For those of you who follow our resource coverage here at Guru Central, you’re well aware of which way we lean regarding precious metals.

There are times when we can’t say enough.

Rarely have the fundamentals underpinning gold (and silver) been so legion, so well-aligned.

The stair-stepping, grind-your-way-higher price action in the metal over the past 18 months is the product of a surfeit of forces—negative real rates, out of control money printing, debt levels that are difficult to comprehend… a global economy brought to its knees.

I think it’s safe to say that gold bugs—those of us who see through the barbaric relic argument—are standing a little taller, chin up, confident in our convictions (okay… waaaay confident).

Gold endures because it holds its value. It’s recognized around the globe as a medium of exchange, it’s divisible. It’s the only currency on this crazy planet that can’t be rammed through a printing press. It can’t be conjured out of thin air.

As our very own Lukas Kane is oft heard to say…

No act of Congress can magically make a tonne of gold appear on the lawn of the White House.

The fact is, no paper (fiat) currency ever created has survived its original form.

Of course, the real leverage to precious metals is in the stocks.

At the bottom of the food chain, you have the junior ExploreCos, hoping to drill that discovery hole. A little further up, you have the development companies intent on pushing their ounces-in-the-ground further along the curve. Then you have your Producers—they come in all shapes and sizes. At the very top of the food chain, you have your royalty and streaming companies.

The beauty of a precious metals royalty-streaming play: it can be a low-risk, high margin proposition—there’s no direct exposure to mining assets (no operating risk).

A handful of the largest companies in the space have put on quite a show since the crash day lows of March 16. Franco Nevada (FNV.TO), Wheaton Precious Metals (WPM.TO), Royal Gold (RGLD.NAZ), and Osisko Gold Royalties (OR.TO) immediately come to mind.

Speaking of Osisko, the trio that played a key role in the evolution of the royalty behemoth are doing it again.

May 27 news release: Nomad Royalty Company Ltd. Completes Vend-In Transactions and Reverse Take-Over

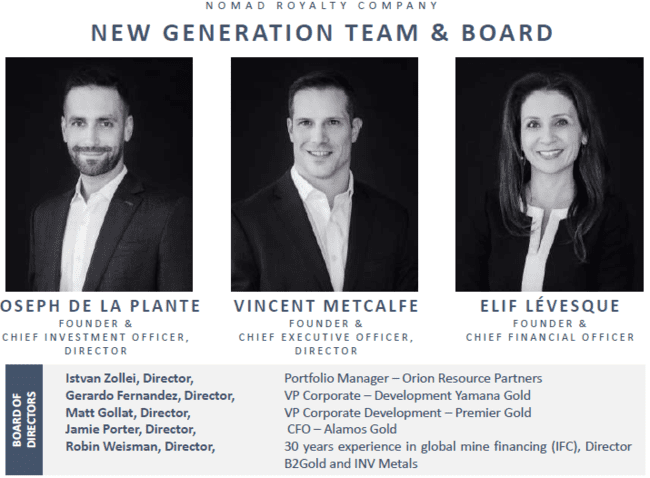

Vincent Metcalfe, Joseph de la Plante, and Elif Lévesque were at the helm of Osisko from day one. They’re now at the helm of Nomad Royalty Company (NSR.TO).

This team possesses the skill-sets required to build a successful royalty company and move it further along the growth curve—much further and quicker—than a team with less experience.

They’ve dealt with every conceivable type of royalty asset. They know value when they see it. They know how to spot the traps. They know how to structure deals. They know how to execute.

Vincent Metcalfe, Chairman and Chief Executive Officer of Nomad:

“The completion of the RTO has allowed us to launch Nomad Royalty Company Ltd., a new growth-oriented precious metal royalty and streaming company. The Nomad team now looks forward to executing on the Company’s business plan which aims to maximize shareholder returns by growing Nomad’s asset base, both organically and through accretive acquisitions of precious metal and other high-quality royalties, streams and similar interests“.

The launch

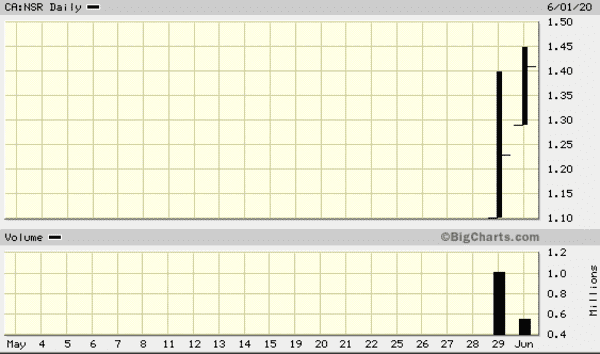

On May 29, NOMAD made its debut on the TSX and investors wasted no time loading up on this new entry into the royalty space, bidding up the company’s common shares, wanting to take advantage of these early innings of trade.

In our introduction to the company on May 5, we stated the following:

This deal was priced at C$0.90 per share, at 11.5x P/2021 Cash Flow or a 1.05x Net Asset Value. Peers in the royalty space are currently trading around 18.0x P/2021 Cash Flow or roughly 1.8x Net Asset Value.

Translation: there’s potential for a significant re-rating as these shares commence trading and the market homes in on this anomaly.

The first two tradings days

The first two tradings days

A re-rating appears to be in the works. The following chart represents NOMAD’s share price performance during its first two sessions of trade…

The origin

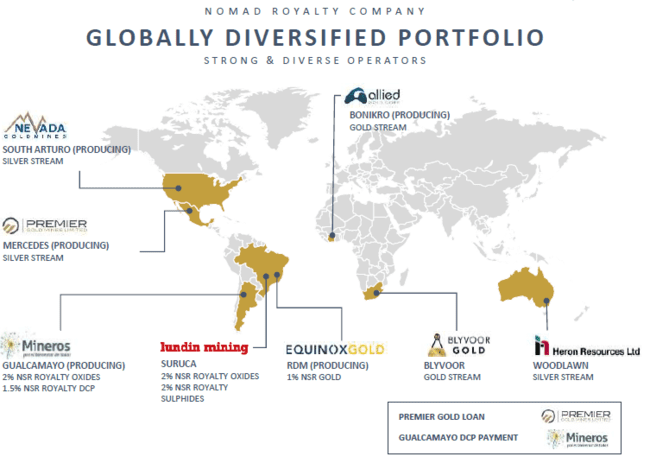

Nomad acquired two royalty and streaming portfolio’s, one from Yamana Gold (YRI.TO) for $65M, the other from Orion Resource Partners for $268M.

Orion owns 77.6% of Nomad’s outstanding common shares, Yamana owns 13%.

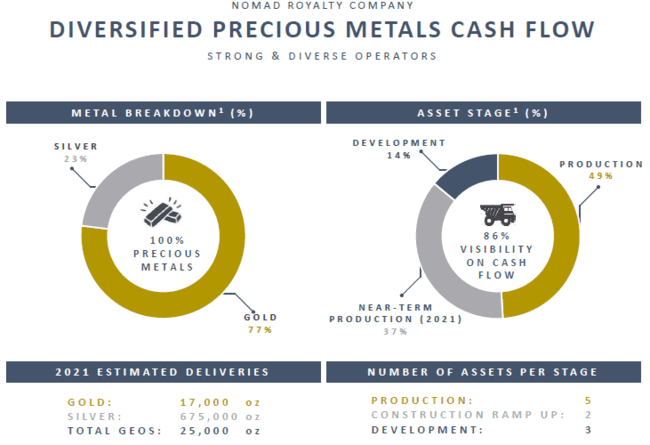

This isn’t a penny-ante, early-stage exploration royalty play. NOMAD boasts a highly diversified royalty and streaming portfolio with heaps of production in the mix.

Of NOMAD’s ten assets, five are currently cash flowing while two are in construction and ramp-up phase.

17,000 ounces of gold and 675,000 ounces of silver (25,000 AuEq ounces) are the estimated deliveries for 2021.

At a $1,500 gold price, 2021 operating cash margin will be in the C$40M range.

At current spot prices (~$1,700 gold), 2021 operating cash margin rises to roughly C$46M.

Shareholders seeking significant low-risk exposure to gold and silver can find it here.

During a recent call with CEO Metcalfe, we discussed two of NOMAD’s assets:

BONIKRO

Location: HIRÉ, Ivory coast

Operator: Allied Gold (89%) / Government (10%) / AFC (1%)

A streaming asset, subject to an ongoing payment of US$400.00 per ounce (gold is currently trading at $1,750 as I type)…

- 6.0% of production until 650k ounces of Au are produced

- 3.5% of production until 1.3M ounces of Au are produced

- 2.0% thereafter

This asset is in production, currently producing roughly 100k ounces per year.

Already boasting a significant resource, Allied Gold has had good recent success with the drill bit, enough to extend Bonikro’s mine life another 2.5 years.

That’s the beauty of holding a royalty on a mine surrounded by geologically prospective terrain. If the resource continues to grow, the royalty on the asset continues to pay.

Saruca

Location: Goias Brazil

Operator: Lundin Mining (100%)

Royalty: a 2% NSR

Suruca is the only development project in NOMAD’s portfolio.

This is a simple, low CapEx, open-pit heap leaching scenario.

Suruca is fully permitted, fully engineered, and only 5.5 kilometers from Lundin’s Chipata mine.

In this rising gold price environment, Suruca takes on much greater significance and could see production much sooner than NOMAD management originally thought.

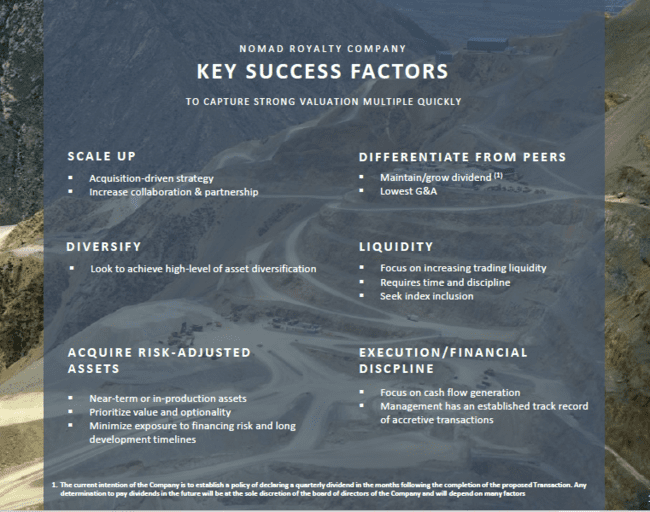

Acquisition strategy

NOMAD’s asset base provides the capacity to use leverage in future transactions.

The focus will be on producing (gold and silver) assets, or advanced stage assets that have been largely de-risked.

Over the years, this team developed numerous connections in the precious metals arena. According to CEO Metcalfe, they have a number of “actionable opportunities” in their crosshairs.

The goal is to maintain a balanced, diversified portfolio. This focus includes looking at jurisdictions outside the Fraser Institute’s top ten list.

Let’s face it, even the best-ranked jurisdiction is not immune to a government suddenly deciding to raise taxes on mining. With global economies having been brought to their knees in recent months, and gov’t receipts taking a massive hit EVERYWHERE around the globe, anything is possible.

The greater the diversification (from a jurisdictional and operational standpoint), the less volatility.

We should see the announcement of a credit facility in the not too distant future.

Future catalysts

Scaling up—getting new high-quality deals through the door as quickly as possible—is at the top of management’s list.

This team is aiming to channel 1/3rd of operating cash flow to shareholders via a dividend (a dividend policy is currently in the planning stage). We could see introductory yields between 2% and 3%, versus its peers at ~ 1%.

Getting a listing south of the border—increasing exposure and liquidity—is a priority.

Increasing market awareness and research coverage is also high on the list.

Of course, if gold and silver continue to claim higher ground, management could have a very accommodating tailwind.

Final thoughts

The royalty space is a world Metcalfe, Plante, and Lévesque know well. This team has vision. And they think like owners. They’re committed to low G&A. Compensation will be linked to share price performance.

Management negotiated these royalty and streaming portfolio’s in a low gold price environment ($1,475 Au).

Their timing couldn’t have been better.

END

—Greg Nolan

Full disclosure: NOMAD is an Equity Guru marketing client.

Leave a Reply