Even though virus-related shutdowns have hindered the pace of mineral exploration in recent weeks—some regions more than others—progress is still being made on multiple fronts. Creating shareholder value is the primary objective of the companies we follow here at Highballerstocks… virus be damned.

Three of the companies on our shortlist dropped headlines last week. Two others ramped up promotion in order to get their story told to a wider audience.

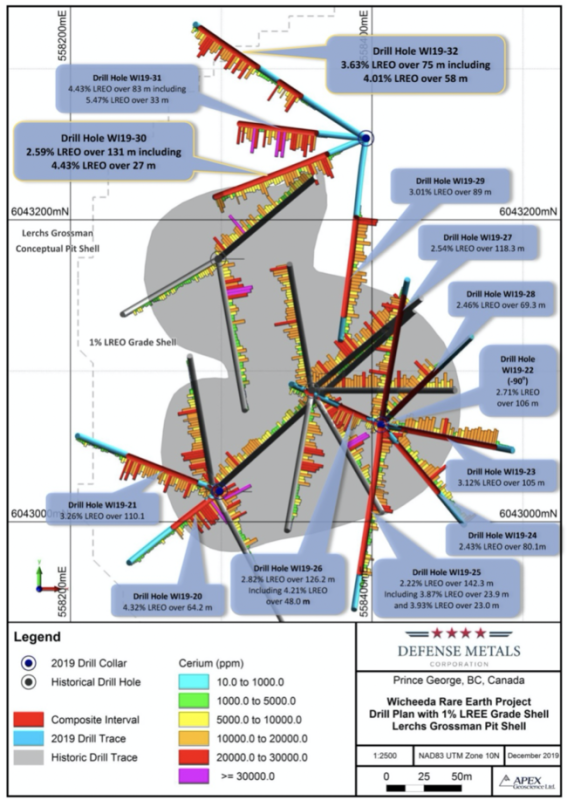

Defense Metals (DEFN.V)

Defense is a stock I singled out early in the going, elevating the company to my top three picks for 2020.

The company’s wholly-owned Wicheeda REE Project located in the mining friendly Prince George region of B.C. is poised for rapid development due to the strategic nature of the deposit.

On April 29, the company closed a PP for nearly $600k, the proceeds of which “will be used for exploration on the Company’s Wicheeda rare earth element (REE) project located in Prince George, British Columbia...”

The company also intends to close an additional non-brokered PP of up to 1,000,000 units at a price of $0.11 for gross proceeds of up to $110,000.

Defense tabled a modest raise this go round, reluctant to blow out its share structure at current prices. But don’t let the size of the raise fool you—the company has serious plans for 2020.

2020 catalysts

- An updated resource estimate which will factor in all 13 holes from the successful 2019 drilling campaign is on deck.

- A diamond drilling campaign designed to follow-up on significant mineralization encountered to the north (and at depth) of the current resource.

- The initiation of baseline environmental studies concurrent with a first pass economic study (this is efficiency at work).

- DEFN is currently being reviewed by US Department of Defense to become a preferred vendor under the Defense Production Act title III program. This REE resource is more important (and strategic) than most people think.

- Entering into discussions re MOUs (memorandums of understanding) and potential offtake agreements.

If you haven’t taken a close look at this REE developer/explorer, now might be a good time.

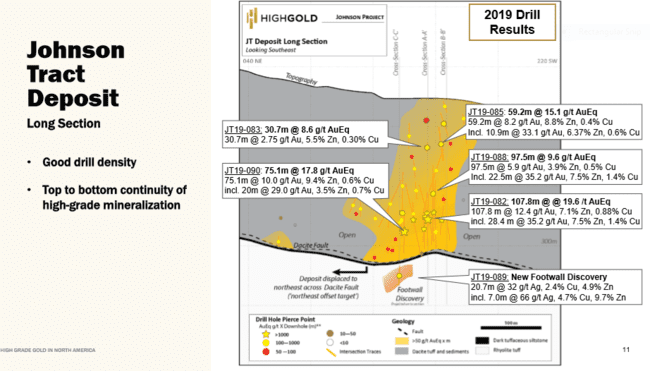

HighGold Mining (HIGH.V)

HighGold, a high-grade development play with assets in Alaska and the Timmins camp of Ontario, dropped the following headline the other day:

The company’s Johnson Tract (JT) Deposit is one of the more compelling exploration plays I’ve come across in the junior arena. JT has Tier One potential (a deposit with a mine life in excess of 10 years with at least 500,000 AuEq ounces of annual production).

The high-grade resource demonstrated below may be only the tip of the proverbial iceberg. The exploration upside in this under-explored corner of Alaska has to be considered excellent.

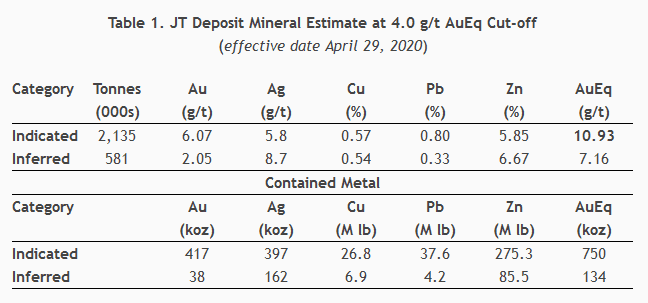

JT Deposit Mineral Resource Highlights:

- Indicated Resource of 2.14 million tonnes (“Mt”) grading 10.93 grams per tonne (“g/t”) gold equivalent (“AuEq”) for 750,000 ounces AuEq;

- Additional Inferred Resource of 0.58 Mt grading 7.16 g/t AuEq for 134,000 ounces AuEq;

- The deposit includes a high-grade core of 1.25 Mt Indicated grading 14.54 g/t AuEq for 583,000 ounces AuEq at an 8 g/t AuEq cutoff;

- 79% of total resource tonnage in the Indicated category, including 85% of the total AuEq ounces;

- Steeply dipping deposit with typical horizontal thickness of 25 to 50 meters, strike length of 300 meters and excellent continuity of grade from surface to a depth of 275 meters;

- Resource open to expansion and multiple high-priority targets located nearby, including the prime Northeast Offset target that is believed to be the fault-displaced continuation of the JT Deposit (editors note: this offset target really gets the speculative juices flowing);

- High metal recoveries and concentrates low in deleterious elements are predicted based on past metallurgical test work, including forecasted total gold recovery of up to 96%.

I’ll dispense with the usual cautions and notes regarding these resource numbers—they can be perused in the guts of the press release.

If you have any concerns re the friendliness of Alaska as a mining jurisdiction, recent comments by Governor Mike Dunleavy should allay any uncertainties you might harbor:

The source: North of 60 Mining News – Alaska’s economy tipping toward mining

One of several Mike Dunleavy quotes from the above article…

“We want the jobs you guys create; we want the wealth that you help create; the governments want revenue that you help create; businesses that support the mining industry want you there.”

CEO Darwin Green on this maiden resource and an upcoming, highly anticipated Johnson Tract drilling campaign:

“We are extremely pleased with the resource estimate which positions the JT Deposit among the highest-grade undeveloped gold projects in North America. In addition to attractive grades and favourable metallurgy, the JT Deposit has several attributes that are attractive for underground development, including excellent width, strong continuity, subvertical geometry, and geotechnically competent mineralization. We view this resource as our starting point and, after laying dormant for 25 years with no exploration until HighGold’s recent 2019 drill program, it provides an excellent springboard for what lies ahead for the Project. The Company’s focus will now turn to further drilling, with the intent of expanding the Johnson Tract Deposit and testing multiple well-developed peripheral targets. With C$11 million in working capital, the Company is fully-funded to carry out its 2020 exploration plans.”

For a deeper delve into this project-rich, well-run junior ExplorerCo, my maiden article from late January 2020 should help satisfy some of your questions:

Skeena Resources (SKE.V)

For those who missed the webinar last week, it’s important to give it a listen, especially if you’re looking to shortlist new investment candidates in the junior arena.

Here’s a link to the webinar replay (the registration process is super simple)

A few (webinar) takeaways…

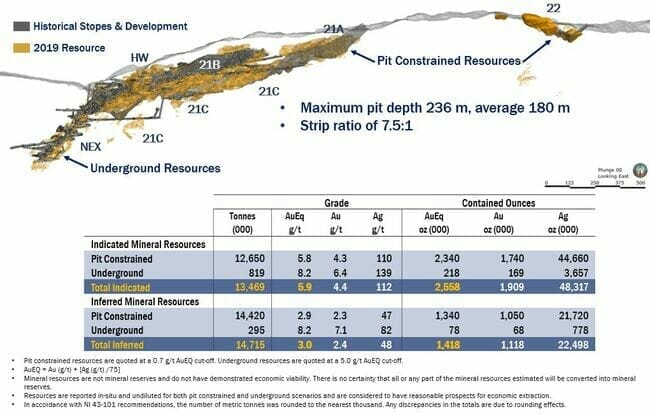

Eskay Creek is a VMS type deposit, and Kelly Earle takes us on a virtual tour of the two styles of mineralization present at Eskay Creek—the mudstone horizon and the rhyolite horizon. Kelly offers some interesting details regarding the geology i.e. 70% of the deposit is in clean rhyolite (no deleterious elements such as mercury, arsenic, antimony) and 30% is in mudstone (deleterious elements occur only in ‘hot spot’ patches).

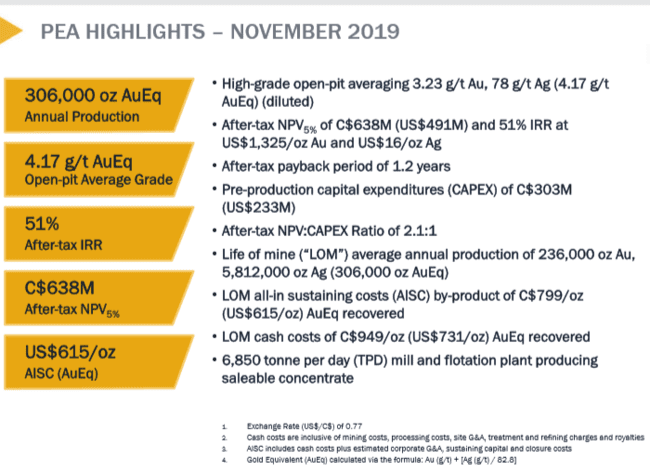

The PEA delivered last November was nothing short of outstanding. Note the after tax NPV and IRR…

The inputs the company used to generate this robust economic study were conservative—$1,325 gold for example.

If we plug in current precious metal spot prices ($1,712 gold – $15 silver), the after tax NPV (5%) rises to just north of $1B and the IRR jumps to 70%.

Clearly, Eskay Creek offers outstanding leverage in a rising gold price environment (which we’re currently in).

The drilling taking place now is infill—the goal is to convert Inferred material into the higher confidence Indicated category.

But the exploration upside at Eskay Creek adds a weighty speculative component to this play. There are several untested zones, particularly at depth, where a recent drill hole tagged a new mudstone horizon outside the current resource: 314.07 AuEq over 2.21 meters. This spectacular hit will be followed up on in due course, once the infill drilling campaign is complete (resource conversion first).

All told, due to the excellent continuity of the mineralization, the company envisions a resource of 5 million ounces at a grade of 5.0 g/t AuEq. An increase in grade—from 4.4 to 5.0 g/t AuEq—would have a dramatic impact on the project’s already robust economics.

More recently, on May 1, the company dropped the following headline:

Speaking of money, the company is in a very strong position with roughly $45M in its coffers.

ATM (at the money) warrants expiring in June could add a further $5M to the company’s treasury should the shares trade north of $1.00 over the next two months.

Skeena, and its shareholders, are in an enviable position.

BNN clips

There are two companies on our shortlist that didn’t exactly produce news this past week, but ramped up their efforts to get their story out to a wider audience. Both Banyan and Cartier are being featured on BNN Bloomberg throughout the day and evenings on May 2nd & 3rd.

Banyan Gold (BYN.V)

Our maiden article on the company—Banyan Gold (BYN.V) – resource expansion and discovery potential in the Yukon—highlighted the following company fundamentals:

Banyan is exploring two projects in the Yukon—the Hyland Gold Project and the Aurex-McQuesten Property.

The 18,620 hectare Hyland project is located in the Watson Lake Mining District of the southeast Yukon.

Hyland’s ‘Main Zone’ backstops Bayan’s modest valuation ($7.85M based on recent trading patterns) with an Indicated resource of 236,000 AuEq ounces at a grade of 0.85 g/t, plus an Inferred resource of 288,000 AuEq ounces at a similar grade.

The BNN clip airing this weekend…

Cartier Resources (ECR.V)

Cartier is another company I elevated to top-shelf status in my maiden Highballer article, Highballer’s Top Three Picks for 2020.

The company is developing its Chimo Mine Project where the resource currently stands at:

- 3,263,300 tonnes at an average grade of 4.40 g/t Au for a total of 461,280 ounces of Au in the Indicated category;

- 3,681,600 tonnes at an average grade of 3.53 g/t Au for a total of 417,250 ounces of Au in the Inferred category.

This resource is a moving target as an ongoing, multiple rig, 10,000-meter drilling campaign is testing for mineralized extensions at depth (deposits in this region are known for their depth potential).

On deck is a resource estimate for Chimo’s North and South Gold Corridor’s.

Cartier also boasts a robust project pipeline, one that could create significant shareholder value as the company moves on down the line.

The BNN clip airing this weekend…

Final thought

Gold has managed to pull itself back up above the $1,700 level in recent sessions.

Poor economic data and geopolitical tension between the U.S. and China—Trump threatened new tariffs against China over the coronavirus crisis—could exert significant upward pressure on the metal in the coming days/weeks.

Technically, if you’re into candles, a bottom my be forming in the pullback that began just over one week ago…

Potential short-term bottom identified by a two-day candlestick pattern

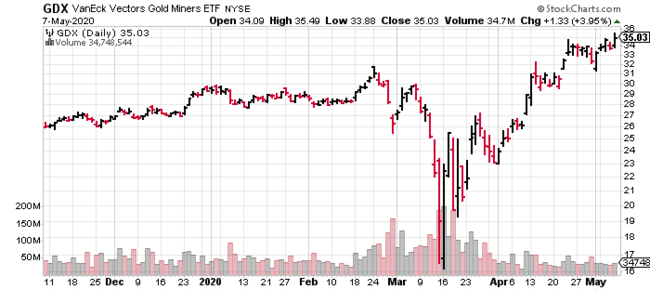

As for the Senior shares, the GDX has broken out to multi-year highs and is currently consolidating those gains:

END

—Greg Nolan

Note: this article is a May 3rd re-post from Greg Nolan’s Highballerstocks.com.

Full disclosure: Defense Metals is an Equity Guru marketing client. We own shares.

Leave a Reply