The massive Vancouver Resource Investment Conference (VRIC) just wrapped up.

It featured 325 exhibitors, including big boys like the $5.4 billion Lundin Mining (LUN.T).

“Going to a mining conference looking for investing tips is like walking into a strip club hoping to find a soul mate,” we wrote in 2018, “The ambiance and the clientele conspire against you.”

The 2020 VRIC was different.

The quality of the exhibitors was high.

It was edgier.

“I know I am going to get some flack for hiring another convict,” stated Cambridge House CEO, Jay Martin, “The last time I did this, it was Edward Snowden, and it cost me my Title Show Sponsor. It was worth it. This year, our first speaker is Conrad Black.”

Six members of the Equity Guru team fanned out across the conference floor, meeting with 135 resource companies.

The company that impressed me most was Euro Sun Mining (ESM.T) – a little-known micro-cap sitting on 10 million ounces of gold in Romania – valued at less than $3/ounce.

I met with the CEO, Scott Moore, shoved my Samsung S9 in front of his face and got his elevator pitch:

“We operate and hold the Rovina Valley project in Romania,” stated Moore, “currently the 2nd largest undeveloped gold asset in the European Union, holding 10 million ounces gold equivalent, comprised of 7 million ounces of gold and a billion and a half pounds of copper, and with a full permit from the Romanian government to exploit that asset.”

10 million ounces of gold equivalent.

Market cap of $23 million.

Euro Sun’s gold is valued at $2.30 an ounce.

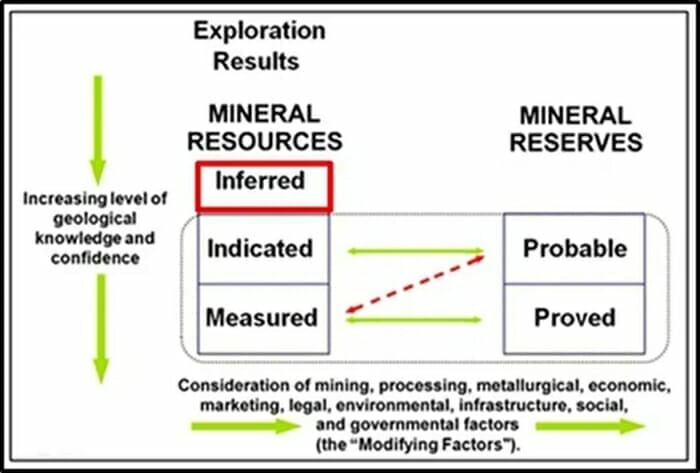

At this point, I assumed Euro Sun’s gold is in the “inferred resource” category, which according to 43-101 standards, is “too speculative geologically to have economic considerations applied to it.”

My initial assumption turned out to be false.

Euro Sun’s gold is in the “Measured & Indicated” category – which “de-risks” the project significantly.

In 2008, M&I gold was worth an average of $70/ounce.

Today M&I gold is worth an average of $30/ounce.

“If you didn’t know anything else about an M&I resource (political risk, type of ore, etc.), but you saw that the company that owned it was trading at $10 per ounce, you can conclude that there must either be something very wrong with the project or the stock is a great speculation,” stated Munknee.com.

Why is Euro Sun’s gold trading at a 90% discount to market?

Is there “something very wrong with the project”?

Euro Sun’s share-price is being punished because of two events that occurred in Romania.

Event#1: In 2000 -the Baia Mare disaster – a dam at mining project overflowed, sending cyanide-contaminated water into the Danube and other rivers – a shameful environmental disaster that confirmed everyone’s worst fears about mining.

Victim: Romania (and down-stream countries).

Event#2: In 2011, a Canadian company Gabriel Resources (GBU.V) was licking its lips preparing to build a gold mine near the Rosia Montana village, 430km west from Bucharest.

Gabriel promised to create 2,000 jobs and provide $5.7 billion of direct benefits to Romania’s economy over the project’s 27-year life.

Opponents warned the project would flatten four mountain tops in a tourist area and cause pollution by using thousands of tonnes of cyanide.

After fierce local opposition, Gabriel’s mining permits were denied.

Gabriel Resources has submitted a legal claim, demanding as much as $4.4 billion compensation.

Romania has now asked Unesco to grant world heritage status to Rosia Montana — which would end any chance of ever developing the mine.

Victims: Gabriel Shareholders (GBU share-price dropped from $8 to .47).

To date, Euro Sun has received a warmer welcome from Romania’s Department of Mining.

After Gabriel’s denied mining permit, the investment community collectively decided, “Romania is not a good place to build a gold mine”.

That collective sentiment may turn out to be correct.

Mining projects can go sideways 100 different ways.

Every gold junior investor should pose the question: is this project in a location that wants a gold mine?

Euro Sun’s project is in a historic mining district known as the “Golden Quadrilateral”, one of the largest gold-producing areas in Europe where it is estimated that more that 55 Moz of gold have been produced since the Roman period.

The Rovina Valley property is accessible year-round via a paved two-lane highway from the historic gold mining town of Brad.

How mining-friendly is the town of Brad?

Hint: it has its own gold museum.

On January 20, 2020, Euro Sun announced that it will complete a non-brokered private placement financing of up to 11.3 million shares at $.29 for gross proceeds of up to $3.3 million with one subscriber.

Euro Sun intends to use the $3.3 million to advance its Rovina Valley Project and for general corporate purposes.

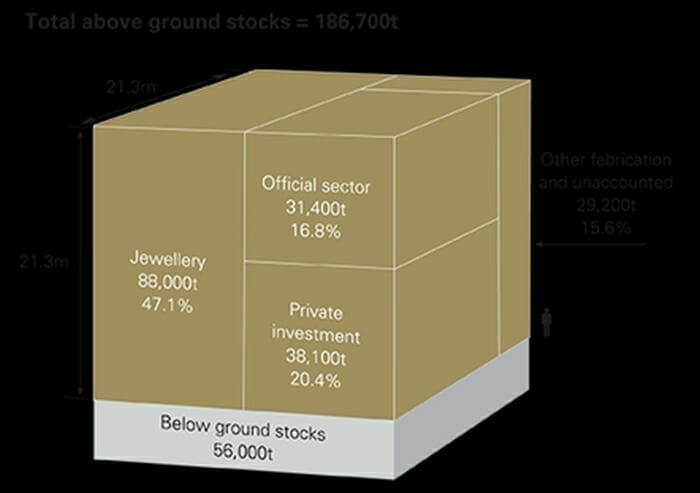

Here’s the thing. Gold’s not that easy to find. Throughout human history, a total of about 185,000 tonnes of gold have been mined. That’s a cube: 60’ by 60’ by 60’. Given all the drilling the blasting and the digging – that’s not a massive object.

NBA Dallas Maverick’s owner Mark Cuban (who – to be fair – isn’t a dummy) refers to gold as “an expensive pet rock”.

But unlike cryptocurrency the value of gold is buried deep in our ancestral psyches.

Shaved flakes of bullion have been found in Paleolithic caves dating back to 40,000 B.C.

The Chinese love gold. India’s population treats it as a religion. We anticipate when the global debt bubble pops, there will be a stampede to gold.

If our premise is correct (Euro Sun is the baby thrown out with Gabriel’s bathwater), ESM could be re-rated sharply upward.

“I want to put it to you, young cannabis investor, that today is the day you should spread your wings and learn about resource investing,” stated Equity Guru’s Chris Parry, “Because it is having a long overdue moment and I expect that moment to kick on in 2020.”

– Lukas Kane

Full Disclosure: Equity Guru has no financial relationship with the companies mentioned in this article.

Leave a Reply