When the savings and loan crisis in the US hit in 1989, a lot of slow-moving investors lost their dough thinking the worst couldn’t possible happen. When the dotcom bubble burst in 2001, a lot of folks got torn up as stocks that had previously been 100-baggers went to zero. When the real estate market burned to the ground amid the financial crisis of 2008, a lot of folks got pulled under, imagining the worst that could happen couldn’t really happen. When the Canadian weed market started imploding in early 2019, true believers told themselves for months, “It’s bound to come back soon,” even as companies lost 95% of their value

And, right now, with the world gripped in a virus that could potentially kill millions if we fumble our response, the markets are burning while some continue to insist ‘there’s a lot of value out there’..

Of course there’s a lot of value there. Here’s the chart for General Electric (GE.NYSE) , a decades long blue chip with so much money and business that a half year out with the flu probably wouldn’t hurt it too hard.

That is a brutal shitcanning.

But today it rose 8%, because, hey, it couldn’t possibly be all that bad… could it?

Here’s Norwegian Cruise Lines (NCLH.U), which has canceled trips and, frankly, doesn’t appear like it’ll be an attractive holiday option for a long time. Today it rose 15% because, come on, look how far it’s dropped, it couldn’t possibly go further… could it?

Bank of America (BOA.NYSE): Up 17.8% today because, hey, we’re only telling every small business in North America to shut down for a month, that couldn’t possibly cause problems for those living on credit, could it?

During every one of the financial crises I mentioned up top of this story, a phase was entered into where all the signs pointed to an absolute shitcanning of everything, but true believers pumped their money into the system, believing it couldn’t possibly get worse.

And it ALWAYS did.

In every crisis, the ones who didn’t get destroyed were the ones that got out early and watched the bombs drop behind them.

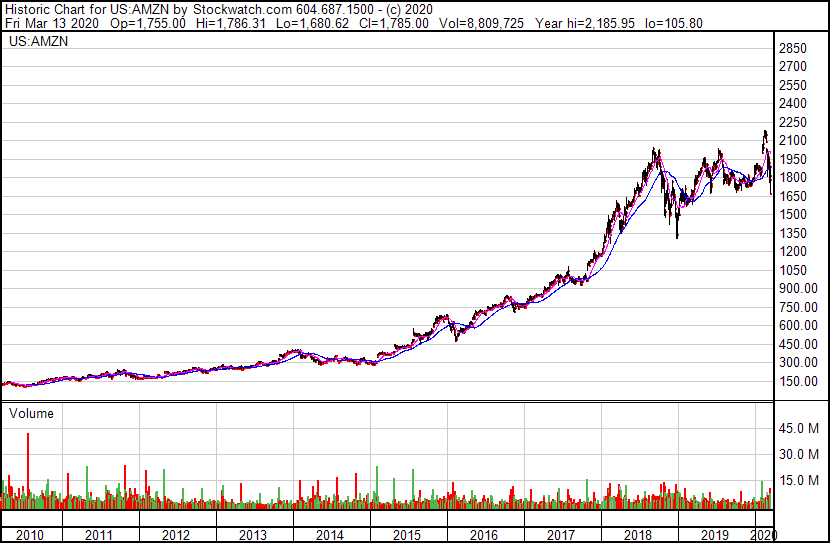

Sure, Amazon came back from the dead to dominate the world, but it didn’t do that in seven days. Realistically, it took another 15 years for AMZN to really start producing wealth for investors.

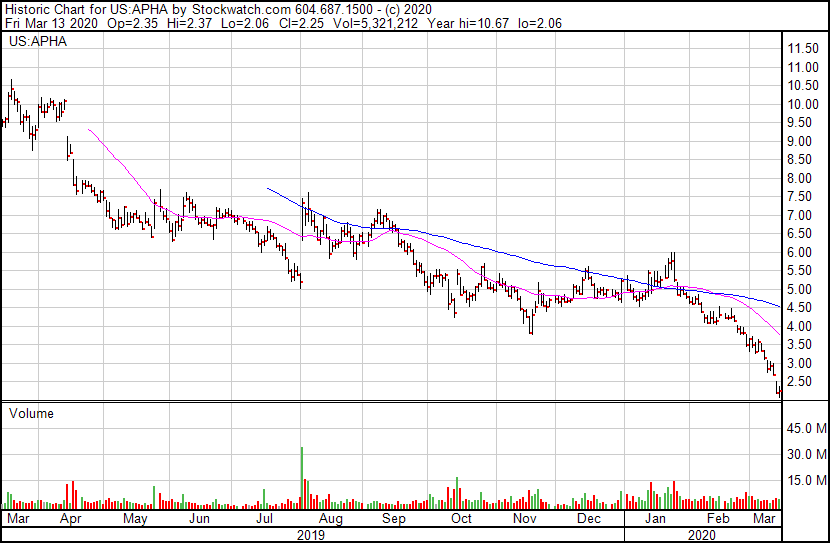

Yes, there’s value targets in the weed space but they’ll still be value targets tomorrow, and the next day, and next week.

Aphria (APHA.T) has a load of cash in pocket and does okay sales and will be around for long enough to perhaps buy some competitors up cheap. But it won’t do any of that tomorrow, or next week. You’ll be able to wait to see it actually rising for some time before you’re going to miss any trains.

Sure, real estate came back hard after the financial crisis, but only for those who had cash on hand to take advantage of the market when it was clear it was rebuilding and not bouncing off the bottom.

In all of these situations, the winners weren’t the ones who stayed in, watched their assets devalue to close to zero, and then waited for the recovery. The winners were the ripchord-pullers, the ones who bailed out of the Mustang the moment it left the road, the ones who heard the missile alert buzzer and ejected at 30,000 feet, rather than waiting to see if the chaff drop worked.

To put it another way, you can love the stock you’re selling and swear you’ll buy it back later, and not be a traitor to your people.

In the last month, We watched Nano One Materials (NNO.V) climb from $1.15 to $1.65 while taking down $11m in financing. I know the people behind the company and think they’re genuinely the best of people, good hearted, abundantly smart, honest as the day is long, and with a track record of continually delivering on their promises. NNO is a company with as much cash it should ever need, raised at a high, with fat largecap partners.

But at $1.60, I started selling the stock, a stock I’d held for the last two years.

Today, it’s at $0.94. Next week it might be lower.

I’m going to buy that stock back, but when I do, it’ll be so fucking cheap it’ll feel dirty to make the trade.

Else Nutrition (BABY.V) was another we’ve been watching and talking about, which has run from $0.35 to over $1.30 in a few weeks, but once it hit a buck, we started selling our shares. Today it’s $0.67. Next week I expect it to get cheaper still. When I buy back in, I’m looking for capitulation levels, and I’ll probably get them because BABY isn’t falling on inadequacies at the company, or expectation it’ll run out of dough (it too just raised $8m). It’s falling because folks want cash in their hand when they enter the rumble at Costco tomorrow morning.

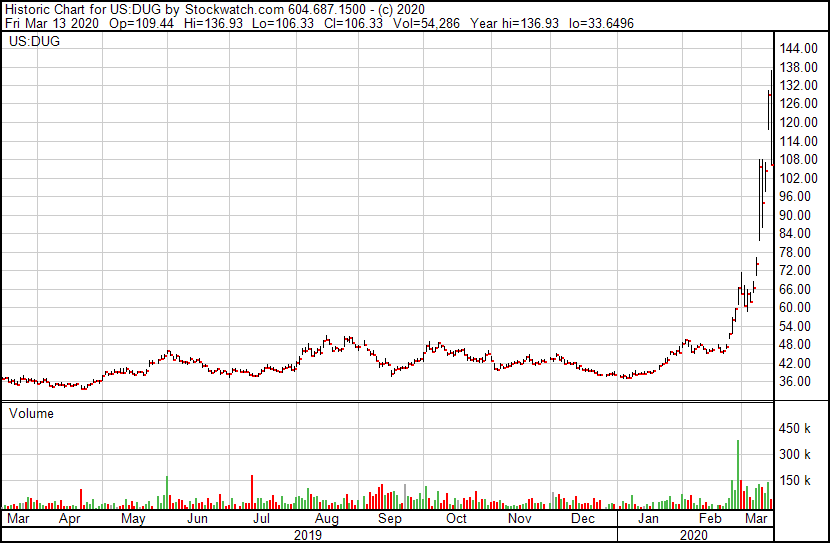

A negative bet might seem to you to be a smart bet. Like DUG, for example.

The Proshares Ultra-Short 2x Bear Oil and Gas ETF [seen above] is a gimme right now, and any negative bet against an airline would seem to me to be just smart play all over, since they’ll be essentially closed for the next six weeks and will take a few quarters for folks to go back to at best.

But that’s a trade. A gamble. On any given morning, the Saudis and Russians could agree to not fuck over the planet’s oil and gas industry, and that ETF will take a haircut. The airlines may get some sort of insane Trump bailout and shoot back up in a morning.

For mine, I don’t want to be stuck in anything. I want to be flush with cash, sitting in my shelter, watching the world burn.

This is your moment, people. Get out of all the damn things, be sitting in cash, and wait.

And when I say ‘all the damn things,’ I especially mean the things you love.

Example: I love GTEC Holdings (GTEC.C). I love the CEO. I love its insanely low market cap. I love their products. And I think, though they’re underfinanced and will be tightening their belt for some time, they’re a solid bet to survive and thrive, to go from the current crazy all time lows to a multiple going forward. They’ll outlast many.

But none of that matters now. Now, they’re going to drop, no matter what the CEO does, because the market dynamics are bigger than they are.

So today I sold a boatload of that stock. Not enough to yank the share price down, but enough to be in cash for a bit. Locked in a loss which will let me make a bunch of money tax-free later in the year, and for the foreseeable future I’m going to just wait and watch until the obvious time comes to buy all that stock back, and a TON more for besides

I’m not going to apologize to GTEC for that move, because I know the CEO would shrug his shoulders and say, well obviously. You don’t get medals for ‘hodling’ while everyone else is selling, and you don’t get bonus stock for being a really good guy. Protect your cash, and use it to be the bully at the table down the road.

I’m using GTEC as an example here but you could substitute just about any company you like, because while some companies will find a way to rise on a given day, or might stand strong for a day or two despite the tradewinds tearing everything else down, everything is going to ultimately be fucked next week.

Everything. The things you love, the things you hate, all of it.

Overreaction?

This is the streets of Italy right now: Empty, with the house-bound citizens singing as one to keep their spirits up.

People of my hometown #Siena sing a popular song from their houses along an empty street to warm their hearts during the Italian #Covid_19 #lockdown.#coronavirusitalia #COVID19 #coronavirus pic.twitter.com/7EKKMIdXov

— valemercurii (@valemercurii) March 12, 2020

It took China emptying entire cities and spraying them down with gigantic mobile Lysol cannons to get their situation just back to flat.

China now spraying disinfectant to contain the #CoronaVirus. (Aljazeera) #LifeSciences pic.twitter.com/9WPFwb8Sdv

— James V. Gingerich (@jamesvgingerich) March 13, 2020

We’re canceling all pro sports, concerts, movies, companies are going into hiatus and staff layoff mode. The government will be compelled to bailout every company and every person before we’re done. Supply chains are already hurting, many will stop altogether.

Here’s the department store situation, right now:

#TraderJoes in downtown Manhattan, on 6th Ave & Spring St. Ppl have lost their goddamn minds. I’ve never seen anything like this. #Covid_19 #CoronavirusPandemic #panicbuying #apocalypse2020 #NYC #masshysteria #GodHelpUs #coronavirus pic.twitter.com/PUwXQVuqyd

— Tiffany Chantel (@tiffchanteuse) March 13, 2020

You think the markets are coming back Monday? Jesus Christ, cut it out.

It doesn’t matter if your favourite stock is cheap, because you can’t pay rent this month with bonds or equities, with Bitcoin or warrants or gold. Usually, in a crisis, you can put your cash into gold, or crypto, or bonds, and it’ll be protected from doom. But not this time – all of those safehavens are falling, because folks aren’t moving their cash, they’re taking their cash out of the system.

Look, I get it – a lot of you are going to tell me I’m a bummer, a buzzkill, fun at funerals, whatever. I understand the need to tell yourself it’ll be okay, and to put your money where your mouth is.

But I’m also ALWAYS right on the big drops. I’ve picked the last three downward cannabis markets, once, infamously, within three days of the crash, I missed the blockchain drop because I thought I was too clever, and I’ve learned my lesson since to be the first guy out, and the 157th guy back in.

You might be looking at your portfolio and thinking, it’s already down too much, there’s no point taking losses now, and to that I’d say ‘bullshit.’

If the stock you’re sitting on has gone from $4.50 to $1.07 (what’s up, Aurora Cannabis), sitting on it while it tears down to $0.50 doesn’t make you a god damned champ, it makes you a knucklehead. Pull out now, watch it keep falling to $0.38, and get three times more stock later when we’re allowed to take in a Katy Perry concert again.

I’ve been watching Last Mile (MILE.V), a stock that picked its go-public day horribly poorly this past Monday, and took a 50% haircut down to $0.25 in doing so. It’s at $0.15 now,

I *genuinely* like this deal. They’re the third largest scooter rental company around, and the only one that is actually bothering to get permitted with the cities it does business in. While others are pumping out financing money into buying as many scooters as possible and just dumping them on the streets, leading citizens to throw them in lakes and roll over them in 4WDs in response to them cluttering up the sidewalks, Last Mile’s OJO chain is growing fast, and in a controlled, responsible, and municipally welcomed fashion. It’s a half billion dollar company in the making, in a $9 million market cap package.

But I’m not buying it today, or Monday. I’m watching and waiting, and if it goes to $0.10 shortly or $0.08 thereafter, I’m going to feast on that shit like Monty Burns.

I’ve been on the phone to a lot of brokers the last few days and every one has told me the same thing.

“When this ends, there’s so much money sitting in cash right now, it’s going to be ferocious when the buying starts back up.”

That wasn’t the line last time we had a financial crisis.

People are starting to get it. This time, don’t be the guy trying to catch the bottom. Be cashed up and revving your engine. Be the guy buying condos in 2009, or the guy buying AMZN in 2004. Be the guy your broker calls with ideas, not the guy who wishes he had some play money when the markets rebuild.

In other words, be the guy who dances as the market crashes.

— Chris Parry

FULL DISCLOSURE: Last Mile is a client. GTEC and Nano One used to be.

Leave a Reply