On January 28, 2020 Equinox Gold (EQX.T) and Leagold Mining (LMC.T) announced that 99.88% of all shareholders voted to approve a merger between the two mid-tier gold companies.

To put that in perspective, if the shareholders of EQX and LMC filled every seat in GM Place, and Frank Guistra shouted: “All those in favour of this merger raise your hand!” – there would be a total of 19 people with their hands resting on their laps.

You could take the all the merger-naysayers out to Tim Hortons without monopolizing the seating area.

Not since a basement-full-of-stoned-frat-boys were asked, “Anyone in the mood for Nachos & Cheese?”, has a question elicited such a confluence of positivity.

Equinox is producing gold from its Mesquite gold mine in California and its Aurizona gold mine in Brazil while building the Castle Mountain gold mine in California.

Leagold owns four operating gold mines in Mexico and Brazil, along with a near-term gold mine restart project in Brazil and an expansion project at the Los Filos mine complex in Mexico.

The two companies have a similar cost and production profile. During the first three quarters of 2019, Equinox produced 115,000 ounces of gold at an all-in sustaining cost of USD $983/oz, while Leagold produced 281,000 ounces at USD $978.

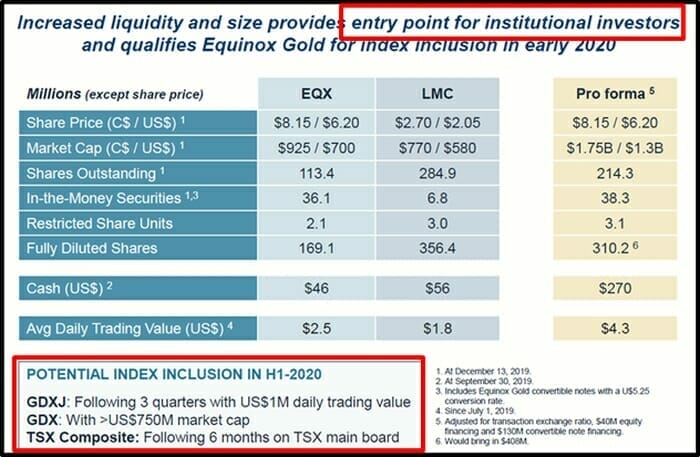

Together, they are valued at $1.7 billion.

History proves that mergers can create synergy. Example: Disney and Pixar combined their creative talents to produce WALL-E, Brave, Inside Out and Frozen the fifth-highest grossing movie ever.

Mergers can also fail spectacularly. Example: Sears and Kmart combined two muddled business plans to ward off Target and Walmart – resulting in an “identity crisis” that lost $7 billion.

Successful or not – when two publicly-traded companies merge – the market typically declares one company a winner (the stock goes up), and the other a loser (the stock goes down).

That didn’t happen in this case.

Both Leagold and Equinox are up about 25% since the merger proposal was announced on December 15, 2019 (bullion is also up 6% in this time frame).

The combined entity will continue operations as Equinox Gold and be headquartered in Vancouver, Canada.

“The mines acquired are far from the lowest cost operations,” observed National Bank analyst John Sclodnick, but “the acquisition will increase Equinox’s leverage to the gold price.”

Transaction Highlights:

- Gold production of 700,000 ounces in 2020

- 2021 production increasing to 1,000,000 million ounces

- Six operating mines in USA, Mexico and Brazil

- Large gold reserve and resource base

- Robust revenue, and free cash flow

- $670 million financing package

- At-market $40 million equity investment from Ross Beaty

$130 million convertible - $500 million in underwritten commitments

- Integrated management team led by Neil Woodyer as CEO, Christian Milau as EVP Corporate, Attie Roux as COO and Peter Hardie as CFO.

“This merger will create one of the world’s largest gold companies operating entirely in the Americas,” confirmed Beaty, “This is the kind of gold company investors want today.”

Beaty – who has “been nicknamed the ‘broken-slot’ machine for his knack of consistently making his investors rich” – is 100% correct.

Yes, the merger is projected to create “operating and https://equity.guru/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative synergies” worth about $10 million a year, but that’s a drop in the bucket – gold companies are notoriously inefficient.

Last fall, the Shareholders’ Gold Council analyzed 47 gold miners and discovered that “General and Administrative Expenses” (G&A) were typically 12% – three times higher than non-gold companies – at 4%”.

Leagold’s G&A expenses are 12.7%, and Equinox’s are 16.6%.

Beaty’s more salient point is that larger companies (with bigger market caps) are more likely to attract investments from conservative money managers and institutions (like pension funds).

“There’s no magic to one million ounces, it’s just a number,” Beaty told analysts, “But it represents scale – and scale really does matter.”

Example, mid-April 2019 Newmont Mining executed a $10 billion acquisition of Goldcorp creating a new merged entity Newmont Goldcorp (NEM.NYSE).

NEM is projected to produce 6.5 million ounces of gold annually over the next ten years in the Americas, Australia and Ghana.

“We are delivering on a promise we made to shareholders when we launched Leagold three years ago,” stated founder Frank Guistra, “I will be stepping down as Chairman and Director to focus on my global philanthropic work but will remain an enthusiastic shareholder.”

“The merger and acquisition activity we witnessed over the past year demonstrates a growing appetite by gold Producers’—predators if you will—to devour smaller, resource-rich quarry,” wrote Equity Guru’s Greg Nolan, in a recent article about sub-$100 million juniors.

Senior Producers’—those highest up on the food chain—require a robust pipeline of Tier-1 (5,000,000-plus ounce) gold deposits to maintain current production levels – Greg Nolan

The Leagold/Equinox merger is expected to close in February, 2020 subject to regulatory approvals from the TSX, the NYSE.

“What you want to always end up with is 1 + 1 = 3,” Beaty told the Financial Post, “We think we’re doing that by having a larger company that will attract new investors.”

– Lukas Kane

Leave a Reply