E-sports stocks are, by and large, a silly thing right now, with a lot of folks bringing out deals that make little sense financially. As with the psychedelic space, the blockchain world, and the early days of the cannabis sector, most investors are less concerned about long term viability as they are not missing a trend.

- E-sports teams? Money-losers for the most part.

- E-sports events? Money-losers for the most part.

- E-sports games? The big guys are already big.

- E-sports streaming? Even Microsoft gave up trying to beat the big boys in this space.

High performance event hosting and e-sports gambling have potential (what’s up AMPD.C and FANS.C), but in the The Gaming Stadium concept, TGS E-Sports (TGS.V) has come public with a business model that literally puts bums on seats.

Or at least it did, until COVID-19 happened.

Before the world got sick, I’d been to the Richmond BC-based Gaming Stadium several times, mostly to pick up my kid who was finding a crowd he really liked and an inviting, respectable atmosphere by those in charge, as he took part in regular Rainbow Six and Fortnite tourneys.

You don’t know this because you’re not 15, but there’s been a proliferation of gaming venues over the last year in Canada, mostly refurbished VR arcades and the occasional pool hall or bubble tea house, making a conceptual switch from a ‘nice little earner’ to a ‘nice bigger earner.’

If that sounds like the modern day incarnation of a pool hall or video arcade, you’re not far off (and giving up your age), but usually these places are small, cliquey, and they’re not going to go out of their way to make sure your kid doesn’t get themselves in trouble.

TGS is different. After school e-sports training academies and birthday parties are part of the business model, as are nightly events that, at least pre-pandemic, were drawing kids from across the Lower Mainland into Richmond.

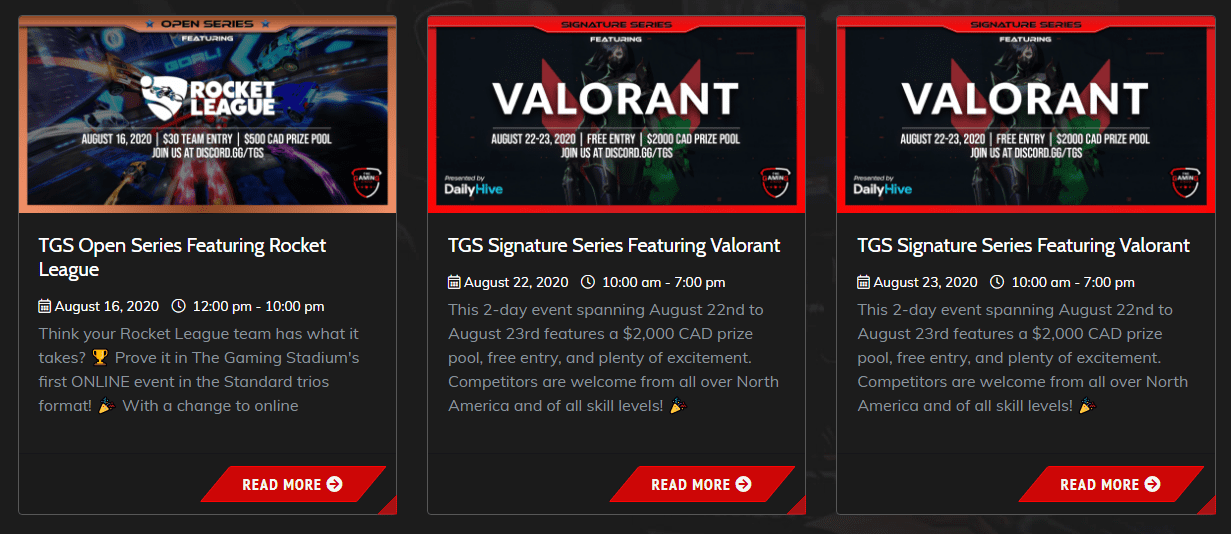

Post-pandemic, they’re keeping things going running online tournaments and, truth be told, the COVID closures likely gave them the breathing room they need to get ready for the public listing.

Going forward, the plan is to open more facilities across Canada, into the US, and South America, as safety allows.

Why? Because it’s next, fam.

Epic Games, publisher of Fortnite, just raised $1.8 billion. Livestreaming platform Caffeine just raised $118 million at a $600 million valuation. And e-sports gambling play Luckbox just raised $5 million as it looms on the public markets.

- If you could have bought into a video game arcade rollup in the 1980’s, you’d have jumped at it.

- If you could have bought a cafe rollup called Starbucks in the 1990’s, you’d have jumped at it.

Gaming stadiums are here to stay, and the draw of being able to play with like-minded friends, on the fastest gaming rigs available, all night without mom asking you to take the trash out – that’s appealing for a lot of kids – and a lot of adults like me, who’ve been gaming since the days of Pong and can still fuck your shit up at Rocket League, thanks very much.

The chart doesn’t show much because it’s a few days old.

But the market cap, as of now, is a more than reasonable $15 million. The company raised north of $1.5 million going public and was oversubscribed on that raise, so there’s interest out there, especially from a Hong Kong based investment company that took up 28% of the company stock.

Don’t expect bricks and mortar to be a place where TGS spends a lot of money in the immediate future, as social distancing remains in effect, but if the company can build a national reputation in online tournaments in the short term, that’s not a bad Plan B for a while.

I’m watching the share price and buying on dips.

— Chris Parry

FULL DISCLOSURE: The author owns stock in TGS E-Sports.

Leave a Reply