With his poll numbers plummeting, U.S. President Donald Trump is reverting to his old playbook of lashing out at enemies – imaginary and real.

China makes a handy foil.

“China has ripped off the United States like no one has ever done before!” Trump declared last week, claiming that Beijing has “raided U.S. factories” and “gutted” American industry.

Then Trump’s functionaries chimed in.

“A supply chain that is overly dependent on China is that of critical minerals, including the “rare earth elements (REEs),” warned Dan Brouillette the U.S. Secretary of Energy on June 28, 2020, “Which are used to build satellites and important defense systems like aircraft and guidance systems.”

The U.S. is fully committed to “diversifying the supply chain” of REEs.

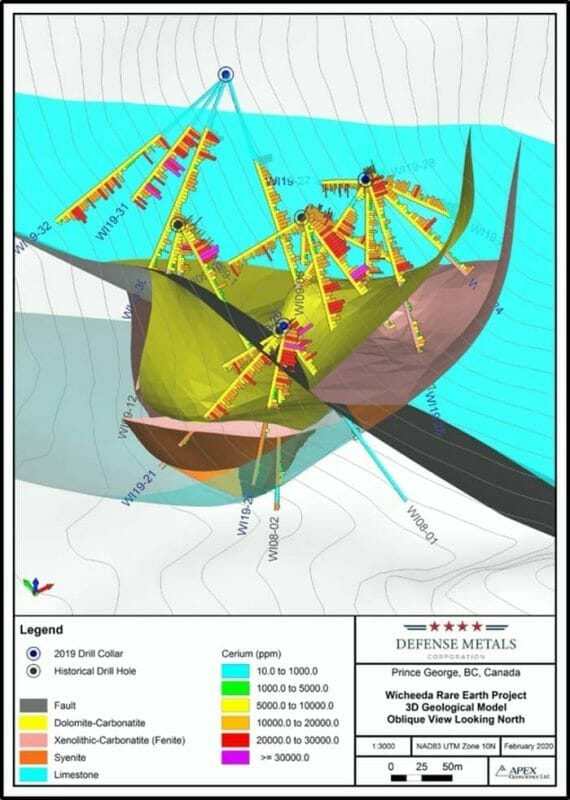

This creates a strong tailwind for North American REE companies like Defense Metals (DEFN.V) which just announced the filing of an updated 43-101 technical report on the 4,220 acre Wicheeda Rare Earth Element (REE) Property located near Prince George, British Columbia.

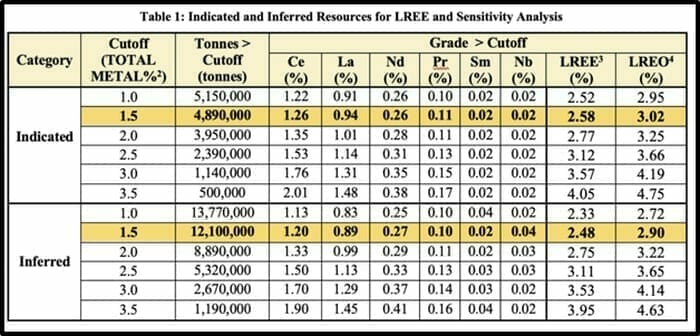

43-101 Technical Report Highlights:

- 49% increase in overall tonnage of Updated Wicheeda REE Project Mineral Resource Estimate (MRE) based on the results of 2019 diamond drilling of 13 holes totaling 2,007.5 metres;

- 30% increase in overall average grade, in part though the incorporation of potentially economically significant praseodymium not previously estimated;

- Conversion of 4,890,000 tonnes to Indicated Resources previously defined as Inferred;

- Increased Inferred Resources by 730,000 tonnes in comparison to Defense Metals Initial Wicheeda MRE; and

- Potential for expansion of the Wicheeda Deposit to the north and west in the down plunge direction.

The updated Wicheeda MRE comprises an Indicated Mineral Resource of 4,890,000 tonnes averaging 3.02% LREO (Light Rare Earth Oxide), in addition to Inferred Mineral Resource of 12,100,000 tonnes averaging 2.90% LREO reported at a cut-off grade of 1.5% LREE.

“Defense Metals’ focus in 2020 will be to complete development of the Wicheeda deposit hydrometallurgical flowsheet, initiate flotation pilot plant processing of the recently collected 30-tonne bulk sample and update the Wicheeda REE deposit mineral resource based on its highly successful 2019 drill campaign,” wrote Equity Guru’s Chris Parry on February 4, 2020.

“A lot of mining explorers don’t actually do much exploring, for fear that they may ruin a good story or get to the end of their CEO salary budget before they have to,” continued Parry, “Defense Metals has been doing the work, finding the good stuff, and doing so at a time when it really matters”.

“REEs - often referred to as the ‘Vitamins of Chemistry’ – are everywhere,” explained Equity Guru’s Greg Nolan a month ago,”

“But there are concerns here in the West regarding supply, and it’s not exaggerated. China controls the lion’s share of the current global REE supply,” continued Nolan, “There’s no replacing REEs. Their properties are so unique—so unequaled—we’d be right-screwed if Xi Jinping were to suddenly slap a ban on exports.”

“Beijing is using state subsidies to build up its rare earths industry and plans to use it as a geopolitical weapon against the West,” reports the Voice of America.

“China is not concerned with economic return in many of these cases,” Horizon founder Nathan Picarsic told the Wall Street Journal. “They see controlling this type of [industry] as a path to win without fighting.”

Investors interested in the REE space should pay close attention to all published metallurgical results.

It is possible to have decent REE grades, with target minerals that are too difficult (costly) to extract from the host rock.

Defense does not have that problem.

“The hydrometallurgical test results showed REE extractions of ~90% from flotation concentrate, in conjunction with our recently released locked cycle flotation tests that produced a high grade 48.7% TREO concentrate, conclude a very successful year-long metallurgical flowsheet optimization process,” stated Craig Taylor, CEO of Defense Metals.

“The Department of Energy (DOE) is playing a leading role in the Trump Administration’s plan to reduce U.S. dependency on China for critical minerals, including REEs,” confirmed Dan Brouillette the U.S. Secretary of Energy.

Mining jurisdiction, geology, metallurgy – all good.

Shifting political winds – even better.

Defense Metals share price has doubled in the last three months.

If you’re thinking, “I missed out” – think again.

There’s only 44 million DEFN.V shares out, and the company has an embryonic market cap of $8 million.

Full Disclosure: Defense Metals is an Equity Guru marketing client

Leave a Reply