Defense Metals (DEFN.V) stoked its treasury to the tune of nearly $600k yesterday (April 29), the proceeds of which “will be used for exploration on the Company’s Wicheeda rare earth element (REE) project located in Prince George, British Columbia...”

The company also intends to close an additional non-brokered private placement of up to 1,000,000 units at a price of $0.11 for gross proceeds of up to $110,000.

Though the news isn’t exactly a high-octane event, two things stand out here:

1) The funds are earmarked for exploration (the market likes to see drill rigs mobilized).

2) The PP was modest in size. The company raised just what it needs to push its Wicheeda REE project further along the curve without blowing its share structure all to hell. This is an important consideration for current and future shareholders. Management won’t be raising fat stacks—not at these levels.

What’s the story here? What’s all the fuss about?

REEs

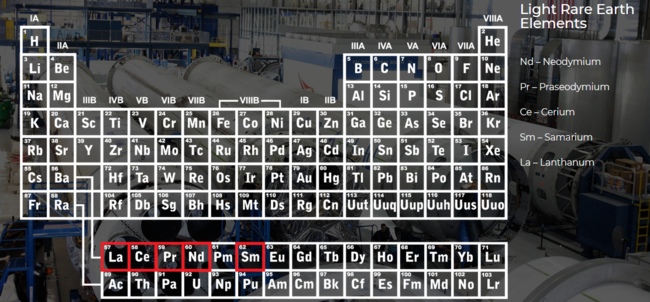

REEs occupy atomic numbers 57 thru 71 on the periodic table (the highlighted numbers are what we’re dealing with).

The role REEs play in this modern age sweep far and wide. In scientific circles they’re known as “the vitamins of chemistry”.

Though dispensed in small quantities, they are an essential ingredient in the production of everything from medical imagining technology, to rechargeable batteries of every conceivable kind, to next-generation (thrust-happy) motors.

For those aligned with the green movement, several pounds of REEs go into every single EV and hybrid car that rolls off the factory floor.

According to Equity Guru’s Chris Parry:

You probably have some in your pocket right now, keeping your Candy Crush scores updated.

The Deposit

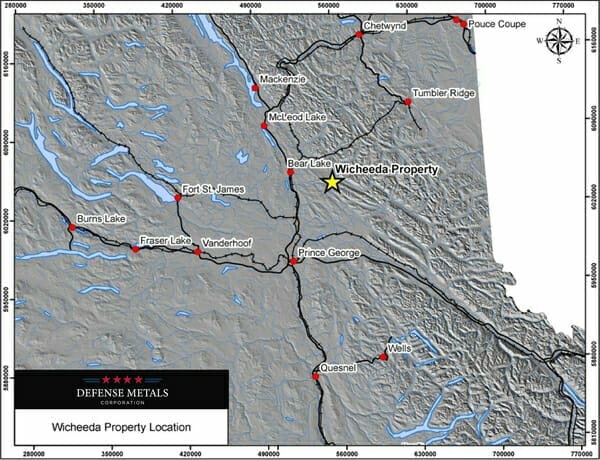

The wholly-owned 1,708-hectare Wicheeda Rare Earth Element (REE) Project is located in the Prince George region of mining-friendly B.C.

The project’s location has distinct advantages.

- Strategically positioned along a major forestry service road that’s connected to a paved highway;

- Hydroelectric power line, a gas pipeline, and rail are a stone’s throw;

- A trained workforce is within hailing distance;

- The nearby city of Prince George is a strategic mining centre.

The resource at Wicheeda currently stands at 11,370,000 tonnes averaging 1.96% LREOs. That’s just for starters. A resource update could drop any day.

To assign a rough value to these pounds-in-the-ground, Wicheeda compares well to a 5.0 g/t gold deposit (a grade of 1% LREEs is equal to approx 2.5 g/t gold).

The resource expansion and exploration upside

Results from the company’s 2019 Wicheeda drilling campaign were nothing short of outstanding. Not a single dud in the lot—all 13 holes tagged significant intervals of high-grade LREEs, including these two step-outs:

- 4.43% LREOs over 83 meters (inc 5.47% LREO over 33 meters)

- 3.63% LREO over 75 meters (inc 4.01% LREO over 58 meters)

Remember, a grade of 1% LREEs is equal to roughly 2.5 g/t gold. With that in mind, examine the following values encountered from recent drilling (nice map fellas).

The metallurgy

Ask any mining man (or woman) and they’ll tell you that metallurgy—the science of extracting valuable metals from their ores and modifying said metals for their intended use—trumps all other considerations.

If you can’t separate the REES from the surrounding rock without creating an environmental wasteland, fugget about it.

Geologists will tell you that REE deposits aren’t exactly rare, but finding one in the right (geological) setting, with the right metallurgy, is indeed a rare thing.

It is in this regard that Wicheeda stands out.

Comprehensive metallurgical test results exceeded the company’s expectations elevating the Wicheeda to among the very best REE deposits on the planet.

In the early going, the company was shooting for the moon, targeting a total rare earth oxide (TREO) metallurgical recovery rate of 80%, and a TREO high-grade concentrate of 40%.

What they achieved blew away those lofty expectations:

- a TREO metallurgical recovery rate of 85.7%;

- a TREO high-grade concentrate of 48.7% TREO (cerium, lanthanum neodymium, and praseodymium oxides (Ce2O3+La2O3+Nd2O3+ Pr2O3))

Whicheeda’s strategic importance/value

In response to supply concerns over China’s overwhelming domination of the REE market, Canada and the U.S. are moving to secure supply chains in their own back yards.

This is a matter of (tech) survival for the two nations.

Earlier this year, the gov’t of Canada dropped the following headline:

Canada and U.S. Finalize Joint Action Plan on Critical Minerals Collaboration

“The Action Plan will guide cooperation in areas such as industry engagement; efforts to secure critical minerals supply chains for strategic industries and defence; improving information sharing on mineral resources and potential; and cooperation in multilateral fora and with other countries. This Action Plan will promote joint initiatives, including research and development cooperation, supply chain modelling and increased support for industry.”

2020 catalysts

I took the following to-do list from the company’s i-deck, slide 21…

✓ Completion of detailed Hydrometallurgical Test Work.

✓ Initiation of Flotation Pilot Plant Processing of 30 tonne bulk-sample to establish viability of bench test results during large-scale continuous operation.

❑ Update Wicheeda REE Project Mineral Resource Estimate.

❑ Diamond Drilling to further define a new mineralized extension along the North Zone at Wicheeda.

❑ Baseline Environmental Study scoping and commencement. Initiate Economic Scoping Studies.

❑ DEFN is currently being reviewed by US Department of Defense to become a preferred vendor under the Defense Production Act title III program

❑ Enter into discussions and MOUs with potential future purchasers for offtake agreements

The resource estimate, which will factor in all 13 holes from the successful 2019 drilling campaign highlighted further up the page, is on deck.

In-the-hole (an apt baseball expression) is a diamond drilling campaign designed to follow-up on significant mineralization encountered to the north (and at depth) of the current resource.

Initiating baseline environmental studies concurrently with a first pass economic study is how it’s done—this is efficiency at work.

I bolded the US Department of Defense in the above checklist for good reason. This REE resource is more important (and strategic) than one might think.

Entering into MOUs (memorandums of understanding) and potential offtake agreements will telegraph to the world that it’s game on.

We’ve covered developments in this part of the resource arena closely. The following link gives you access to all of our insights over the past year-plus:

Final thought

Though the market hasn’t quite caught on, this company is the real deal. I’m biased though. We own shares.

END

—Greg Nolan

Full disclosure: Defense Metals is an Equity Guru marketing client.

Leave a Reply