Western Australia—as a mining destination, there is no friendlier jurisdiction on the planet. According to the esteemed Fraser Institute, in its most recent “investment attractiveness” survey, Western Australia claims top spot when it comes to kicking rocks and digging ore outta the ground.

This is a huge advantage for companies working geologically prospective projects in the region.

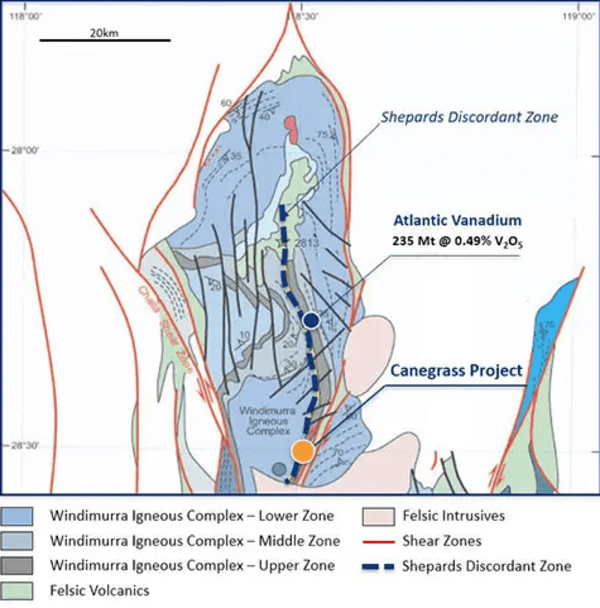

On the subject of prospectivity, Bluebird Battery Metals’ (BATT.V) flagship Canegrass Project—a 4,200 hectare chunk of terra firma—lies within a highly prospective geological setting, surrounded by world-class deposits.

The Windimurra Complex is Australia’s largest, exposed, layered mafic intrusion complex measuring some 85 kilometers x 37 kilometers by some 11 kilometers thick.

This Archean-aged complex is geologically similar to the Bushveld Igneous Complex in South Africa, the source of much our planet’s nickel, copper, cobalt, and platinum group elements.

On some of the online resource forums I visit—Tommy Humphreys ceo.ca is a standout—people get tired of hearing the expression ‘Elephant Country’ where mining jurisdictions are concerned. But Windimurra deserves the designation (revisit the map above)…

Within the Windimurra Complex, the prospective Shepards Discordant Zone—a 600 meter thick sequence of magnetite-rich leucogabbro—can be traced for more than 50 kilometers and trends directly on through Bluebird’s Canegrass ground.

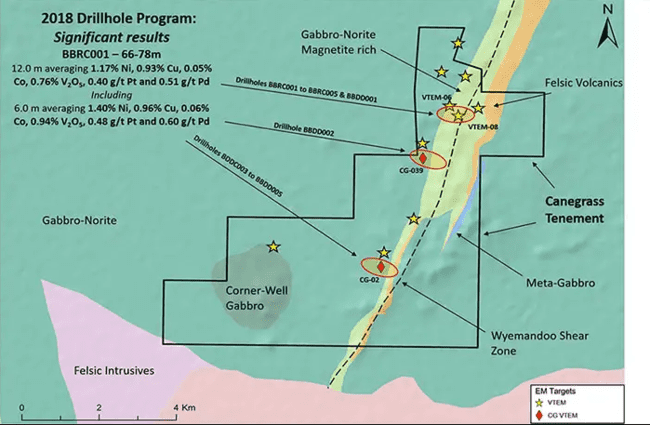

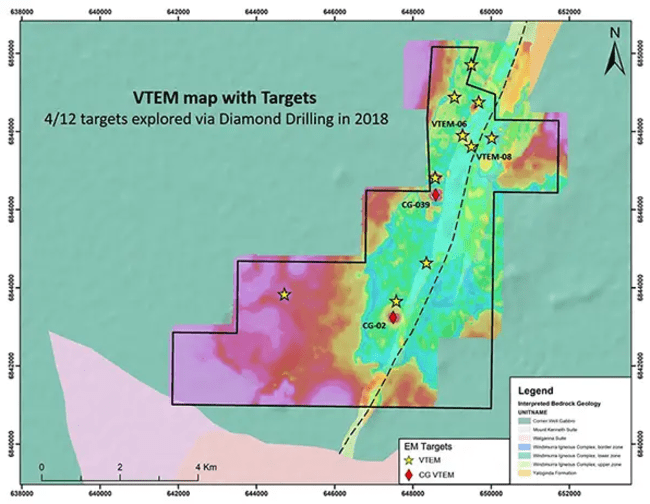

Zooming in on Canegrass exposes 8.5 kilometers of magnetite rich-gabbro-norite trending parallel to a shear zone.

Geologically, this is a fertile setting for subsurface mineral wealth.

Note the yellow stars and red diamonds distributed along this 8.5 km trend. These symbols represent no less than twelve geophysical anomalies, several of which correlate well with significant drill intercepts from a 2018 drilling campaign (details re this 2018 program further down the page).

Also, note the yellow star and the grey circular anomaly in the southwest corner on the above map—the Corner-Well Gabbro. Note the map’s scale. The company is excited about the potential of this large zone. It should see multiple probes with the drill bit during the upcoming field season.

Downhole EM surveys indicate strong to moderate off-hole anomalies that remain untested.

Downhole EM surveys… the company is relying on good, disciplined science to generate and prioritize drill targets.

Further bolstering the geological prospectivity of Canegrass, a 2007 surface sampling campaign along four kilometers of strike produced over 325 grab samples yielding Vanadium grades averaging 1.21%.

A drilling campaign back in 2014 tagged anomalous nickel, cobalt, and copper mineralization at two targets on the property in nine out of the ten holes drilled.

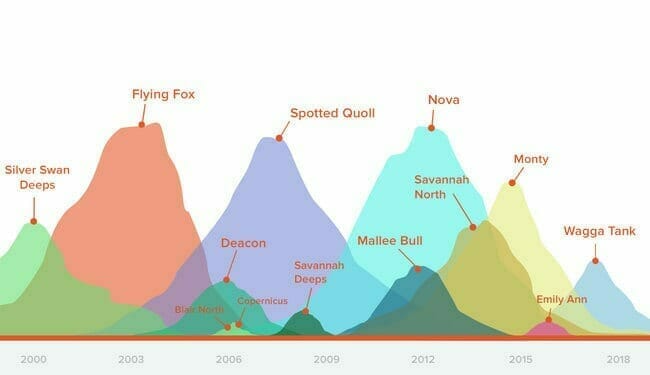

Western Australia is a hot zone for sulphide nickel

Nickel sulphide deposits are very amenable to producing battery-grade nickel. That’s what Bluebird is on to at Canegrass.

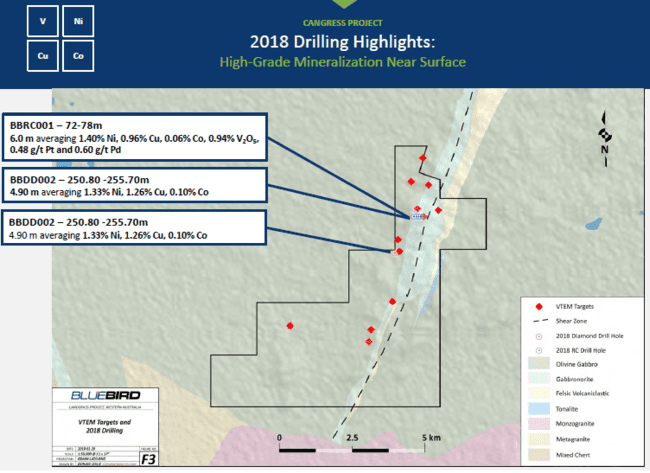

Western Australian nickel deposits often have two components: a disseminated zone (low-grade bulk tonnage material), and a higher grade component (a zonally confined structure).

Nickel deposits in this corner of the world also have tremendous (mother-lode) potential at depth—the intervals highlighted on the map below may represent only ‘fingers‘ of a much larger (richer) ‘hand‘ buried below.

A 2018 drill hole tested one of the geophysical targets tagging 6.0 meters of 1.40% Ni, 0.96% Cu, 0.06% Co, 0.94% V2O5, 0.48 g/t Pt and 0.60 g/t Pd. This intercept was contained within a broader interval of 12 meters averaging 1.17% Ni, .93% Cu, 0.4 g/t Pt, and 0.51 g/t Pd.

That’s a solid hit. But again, it may represent only a finger of a much larger structure at depth. The company plans to step-out from this hole this upcoming field season.

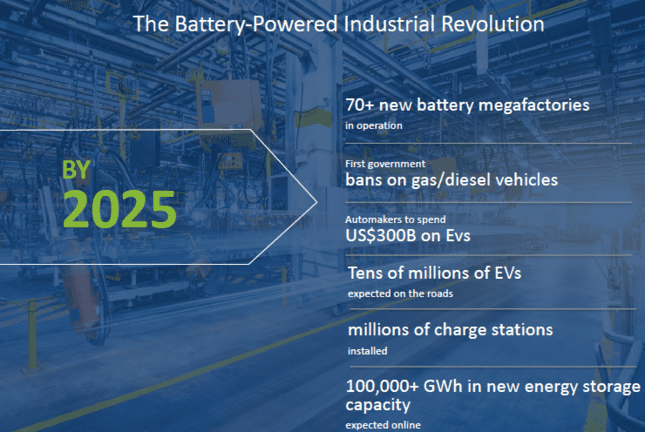

Note the battery metal values from the 2018 drilling program. Long time readers of our work know that we’ve explored the battery metals space through and through. But it’s an ever-evolving sector.

In an April 30 press release, the company offered up some fresh intel regarding the direction electric vehicle (EV) battery technology is now taking.

The new generation of EV batteries is all about range. It makes sense. If I were to embark on a long journey of desert highway in an EV, my biggest concern would be my battery’s travel range. The newer designs factor in a much higher component of nickel in order to achieve that range.

Bottom line: The world is going to need a lot more nickel.

From Bluebird’s April 30 news release:

- Robust Longterm EV Sales Outlook Due to Global Decarbonization. Driven by government and consumer need to decarbonize, along with falling battery prices, annual passenger EV sales expected to hit 10 million in 2025, up from 2.3 million in 2019;

- Battery Megafactory Boom Continues. 115 battery megafactories are in the pipleline worldwide, up from just 3 in 2015. Electric Vehicle (“EV”);

- Battery Design Changes Favour Nickel, Manganese and Cobalt. To overcome travel distance shortcomings in current electric vehicles, battery makers are moving away from lithium ion phosphate batteries and embracing newer designs based on NMC111 (equal parts nickel, cobalt, manganese) and NMC811 (80% nickel, 10% manganese, 10% cobalt);

- Western Australia Now World’s Top-Rated Mining Jurisdiction. Large proportion of battery metal supply from higher-risk jurisdictions, including estimated 33% of nickel supply from Indonesia and the Phillipines, and 65% of cobalt supply coming from the DRC. Battery manufacturers are demanding greater security of supply and Western Australia, a major nickel supplier, has now become the number one rated mining jurisdiction in the world.

Peter Dickie, Bluebird’s President and CEO:

“Thanks to the continued desire for global decarbonization towards a green economy, the long term prospects for the battery sector are robust. With 115 battery megafactories under construction, and manufacturers beginning to turn to battery chemistries focused on nickel, manganese and cobalt, we are particularly excited about the potential of our project portfolio in Western Australia. Following a detailed project review, we are in the planning stage for a series of work programs aimed at advancing our Canegrass project, which is host to the full suite of battery metals, including high-grade nickel.”

This April 30 release also updated shareholders re the company’s exploration plans for 2020….

Project Review Highlights

- Canegrass Project Hosts Multiple Battery Metals, Including High-Grade Nickel: Canegrass, located in the Windimurra Complex of Western Australia, has been identified as the company’s priority project going forward, with drilling in 2018 encountering near surface, high-grade nickel mineralization, as well as cobalt, copper, platinum and palladium;

- Clear Advancement Path for Canegrass: Additional, high-priority drill targets have been identified at Canegrass, together with follow up drilling to the successful 2018 drill holes. The project is road accessible and has no aboriginal title challenges;

- Drilling Planned for 2020: Following the successful drilling program in 2018, downhole geophysics, along with additional review of surface work, has produced several new and follow-up drill targets warranting further exploration. A drill program is planned for 2020, as soon as conditions permit (editors note: we could see a drill rig mobilized as early as late June);

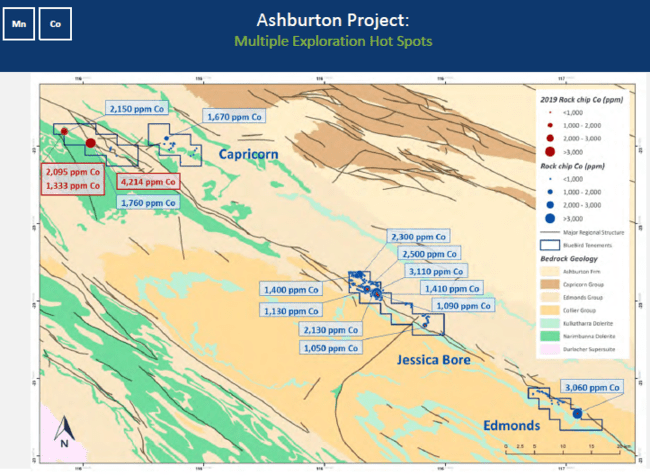

- Ashburton Project Hosts Significant Cobalt-Manganese Mineralization: Comprehensive sampling at Bluebird’s Ashburton project, located in the Pilbarra District of Western Australia, has encountered significant cobalt-manganese mineralization. The Company is reviewing fieldwork options to determine the next stage of advancement.

Regarding this next phase with the drill bit, CEO Dickie:

“The 2018 drill program at Canegrass produced exceptional results, including BBRC-001 which returned 12 m averaging 1.17% Ni, 0.93% Cu, 0.05% Co, together with significant PGE and Vanadium credits. On the back of this success, we are finalizing plans for an expanded drill program to be carried out as soon as conditions permit in 2020.”

The above Project Review Highlights also refer to the ‘Ashburton Project’. While the lions share of the company’s exploration dollars will flow into Canegrass, it’s good to see the other iron enter the fire.

The 189 square kilometer Ashburton Project is located in the Pilbara region of Western Australia. It covers the northwestern extent of the Edmund Basin where it lies unconformably on the Ashburton Basin.

The project is characterized by 30 kilometers of northwest to southeast strike along the Talga Fault Zone—a thick sequence of low-grade meta-sediments and meta-volcanic rocks.

Bluebird management

This Bluebird crew is top-shelf. There’s a lot depth here.

CEO Peter Dickie, a veteran in the resource arena, was at the helm of NioCorp Developments where he grew the market cap from < $5M to $200M-plus.

Neil McCallum (B.Sc, P.Geo), a Senior Geologist, has been involved with industry-leading Dahrouge Geological Consulting Group for the better part of 15 years.

Nathan Tribble (P.Geo), a Professional Geoscientist, spent over 13 years as Senior Principal Geologist for Sprott Mining, Senior Geologist for Bonterra Resources, Jerritt Canyon Gold, Kerr Mines, Northern Gold, Lake Shore Gold and Vale Inco.

This is what I look for in a crew: experienced, sharp… a track record of creating significant shareholder value.

Adding even greater depth to this team, NEWEXECO—one of the world’s leading, most awarded specialist consulting and contracting groups—will be guiding exploration at Canegrass.

NEWEXECO has a history of (Ni discovery) success…

… and they believe Bluebird could be onto something big at Canegrass.

Final thoughts

Bluebird currently has a very modest market cap of $5.21M based on its 52.06 million shares outstanding and recent $0.10 close.

80% of the company’s float is either insider or house controlled.

The mobilization of a drill rig to a series of high priority targets, in a region defined by multiple world-class orebodies, is a potent catalyst for a company like Bluebird.

END

—Greg Nolan

Full disclosure: Bluebird Battery Metals is not currently an Equity Guru marketing client.

Leave a Reply