Hemptown USA is currently a private company. With the DJIA falling 8,000 points in the last six weeks, that’s not a bad place to be. We expect Hemptown to go public in the near future.

On March 18, 2020 the new CEO Eric Gripentrog gave a Live Webcast, updating seed investors and potential future shareholders on the progress of the company.

Hemptown has been moving fast. In two years, the company grew from a 50-acre cultivation operation in Oregon to a massive operation in three states, extracting CBG and CBD from industrial hemp.

Mr. Gripentrog has worked in the Consumer-Packaged Goods industry for 27 years, most of that time with the Kellogg Company.

His appointment syncs up with Hemptown’s goal of developing and monetizing downstream hemp-based products.

Webcast excerpts:

On his biography:

Gripentrog: I lived in Europe for 4 years led the ‘food away from home business unit’ and also led European sales. I led a turn around operation for Kellogg Caribbean before we consolidated that business, then moved back into the US for Kellogg’s to lead a very large direct to door delivery operation. I consider myself a strong generalist, understanding all aspects of the business.

On agriculture:

Gripentrog: Hemptown USA is primarily focused on CBG. We deem ourselves the largest supplier of CBG in the U.S. and potentially the world. We’ve got over ten years of farming experience. We’ve acquired a facility that is FDA licenced and CGMP certified with pharmaceutical grade manufacturing capabilities.

On the team:

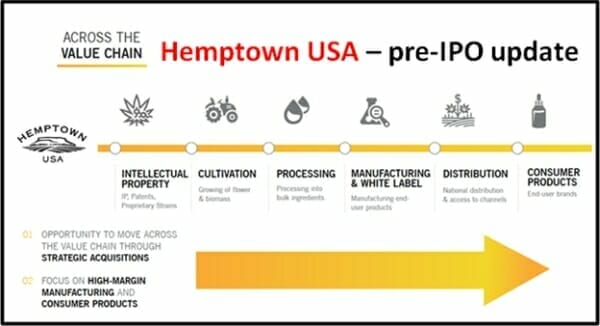

Gripentrog: We’ve got experience in the capital markets, in cultivation, in consumer packed goods and we also have experience in sale and distribution. The plan is to leverage this team and also to build and strengthen the team moving forward as our business morphs from a farming operation into more of a fully integrated vertical value chain operation.

On the juicy part of the value chain:

Gripentrog: We are currently primarily focused on wholesale, selling bulk products. Quickly, we will be pivoting to the $16 billion dollar industry which breaks out between nutraceuticals, beauty aids, food and beverages. We’re joining this race at the right moment with CBG and with our manufacturing facility in Portland, Oregon. I believe we can capture market share at a premium price point. Producing for our own finished goods, allows us to control our own destiny and also farming novel cannabinoids will allow us to manage against the price compression that’s happened to CBD.

The opportunity:

Gripentrog: A lot of the business that I ran were relatively smaller nature – somewhere between $100-$300 million in revenue, which allowed me to innovate and get creative in finding solutions. A start-up situation excites me more than jumping into a big company where there is a lot of bureaucracy.

On biomass:

Gripentrog: We produced a lot of product. A lot of CBD and a lot off CBG so there is a significant amount of biomass that we currently have in Colorado and Kentucky. Monetizing that is one of the catalyst were looking at to meet the 45 million dollar revenue target.

On capital requirements:

Gripentrog: We would probably need to raise more funds to complete an acquisition. We’re looking at any and all options. I think we are looking at a merger or an acquisition or bringing two companies together to complete the value chain. All ideas are on the table to get to ownership of the value chain in general.

On revenues:

Gripentrog: The majority of our revenue in 2020 will come from bulk products. In 2021, will be shifting more into consumer-packaged products. We are in the infancy stage of development in product development for packed goods. I think we can accelerate that rapidly because we have existing formulas in products up at Kirkman. By adding CBG or CBD into that we can launch that under our Hemptown brand. One goal is to have a diet pill as soon as we can. For 2020, the focus is to make sure we deliver upon the expected revenue of 45 million dollars.

According to a well-researched article by Jacqueline Havelka on Leafly.com, “CBG is a powerful vasodilator that has neuroprotective effects” while also showing “great promise as a cancer fighter.”

Havelka is literally a “a rocket scientist turned writer”.

“CBG has been found to act on very specific physiological systems and problems, and results for medicinal use are promising,” writes Havelka, “CBG is thought to be particularly effective in treating glaucoma because it reduces intraocular pressure.”

Hemptown’s product lineup includes the Hemptown CBG Tincture, the Hemptown Salve Balm, and an assortment of capsules designed for a variety of uses.

The company is capable of producing white label products for third parties and fulfilling bulk orders for CBG and CBD crude oil, distillates, isolates and water-soluble solutions.

Today, the DJIA surged 9% as the market anticipated a $2 trillion injection of borrowed money. Gold explorers are on the move, although for the last two weeks gold bugs have watched helplessly as the metal sold off in what has been limply described as a “liquidity event”.

It’s not a bad time to be a pre-IPO hemp company, harvesting biomass, and executing a plan to monetise it.

Full Disclosure: Hemptown USA is an Equity Guru marketing client, Equity Guru principal Chris Parry has participated in several early financing rounds.

Leave a Reply