Apologies for my tardiness. I had planned to put this article up over a week ago. But things have been pretty damn busy here at Guru Central, a clear indication that the next bull wave in mining stocks is upon us.

Another indication that it’s game on in the junior arena: Nearly every private placement (PP) that crosses my screen goes into oversubscribed mode. Fast.

Those who understand the underlying dynamics—lean project pipelines, Peak Gold, Printing Presses Gone Wild—are piling into high-quality junior exploration companies in the expectation of a bull run of epic proportions.

At the risk of sounding like a broken record…

The fact that Senior Producers dramatically scaled back exploration spending during the lean years—the bear market years—means that project pipelines, the foundation of future reserves and resources, are not nearly as robust as they should be.

Every day a gold producer digs ore out of the ground—every day they’re open for business—they reduce their mineral inventory.

If a Producer wants to keep pumping out gold bars ten, twenty years from now, they need to replace the ounces they mine today.

The best and easiest way to bulk up a project pipeline is to take a run at a smaller company—one with significant resources on its books.

In a previous offering, Guru’s shortlist of producing and advanced stage ExploreCos (those with endgame potential), I promised to work my way down the food chain and feature a shortlist ExplorerCos with valuations between $20M and $80M.

Well, here it is…

Blackrock Gold (BRC.V)

- 69.4 million shares outstanding

- $21.51M market cap based on its recent $0.31 close (up from $0.20 since our last coverage 4 months back)

In 2019, Blackrock focused its resources and talent on the vastly under-explored Silver Cloud Project along the confluence of the Carlin Trend and the Northern Nevada Rift.

Silver Cloud is characterized by low-sulphidation epithermal Au-Ag banded veins where historic drilling by Teck (TECK.TO) and Placer Dome cut multiple high-grade intercepts (1.5 meters of 157.7 g/t Au and 1.5 meters of 12.5 g/t Au respectively).

More recently, a 2,200 meter drilling campaign established 250 meters of east-west strike at NW Canyon.

Highlights from this recent program include:

- 3.93 g/t Au over 0.8 meters and 8.32 g/t Au over 1.5 meters, two hits separated by a distance of 1.5 kilometers, interpreted to be within the upper levels of the epithermal system.

A follow-up program tested the potential at depth. Assays are pending.

Back in late February of this year, the company made an interesting acquisition in the Tonopah Silver District along the Walker Lane trend of western Nevada.

Acquisition highlights:

- The Tonopah District produced over 174 million ounces of silver and 1.8 million ounces of gold from approximately 7.5 million tonnes of high-grade silver-gold epithermal quartz veins making it one of the most significant silver-gold districts in North America1. Mineralization hosted on adjacent or nearby properties is not necessarily indicative of the mineralization hosted on the Tonopah West Project.

- Blackrock has acquired an option to purchase the Tonopah West Project, consisting of 98 patented and 17 unpatented lode mining claims. The optioned Tonopah West Project produced 30% of the tonnage and 26% of the revenue from the Tonopah District, making it the third largest producer in the Tonopah District which contributed to the historic production that made Tonopah the second largest silver district in Nevada, behind only the Comstock Lode.

- First consolidated ownership of land package since Howard Hughes held it in the 1960’s, giving Blackrock control over largest claim package in the Tonopah District.

- Blackrock has identified four target areas with the potential ranging from 2.5 million to 6 million tonnes averaging 13 to 21 g/t gold and gold equivalent.

This is your classic brownfield play.

Two recent press releases outlined plans for the project this upcoming field season:

April 27 news: BLACKROCK OUTLINES 2020 EXPLORATION PROGRAM FOR THE TONOPAH WEST PROJECT

Cartier Resources (ECR.V)

- 192.81 million shares outstanding;

- $39.53M market cap based on its recent $0.205 close (up > 100% since our last coverage 3 months back)

Cartier’s wholly owned Chimo Mine Project, a past producer of some 379K ounces of gold, is located in the prolific Val-d’Or Mining Camp.

Total gold resources at Chimo’s Central, North and South Corridors are as follows:

- 4,017,600 tonnes at an average grade of 4.53 g/t Au for a total of 585,190 ounces gold in the Indicated category;

- 4,877,900 tonnes at an average grade of 3.82 g/t Au for a total of 597,800 ounces gold in the Inferred category.

The ounce count at Chimo now stands at 1,182,990.

There’s more to come. The company is currently focused on blocking out additional ounces at Chimo where it continues to encounter significant high-grade values at depth.

April 7 news: Cartier Intersects 5.0 g/t Au over 10.9 m, 250 m Below New Zones 5B4-5M4-5NE

May 21 news: Cartier Cuts 20.8 g/t Au over 4.0 m at Chimo Mine 500 m below the New Zones 5B4-5M4-5NE

May 28 news: Cartier Cuts 16.5 g/t Au over 4.5 m at Chimo Mine 500 m below the New Zones 5B4-5M4-5NE

The following map lays it all out…

Aside from Chimo, the company has a robust pipeline of brownfield projects shrewdly acquired for pennies on the dollar—Benoist, Wilson, and Fenton.

Cartier has endgame potential. It’s in my top three picks for 2020.

Coral Gold Resources (CLH.V)

- 46.17 million shares outstanding;

- $32.32M market cap based on its recent $0.70 close (up from $0.425 since our last coverage 3 months back)

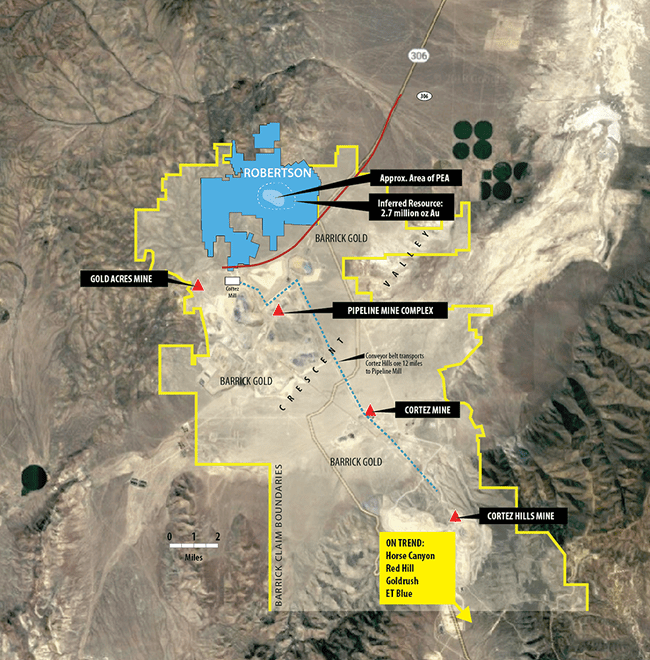

Coral holds an uncapped sliding scale (1% to 2.25%) net smelter royalty (NSR) on over 2.7 million ounces at Barrick Gold’s ( ABX.TO) Robertson Property located along the prolific Cortez Gold Trend of northern Nevada.

Robertson is a joint venture between Barrick (61.5%) and Newmont-Goldcorp (38.5%). This JV among mining behemoths is called Nevada Gold Mines, NGM for short.

Examine the following map (note the scale) and know that Pipeline, Cortez Hills and Goldrush—all on-trend and in close proximity to Robertson—represent three of the largest Carlin-type gold deposits on the planet. They make up NGM’s lowest-cost assets with over 50 million ounces of gold reserves & resources.

It’s important to note that Robertson’s ounces are now considered part of the mineral resource base at the Cortes Mine Complex.

It’s also important to note that finding a deep, rich ‘feeder’ type deposit is a high-priority for NGM. Such a discovery could blow this play wide open.

It seems every time I check on the cap structure of the company, the outstanding shares shrink. This is due to a Normal Course Issuer Bid the company announces each summer.

Coral is also in my top three picks for 2020.

Dolly Varden Silver (DV.V)

- 83.95 million shares outstanding

- $41.98M million market cap based on its recent $0.50 close (up > 100% since our previous coverage 5.5 months back)

Just about every high-quality silver stock I follow—those with significant resources and/or highly prospective geological settings—has gone on a tear of late. This Golden Triangle explorer/developer is no exception.

To its ounce credit, Dolly has 32.9 million ounces of silver grading 300 g/t Ag in the Indicated category and a further 11.477 million ounces grading 277 g/t Ag in the Inferred category.

Since our last visit, the company has made changes to its BOD and beefed up its technical team. Robert McLeod is a name that stands out.

On May 19, the company dropped the following headline:

Dolly Varden Announces Strategic Investment by Eric Sprott Increasing his Holdings to 19.9%

Regarding Sprott’s interest in the company, Shawn Khunkhun, CEO of Dolly:

“With so many investment choices available, we are pleased that Eric Sprott will be taking a substantial position in Dolly Varden by increasing his strategic investment to 19.9%. This is a strong endorsement of our current high-grade silver resource and the substantial growth potential of our assets in the prolific Golden Triangle of British Columbia. With Eric’s investment, we are in a very strong cash position of just under CAD$6 million that will allow the Company to continue expanding its silver mineral resource with new high-grade silver discoveries on the property”

These FT funds need to go directly into the ground, and the company has no shortage of drill targets to demonstrate the region’s resource expansion and discovery potential.

One day after the above noted raise, the company announced this:

Dolly Varden Announces $4.5M Private Placement Financing

CEO Khunkhun again:

“We would like to thank our existing institutional shareholders and Mr. Eric Sprott for giving us this opportunity to fully optimize the quantity and quality of high-grade drill targets that have never been fully tested on the Dolly Varden property. With an exploration team that has extensive regional experience, we look forward to an aggressive exploration season with the war chest (+$10M) required to achieve our exploration goals. Our exploration plan for 2020 will be focusing on the highest-grade targets for expanded mineralization and new silver discoveries.”

Music to shareholder’s ears: “we look forward to an aggressive exploration season…”

Note that during the summer of 2016, Hecla Mining took a run at Dolly Varden offering $0.69 per share.

GFG Resources (GFG.V)

- 132.55 million shares outstanding

- $33.14M market cap based on its recent $0.25 close (up from $0.165 since our previous coverage 4 months back)

We’ve witnessed tremendous share price volatility on this one due to newsflow from two jurisdictionally distinct projects.

The What-For delivered earlier this year was the result of disappointing assays from the company’s Rattlesnake Project in Wyoming, a joint venture with Newcrest Mining (NCM.ASX).

The beautiful up-gap price trajectory in early April was due to the following headline out of the company’s 100% owned Pen Gold Project located 40 kilometers west of the prolific Timmins Camp in Ontario.

The headline numbers included an intercept of 511.00 g/t Au over 1.15 meters at a vertical depth of roughly 50 meters.

Nice hit.

On the strength of this high-grade discovery, the company dropped the following headline on May 6:

Brian Skanderbeg, President and CEO of GFG:

“The Company is pleased to close the oversubscribed financing and welcomes Alamos as a strategic investor. With a strong treasury and multiple highly prospective targets, we are excited to resume our 2020 exploration programs to demonstrate the potential for the Pen Gold Project to host multiple gold deposits next to the world-class Timmins gold camp.”

Golden Predator Mining (GPY.V)

- 168.18 million shares outstanding;

- $50.46M market cap based on its recent $0.30 close (up from $0.20 since our last coverage 3 months back)

Focused on the past-producing Brewery Creek Mine, this one has near term production and exploration upside.

At Brewery Creek, the current resource stands at…

The Brewery Creek project features:

- A past producing open pit/heap leach mine, temporarily suspended in 2002 due to gold price falling below $300/ounce;

- A Quartz Mining License, Water License and Mining Land Use Permit for further exploration

Socio Economic Accord and Council Resolution with Tr’ondek Hwech’in supporting resumption of production; - Year-round road access/air service 55 km from Dawson City, 17 km from grid power

Three years of drilling (2009-2012) has added total combined 1mm ounces of oxide Gold; 80% exploration success rate; - A 180 km2 property with many exploration targets remaining open or untested

- Proposed work to be completed in 2020 includes completion of a feasibility study to evaluate reprocessing of historic heap leach material, an updated mineral resource estimate and additional metallurgical and geotechnical testing.

Since our last look at the company back in March, GPY monetized its 3 Aces project.

On June 4, Golden Predator CEO, Janet Lee-Sheriff offered greater detail regarding the fundamentals underpinning her company (note her mention of the “disruptive technology” they’re bringing to the mining industry—this could be the real deal)…

Gowest Gold (GWA.V)

- 73.1 million shares outstanding

- $23.39M market cap based on its recent $0.32 close (up from $0.215 since our last coverage 4 months back)

GWA’s North Timmins Gold Project is located on the Pipestone Fault / North Pipestone Break, two highly prospective gold-bearing structures in the Timmins Camp.

That Bradshaw deposit contains:

- Probable Reserves stand at 1,800,000 tonnes grading 4.82 g/t Au for 277,101 ounces of gold

- Indicated Resources stand at 2,120,000 tonnes grading 6.19 g/t Au for 422,059 ounces of gold

- Inferred Resources stand at 3,620,000 tonnes grading 6.47 g/t Au for 754,533 ounces of gold

The company has a Bankable Feasibility Study (BFS) on the project using a very conservative $1200 Au price. The numbers don’t look too bad, and the CapEx is very modest (note the price sensitivity chart on the right).

On April 6, the company entered into a bridge loan agreement with Lush Land Investment Canada Inc.:

GOWEST GOLD ENTERS LOAN AGREEMENT

On May 6, the company delivered the following Bradshaw update:

Gowest Gold Development Update

Earlier this month (June 1), the company tagged the following values outside the Bradshaw resource block:

- 2.2 meters of 12.24 g/t gold (including 0.7 meters grading 33.9 g/t Au);

- 2.5 meters of 1.89 g/t gold in the same hole (including 0.5 meters grading 4.36 g/t Au).

HighGold Mining (HIGH.V)

- 40.74 million shares outstanding;

- $58.66M market cap based on its recent $1.44 close (up from $0.76 since our last coverage 3 months back)

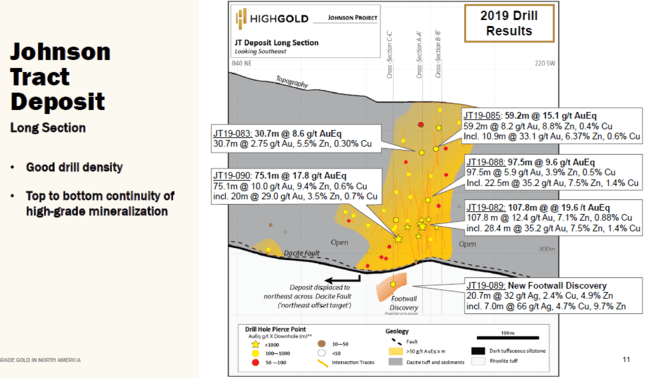

I added HighGold to my shortlist of companies over at Highballerstocks on January 26 in a piece titled A high-grade gold and base metal play with Tier-1 potential – HighGold Mining (HIGH.V)

The company’s Johnson Tract (JT) project in southcentral Alaska is one of the more compelling exploration/development plays I’ve come across in the junior exploration arena.

JT has Tier One potential (a deposit with a mine life in excess of 10 years with at least 500,000 AuEq ounces of annual production).

On April 29, the company dropped the following headline:

JT now boasts the following fundamentals:

- An Indicated Resource of 2.14 million tonnes grading 10.93 g/t gold equivalent (“AuEq”) for 750,000 ounces AuEq;

- An additional Inferred Resource of 0.58 Mt grading 7.16 g/t AuEq for 134,000 ounces AuEq;

- The deposit includes a high-grade core of 1.25 Mt Indicated grading 14.54 g/t AuEq for 583,000 ounces AuEq at an 8 g/t AuEq cutoff;

- 79% of total resource tonnage in the Indicated category, including 85% of the total AuEq ounces;

- Steeply dipping deposit with typical horizontal thickness of 25 to 50 meters, strike length of 300 meters and excellent continuity of grade from surface to a depth of 275 meters;

- Resource open to expansion and multiple high-priority targets located nearby, including the prime Northeast Offset target that is believed to be the fault-displaced continuation of the JT Deposit (editors note: this offset target really gets the speculative juices flowing);

- High metal recoveries and concentrates low in deleterious elements are predicted based on past metallurgical test work, including forecasted total gold recovery of up to 96%.

As we head into the 2020 field season, keep in mind that the analog for JT is Sandstorm’s Hod Maiden deposit (2.6Moz @ 8.9 g/t Au & 1.4% Cu).

The company also controls three highly prospective projects in the world-class Timmins Gold Camp of Ontario—Munro-Croesus, Golden Mile, and Golden Perimeter.

IMPACT Silver (IPT.V)

- 116.99 million shares outstanding;

- $79.55M market cap based on its recent $0.68 close (up over 100% since our last coverage 3 months back)

Impact was featured prominently in these pages after Equity Guru’s Lukas Kane and I ventured south to view the company’s Mexican assets earlier this year.

We both walked away sufficiently impressed. The Impact crew runs a tight show.

There’s extraordinary leverage to rising silver prices here. The recent strength in silver is fully realized in the company’s share price trajectory. The following is a 3-year (weekly) chart demonstrating IPT’s recent test of multi-year highs.

On April 6, the company released full year production results:

IMPACT Silver Announces Full Year 2019 Financial & Production Results

2019 Production Overview:

- 2019 full year silver production, resulted in revenues increasing by 2% over 2018 on production of 664,056 ounces (2018 -743,950 ounces) due to higher grades in spite of fewer tonnes milled

- Revenue per tonne sold was $105.47 in Q4 2019, an increase of over 33% from Q4 2018 at $79.55 Revenue for 2019 per tonne sold was $92.82 compared to $74.88 in 2018.

- Average mill feed grade for silver was 182 grams per tonne (g/t) in Q4 2019, an increase of 7% from 170 g/t in Q4 2018. Average mill feed grade for the year was 173 g/t compared to 159 g/t in 2018.

- Throughput at the mill decreased to 140,878 tonnes milled in 2019 from 173,217 tonnes in 2018 as the Company shifted focus to higher grade tonnes.

- Adjusted mine operating income was $1.3 million (excluding $1.5 million in amortization and depletion) compared to a loss of $1.6 million in 2018 (excluding $1.9 million in amortization and depletion). Mine operating loss for the year was $0.2 million compared to a loss of $3.5 million in 2018.

- IMPACT continues to focus on cost reductions and maximizing revenues per ounces sold. Direct costs per production tonne were $82.60 in Q4 2019, a 10% decrease from Q4 2018 at $91.50.

On May 25, the company released Q1 results:

Q1 Production Overview:

- Silver production increased to 178,994 ounces in Q1 2020 compared to 163,575 ounces in Q1 2019 due to higher grades and increased tonnes milled.

- Production at the Guadalupe mill during the first quarter of 2020 came from the Guadalupe Mine (38% of total mill feed), the San Ramon Mine (22% of mill feed), the Cuchara Mine (23% of mill feed), and the Veta Negra Mine (17% of mill feed).

- Average mill feed grade for silver was 170 grams per tonne (g/t) in Q1 2020, an increase from 167 g/t in Q1 2019.

- Throughput at the mill in Q1 2020 was 39,537 tonnes compared to 35,788 in Q1 2019.

Having suspended operations soon after C-19 reared its ugly head, on June 4, the company announced the restart of operations at its at the Guadalupe production center.

Game (back) on.

Moneta Porcupine (ME.TO)

- 311.54 million shares outstanding;

- $49.85M market cap based on its recent $0.16 close (up over 100% since our last coverage 3 months back)

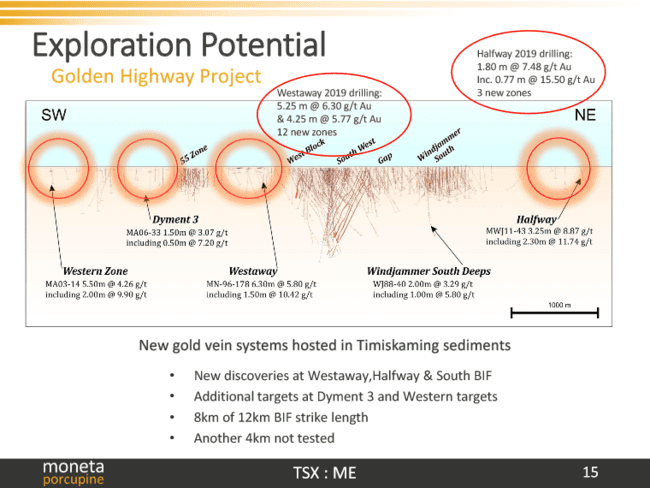

Moneta’s Golden Highway Project is located along the Destor-Porcupine Fault of the Timmins Gold Camp in northeastern Ontario.

Golden Highway hosts a 43-101 resource of some 556,500 ounces of gold in the Indicated category (3.8Mt at 4.53 g/t Au) and 1,174,000 ounces of gold in the Inferred category (8.5 Mt at 4.31 g/t Au).

Since we last checked in roughly three months ago, the company announced the commencement of a Preliminary Economic Assessment (PEA) for its South West deposit.

On May 5, the company announced results from five drill holes testing the extensions of mineralization at its new Westaway Target located outside of the above resource:

On May 14, the company announced results from four drill holes testing the western and eastern extensions at its Windjammer South deposit located beyond the above resource blocks:

Moneta Expands Gold Mineralization at Windjammer South in Step-Out Drilling

On May 21, the company announced the discovery of a new zone tagging 8.09 g/t Au over 3.50 meters (including 0.55 meters @ 30.40 g/t Au):

Renaissance Gold (REN.V)

- 68.52 million shares outstanding

- $26.04M market cap based on its recent $0.38 close (up from $0.33 since our last report 5.5 months back)

The biggest recent development regarding Renaissance is its merger with Evrim Resources (EVM.V).

Characterized as a “merger-of-equals“, Evrim will acquire all of the outstanding common shares of Renaissance via a share exchange transaction to create a new company, one Orogen Royalties Inc.

Evrim Resources and Renaissance Gold Combine to Form New Royalty/Prospect Generator Company

Combined Company Highlights

Organically Generated Royalty Portfolio:

- Ermitaño West gold deposit in Sonora, Mexico (2% net smelter royalty (“NSR”)), being developed by First Majestic Silver Corp. and planned to be in production in 2021;

- Silicon gold project (1% NSR) in Nevada, USA, being advanced by AngloGold Ashanti NA;

- Cumobabi project (1.5% NSR), adjacent to the Ermitaño property;

- Four precious metal exploration-stage projects in Argentina, each with a minimum 1% NSR.

Financial Strength:

- Near term cash flow potential from the Ermitaño West Royalty and long-term growth potential provided by the Silicon Royalty;

- Proforma cash of $13.5 million as of May 31, 2020;

- Significant G&A cost reductions and operational synergies;

- Improved capital markets scale.

Increased Diversification:

- Exploration expertise for precious and base metal projects in the western cordillera of North America including Nevada, British Columbia, and western Mexico;

- Enhanced project pipeline in USA, Canada, and Mexico;

- Active exploration joint ventures and alliances across multiple geological terranes.

Paddy Nicol, Evrim’s President & CEO:

“The combination of Evrim and Renaissance to form Orogen Royalties Inc. is an important and exciting milestone on the path towards creating an enlarged royalty portfolio with exceptional capability to generate additional royalties through organic prospect generation and joint venture partnerships. The future revenue we expect to receive from our royalty portfolio will fund acquisitions and exploration and enable us to maintain tight control over our capital structure. Furthermore, we are delighted to join in Renaissance’s exploration efforts in Nevada. The Reno-based technical group is very experienced and highly capable at generating projects in one of the premier gold districts in the world.“

Robert Felder, Renaissance’s President & CEO:

“Bringing together two very successful and well-funded prospect generators with meaningful royalties creates a very strong platform from which to advance and grow our business. This transaction represents a compelling opportunity to build a company that can operate long term, successfully execute our model on both technical and business levels, and generate significant shareholder value. We think very highly of the Evrim team and look forward to what we can accomplish together.”

Reyna Silver (RSLV.V)

- 73.15 million shares outstanding

- $49.74M market cap based on it recent $0.68 close

Reyna is a new kid on the block. In a transaction priced at $0.20 per unit (each unit consisting of one share and one-half warrant exercisable at $0.45 for 24 months), the company’s debut on the Venture exchange was greeted with open arms.

With MAG Silver holding 19.9% of the company’s outstanding common, Reyna’s project portfolio consists of the following assets:

Guigui (4,500 ha) – Flagship Asset

- Covers almost the entire Santa Eulalia Mining District, which holds Mexico’s largest known Carbonate Replacement system.

- Significantly located near Grupo Mexico’s San Antonio Mine.

- The Santa Eulalia District has produced 50Mt at 310 g/t Ag, 8.2% Pb and 7.1% Zn.

Batopilas (4,800 ha)

- Comprises nearly the whole historic Batopilas Native Silver District. The deposit historically produced 300M oz of silver until 1910.

- Unique mineralization (native silver within carbonate veins).

El Durazno (26,576 ha)

- Lies within the old Mulatos Mining District, bounded by claims of active mining companies (Agnico Eagle, Evrim, First Majestic, Alamos Gold, Peñoles, Kootenay, etc.)

- Large underexplored land package with similar geology & mineralization to nearby existing mines (La India & Mulatos)

Matilde (1,797 ha)

- Lies within the Sonora’s Au-Ag-Cu belt.

- Hosts low-sulfidation epithermal Au-Ag deposit.

Sailfish Royalty (FISH.V)

- 58.18 million shares outstanding;

- $56.43M market cap based on its recent $0.97 close (up from $0.58 since our last coverage 3 months back)

Sailfish is a precious metals royalty and streaming company with several advanced-stage assets in its portfolio:

- A NSR (up to 2%) on Moonlight Property along the same structural trend as Spring Valley and Rochester, Pershing Country, Nevada;

- A NSR (up to 3%) on the multi-million ounce Spring Valley gold project

- A NSR (up to 3.5%) on the Tocantinzinho Gold Project in the prolific Tapajos district of northern Brazil.

- A gold stream equivalent to a 3% NSR on the San Albino Gold Project in northern Nicaragua, and a 2% NSR on the remaining area surrounding San Albino.

- A 1.5% NSR on El Compas, Endeavour Silver’s fourth and highest-grade silver equivalent mine located in Zacatecas, the 3rd largest historic silver mining district in Mexico.

- A 1% NSR on the La Cigarra silver project located in the state of Chihuahua along the eastern fringes of the Sierra Madre Occidental in north central Mexico.

There’s been very little in the way of news since we last checked in on the company. Though it’s a thin trader, the share price has been firming up of late.

Scottie Resources (SCOT.V)

- 104.46 million shares outstanding

- $30.29M market cap based on its recent $0.29 close (up from $0.22 since our last coverage 3 months back)

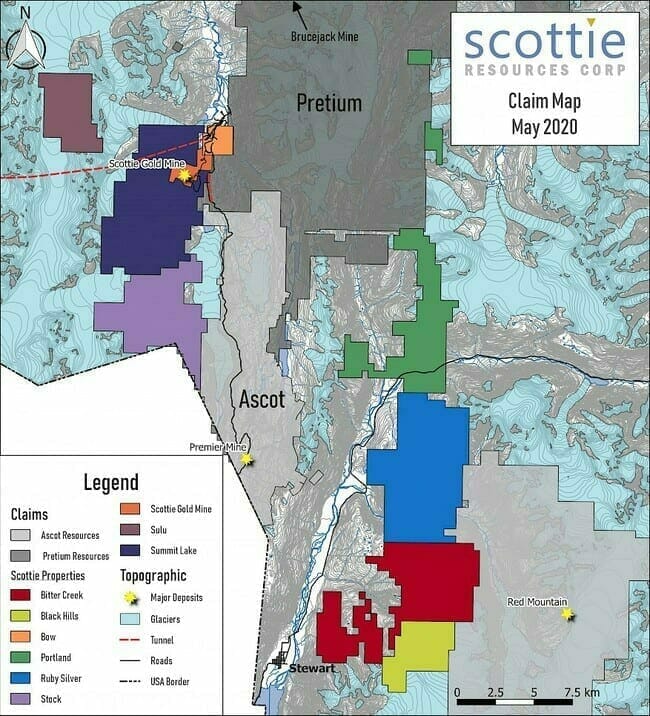

Scottie holds a 100% interest in the past-producing Scottie Gold Mine property, strategically located 20 kilometers north of the Premier Gold Mine and 27 kilometers south of the high-grade Brucejack Mine operated by Pretivm (PVG.TO).

The company also has an option to acquire a 100% interest in the Bow Property right next door.

Note the company’s claims and their proximity to ground held by Ascot (AOT.T) and Pretivm.

Since our last visit with Scottie, the company reported on a number of recent property transactions and option agreement negotiations.

Scottie Resources Advances Acquisition of Strategic Land Position in BC’s Golden Triangle

In preparation for its 2020 field season in the Golden Triangle, the company announced two private placements, including this one:

Strategic Metals (SMD.V)

- 96.65 million shares outstanding;

- $50.26M market cap based on its recent $0.52 close (up from $0.31 since our last coverage 3 months back)

Strategic generates newsflow from a number of projects, but it’s Mount Hinton that has my undivided attention.

The project came to light on August 21, 2019 via the following headline:

Strategic Metals Ltd. Announces 2340 G/T Gold in a Rock Sample From its Mount Hinton Property, Yukon

Then, on September 9, the company dropped another Mt. Hinton headline (a phase two follow-up to the previous surface sampling results):

Strategic Metals Discovers More Gold-Rich Veins at Its Mount Hinton Property, Yukon

Highlights from this surface sampling campaign:

- A two-meter wide vein, intermittently exposed along a 75 meter strike length, where four widely-spaced rock samples returned: 28.5 g/t gold; 23.5 g/t gold with 1720 g/t silver; 11.6 g/t gold; and 4.44 g/t gold;

- Another outcropping vein, found within a fault zone, graded 12.6 g/t gold and 2100 g/t silver;

- A second exposure within the same vein fault located 50 meters along strike, where chip sampling returned 30.5 g/t gold and 53.1 g/t silver over 1.2 meters and a grab sample assayed 48.5 g/t gold and 74 g/t silver;

- A third, 0.5-meter wide vein in outcrop, which is covered by talus along strike in both directions, assayed 46.9 g/t gold and 446 g/t silver.

Later in November, building on previous success at Mt. Hinton, the company released the following results from a phase three exploration campaign, one that included a LIDAR survey, mechanized trenching, road building, geological mapping, and prospecting.

Phase three highlights:

- Discovery of two new veins in outcrop on the western side of Granite Creek. One where a chip sample returned 24 g/t gold over 1.25 meters, and another that is up to 1.5 meters wide, where a grab sample yielded 9.67 g/t gold;

- A sample from a large boulder of quartz vein, which assayed 42.4 g/t gold, expanded the main high-grade float train identified in phases one and two, on the east side of Granite Creek;

- A sample from a northeast striking zone of quartz vein float surrounded by oxidized breccia that is located 60 meters west of, and parallel to, the main high-grade zone on the east side of Granite Creek, yielded 12.45 g/t gold;

- A one meter wide chip sample across a quartz vein and altered quartzite wallrock exposed in a trench on the west side of Granite Creek, returned 9.9 g/t gold;

- Float samples from other new areas of mineralization yielded 28.9 g/t gold, 14 g/t gold, 9.68 g/t gold, 8.7 g/t gold with 115 g/t silver, 4.36 g/t gold with 180 g/t silver and 1.83 g/t gold with 328 g/t silver.

It’s been more than a few months since the company reported anything out of Mt. Hinton. But on June 3 the company delivered what I was looking for—plans for an aggressive 2020 field season at their flagship project:

“The 2020 work program at the Mt. Hinton property will consist of excavator trenching and road construction along with detailed mapping and prospecting is scheduled to begin in mid-June. An estimated 7,000 meters of drilling will follow the initial work.”

7,000-meters is bigger than I was expecting. We should see significant newsflow out of Mt. Hinton over the next six months or so.

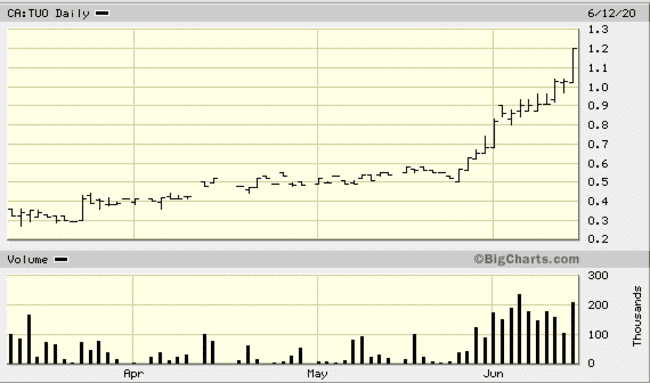

Teuton Resources (TUO.V)

- 43.42 million shares outstanding

- $39.51M market cap based on its recent $1.20 close (up from $0.34 since our last coverage 3 months back)

Though Teuton boasts a large project and royalty portfolio, the company’s 20% stake in Treaty Creek is generating the price trajectory we’re now witnessing…

This 17,913-hectare property is located in the prolific Golden Triangle, along the northern portion of the Sulphurets Hydrothermal System (SHS).

Seabridge’s mammoth-sized KSM property lies to the southwest, Pretium’s Brucejack property to the southeast. The past-producing Eskay Creek mine lies 12 kilometers to the west.

This is a damn fine neighborhood.

“The Goldstorm zone on the Treaty Creek property has been explored for the past four years and is beginning to show signs that it has the potential to rival the size and grade of other mega-porphyry gold deposits in the SHS. In 2019, Hole GS-19-42 yielded 0.849 g/t Au Eq over 780 meters with 1.275 g/t Au Eq over 370.5 meters and GS-19-47 yielded 0.697 g/t Au Eq over 1,081 5 meters with 0.867 g/t Au Eq over 301.5 meters. The current known length of the northeast axis of the Goldstorm System is over 850 meters long and the southeast axis is at least 600m across. The system remains open in all directions and to depth.”

On May 11, project operator, Tudor Gold (TUD.V), announced the commencement of an aggressive 20,000-meter diamond drilling campaign at Treaty Creek.

TUDOR GOLD INITIATES DIAMOND DRILLING AT THEIR FLAGSHIP TREATY CREEK AU-CU-AG PROJECT

This is an early start to their field season—one month earlier than last year’s start.

The priority at Treaty Creek is to continue expanding the Goldstorm System to the southeast, and to the northeast.

On June 2, Eric Sprott stepped in for another helping of Teuton common…

Private Placement – Eric Sprott to take 2,000,000 Units

Of all the Golden Triangle drilling campaigns I follow, Treaty Creek has my undivided attention.

I look forward to a maiden resource on this one.

West Kirkland Mining (WKM.V)

- 425.35 million shares outstanding;

- $46.79M market cap based on its $0.11 share price (up from $0.065 since our last coverage on 3 months back)

WKM is developing its 75% owned advanced stage Hasbrouck Gold Project in the Tonopah region of Nevada.

A fully permitted project, Hasbrouck sports 784,000 ounces of gold in the Mineral Reserve category.

This is a simple mining scenario—about as simple as it gets.

A pre-feasibility study tabled in 2016 shows a CapEx of US$47M, an after-tax NPV of US$120M, and an IRR (after tax) of 43%… all based on a $1275.00 gold price assumption (gold is currently trading at $1,740 as I type).

These are solid numbers—the project’s CapEx is very modest.

The company hasn’t produced much in the way of news since we last checked in, but the stock is correlated nicely to firmer gold prices.

That’s it for this round-up.

On deck, our sub-$20M shortlist.

END

—Greg Nolan

Full disclosure: we have no marketing relationships with any of the companies featured above (the author owns shares in Strategic Metals and may initiate purchases in the remaining companies featured above in the coming days/weeks).

Leave a Reply