Defense Metals (DEFN.V) is no stranger to these pages. We’ve followed developments every step along the way as the company aggressively pushes its strategic, wholly-owned Wicheeda REE Project further along the curve.

Wicheeda, located in the Prince George region of mining-friendly British Columbia, is road accessible with ample infrastructure all around.

To briefly summarize what Wicheeda holds in its subsurface layers:

- An Indicated Mineral Resource of 4,890,000 tonnes averaging 3.02% LREO (Light Rare Earth Elements);

- An Inferred Mineral Resource of 12,100,000 tonnes averaging 2.52% LREE;

- All reported at a cut-off grade of 1.5% LREE (sum of cerium (Ce), lanthanum (La), neodymium (Nd), praseodymium (Pr), and samarium (Sm); in addition to niobium (Nb) percentages).

The above numbers, released only one month ago, represent a significant upgrade versus the company’s previous resource estimate.

Defense Metals Announces Updated and Increased Mineral Resource Estimate for Its Wicheeda Rare Earth Element Carbonatite Deposit

This new resource demonstrates:

- A 49% increase in overall tonnage based on the results of the 2019 diamond drilling of 13 holes totaling 2,005 meters;

- A 30% increase in overall average grade, in part through the incorporation of potentially economically significant praseodymium not previously estimated;

- Conversion of 4,890,000 tonnes to Indicated category previously defined as Inferred;

- Increased Inferred Resources by 730,000 tonnes in comparison to the initial Wicheeda MRE1;

- Potential for expansion of the Wicheeda Deposit to the north and west in the down plunge direction.

This tremendous increase in tonnage and grade was the outcome of a summer-of-2019, 13-hole diamond drilling campaign that yielded some exceptional results:

Four things to home in on regarding the above map:

- Note the long intercepts of mineralization in ALL 13 holes drilled.

- Note the grades in ALL 13 holes drilled.

- Note drill hole WI19-31 – 4.43% LREO over 83 meters (including 5.47% LREO over a drill core interval of 33 meters). Boom!

- Note where the Wicheeda deposit remains open for resource expansion – to the North, to the Southwest, to the East, and at depth.

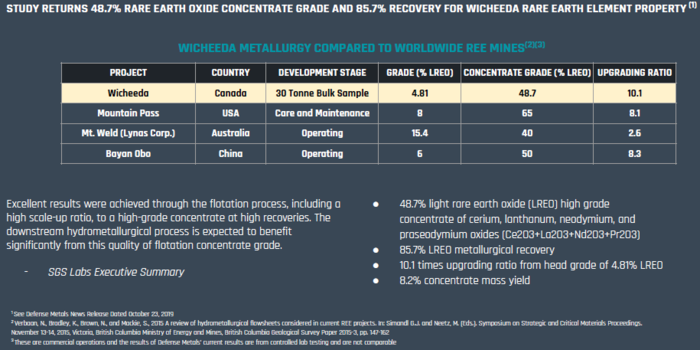

For you mining types out there, Wicheeda is ranked plenty high among its peers, metallurgically speaking.

Metallurgy is the one aspect of exploration and development that can trump all others combined (it’s the science—some prefer the word ‘art’—of extracting valuable metals from their ores and modifying said metals for their intended use).

Still on metallurgy, on October 23, 2019, the company dropped news that de-risked the Wicheeda deposit in a major way.

Prior to this news event, the company was optimistically targeting a total rare earth oxide (TREO) metallurgical recovery rate of 80%, and a TREO high-grade concentrate of 40% from these tests.

These (final) numbers exceeded all expectations:

- a TREO metallurgical recovery rate of 85.7%;

- a 48.7% TREO high-grade concentrate of cerium, lanthanum neodymium, and praseodymium oxides (Ce2O3+La2O3+Nd2O3+ Pr2O3)

As noted above, these results place Wicheeda among the best REE deposits on the planet.

Some of you new to this space might be asking, “why should I care about an REE deposit, even if it is in a mining friendly jurisdiction like B.C.?”

REEs are everywhere in this modern world and are often referred to as the ‘Vitamins of Chemistry’.

Exhibiting an extraordinary range of electronic, optical and magnetic properties, they are used in everything from medical imaging technology, to flat-screen TVs, to nuclear power generation, to electric vehicle (EVs) batteries and motors.

Equity Guru’s Chris Parry on the subject:

“Just understand folks want it, for reals. You probably have some in your pocket right now, keeping your Candy Crush scores updated.”

The fact that China controls the REE refining market is another reason you should care. This market dominance is a big problem for the West, and it has us scrambling to secure alternative sources.

Last December, Reuters reported that the U.S. Army plans to fund construction of a number of REE processing facilities, part of Washington’s urgent push to secure domestic supply.

In order to add greater depth to the Defense team, the company recently announced a strategic hire in one Karl T. Wagner.

Mr. Wagner brings over 31 years of worldwide experience to Defense Metals including work in Latin America, East Asia, South Asia, the Middle East and North Africa. Mr. Wagner will advise Defense Metals on government relations and business development opportunities worldwide.

Mr. Wagner previously served as Senior Director, Global Security at Tesla. His last position at the Central Intelligence Agency (CIA) was Chief of Counter-Intelligence (CI) Operations. He also served as Executive Assistant to CIA’s Executive Director, Chief of the CIA’s Special Middle East Task Force and in leadership positions in CIA stations overseas including a large station in North Africa, multiple war zones in the Middle East and South Asia, and high CI threat stations in Latin America and East Asia.

All of the above factors put Defense in a very enviable position.

It’s only a matter of time before the market figures it out.

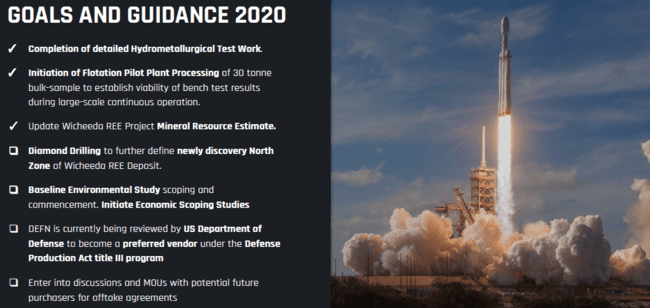

But the company isn’t resting on its laurels. It has plans for the balance of 2020, and to that end, the company dropped the following headline late last week:

The company closed the first tranche of this non-brokered flow-through PP (3,460,000 flow-through units priced at $0.25) for gross proceeds of $865,000.

“Each FT Unit is comprised of one flow-through share and one common share purchase warrant. Each warrant is exercisable to purchase one common share of the Company at a price of $0.35 per share for a period of twenty-four (24) months from the date of closing the FT Private Placement.”

The Company also closed the first tranche of its non-brokered hard dollar PP (675,000 units priced at $0.20) for gross proceeds of $135,000.

“Each Unit is comprised of one common share and one common share purchase warrant. Each warrant is exercisable to purchase one common share of the Company at a price of $0.30 per share for a period of twenty-four (24) months from the date of closing the Private Placement.”

These funds are earmarked for its REE flotation pilot plant, a phase-2 proposal recommended by SGS Canada Inc.

Pilot plant completion is expected by the end of July 2020. Initial results are expected in August.

The objectives of this phase-2 pilot plant testwork:

- Confirm metallurgy in a pilot plant environment;

- Generate data to support engineering;

- Produce a large amount of concentrate for downstream hydrometallurgy testing.

In the video link below we get our first look at the pilot flotation plant as it currently exists.

SGS Canada—the world’s leading inspection, verification, testing and certification company with over 2,600 offices and labs worldwide—is running the show.

The fact that SGS is involved adds heaps of validity to the Wicheeda deposit.

This is the real deal folks.

Keep in mind that Defense has 30 tonnes of REE rich material stockpiled above ground—material that was bulk sampled in early 2019.

“The pilot plant will treat up to 30 tonnes of material in a continuous manner over 180 hours of operation, at an anticipated feed-rate of approximately 150 kg per hour. The approach will be to first commission the circuit in mid-June. This will be followed by a series of optimization runs through later June / early July. A continuous 48 hour run will serve to confirm metallurgy over extended operation in later July.”

The second tranche of the PP is expected to close later this month. Those funds will get a drill rig mobilized to the Wicheeda project, a campaign that will infill the current resource, upgrading the Inferred material to the higher confidence Indicated category, as well as test for mineralized extensions to the North, to the Southwest, to the East, and at depth.

I expect newsflow to be steady over the balance of the year.

END

—Greg Nolan

Full disclosure: Defense is an Equity Guru marketing client. We own shares.

Leave a Reply