Today was a day that daytraders have been looking forward to for some time; the day that shroom stocks finally gripped the road and took off.

Mind Medicine (MMED.E) ripped 90% to $0.77 on the back of 15m shares traded, reminding anyone who’d listen that ex-Canopy CEO Bruce Linton and pretend billionaire Kevin O’Leary were on board. Champignon Brands (SHRM.C) zoomed 40% to $0.33 on a lot smaller market awareness spend by a handy ticker, Roadman Investments (LITT.V) was up 30% to $0.065 being sucked along in the other two companies’ wake, and Revive Therapeutics (RVV.C) was up 81% to $0.10 on ripples caused by the rest.

Mind Med’s run is great news for the financial phone booth that is the NEO Exchange, where it listed this week only for folks to spend its first few days of public life asking, ‘where the fuck do I find NEO stock data?’

Forget level-two info. Many of us are struggling to find level-one info on an exchange that’s usually home to a handful of ETFs and a couple of public companies based out of a We-Work.

MMED’s first day was rad, its second was a total and utter sell-off, and its third was rad again, with a massive move on huge volume, which tells me that there’s a lot of early money getting out as retail flocks in. Frankly, on the amount of stock bought and sold, MMED should have long ago cracked a buck. That it hasn’t tells me I should think twice about chasing until we see definitive trends – especially considering the $150m-plus market cap, which is hard to justify right now.

SHRM on the other hand, sits at a $9 million cap. Granted, it has less recently-fired cannabis CEOs and reality show hosts at the helm, but a $9m cap gives plenty of room for honest upward movement and is more justified for what they have right now. LITT, at a $5m cap, finds itself in the same position, with a defensible cap and value based on plans rather than completed business. RVV, at $3.3m, is so small it’s almost a gimme, considering what’s going on around it.

To be clear, none of this is real ‘investment’ material just yet. Not Linton’s carnival act, not the little guys, not anyone. For mushrooms and psychedelics in general to really move forward, what’s needed is a court case to make them legal, as happened with weed in 2013, and governments to respond to that in ways that lay out the legal path forward. Those cases are being heard, and while I expect the mushroom business to move faster than weed did, it’s still going to be a while before profit are brought – or even a motivating factor (See Linton, Bruce).

For now, companies will ‘research’ mushrooms, or run clinics in places with lax laws, or partner up with universities, or acquire non-psychedlic mushroom assets that might be a good base going forward.

Roadman is a good example of this – they’re LOIing to get partners and clinics happening, but there’s a big proviso:

One of the important considerations that Roadman and Psychedelic Insights will be focused on is the regulatory and legal aspects of this venture. Currently https://equity.guru/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistering of psychedelic medicines is only permitted under FDA and DEA approved clinical trials. Roadman believes that this should change in the future given that in November 2019 activists filed a ballot measure to legalize psilocybin mushrooms in the state of California.

2013 memories abound, right? That’s not to say the laws won’t change and Roadman won’t be in a position to take advantage when they do, but if you look at their website right now, there’s no mention of mushrooms or psychedlics on it. It looks like a capital pool corporation keeping its options open.

To that – it has to. As a public company, LITT can only engage in business that is legal, and can only project forward so much. It will ‘explore’ deals and ‘sign LOIs’ that won’t execute until legality hits, and acquire others who have wisdom and experience in the field, and that will be fine because, right now, it’s all about positioning.

Here’s Revive doing a deal with a Dutch company for ‘truffles’ that will be used for research.

Pursuant to the agreement Red Light will sell to Revive a consistent strain of truffles for the sole purpose of Revive undertaking research and development on the suitability and implementation of its novel cannabinoid delivery technology with respect to the truffles and their extracts.

We see you, Revive. Do what you do, keep the codewords coming.

The David Stadnyk-run Codebase Ventures (CODE.C) is also in there swinging the pillow fists, JVing with Mycology Ventures through a subsidiary with the promise that research will be done, while also tossing dough at mobile games and hemp.

Mycology’s leadership brings extensive experience and combined networks from the cannabis, CBD (cannabidiol) and mushroom sectors, in addition to medical and academic research fields, which will be deployed to identify and secure early-stage investment opportunities to benefit Codebase shareholders.

Stadnyk was a first mover in the weed space, founding Supreme Cannabis (FIRE.T) and later 1933 Industries (TGIF.C), but he doesn’t tend to stick about long once the business is standing up. I’m not sure if he’s still rocking the Gucci onesie in public or not but, if Stadnyk is in early, others will follow.

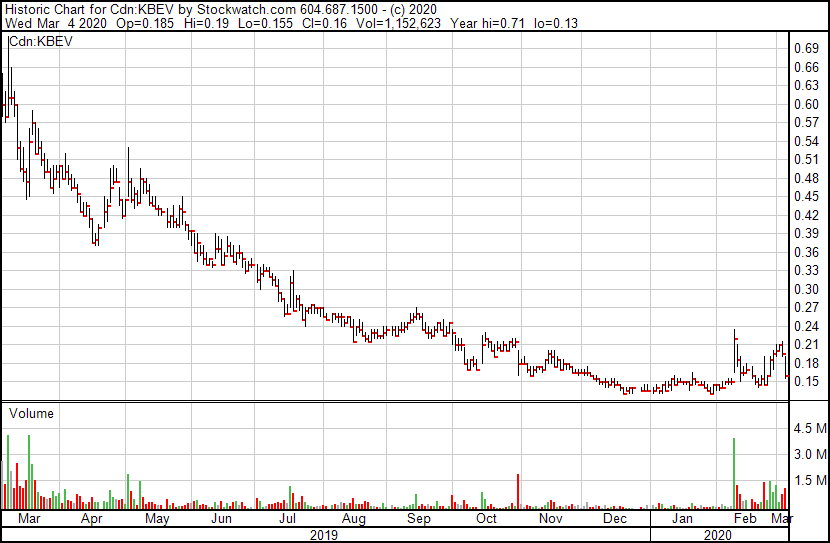

Others first movers are working on the mushroom equivalent of cannabis 2.0, adding non-psychedlic versions of them to existing products. Enter the $15m market cap functional beverage play Koios (KBEV.C):

This coffee is enhanced with two different types of mushrooms: hericium erinaceus (lion’s mane) and inonotus obliquus (chaga). The lion’s mane mushroom variety has been reported to enhance brain function (particularly when combined with caffeine) and cause adaptogenic stress reduction, and chaga mushrooms are an adaptogen that have been reported to improve users’ adrenal function. Lion’s mane mushroom is used in the company’s Koios-branded beverages, and both lion’s mane and chaga mushroom are used in Koios-branded stick packs and supplement powders.

There’s nothing illegal about that, mushroom coffee is already a thing – but it’s really just a placesetter, and has been largely sold off as others have emerged with more exciting plans.

Champignon Brands has the asset of a sector-recognizable ticker in SHRM, which is blessing it with more attention than it may have otherwise had based on their shroom tea plans.

Champignon’s mushroom-derived CPG portfolio includes the company’s flagship brand, Vitality Superteas, which have been formulated with the goal of revolutionizing conventional organic tea through the infusion of a proprietary blend of artesian mushrooms with medicinal properties. Champignon has assembled a roster of health professionals and food scientists with expertise in the realms of nutrition, naturopathy and biochemistry with the objective of combining premium, organic tea blends with some of the world’s most powerful superfoods.

Again, this is a company that wants to do business in psychedelics but can’t just come out and say so because it’s not legal yet. So we’ll get rickrolled with other plans that we’ll decode as being what we’re all really hoping is to come; legal, quality, consistent, safe shroom products for recreation and medicine.

When the markets are engaging in a new shift, you’ll often find certain people early on the scene. These folks have their ears pricked always and when they sense a change in the force, they run into that change at full speed.

Yield Growth (BOSS.C) pulled that a few weeks back, ever the opportunist, adding shroom elements to an existing CBD company, right before they also announced a similarly quick hand sanitizer play. BOSS didn’t get the same kickalong the other shroom deals got today, but it’s not for lack of trying. Yield’s Penny Green has put out more shroom news releases than anyone else recently, by a long way, and when she blows her public markets horn, it releases a thousand flying monkey imitators in all directions. They be a-comin’, children.

Understand, one and all, that this moment in time for the shroom industry is the same moment we experienced in late 2013/early 2014, when public companies were sending out codeword-stuffed news releases indicating that they were ‘exploring opportunities in technology, healthcare, wellness, agriculture, and resources’. These were all words used to avoid saying ‘cannabis’, which would have necessitated trade halts and sector changes and missed opportunities for stock to rip. Even when cannabis legalized, it took time for stock exchanges to welcome conmpanies engaged in it, and the risk of a long ‘change of business’ halt kept many companies avoiding any mention of cannabis for months, even as investors were buying their stock for that specific purpose.

To get around those limitations, some companies changed tickers to weed words as a signal to the market.

What’s up, BUD.V?

If you’re looking for other points of reference from that time that compare to today, there was a cannabis company steered by Bruce Linton taking a ton of early money from the big boys, and using it to front run everyone else’s deal. That company did okay in terms of building wealth, not so hot in terms of building a company.

Six years down the line, we’re back at the same place, only with a different line of SKUs looming.

I can guarantee you, tonight, after today’s buying action, there are five other companies prepping news releases to go out tomorrow morning announcing they’re making some sort of shift into the mushroom space. They’ll use code words. They’ll talk about LOIs with foreign companies you haven’t heard of. They’ll focus on ‘research’. Or they’ll say nothing more than they’re ‘looking at opportunities’.

You saw this in bockchain. You saw it in cobalt and lithium. You saw it in e-sports.

The shroom sector will be insane.

Is insane.

Expect FOMO to kick in overnight and the green numbers to build. None of this is attached to real business yet, so be careful. Set your exits, don’t chase, use playmoney, believe nothing. It’s Cannabis 2014 all over again. https://t.co/TMRmRHzagM— Chris Parry ™ (@ChrisParry) March 4, 2020

By all means, engage. But don’t fall in love this time.

Not yet.

— Chris Parry

FULL DISCLOSURE: Several of the companies mentioned in this piece hav e been in negotiations to engage in marketing deals with Equity.Guru. Supreme Cannabis and Yield Growth are existing clients and the author hold stock in both.

Leave a Reply