Respect where it’s due, I haven’t been to an investor conference in a long time where I came away interested in most of what I saw, let alone *everything* I saw, but this year’s Gravitas Securities Growth Conference lineup absolutely hit it out of the park.

The GSGC isn’t the biggest show around, but they know how to turn out the playahs, and the only way you keep big money showing up is to be a little bit picky with what you offer them. Don’t waste anyone’s time and they’ll know it’s cool to return.

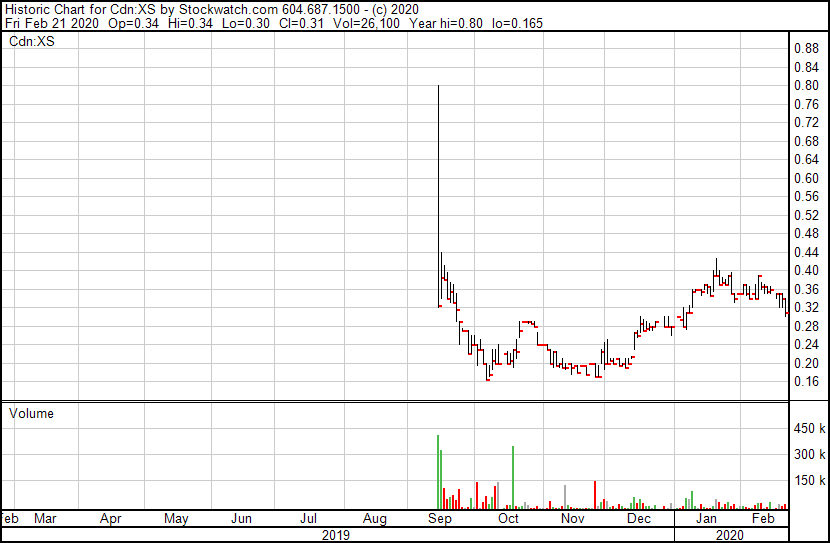

For mine, the most interesting deal I was pitched on at this show yesterday was one of the most unexpected; Xtraction Services (XS.C).

CREDIT FOR THE CANNA BIZ

For real, I still get weed deals pitched at me several times a day, and the number that are a variation on ‘we’re going to grow it better/cheaper than anyone’ is staggering. Read the fucking room, people. Growing is for dirt farmers in the third world or folks who can obtain the highest of high quality levels, it’s not a bog standard agricultural play meant for pharmaceutical grade facilities in the snow.

So for a cannabis deal to strike me as interesting you have to be doing something novel.

Xtraction Service is doing just that, by offering equipment leasing solution for US companies getting into the cannabis and hemp extraction business.

Boring? Not hardly.

Like I’ve been saying for weeks now, if capital is hard to come by for the entire cannabis industry, you invest in not just the companies that actually have capital at the ready, but also in those offering capital to those in desperate need. I’ve talked about how I like Trichome Financial (TFC.C), and how they’re filling that capital gap to help keep some LPs alive, while also charging enough interest to make their risk worthwhile, and picking up warrants for upside, and getting first dibs on any credit default liquidation of equipment and assets.

Xtraction Services is in the same game, though rather than offering survival money, they’re offering startup money specifically related to the purchase of equipment, which is a big problem in the US, where credit for cannabis companies is not a thing you find naturally in the wild.

When Company ABC decides to build an extraction lab, but doesn’t have the $300k to $1 million needed to buy their equipment, the equipment supplier brings in XS to finance the deal.

XS gets themselves a little discount from that supplier for helping them finance the sale, they get interest from the buyer to help acquire the equipment, and in the end turn what might be a $550k purchase into what is ultimately a $1.5 million revenue return.

If the buyer should default on their payment, XS wants to be able to reclaim most of their investment, so they only finance those assets that can be resold – no lights, no HVAC.

The vendors like this deal because offering their own financing isn’t their business, and the due diligence XS does on those potential customers helps the vendor know they’re doing business with real organizations that are building something.

Xs has four existing contracts in place and one sale-leaseback (with Halo Labs (HALO.NEO)), so the operation is already turning over revenue, and their recent grant of a California lender’s license opens up that state.

What’s really interesting to me is their deal with the $167 million valued Kushco Holdings (KSHB.OTC), which brings Kushco in as a 19.9% investor and gives XS first right of refusal on the financing of equipment for any and all Kushco customers.

If you don’t know what a Kushco is;

Founded in 2010, KushCo has now sold more than 1 billion units and regularly services more than 6,000 legally operated medical and adult-use growers, processors, and producers across North America, South America, and Europe. We maintain facilities in the five largest U.S. cannabis markets and we have a local sales presence in every major cannabis market across the US and Canada.

[..] “For the past several months, we have been evaluating ways in which we can successfully enter the equipment financing arena, which we identified early on as being another growth driver and margin accretive business that can significantly complement our existing ecosystem of ancillary products and services,” said Nick Kovacevich, KushCo’s Co-founder, Chief Executive Officer, and Chairman. “After much due diligence and internal review, we realized that an investment in and partnership with Xtraction Services-who has already built a robust equipment financing platform, including relationships with more than 70 OEMs and distributors across the laboratory, testing, processing, and extraction space-is the best option for KushCo and our customers.”

I talked at length with XS CEO David Kivitz, who has a grasp on the numbers behind his company that would rival anyone I’ve dealt with. He’s a cynic when it comes to the cannabis sector; certainly not someone who is going to hand out capital just because it’s asked for. He wants to know everything to do with a borrower’s business, and he wants to know his money is coming back as planned. Getting first dibs on assets in the event of a default will cover his bottom line, but he doesn’t want to be in the business of reselling extractor units on Craigslist. He wants his money back x3, and he knows he’s going to get it if his borrowers are raking it in with a successful operation.

“Every other industry you can think of has equipment leasing options, except for cannabis which is in this weird credit vacuum, at least in the US.” says Kivitz. “We’re generating revenue at a time when a lot of growers aren’t. We’re making money when money is hard for a lot of people in the business to find. We’re not here for the 10x multiple, we’re here for the 40% per year. And we’ll be around long after a lot of companies have run out of steam because, at the absolute worst, we get our equipment back.”

The twist in this tale is that, while interest on loans would be, for most borrowers, tax deductible, it’s not in the cannabis business because, illegal. But equipment lease payments are absolutely deductible. This means doing business with XS brings a tax break, and because XS isn’t touching anything illegal, it can acquire finance as needed.

A case study in the XS deck shows a 36 month lease term with $550k of cost exposure on $1.2 million in equipment returning $1.5 million in total revenue. DEAL.

XS portfolio underwriting guidelines dictate repayment should be full inside 30 months, and gross returns should be >50% IRR on leasing and leaseback deals. That’s the side of the arrangement I want to be on, because the profits aren’t reliant on the markets loving your story or weed being legalized, but on simple credit math. You put X dollars in, you get >50% more out.

Put your weed capital into weed capital businesses, and you’ve got ample upside with all the downside protection.

These are early days for XS and the market doesn’t yet have religion over deals that capitalize capital, but as more bodies float by, more people will see the light in being the guy who decides who lives.

THE PRINCE OF PRE-ROLLS

Along similar lines of ‘let’s invest in the professional approach’, I also enjoyed hearing the Icanic Brands (ICAN.C) pitch.

Icanic boss Brandon Kou has only been at the helm of his company for a few months, taking over the flailing Integrated Cannabis and rebranding it inline with his belief that it’s better to do one thing really well than everything badly.

Icanic does pre-rolls. That’s it.

Well, that’s not it entirely, but it’s the focus. While the company has products in the CBD and edibles space left over from parts they’ve acquired and earlier business models, Kou is zeroing in on pre-rolls as his reason for being.

“Most companies, if they offer pre-rolls, it’s an afterthought,” he says. “It’s not your most cost effective product – you’re spending money on hands, pretty much, hands to roll paper and dole out the right amount of weed. It’s laborious, expensive, and imperfect.”

This is absolutely true. And because of this, most pre-roll brands use bullshit shake as their central element. If it’s costing you dough on the processing in, you save money on your ingredients. This offers the customer a shitty experience and repeat business is lost.

Kou isn’t down with that.

“Granted, a lot of folks don’t want to smoke,” he says, “but part of that is they don’t want to roll papers, grind, mess about with the product. We know our customers appreciate having a legitimate product of high quality, a great experience, and a reasonable price.”

How he manages that is automation.

And that’s where I laugh, and remind him that automation usually means a degradation of quality.

Kou sees this one coming.

“Not at all,” he says, telling me his company brought in engineers who have worked with Tesla, among other high tech firms, to perfect a process that he has exclusive use of.

“This reduced costs by 65% and lets us roll at 400 units per hour without human hands involved,” he says. “An upgrade we’re working on right now will move that to 1,000 units per hr. That allows us to fill our supply chain, and offer any excess capacity to other companies.”

“If we can white label a product for others, at a price lower than they can make it themselves, now we’re a part of everyone else’s deal.” he says.

That’s all well and good, but California’s cannabis feedstock scene is problematic. Getting a consistent supply of weed for value-added processing can be expensive, even impossible if you’re looking for pesticide-and fungicide-free inputs.

So Kou locked down his own grow facility, and in doing so dropped input prices from as much as US$2300 per lb to $1000 from a 4.3k sq ft grow.

“It gives us what we need to operate, allows us to be consistent in what we produce, and ensure supply chains aren’t interrupted,” he says. “Being on shelves all the time is important to having customers engage in repeat business.”

As Integrated Cannabis, ICAN was bloated – inefficient, overvalued, an example of cannabis 1.0 that needed to be updated, pared down, and streamlined for the new way of doing things.

Kou was brought in to do that, having previously established the home office and investment vehicle for former NBA all-star Steve Nash, which included large stakes in Steve Nash Fitness World, Indochino, Sharecare, Onebode, and the Vancouver Whitecaps MLS team, among others. He didn’t leave that world to be a fly by night weed CEO.

“This is a grown up business doing grown up things,” he says. “Capital isn’t easy to come by, so you have to be focused with what you have, do one thing great instead of eight things poorly just so you can bang out more press releases.”

To that end, Icanic has around $1 million in cash in hand to utilize for the short term. It’s not yet profitable but that’s the near term ambition, and if Kou needs short term capital he’s not planning to go takeout any payday loans.

“We have an asset in Nevada that, frankly, we don’t see short term value in progressing, but it’s real estate and has value and we will likely move that on when the time is right rather than dilute the stock with financing or pay a crazy interest rate,” he says.

That facility, with 4k sq ft of cultivation and a full license to grow comes with a 3k sq ft manufacturing facility, and a 1.5 acre parcel of land. For a lot of companies, that’d be an excuse to call yourself a US Multi-State operator (MSO) and hype the market that you’re coming for 50 states soon.

“Nah,” says Kou. “California is a massive market by itself, and in that market we’re in 340 of what we perceive to be a realistic 430 possible dispensaries right now. We’d rather build on that in a place with a massive potential market, where we’ve already built a sales and distribution network, and can make small tweaks to ramp up revenues.

Like adding a jarred flower SKU.

“We’re hyperfocused on pre-rolls, but flower is a component of that product so it’s a very small sideways step to put some of it in jars and have a second product on the shelf,” says Kou, adding, “That’s not the same as producing vape cartridges, where you need a whole new processing line, or gummies, or chocolates where you’re developing products over months.

Early participants in Integrated Cannabis are down on their pre-public investment, but that’s okay to Kou. He’s there not to propel it to the stars but to deliver on their early promise.

“If it takes a little while to build, that’s okay, because we’re going to build something that will repay itself over many years. If investors like that plan, we’re happy to welcome them.”

BETTING ON E-SPORTS

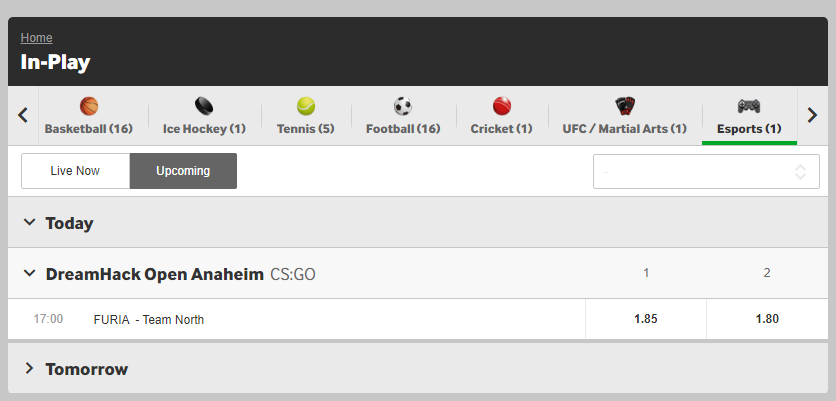

Two cannabis companies and two interesting deals already makes this a conference worth my time, but the next one is in e-sports… or, rather, gambling on e-sports, an area I’ve publicly ridiculed previously because I can’t imagine thinking that betting on two 15-year-olds in a Fortnite game won’t be a task subject to weirdness.

Luckbox is the company that has me rethinking that mindset, and to the point where I invested in an early private round.

Luckbox is a (for real) fully licensed e-sports gambling platform.

No. Really.

Based out of the Isle of Man, the company is legally permitted to operate gambling activities online across much of the world. It’s festooned with management that has come from some of the bigger gambling and content organizations in the world, from Pokerstars to Bwin, BBC to Sony, Playtech and UltraPlay. This is not your bog standard Bodog setup, where they’ll take as much cash as they can before the feds kick the door in, or some Russia-backed online platform that’ll look the other way while you launder money.

“We absolutely consider ourselves the cleanest deal in the sector,” says Luckbox CEO Quentin Martin.

Martin is another of those CEOs who doesn’t fuck about, he’s got all the info, all the numbers, no time for hype, is quick to shoot down advanced expectations, and wants you to know that his group’s main plan is to be around at the highest levels of the business long enough that a bigger fish pays a premium to take it over.

That means more opportunities to bet on e-sports right now than anyone else, on more games than anyone else, and in more ways than anyone else.

“We’ve spent some time and money building out our system so that we can plug into other operations, offer white label options, and be the obvious, most complete e-sports gambling option while many others are treating it as an after-thought.”

Martin is right on this. I’m well plugged into the e-sports scene, and can usually see through bullshit applied to it. But a simple check of the Luckbox site as I was preparing this article found three tournaments open to betting on a Friday afternoon (all CS:GO), both in Europe and North America, with League of Legends tourneys an hour away, a North American DOTA 2 tourney alongside that, and DreamHack’s CS:GO tourney on the way.

For sheer number of options, the 22 available between 4pm and midnight Pacific time, complete with streaming options, were impressive.

By comparison, Betway offered one – the Dreamhack tournament – and nothing upcoming on the Saturday at all. That may be good for maybe a few fly-by bets in passing as you get your Premier League soccer betting fix, but hardly enough to keep die-hards interested in staying on their site.

Elsewhere, if you’re into Russian enterprises backed by guys who would gut me in a Leningrad alleyway if I asked too many questions, GG.Bet competes with Luckbox for the sheer number of betting options, but if you’re happy putting your credit card into a system that allows you to freely exchange cryptocurrency in and out of your credit card at will (read: launder your money), you’re in a whole other business than what Luckbox wants to be in.

“Not going to comment on other operations obviously,” says Martin, “I’ll only say that we’re not building this company for the opportunity to rake in as much currency as we can in the short term until we get shut down. We’re here to build a real e-sports betting business with the highest level regulatory compliance and a backend that is totaly secure and can be integrated into a larger partner or acquirer without any concern that something fishy is going on behind the scenes. That’s our business, to be shiny clean and worth acquiring by a large, compliant, well financed buyer.”

Martin will allow himself to add one shot at the competition, saying, “Others do not share our long term ambitions, and that’s on them. We’ll do it the right way, which is how many of our management team have done it before.”

The online gambling world is a nutty place, to be sure. From those spending hundreds of millions trying to corner the US daily fantasy sports market, which took a beating a year ago when the feds all but shut it down, to the early poker websites that hauled in users offering free gaming options that inevitably led to paid gambling and raids and fleeing off-shore, to the Asian mega-casinos and horse racing giants, to the established UK sports betting scene and massive Vegas sportsbooks, there are a lot of niches where one can make serious dollars – if you can navigate the compliance side.

That’s Luckbox’s main selling point.

“We have our licensing locked down,” says Martin. “That gives us access to payment processors at good rates, it means we can add standard casino gaming options, that players have their money protected, and we can provide services to other companies in the space without putting their own operations at risk.”

This doesn’t necessarily mean you’re going to be able to place your bets in Florida or Rhode Island; there are still a world of gambling rules and licensing and permits that have to be negotiated to service everyone, but Luckbox has 40% of the globe covered right now.

To ensure you’re not some human traffickers using their system to move drachma into shekels, you’re going to need to provide ID and show you’re not on any terrorist watchlists, you might get checked on a list of politically connected individuals or voter registration lists or do-not-fly lists – but assuming that’s okay with you, all bets are on.

Luckbox will go public soon.

Others at the GSGC include Bruush, an early private electric toothbrush subscription deal that sends you a Sonicare equivalent for $59 (as opposed to $200+ at the competition) and regular brush head replacements in much the same manner as Dollar Shave Club – a deal that is growing quickly, raising some dough, but is still a way off being ready to go public.

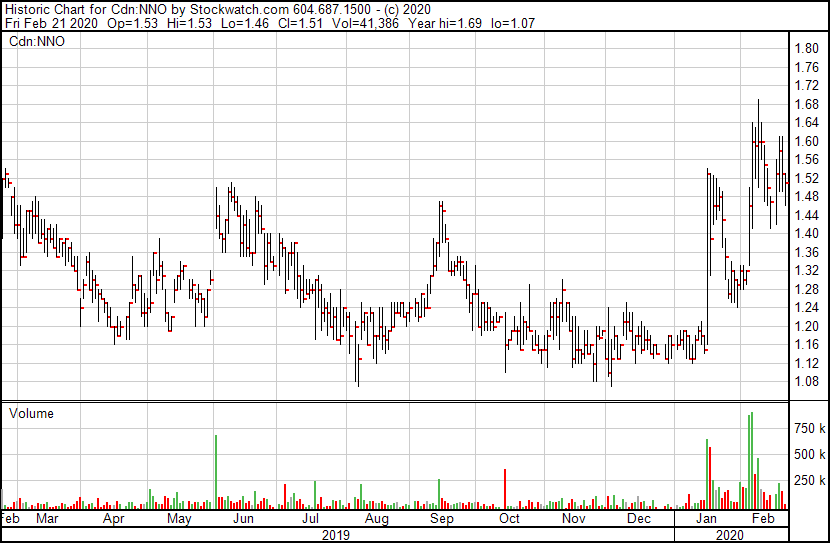

WELL Health Technologies (WELL.T) CEO Hamed Shahbazi held court as the keynote speaker, and boy has he dominated with what he says isn’t a private healthcare roll up, even as he rolls up nice healthcare assets at a fast clip, building value all along the way. Nobody has a chart like this one – it’s sick, no pun intended.

Shahbazi, who already has a filthy exit to his name, is a darling of the street, presents extremely well not only as a CEO but a thought leader, and says he’s looking at document security and cyber security in health care as potential growth areas.

Also holding court, Nano One Materials (NNO.V) boss Dan Blondal, who has a smile like the cat that cornered the market on canaries, after offering a $5 million financing last week that not only ended up closing at $12 million, but also saw the stock run from $1.15 (the financing price) to $1.60 while the financing was going.

NNO IR Paul Guedes says he’s been dealing with a lot of investors who are irked they couldn’t get their full allocation, though they could have had as much stock as they wanted at $1.15 a few weeks ago. The difference now is, that raise opens up $5 million in government grant money for NNO, and several institutional investors have realized the company is real and aren’t waiting for PPs to close.

The buying has been consistent and roared past the warrant price of the raise, which should mean the company will receive more money from those who can execute them.

Frankly, there are a lot of good options out there in the smallcap space right now, both publicly and privately, that are engaging business plans focused on being an adult in the room, and I love that. For those who have been swirling around the drain in the cannabis space for the last year, wondering why selling drugs isn’t profitable, the offerings on display here built a strong case that they can be, and will be, if done right.

In the battery tech space, NNO is putting the finishing touches on a long strategy of partnering with giants like Saint Gaubain, Volkswagen, and Pulead Technology, while bringing down patents in multiple countries and expanding their facility by double while attracting visits from the Prime Minister. WELL is creating a private health care juggernaut. Luckbox is putting together perhaps the first true e-sports deal.

Thanks for the invite. Enjoyed the vittles. Already placed several bets.

— Chris Parry

FULL DISCLOSURE: Nano One Materials has been an Equity.Guru marketing client previously and the author owns stock in that company that he has held for several years. Other companies mentioned may in the future become EG clients.

Leave a Reply