On the 7th day of August in the year of our Lord 2020 – Nomad Royalty (NSR.T) released its inaugural financial results in U.S. dollars – and they were good.

6-Month Financial Highlights, ending June 30 2020:

- Gold ounces earned – 5,629

- Silver ounces earned – 100,217

- Revenues of $12.4 million

- Adjusted net income of $6.4 million

- Cash operating margin $11.7 million

- Cash operating margin 94%

- $12.2 million in cash at June 30, 2020.

On July 15, 2020 Nomad announced that it has entered into an agreement with three banks (Scotia, CIBC and RBC) for a USD $50 million revolving credit facility with the option to increase to USD $75 million.

At that time Nomad owned a portfolio of 10 royalty, stream, and gold loan assets, of which 5 are on currently producing mines.

Since then, Nomad’s portfolio got bigger.

On July 27, 2020 Nomad announced that it acquired a 1% net smelter return royalty on the Troilus Gold project located in Québec, Canada for USD $7.5 million.

The Royalty covers all metals and minerals produced from 81 mineral claims and one surveyed mining lease comprising the Property. The Troilus Gold Project is an advanced gold exploration project.

Royalty companies invest in miners in exchange for a share of the mine’s future cash sales. A “streaming company” is similar but they take a share of production ounces, instead of cash.

The beauty of Royalty companies is that they don’t run airborne surveys, they don’t drill, they don’t own haul-trucks, they don’t have to pay an army of underground miners.

Compared to an explorer or miner – the monthly burn-rate is minuscule.

“If you are a novice where precious metals and mining are concerned but want exposure to this fast-moving sector without exposing your portfolio to heaps of risk, I honestly can’t think of a better vehicle than a royalty and streaming Co,” wrote Equity Guru mining wizard Greg Nolan on July 29, 2020.

“Of course…management is key in choosing the right vehicle,” continued Nolan, “The Nomad team, the trio of Vincent Metcalfe, Joseph de la Plante, and Elif Lévesque, were at the helm of Osisko Gold Royalties (OR.T) from day one. Osisko currently dons a $2.63B market cap.

“This team possesses the skill-sets required to build a successful royalty company and move it further along the growth curve—much further and quicker—than a team with less experience.” – End of Nolan.

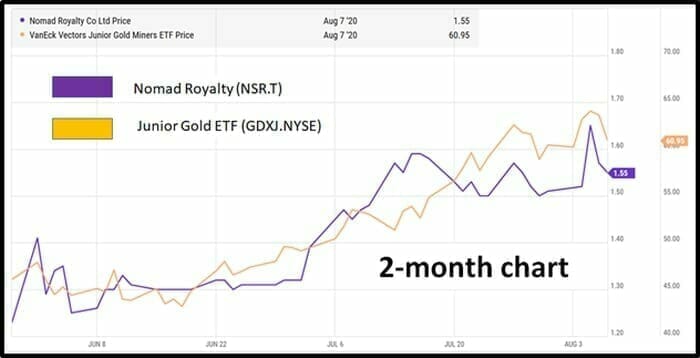

Nomad is brand new company. It’s entire trading history can be seen on the graph below.

Nomad’s Q2 revenue was sourced 100% from gold and silver – 85% from the Americas, 7% from Africa and 8% from Australia.

The company’s objective is to maintain a focus on precious metals (primarily gold and silver) with a target of no more than 10% in revenue from other commodities.

Nomad Corporate Update:

- On May 27, 2020, completed reverse take-over transaction

- On May 29, 2020, Nomad graduated from the TSX Venture and began trading on the Toronto Stock Exchange under the ticker NSR.

- On July 13, 2020, Nomad qualified and started to trade on the OTCQX Best Market under the ticker NSRXF.

- On July 15, 2020, Nomad entered into an agreement with a syndicate of banks for a $50 million revolving credit facility with the option to increase to $75 million.

- On July 31, 2020, Nomad closed the acquisition of a 1% NSR on the Troilus Gold project located in the Frotêt-Evans Greenstone Belt in the Province of Quebec for a cash consideration of $1.9 million and by the issuance of 5,769,231 units.

Equity Guru produced a short video on Nomad here:

Nomad Asset Update:

- Blyvoor gold mine began day and night shift development blasting and also initiated commissioning of its gold plant. Expected to produce its first ore in Q4, 2020.

- Operations at the Bonikro mine have not been interrupted to date by the COVID-19 pandemic.

- South Arturo silver stream: El Nino mine production exceeded expectations during the second quarter. A new NI 43-101 report was commissioned for South Arturo. The JV partners are assessing additional development opportunities including the Phase 1 and Phase 3 open pit projects and the potential for an on-site heap leach. The JV partners expect to complete the updated technical report during the third quarter with the goal of providing a long-term view of the opportunity provided by this project.

- Mercedes silver stream: Ore was stockpiled in June and processing resumed in early July. During the pandemic shutdown, a plan was developed to re- start operations with a strategy limiting mining and development activities to the Lupita (including Lupita Extension) and Diluvio zones. This realignment recognizes the need to optimize Mercedes’ production to its current reserve base rather than its processing capacity.

- RDM NSR royalty: Equinox Gold temporarily suspended mining activities in response to COVID-19 at RDM from March 23 to April 2, 2020. The mine has been operating normally since April 3, 2020. Expansion capital of $17 million relates almost entirely to open-pit expansion and capitalized stripping.

- Gualcamayo NSR royalty: In response to the COVID-19 pandemic and following the restrictions from the Argentina Government, mining operations were stopped between March 20 and April 3, keeping activities on the leaching processes and processing plant. On April 3, mining was added to essential activities and the Gualcamayo operations were normalized.

- Woodlawn silver stream: In response to the COVID-19 pandemic and following the restrictions imposed by the Australian Federal and State Governments on March 24, 2020, Woodlawn mine was placed on care and maintenance and has yet to resume operations. Prior to the shutdown, Woodland mine shipped a total of 5,368 dry metric tonnes (“dmt”) of zinc concentrate and 1,796 dmt of copper concentrate.

- Troilus NSR royalty: On July 28, Troilus Gold Corporation reported a new mineral resource estimate of 4.96 million indicated gold equivalent (“AuEq”) ounces and 3.15 million inferred AuEq ounces.

Nomad’s royalty and stream revenues are converted to gold equivalent ounces (“GEOs”) by dividing the gold royalty and stream revenues for a specific period by the average realized gold price per ounce for the same respective period.

Silver earned from royalty and stream agreements are converted to gold equivalent ounces by multiplying the silver ounces by the average silver price for the period and dividing by the average gold price for the period.

“The royalty space is a world Metcalfe, Plante, and Lévesque [Nomad management] know well,” stated Greg Nolan, “This team has vision. And they think like owners. They’re committed to low G&A. Compensation will be linked to share price performance”.

“Management negotiated these royalty and streaming portfolio’s in a low gold price environment ($1,475 Au),” added Nolan, “Their timing couldn’t have been better”.

Gold is currently trading at USD $2,046.

On the 7th day – after the August 7, 2020 financials – Nomad shareholders rested easy.

– Lukas Kane

Full Disclosure: Nomad Royalty is an Equity Guru marketing client.

Leave a Reply