A quick scan of headlines today would tell a harrowing story that Heritage Cannabis (CANN.C) was in big trouble and had lost $13 million and pandemonium had broken loose, and dogs and cats were going to be living together any time now. That’s because the company led their Q4 financials news release today with their yearly metrics filling the headlines, while their not-so-rough quarterly numbers were largely and inexplicably hidden from view.

Heritage Cannabis loses $13.2-million in fiscal 2019

Financial highlights:

- Revenue of $3.6-million in fiscal 2019, compared with nil in the 12-month period ended Oct. 31, 2018;

- Net loss of $13.2-million, or three cents per common share, in fiscal 2019, compared with a net loss of $6.4-million, or four cents per common share, in fiscal 2018;

- Although the company is not yet producing positive cash flows from operations, management expects to achieve positive cash flows from operations by Q3 2020. In the interim, management believes it has sufficient capital resources on hand to execute its business strategy;

- As at the end of fiscal 2019, the company had a cash position of $11.5-million, including GICs totalling $9.1-million and working capital of $11.7-million, compared with $1.2-million cash at the end of fiscal 2018 and working capital of $900,000.

The company is pretty clear that the $13m loss was annualized but they didn’t even mention what their quarterly loss was, despite it being well down from the quarter before. Looking over social media, the company took a beating from some people based on the annual numbers.

Get 3.5MM of revenue pay ~800k in “communication” 23%~ of revenue LOL $cann $cann.c have fun pot co bro’s https://t.co/4LrY3AfU7y

— BullishBearz (@BullishBearz) February 28, 2020

I’ll admit, ‘$3.5 million in revenue against $2.1 million in consulting fees’ is a bad look – UNTIL you understand the $3.5 million is just one quarter of revenues, and the consulting fees go back to this time last year, and involve the fees involved with several acquisitions.

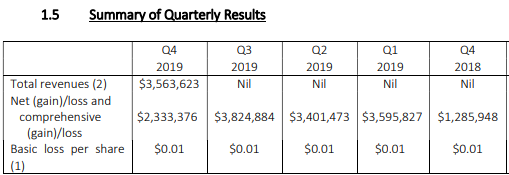

On a quarterly basis, Heritage only dropped $2.3 million in net losses in Q4 2019, which was $1.5 million less than the loss a quarter earlier – in fact it was better than any quarter going all the way back to Q4 2018.

That $13 million annual loss isn’t small, but from their MD&A: “The Company invested $8,915,049 in property, plant and equipment during 2019” – And those expenses don’t repeat in 2020.

Heritage has done a host of deals with partners, suppliers, vendors, and acquisitions, that have brought them licenses and steady product supply and got them on shelves fast. This quarter is the quarter all that comes together, so the expectation will be for their losses to shrink, and sales to grow.

But I’m not going to try to convince everyone they should share my optimism because, admittedly, I’m conflicted, as a marketing partner with the company. If you think these numbers don’t justify the share price, that’s fair and nobody should give you shit for thinking so. There are others out there who will take your side and that’s fine.

Frankly, if I was the sort of guy who had a hate on for Heritage Cannabis, and there are plenty of people out there who do, god bless ’em, I could look at the financial statements they just put out and build a case that takes the angle that they’re shitty.

In fact, let’s do that:

$13 million lost over the year, stock performance has been weak, admittedly in line with, well, everyone in the sector, there are a LOT of incentive stock options out there, some intangibles that jack the numbers, and they’re paying a decent wedge of interest on the $11 million in finance they’ve received from Trichome Financial (TFC.C).

This is all true, and I won’t try to tell you otherwise. And if you read that passage and that alone, you’d be justified in thinking Heritage was a dud. In fact, by focusing on annual numbers in their news release, while investors are used to companies goosing their figures by focusing on smaller quarterly losses, they’ve actually done a lot of the hard work for the negators out there already.

If you hate Heritage, you’re going to keep hating Heritage.

But if you actually look into the detail of what Heritage has done over the last year, and you look at the last quarter of business, they had a fucking amazing three months.

Heritage’s first revenues EVER came through in this past quarter at $3.56 million. We’re used to small cannabis outfits coming out of the blocks with a digit less than that, maybe even two (what’s up, Cannmart), and with quarterly losses far larger than the $2.3 million Heritage lost in the same time frame. You ideally don’t want to be losing anything, but I’ll take a $2.3m ding in your first quarter ever selling product. That’s reasonable and fair and shows progress.

With the cash they have in hand, even if their quarterly revenues don’t move an inch going forward (and you ignore the $5m+ in weed they’ve grown but yet to process or sell), they have enough cash available, both on hand and on offer, to get them through most of the next five quarters.

Obviously survival shouldn’t be the object of the enterprise, and I don’t honestly think they’ll stop growing sales after one quarter (especially as they’re saying their facilities are only 2/3 functional so far and some of their SKUs are only now hitting shelves).

But if the world burns and nothing good ever happens again to Heritage beyond what’s happened already, they’ve got a year-plus to figure it out.

MOST OF THEIR COMPETITORS DO NOT.

Understand, I’m not going to blow smoke up your ass and say it’s all donuts and butterfly kisses at Heritage. They did a big deal with Cronos (CRON.T) to supply them vapes and cartridges, they’ve got another deal with Zenabis (ZENA.T) in which they’ll sell them part of their harvest, and another deal puts it on James E. Wagner (JWCA.V) to manufacture those cartridges that’ll ultimately shift along to Cronos.

We’ve written before that JWCA is in real financial trouble, so fulfilling that supply agreement may prove hard – though Trichome has financed both Heritage and JWCA recently, so its safe to say that group has looked deeper at the numbers than we have and is perhaps compelling the two groups to work together as a condition of their loans. Trichome founder Marc Lustig has already done a great business in financing weed startups, doing royalty deals, and bringing together groups that can be successful trading off one another, with Origin House (OH.C). If he sees reason to offer millions to Heritage, that’s a vote of confidence I take seriously.

Zenabis has had its own troubles recently, so there’s every reason to believe they might choke back their third party sales given half a chance. This could negatively impact Heritage in a worst case scenario but I’ve no indication that’s on the cards.

That Cronos deal, however, is legit. Assuming Heritage can keep their supply chain growing and their partner supplier’s rent paid, that deal is meaningful and large and a gamechanger. The straight ‘grow weed sell weed’ business is a great baseline to add to that. I’m long – come at me.

— Chris Parry

FULL DISCLOSURE: Heritage Cannabis is an Equity.Guru marketing client.

Leave a Reply