, and there’s an election coming that Russia is almost certainly going to try to tilt, and though the economy is generally strong, that’s a result of the US printing so much money and going into so much debt that, at some point, the bill comes due and everything goes to shit. If that happens, gold and cryptocurrency will be where folks hide their dough.

- Cryptocurrency is not where you want to be hiding your dough. There’s not much point in being a paper millionaire if you can never successfully extract your investment because every crypto exchange implodes within a year, and enough of us got burned on crypto last time around that we won’t be coming back anytime soon.

- Metals are important. As much as you may love the environment and wish we never stuck another shovel in the ground to extract a precious resource, you literally have a pocket full of precious metals and industrial metals and rare earths, and one that was popped together by ten-year-olds at that, so quit pretending you’re cleaner than you are. We need metals, we’re going to get at metals, and whether the companies that dig them up do so with an environmentally friendly mindset or not really depends on what their shareholders tell them is important. You’re either in that conversation or you’re unimportant to it.

- When gold rises, so does a lot of other stuff. Silver and gold have traditionally been ever linked, and when folks are making dollars investing in either/or, there’s a flow on to other metals. The copper supply is low, renewable energy metals are in freakish demand, folks are talking about graphite again.. when the tide begins turning, it lifts a lot of boats.

- Cannabis is dead, bruh. You thought there’d be a period of acquisitions right about now, but there’s nobody offering cheap financing for those anymore, and the market isn’t exactly rewarding such moves anymore. Cannabis, today, is about survival and profitability, and nobody’s buying stuff at a premium when that’s the mindset. Frankly, I expect a handful of weed companies to start talking about mushroom production plans soon, while others will need to explore the potential of growing vegetables and herbs, which might actually be more profitable going forward than weed, especially if the developing world gets its shit together.

“BUT I CAN’T INVEST IN RESOURCE STOCKS, CHRIS!” I hear you moan. “I DON’T KNOW ANYTHING ABOUT THEM!”

Ugh. Crack a book already.

Or, like, go to the VRIC show and take notes because some really freaking smart folks are going to tell you what’s up.

If I’m not your flavour, you could (should) get to the bull statue and take a walking tour of the best investment opportunities of some of the resource world’s best pundits. I did the first walking tour at VRIC a couple of years ago and it’s since blossomed into one of the best opportunities at the event to get good investment ideas and actually talk in person to a series of smart mining writers about why they like what they like.

On Sunday, you can walk with The Mercenary Geologist, Mickey Fulp, at 10:10am, Exploration Insights boss Brent Cooke at 12:10pm, Outsider Club honcho Nick Hodge at 3:10pm.

On Monday, you can walk with The Calandra Report’s Thom Calandra at 10:10am, Agora Financial‘s Byron King at 12:10pm, and Sprott Global‘s Rick Rule at 3:10pm.

These personal walkabouts are your chance to talk with the folks you normally pay to read, and their insights are genuinely worth hearing. It’s also a good way to meet other investors, strike up conversations, and expand your own network.

If you’re less interested in stock picks and more interested in learning how to find your own, there’s a long list of good presentations to get to, with my top pick being Rick Rule’s Private Placement Bootcamp and Steven DeJong’s Investing in the 2020s and why it’s time to ditch the .PDF pitch.

Rule is always a headliner at these shows and if you’ve never gone in on a private placement financing before, or don’t know what they are, this’d be a good place to start. DeJong is always one of the most interesting people at these kinds of events, having already turned one fledgling gold deal into a nine-digit exit at a young age, and having built a real track record as a total outside the box thinker. If anyone at the VRIC show will appeal to the millennial investor, he’s it.

Others include:

- The Coming Silver Shock, with Casey Research’s Jeff Clark

- Which EV Metal will Outperform in 2020, with Fundamental Research’s Sid Rajeev

- Overlooked and Unloved: Three Metals that are Poised for a Comeback, with Mining.com’s Michael McCrae

- Patrick Ceresna, of the MacroVoices podcast is a gold fan; he represents with a pair of presentations; How To Make Big Gains Without Taking Big Risks On Your Favourite Gold Stocks and How To Leverage Gold Like A Pro, Even If You Hate Risk

The conference draws some star power, at least for those interested in Canada’s media circles, when Lord Conrad Black brings his word scramble to the party with Mining and Natural Resources: A Canadian Manifesto

If you like to cram your stock celebrities into one place, the Kitco Gold Panel, featuring Grant Williams, Peter Schiff, Frank Holmes, and Rick Rule promises to draw a decent sized crowd of middle-aged white guys who know more than you do. Holmes doubles up with The Quant Approach to Picking Gold Stocks, and Gianni Kovacevic, who hasn’t met a group of three or more people in the last five years without giving them his master class on copper investing, shows up with a conversation about… helium?

If a lot of these sound like someone just reshuffled versions of the words “gold”, “outperform”, “gains”, and “2020”, that should tell you a little about what those in the know see as the future of investing in 2020.

Here’s why:

How undervalued are the miners ($GDX) to gold?

Last 3 times gold traded @ $1550/oz:

6/2011: GDX was $52

4/2013: GDX was $34

Today: GDX is $28.68 pic.twitter.com/GhSwE15QOB

— Kip Herriage (@KHerriage) January 16, 2020

The last time Gold stocks were this weak in a January with a rising gold price was Jan. of 2000. That was the bottom of a 20-year beak market in gold and the peak of the Dotcom bubble. Optimism on U.S. stocks and pessimism on #gold could not have been higher, nor more wrong.

— Peter Schiff (@PeterSchiff) January 14, 2020

CNBC guest just said to lighten up on stocks because valuations are high and people aren’t paying attention to other asset classes such as Gold.

Gold with 0 yield is up 29% in 15 months. Who the f*ck is not paying attention?

— Frank Nunziato (@nunziato_frank) January 16, 2020

If any of that sounds attractive to you, if the idea of learning about mining stocks and mingling with the smartest guys in the business is something you might like to try, go register here and use the promo code PARRY100 to get a 100% discount.

That’s right – you get it for free.

— Chris Parry

Leave a Reply