A translation of this article is available in Chinese at our content partner NAI500 here.

With this entry, I’m two-thirds of the way into a series of roundup pieces that cover three distinct categories:

1) sub-$100M market cap ExplorerCos with 43-101 resources;

2) $100M-plus market cap ExplorerCos that are, for the most part, further along the development curve;

3) sub-$20M market cap ExplorerCos looking tag or confirm a significant new discovery.

The first roundup piece in this three-part series—Undervalued and underappreciated – our sub $100M market cap junior exploration company shortlist—highlights companies that could see significant upside trajectory if (when) gold stocks begin their next leg higher.

The following $100M-plus market cap shortlist is composed of companies with a little more meat on the bone—companies sporting significant 43-101 resources that are further along the development curve.

Our $100M-plus market cap shortlist

Several of these companies have already delivered significant gains since we first covered them.

- Alexco – up 84% since we first highlighted the stock 12 months ago.

- Skeena – up 137% since we first featured the stock nine months ago.

- GT Gold – up a solid 60% since we featured the company nine months back.

- Great Bear Resources – up a super-solid 340% since we first put it on our shortlist back in January 2019.

- PGM – up a very respectable 43% since we first featured the company 3 1/2 months ago.

Not all of the companies on our list registered solid gains. Some have taken hits. And this price weakness may represent an opportunity.

Our must-have criteria for the following list:

- the company must have a resource of some significance.

- the company must have a market cap north of Cdn $100M (indicative of a substantially de-risked asset).

- the company must have an experienced team at the helm.

- the company must be located in a mining-friendly jurisdiction.

By clicking on the name of each company, you will find our most recent coverage—a decent enough starting point to begin your own due diligence. Cursory notes will follow.

I’ll start in the Yukon Territories, then travel south, then head north-east.

Here we go…

YUKON

Alexco Resources (AXU.T)

- 119.15 million shares outstanding

- $272.86M market cap based on its recent $2.29 close

The stock is up 84% since we first highlighted the company 12 months ago.

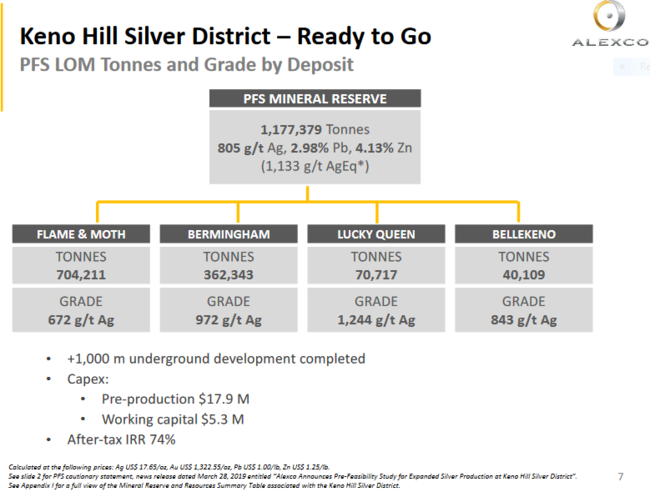

Alexco operates in the Keno Hill Silver District, one of the highest-grade silver destinations on the planet.

The Keno Hill Silver District historically produced more than 200 million ounces of silver from over 5.3 million tonnes of ore grading 44 ounces of silver per tonne (1,247 g/t Ag).

I began following Alexco back in 2006 when the story began to unfold (after the company successfully consolidated the entire Keno Hills district). It was a good story back then—it’s an even better story now.

The last 13 years have seen a systematic approach to exploration and development.

Next stop… production.

The company is on the cusp of making a production decision to become Canada’s primary’ silver producer (primary in the sense that > 50% of production revenue will be derived from the metal itself).

As the above slide suggests, a 2019 Prefeasibility Study (PFS) demonstrates high-grades, robust economics, and an extremely modest CapEx:

- an after-tax net present value NPV (5%) of $101.2 M;

- an after-tax internal rate of return of IRR of 74%;

- all-in sustaining costs (AISC) between $11 to $12.00;

- capital expenditures (CapEx) a very modest $23M.

Two days after our December coverage, the following assays dropped from a new zone on the property:

If you’re looking for silver exposure, take a close look at the production history of the Keno Hills District, the high-grade production scenario on deck, the exploration upside, and the company’s environmental services division—a profitable and rapidly growing business in its own right.

We should have a production decision this quarter.

Victoria Gold (VIT.V)

Investor presentation (scroll down to the right)

- 57.53 million shares outstanding

- $475.75M market cap based on its recent $8.27 close

When we first featured the company 12 months ago, it had 785.97 million shares outstanding. It has since undergone a dramatic rollback. The current share count is 57.53 million. After performing some rough math on the above, it looks like VIT is up approx. 10% since our earlier coverage.

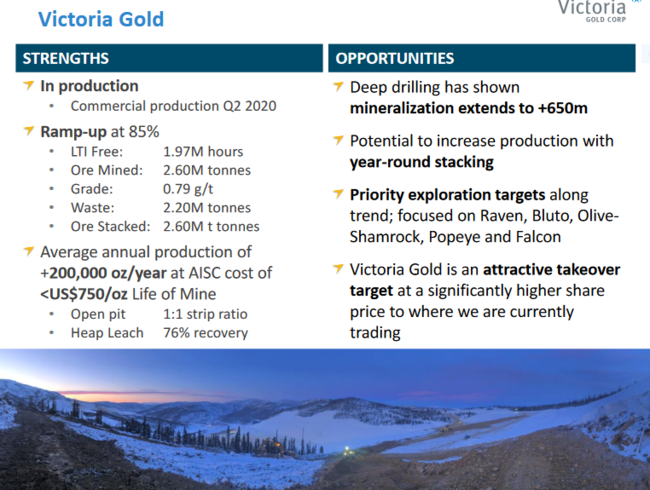

Victoria’s Eagle Gold Project has evolved from a development project to an operating mine.

This slide from the company’s January 2020 i-deck shows where the company is at in the ramp-up cycle:

On December 4, 2019, the company released a new technical report for the Eagle Gold Mine.

Details:

- Reserves increase from 2.7 Million to 3.3 Million ozs Au;

- Annual production increases from 200,000 ozs to 220,000 ozs Au;

- Cash Cost per Au ounce: US$577;

- All-in Sustaining Cost (“AISC”) per Au ounce: US$774;

- Post tax Net Present Value @ 5% discount = $1,034 million.

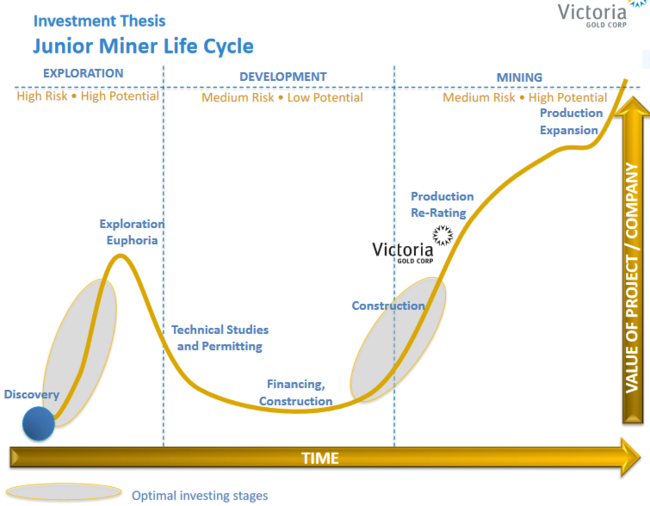

The following slide shows where Victoria is positioned along the ‘Junior Miner Life Cycle’.

Save this slide as it can help you navigate this sector.

White Gold (WGO.V)

- 124.45M shares outstanding

- $112.01M market cap based on its recent $0.90

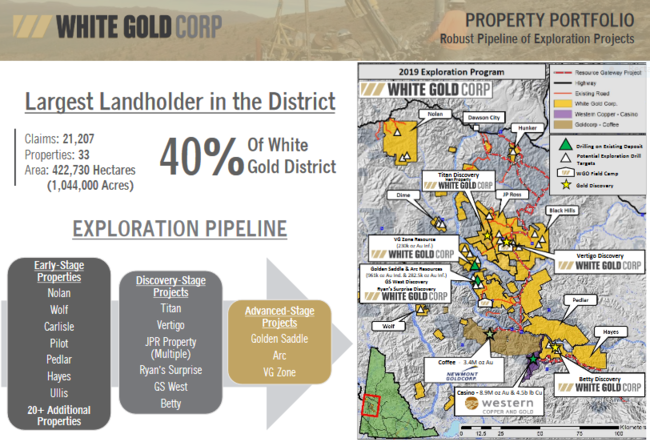

White Gold boasts multiple-project resource potential, not to mention the wide-open exploration upside in an established mining district.

According to the company’s project overview page, the company controls, “a claim portfolio of over 422,000 hectares, representing over 40% of the District, the company’s gold resources include its flagship Golden Saddle & Arc deposits containing 1,039,600 oz Indicated at 2.26 g/t Au and 508,700 oz Inferred at 1.48 g/t Au, and its VG resource containing 230,000 oz Inferred at 1.65 g/t Au. The company’s proprietary exploration strategy and experienced management team continues to produce multiple high-grade gold discoveries, including Titan with 72.81 g/t Au over 6.09m from 10.67m depth, including 136.36 g/t Au over 3.05m, Vertigo with 23.44 g/t Au over 24.38m, Ryan’s Surprise with 20.64 g/t Au over 6.09m, GS West with 2.97 g/t Au over 10.0m and Betty with 1.08 g/t Au over 50.29m.

This Nov. 26, 2019 headline showcases the regions considerable blue sky potential:

On January 9, the company dropped the following headline:

When we first featured the stock 12 months ago, it was trading at $1.47.

If you liked this company’s prospects when it was trading in the $1.50 range, you’ll like it even more sub-dollar.

Newsflow for the upcoming field season promises to be eventful and steady.

GOLDEN TRIANGLE B.C.

Seabridge Gold (SEA.T)

- 63.50 million shares outstanding

- $1.18B market cap based on its recent $18.61close

Seabridge is up a respectable 12% since we first featured the stock nine months back.

Seabridge’s KSM Project, a quartet of deposits known as Kerr, Sulphurets, Michell, and Iron Cap, represents one of the largest untapped resources of gold and copper on the planet.

Current Measured and Indicated resources = 49.694,000 ounces of gold.

Inferred resources = 56,330,000 ounces.

All told, the company boasts 106 million ounces of gold in all categories, plus significant amounts of copper, silver, and moly.

KSM’s Proven and Probable reserves stand at an eye-popping 38.8 million ounces of gold, plus significant copper, silver, and moly credits.

In recent developments, it would appear KSM has more to offer in its subsurface layers.

On Jan. 23, 2020, the company dropped the following headline:

Rudi Fronk, CEO of Seabridge Gold:

“We acquired Snowstorm in 2017 because we think it has an excellent chance to host a Getchell-style deposit. Nothing we have learned to date has downgraded this opportunity. We have identified the favorable stratigraphic host for a Getchell style deposit as well as similar structures which fed the deposits to the south.”

Skeena Resources (SKE.V)

- 123.39 million shares outstanding

- $128.33M market cap based on its recent $1.04 close

We first featured Skeena nine months ago when it was trading at $0.44. It’s had a nice run since then—up 137%.

Skeena boasts one of the highest grade open pit deposits on the planet at its flagship Eskay Creek Project, a resource of some 4M ounces grading 4.4 g/t AuEq.

The company is fast-tracking Eskay Creek towards production. A PEA released last November demonstrated impressive economics.

PEA Highlights:

- High-grade open-pit averaging 3.23 g/t Au, 78 g/t Ag (4.17 g/t AuEq) (diluted);

- After-tax NPV5% of C$638M (US$491M) and 51% IRR at US$1,325/oz Au and US$16/oz Ag;

- After-tax payback period of 1.2 years;

- Pre-production capital expenditures (CAPEX) of C$303M (US$233M);

- After-tax NPV: CAPEX Ratio of 2.1:1;

- Life of Mine (“LOM”) average annual production of 236,000 oz Au, 5,812,000 oz Ag (306,000 oz AuEq);

- LOM all-in sustaining costs (AISC) of C$983/oz (US$757/oz) AuEq recovered;

- LOM cash costs of C$949/oz (US$731/oz) AuEq recovered;

- 6,850 tonne per day (TPD) mill and flotation plant producing saleable concentrate.

It’s not very often you see an after-tax IRR north of 50%. The price assumptions applied here were conservative—$1325 gold.

If we use a $1500 gold price, more in line with current prices (gold is currently trading at $1588), the IRR jumps to 63% and the after-tax payback period is measured in months, not years.

Skeena might be one of the better vehicles to ride during the next leg up in gold. Buying on weakness could pay off handsomely in the medium to long term.

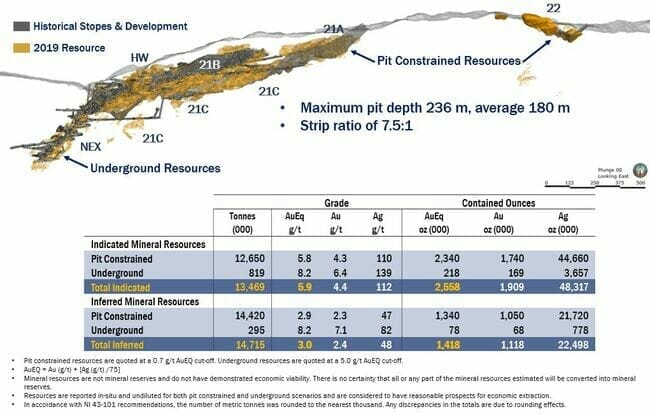

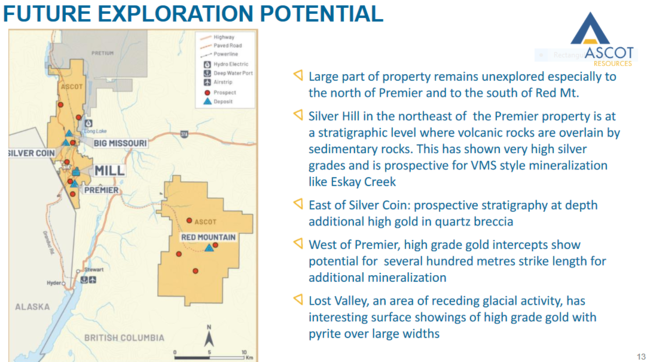

Ascot Resources (AOT.T)

- 233.13 million shares outstanding

- 165.52M market cap based on its recent $0.71 close

Ascot is down since we first featured it nine months back (first featured at $0.89).

Ascot is looking to re-start the historic Premier Gold Mine, just a stone’s throw from the town of Stewart.

The project is steeped in mining history.

Hailed as one of THE greatest gold and silver mines on the planet in its day, Premier began production back in 1918, hitting its peak during the Great Depression.

High-grade assays drop as a matter of routine in Ascot land.

- Dec.2, 2019 – Ascot Reports High-Grade Gold at Premier’s Silver Coin Deposit Including 52.67g/t Au Over 3.59 Metres

- Dec. 5, 2019 – Ascot Exploration Drilling Intersects 17.29 g/t Gold Over 3.58 Metres in New Area West of Premier Portal

- Dec.10, 2019 – Ascot Reports Final Drill Results From Big Missouri Including 22.54g/t Gold Over 5.50 Metres

- Dec.16, 2019 – Ascot Intersects 880g/t Silver Over 1.00 Metre at New Silver Hill Target

- Jan. 6, 2020 – Ascot Continues to Intersect High-Grade Gold In Multiple Drill Holes at Silver Coin

Jan. 15, 2020 – Ascot Increases Indicated Resources at Premier Gold Project by 60%

Highlights:

Current resources at the Premier Gold Project:

- Indicated Category: 1,066,000 ounces of gold and 4,669,000 ounces of silver

- Inferred Category: 1,180,000 ounces of gold and 4,673,000 ounces of silver

When you combine the resources at both projects—Premier and Red Mountain—you get:

- Measured & Indicated: 1,849,000 ounces of gold and 6,824,000 ounces of silver

- Inferred: 1,250,000 ounces of gold and 4,769,000 ounces of silver

That’s a nice high-grade ounce count for the two projects.

They say “Good Grades Make For Good Miner’s”.

Ascot certainly has the grade.

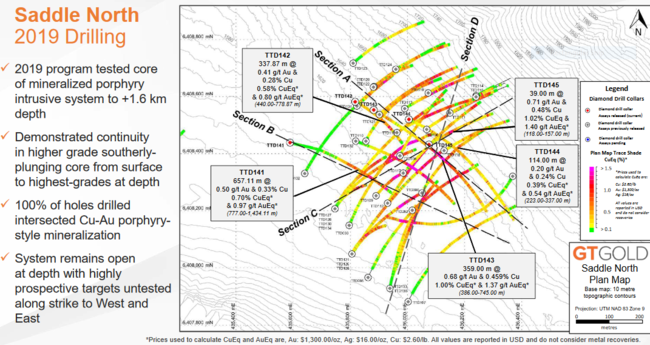

GT Gold (GTT.V)

- 116.56 million shares outstanding

- $166.68M market cap based on its recent close at $1.43

The company’s shares up a solid 60% since we first featured the stock at $0.90 ten months back.

GT Gold’s 100% owned Tatogga Property is the location of a new gold-copper-silver porphyry discovery called Saddle North.

Last May, the company announced a strategic investment by Newmont-Goldcorp (NGT.T), followed by a solid hit early in the season from Saddle North.

Newmont-Goldcorp ‘s appetite appears insatiable:

Nov. 27, 2019 – GT Gold Announces a C$8.3 Million Investment by Newmont Goldcorp Corporation

Both Saddle projects—North and South—have delivered assays in recent weeks:

Not to be outdone, the project that put GT Gold on the map delivered the following high-grade assays:

Jan. 16, 2020 – GT Gold Drills 53.73 meters of 10.00 g/t Au, 46.84 g/t Ag at Saddle South

With roughly $18M in cash, the drill bit will be put to good use in 2020.

NEVADA

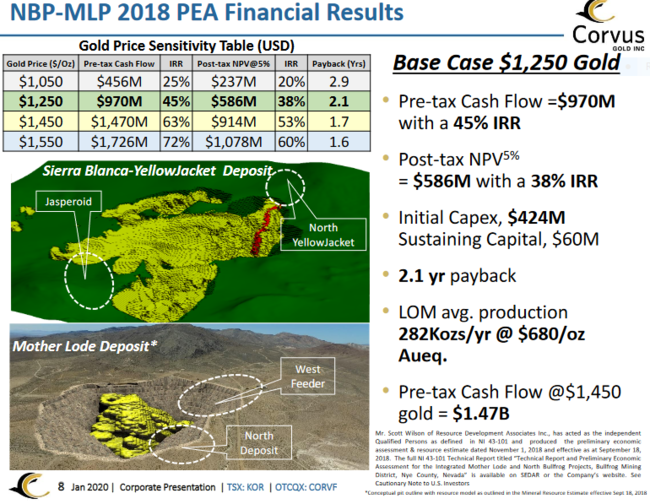

Corvus Gold (KOR.V)

- 123.99 million shares outstanding

- $262.85M market cap based on its recent $2.12 close

Corvus has seen some serious volatility in recent months.

The stock is up 7% since we first featured it last March.

Corvus’ primary focus is developing its North Bullfrog and Mother Load projects.

On Nov. 5, 2019, the company announced a project optimization update, targeting lower Capex and Opex, with near-term production scenarios at both of its projects.

On Dec. 5, 2019, the company dropped the following assays:

Then, on Jan. 14, 2020, this assay related headline dropped:

The price sensitivity table featured on the above PEA slide demonstrates a 60% after-tax IRR at current gold prices. With any luck, they’ll figure out a way to bring the CapEx down.

Gold Standard Ventures (GSV.T)

- 277.53 million shares outstanding

- $283.08M market cap based on its recent $1.02 close

GSV is trading down significantly since we first featured the stock last March (from $1.52 to its current $1.02).

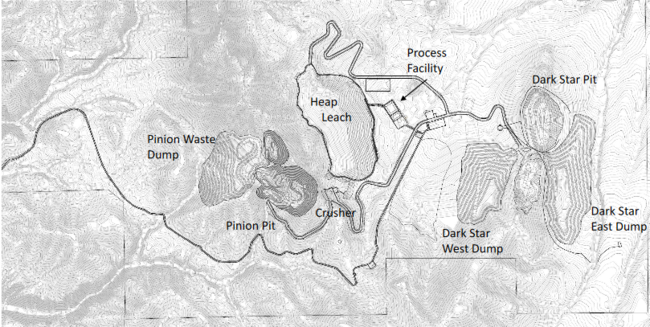

The Company’s flagship Railroad Project is located along the Piñon mountain range of the Railroad Mining District of Nevada.

The Pinion and Dark Star gold deposits offer a potential near-term development option for the company.

Pinion has an Indicated resource of 31.61 million tonnes grading 0.62 g/t Au for 630,300 ounces of gold and an Inferred resource of 61.08 million tonnes grading 0.55 g/t Au for 1,081,300 ounces of gold. This resource is due for revision to include recent success with the drill bit.

Dark Star, 2.1 kilometers to the east of Pinion, has an Indicated resource of 15.38 million tonnes grading 0.54 g/t Au for 265,100 ounces of gold and an Inferred resource of 17.05 million tonnes grading 1.31 g/t Au for 715,800 ounces of gold. This resource is also due for revision to include highly favorable results from a 2018 drilling campaign.

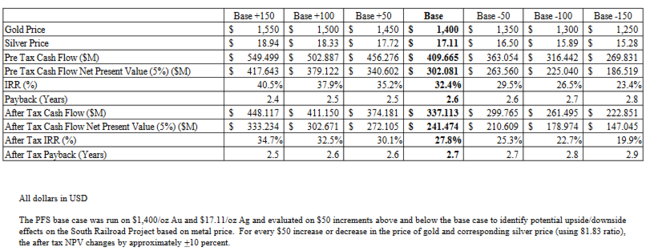

The company recently tabled a prefeasibility study (PFS) for its Dark Star and Pinion oxide gold heap leach projects with a reasonable CapEx ($194M) and good leverage to firmer gold prices.

Note the price sensitivities to higher Au prices (a 34.7% after-tax IRR at today’s $1550 Au price range).

The last piece of news the company tabled was on Nov. 12, 2019:

Gold Standard Discovers High-Grade Oxide Gold Mineralization at the LT Target

The crew running GSV is one of the best in the business.

ONTARIO – QUEBEC

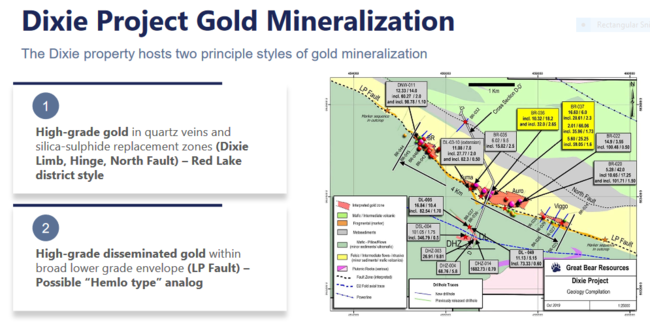

Great Bear Resources (GBR.V)

- 45.55 million shares outstanding

- $408.17M market cap based on its recent close at $8.96

Great Bear Resources (GBR.V) is up 340% since we first put it on our shortlist back in January 2019.

“Booyah”?

Those early price gains were fueled by uber high-grade hits at the company’s Dixie Project, specifically the (South) Limb and Hinge zones.

There’s potential to grow high-margin gold ounces in the higher-grade zones, but the real potential lies in the impressive scale of the 18-kilometer long LP Fault Zone where broader, lower to moderate grade zones could pile on the resource ounces in a hurry.

3 1/2 months ago, we suggested that the following news releases demonstrated the resource building potential at Dixie (rarely do you see headlines this long, but there’s much to highlight here):

and…

The company’s shares were trading hands at $6.50 back then. Today, they’re just shy of a nine dollar bill.

Assay related newsflow continued since we last checked in:

Then came a Dec. 5, 2019 press release, announcing a dramatic expansion in its drill program at Dixie—from 90k meters to 200k meters. They also announced that additional drill rigs would be added to the campaign beginning this month.

“The expanded drill program remains fully-funded with a 2020 budget of $21 million, and the Company has the ability to further augment the program with cash on hand.”

The most recent news out of the company was on Dec. 16, 2019:

200k meters will generate a lot of assay related newsflow over the coming months. If the company continues delivering headlines like the one above, it could see a takeover offer from one or more resource-hungry predators.

Harte Gold (HRT.T)

- 676.96 million shares outstanding

- $98.16M market cap based on its recent close at $0.145

In Great Bear Resources (above) we experienced the thrill of victory.

In Harte Gold, you may have experienced the agony of defeat.

We first looked at the stock back in mid-October when it was trading at $0.235.

Ramping up a mine is never a seamless task.

The news that jarred shareholders’ nerves, triggering a wave of selling, arrived on Nov. 1, 2019.

Harte Gold Provides Third Quarter Update and Guidance for 2019

“Quarterly results when compared to the Feasibility Study were below target. Based on results to-date, full year 2019 guidance has been adjusted to 24,000 to 26,000 ounces at an AISC of US$2,000 to US$2,200 per ounce. Previous guidance was 39,200 ounces at an AISC of US$1,300 to US$1,350 per ounce.”

Ouch!

Since our coverage a few months back, the company has recruited new talent.

Early in the new year, the company offered a new sense of hope for loyal shareholders.

Earlier this week, on Jan. 28, 2020, the company continued making adjustments to its management team:

Harte Gold Strengthens Management Team – Drilling Underway at TT8

Mining is a tough business—I don’t need to explain that to HRT shareholders’.

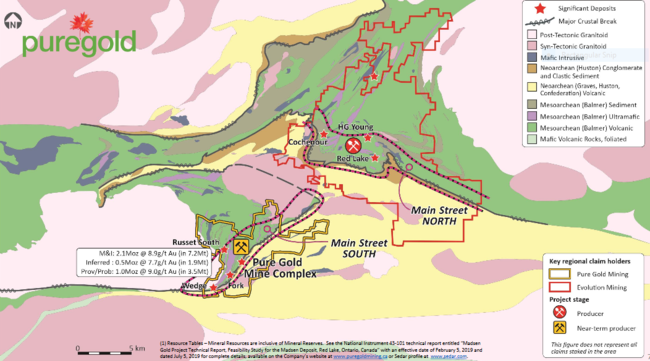

Pure Gold (PGM.T)

- 358.48 million shares outstanding

- $290.37M market cap based on its recent $0.81 close

PGM is up a very respectable 43% since we first featured the company 3 1/2 months ago.

This near term production scenario is positioned in the heart of the high-grade gold capital of the world—Red Lake.

Fully funded to production, the first gold pour at the company’s flagship Madsen Project is set for Q4 2020.

FEASIBILITY STUDY HIGHLIGHTS

Base case parameters assume a gold price of US$1,275/oz and an exchange rate (C$ to US$) of 0.75.

- Probable Mineral Reserves of 3.5 Mt at 9.0 g/t containing 1.0 million ounces of gold;

- Low initial capital requirement of $95 million including a 9% contingency;

- Mine life of 12.2 years with a 13 month pre-production period;

- Peak annual production of approximately 125,000 ounces with average annual gold production in years 3 through 7 of approximately 102,000 ounces;

- Life of mine (“LOM”) direct operating cash cost estimated at US$607 per ounce of gold recovered;

- LOM all in sustaining cash cost (“AISC”) estimated at US$787 per ounce of gold recovered;

- Pre-tax NPV5% and IRR of $353 million and 43% respectively with a 3.0 year payback of initial capital;

- After-tax NPV5% and IRR of $247 million and 36% respectively with a 3.4 year payback of initial capital

Note that a very conservative $1,275 gold price anchors this study (gold is currently trading at $1575 as I type).

Madsen’s CapEx is a very VERY modest $94M.

Exploration in recent weeks involved both infill and stepout drilling.

Dec. 16, 2019 – Pure Gold Drilling Intersects High Grade Gold Mineralization at 8 Zone Gap and Wedge

Very decent results dropped just last week:

- 24.9 g/t gold over 1.0 meter from drill hole PG19-708;

34.1 g/t gold over 2.2 meters from drill hole PG19-710; including - 64.6 g/t gold over 1.0 meter;

- 33.1 g/t gold over 3.4 meters from drill hole PG19-719; including

- 79.4 g/t gold over 1.4 meters;

- 13.2 g/t gold over 6.3 meters from drill hole PG19-735; including

- 26.3 g/t gold over 2.0 meters.

Darin Labrenz, President and CEO of Pure Gold:

“The Pure Gold Red Lake Mine continues to produce significant, high-grade gold drill intercepts and today’s results from areas planned for mining this year highlight local opportunities for mine expansion”.

What’s not to like about Pure Gold?

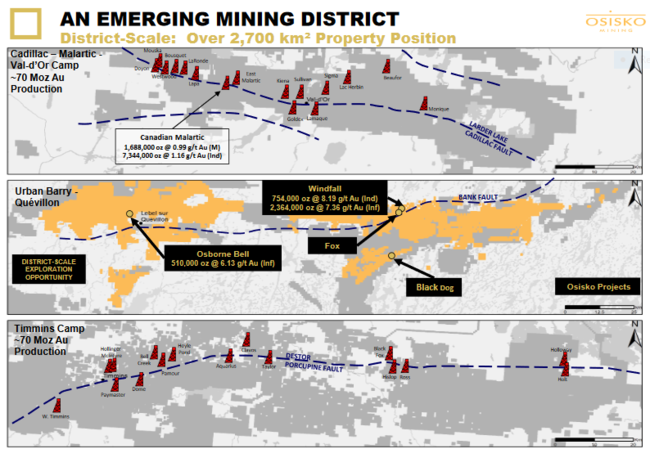

Osisko Mining (OSK.T)

- 290.03 million shares outstanding

- $1.17B market cap based on its recent $4.02 closing price

Osisko is up 28% since we first featured it 3 1/2 months ago. It’s now solidly in the one-billion-dollar territory.

The company’s assets include:

- A 100% interest in the high-grade Windfall Lake gold deposit located between Val-d’Or and Chibougamau, Québec.

- A 100% undivided interest in a large area of claims surrounding the Urban-Barry area and nearby Quevillon area (over 3,300 square kilometers).

- A 100% interest in the Marban project located in the heart of the Abitibi.

- Properties in the Larder Lake Mining Division in northeast Ontario.

- Interests and options on a number of properties in northern Québec and Ontario.

Since we last checked in, aside from closing a whopping $61M private placement financing, the company has released a plethora of drill hole assays from multiple zones.

OSISKO MINING RECAPS WINDFALL DRILL PROGRAM AND 50 TOP INTERCEPTS

If you wanna see how a junior exploration company achieves $1B-plus status, check out Osisko’s Newsroom. The volume of assay related drill hole data is daunting.

Final thoughts

That’s it for our $100-plus market cap shortlist.

On deck is our sub-$50M ExplorerCo list.

END

Greg Nolan

Full disclosure: we have no marketing relationship with any of the companies featured in this article.

Leave a Reply