Back in October of 2019, I penned the following concerning gold and the companies that make the metal their business:

In times of rampant currency debasement, geopolitical uncertainty (twitchy chest-puffing politicians instigating trade wars via Twitter), gold belongs in a balanced portfolio in order to reduce risk.

Not only is gold a great hedge against uncertainty, when the uptrend is locked in, the price trajectory can be spectacular, particularly in the stocks of companies that mine, develop and explore for the stuff.

Currently, the average dart tossing Shmoe is waaaay under-weighted in gold. This represents an intriguing setup for those having the foresight to position themselves early, especially considering the fact that the combined value of every gold mining company on the planet is far less than the current market cap of Apple (AAPL.NAS). Think about that for a moment.

If all of a sudden investors around the globe decide to add gold to their portfolio as a hedge, the run-up in mining equities would be epic. Even if only a fraction of investors shifted, say, 5% of their portfolio into gold, it would be like “trying to push the contents of Hoover Dam through a garden hose,” to quote Doug Casey. That’s how tiny the gold universe is.

It was inevitable that Warren Buffet’s recent sudden U-turn in gold would generate innumerable bullish “it’s game on” headlines.

I’ve quoted all kinds of gold-related blather in the past. The following is classic Buffet:

“Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

Well crafted.

I could sorta see where he was coming from, especially considering the digital age we live.

But gold has no utility? This one was a bit of a head-scratcher as the metal has been recognized as a medium of exchange for thousands of years.

Archaeologists discovered gold flakes in Palaeolithic caves dating back as far as 40,000 BC.

Gold’s official role as a currency began in 643 B.C., in Lydia (present-day Turkey) after the Lydian’s stumbled upon a way to separate gold from other metals, creating the first solid gold coin.

It has no utility?

Gold is probably the ultimate safe-haven asset.

To quote Doug Casey:

It’s durable (almost indestructible – that’s why we don’t use food as money), divisible (each divided piece is valuable – that’s why we don’t use artwork as money), convenient (its unit value is very high – that’s why iron isn’t a good money), consistent (all .999 gold is identical – that’s why we don’t use real estate as money), and has value in and of itself (which is why we shouldn’t use paper as money). Just as important, governments can’t create gold out of thin air. It’s the only financial asset that’s not simultaneously someone else’s liability.

Moving along…

The following Cos on our client list generated news over the past week or so:

Defense Metals (DEFN.V)

I covered Defense’s most recent headline in the following piece published earlier this week:

An REE supply crunch and an undervalued development play—Defense Metals (DEFN.V)

Details regarding the most recent Flotation Pilot Plant results are all here, but the one consideration that stands out in my mind is something the market fails to grasp:

Getting back to the REE supply farce, on July 27th, Lynas Corp (LYC.AX) inked a deal with the US Department of Defense, one where the Pentagon will fund initial design work for a heavy rare earth separation facility in Texas.

This REE refining facility will be built in Texas… to process material from an REE deposit 16,600 kilometers away, in Western Australia (Lynas’ flagship Mount Weld deposit).

With China’s grip on the global REE refining market, this stratagem exemplifies just how precarious the REE supply chain truly is.

The Efficient Market Hypothesis holds no sway in the junior exploration arena—zip zero nada.

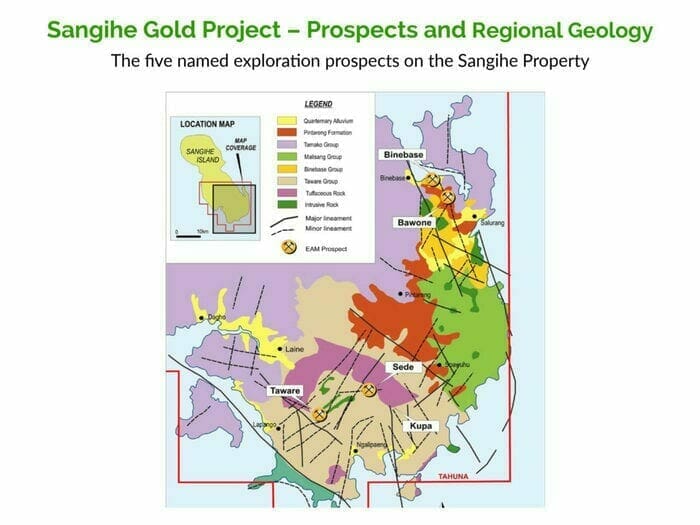

Today’s update out of the EAS camp created excitement among those following this asset-rich gold play in mining-friendly Indonesia. Investors are becoming increasingly confident that CEO Terry Filbert will begin breaking ground at the Sangihe Gold project by year-end.

East Asia’s flagship Sangihe Gold Project—two blocks covering 42,000 hectares of highly prospective terra firma—is in the very final stages of the permitting process.

Project Highlights:

- 266,000 oz Au including near-surface oxides for near-term production cash flow;

- Covers 42,000 ha including the Bawone and Binebase Prospects;

- Sede Zone One, with sample grades of 13.4, 15.0 and 42.6g/t Au;

- Sede Zone Two, with sample grades of 7.78, 11.2 and 16.0g/t Au;

- Kupa, Southeast of Sede, returned sample grades of 122.0, 82.4 and 73.8 g/t Au;

- East Asia has a 70% working interest

In today’s update (August 20)…

East Asia Minerals Announces Survey Contract for Land Acquisition & Meeting Date for AMDAL

… we learned that the necessary steps required to update the AMDAL—THE (drum roll) final environmental assessment study—are complete and that the relevant government and community authorities will have their meeting on August 28, 2020.

Delays in scheduling the meeting were due to the new COVID-19 quarantine requirements and a week of Indonesian government holidays.

After approval of the AMDAL, the Company intends to apply for an upgrade of the license to 30-year operation production status and complete the acquisition of the construction financing.

Also, in this press release, the company announced the purchase of additional land in the area to facilitate production and has retained Martin Jati Lawyers to speed the process along.

The services provided will include, preparation of working maps based on definitive coordinates of the Concession Area; conducting orientation survey to the mining area; conducting temporary poles establishment for the mining area; conducting land inventory for crops, trees, any vegetation, and survey for the appropriate pricing for the land, crops, trees and vegetation that will be compensated within the mining area; mapping of land use, https://equity.guru/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative, occupants, and land price estimation within the Concession Area; preparing a progress report, the final report, and recommendations based on the preliminary land survey; verify the Concession Area to determine legal standings of prospective participants of the land release program; providing assistance with land release program socialization; collection and verification of personal data and land documents provided by prospective participants; providing assistance during negotiation; preparation of the land release documentation and coordination with https://equity.guru/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative village officers of land offices’; providing assistance to facilitating payments based on completion of land release documents through cash or bank transfers; and delivery of land acquisition documents and maps.

We’ll have plenty more to discuss regarding this highly leveraged gold play later this month or early next. Stay tuned.

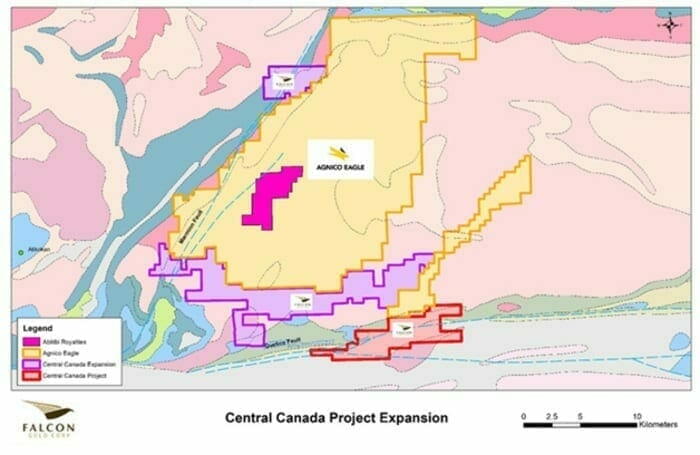

Falcon Gold dropped two noteworthy headlines over the past week. The first covered assays retrieved from the second hole from the company’s 10,392-hectare flagship Central Canada Gold project:

I would characterize assays from this 2nd hole as encouraging—not exactly out-of-the-park home runs.

The company has another five holes to report from this modest drilling campaign.

Equity Guru’s Lukas Kane offered his take on these assays via the following Guru offering:

Falcon Gold (FG.V) releases strong results from 2nd drill hole in Ontario

The next headline was delivered on August 18th:

Here, we have additional surface sample assays from a project located in a well-established mining jurisdiction.

Company geologists believe they may be on to a low sulphidation epithermal deposit, which, if confirmed, could yield considerable exploration upside.

To supplement the recent gold assay results averaging 59.8 g/t Au over 2.2 meters which included a 1 m interval assaying 122 g/t Au (Press Release dated August 4th, 2020) Company geologists collected representative rock samples and completed geological mapping throughout the project area. The results from this campaign indicated 3 target areas of highly prospective low-sulphidation epithermal gold mineralization and potential feeder zones. Additional copper and silver targets were discovered where sampling returned up to 0.61% copper and 10-13 g/t silver.

The company intends to complete a round of geophysics on the property to determine the scale of alteration with a goal of defining high-priority drill targets.

A round of geochemical surveys—soil and rock sampling—is now underway to further define high priority targets.

Karim Rayani, Falcon CEO:

“We are greatly excited to see the project grow from an underexplored volcanic terrain in which only high-grade gold was exploited at surface into a potential large scale precious and base metal bearing discovery. We believe the types and high grades of the Spitfire-Sunny Boy zones conform to a low sulphidation epithermal deposit model that could host world-class mining intercepts. We are taking the necessary steps to completely understand the area and our geological team has been working diligently to fully understand the discovery and provide reliable targets for drilling this year.”

Golden Lake is currently drilling its highly prospective Jewel Ridge Project located at the south end of Nevada’s prolific Battle Mountain—Eureka trend.

“The deposit types of interest at Jewel Ridge are Carlin-type, sedimentary rock-hosted, gold deposits and carbonate replacement deposits. Carlin-type deposits include many deposits that occur in the Battle Mountain-Eureka Trend, Carlin Trend and other well-known mineral trends in north-central Nevada. Jewel Ridge is located adjacent to, and south of, the former Ruby Hill gold property, which was operated by Homestake Mining Company from 1997 until 2002 and produced about 680,000 ounces of gold from the Archimedes open pit. In February 2007, Barrick Gold Corp. commenced production on a 1.1-million-ounce gold resource from the adjoining East Archimedes deposit. From 1976–2012, production from these Carlin-type deposits in the Eureka district was approximately 44.9 tonnes (1.38 million ounces) of gold.”

On August 13th, the company offered the following update:

Jewel Ridge Property Drill Program Update Jewel Ridge Gold Property, Eureka, NV

Golden Lake is in the midst of a phase-one 1,500 meter RC drilling campaign.

According to this press release, three holes on the Hamburg Mine target have been completed for a total of 549 meters.

The drill was subsequently moved 1.5 kilometers to the northwest to patented claims on the South Eureka Tunnel target area. Drilling will continue on this target for the remainder of the program (roughly 1,000 meters).

Note the following historic drill results at South Eureka:

This August 13th press release went on to state the following regarding a planned follow-up program, one designed to complement this phase-one campaign:

“The Company is also pleased to announce that EM Strategies has been retained to lead the Company’s permitting of a Phase 2 drill program on additional targets on Federal Bureau of Land Management (BLM) claims on the Jewel Ridge property. EM Strategies, based in Reno and Elko, specialize in third party and proponent work with the BLM, US Forest Service (USFS), state and county governments to provide permit acquisition and regulatory compliance services.”

This just in:

Hole JR-20-05, the second hole on the South Eureka Tunnel target, intersected a significant width of oxide mineralization at depths that have never been probed historically.

This oxide material was encountered at 183 meters but the hole was lost at 206 meters, bottoming out in mineralization.

Deeper we go…

The occurrence of alteration and strong oxidization at these depths on the South Eureka Tunnel target represents a new target that will require additional drilling. The deepest previous hole on this target was drilled in the 1980s to a depth of 340 ft (104 m). The Company is proposing to deepen two of its planned holes of this Phase 1 program to test the deep oxide target.

The Company is negotiating with the drill contractor for a return to the Jewel Ridge property for a Phase 2 drill program. As part of this planned program, the Company will make necessary site preparations to allow the drilling of deeper holes (230 to 275 meters depth) to test the new deep oxide target.

This is the kind of development that could really move the needle for Golden Lake.

A potential analog…

The Ruby Hill mine further to the north has a deep sulphide zone—the Ruby Deeps—with grades in the range of 6.5 g/t Au.

How can you not be romantic about the pursuit of buried treasure?

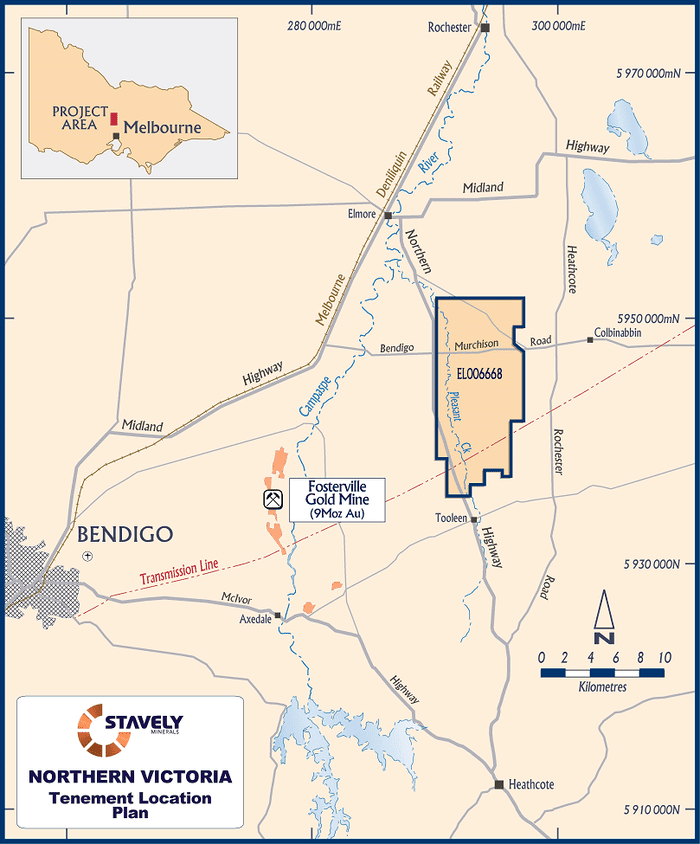

Nubian’s first foray into Australia was via the acquisition of the Yandoit Gold Project, a 38 square kilometer chunk of highly prospective terrain along the prolific Bendigo Structural Zone, some 70 kilometers southwest of the Fosterville Gold Mine operated Kirkland Lake (KL.T), the world’s highest grade-lowest cost gold mine.

The Bendingo Structural Zone accounts for > 60 million ounces of production:

- Bendingo – 22 million ounces at 15 g/t Au (historic production);

- Ballarat – 14 million ounces at 12 g/t Au (historic production);

- Fosterville – 6 million ounces at 7.9 g/t Au (current production).

In 2019, Fosterville produced 619,366 ounces of gold at an average grade of 39.6 g/t Au, with the Fosterville Mill achieving a record average recovery rate of 98.8%.

Yandoit is an advanced stage project.

A more recent acquisition—the 82 km2 Fosterville East project—positions Nubian within 10 kilometers of the world-class 9 million-ounce Fosterville Gold Mine. The company also gained a pair of projects in northeast Tasmania—Lefroy and Mathinna—via the same transaction.

My maiden article on July 17th captures the details of these significant acquisitions:

Nubian Resources (NBR.V) sets its sights on high-grade Australian gold

These acquisitions piqued the interest of one Eric Sprott—a Cdn billionaire investor with a serious appetite for high-quality mining assets (Sprott has a sizeable interest in Kirkland Lake).

Sprott just took down a $4.2M position in Nubian, the deal closed today (August 20th).

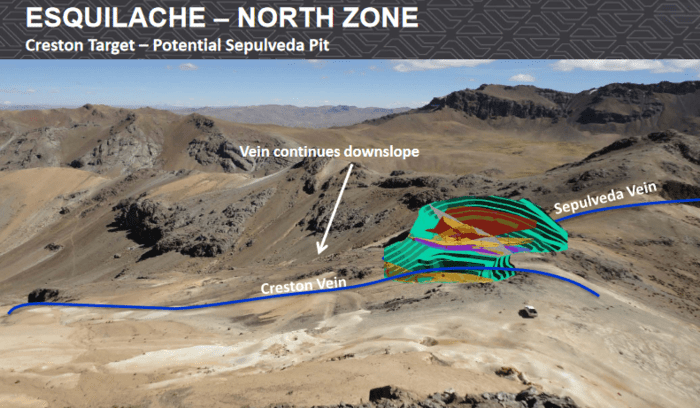

On August 18th, the company dropped the following headline regarding a medium to high-grade silver play in South America:

Nubian accelerates its ownership in the Esquilache Silver Project, Peru

The Esquilache Silver Project includes the historical Esquilache underground silver mine and adjacent Virgen de Chapi prospect located in Southern Peru.

This 1,600-hectare project features three main zones—Sepulvada, Creston, and Mamacocha—where more than 200 mineralized veins and breccia pipes have been mapped.

Located 28 kilometers east of Buenaventura’s San Gabriel Gold / Silver deposit, historic Esquilache drill results include 24.2 meters of 131 g/t silver, 0.4 g/t gold (including 8.1 meters of 292 g/t silver, 0.73 g/t gold).

The project was last mined by Hochschild Mining in the early 1960’s and 70’s where historical reports mark past production at approximately one million tonnes grading 3.4 oz silver, 4.8% zinc, 3.2% lead, and 0.3% copper.

According to this press release, Nubian succeeded in negotiating and advancing a final project payment and is now able to register its 100% ownership with the Peruvian Department of Mines. This will allow the company to accelerate development through further drilling and engineering. This 100% ownership also clears a path for Nubian to apply for a mine permit and firm up agreements with the local communities.

Richard Brown, Nubian’s South American Manager:

“We are very pleased to have accelerated this purchase and we’re looking forward to commencing community and development work on our high grade, near surface, drill ready Project. With the upward trend in silver prices in the recent months and Nubian now well-funded, the Company is now well positioned to advance the Esquilache Silver Project along with its other projects.”

On August 18th, Nexus announced initial diamond drill hole assays from its McKenzie Gold Project in the Red Lake mining camp of Ontario.

The headline number represents a solid hit. Equity Guru’s Lukas Kane covered the news event via the following article:

Nexus Gold (NXS.V) hits 13.25 grams/tonne over 2.75 meters at McKenzie Gold Project in Ontario

Quoting Kane from the above article:

“The Ontario drill results published on August 18, 2020 are encouraging. The market will now be looking for consistency in intercept widths and grades.

Results from the remaining seven holes (1,200 meters) of the current drill program at McKenzie Gold Project drill program are expected later this month.”

If I’m not mistaken, we should see a drill rig mobilized to the company’s Dakouli II project in Burkina Faso in the coming weeks.

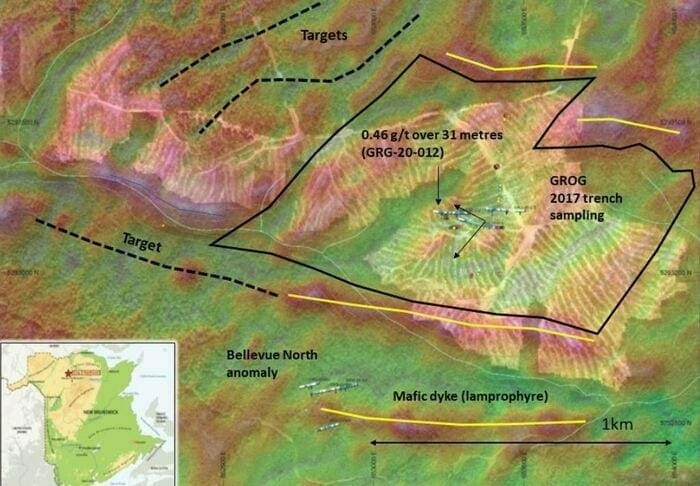

On August 10th, X-Terra announced the completion of a soil sampling campaign at their Grog property in Restigouche County, New Brunswick.

X-Terra Resources completes geochemical sampling program at the Grog target

The company continues to use good science, stacking geological data—both geochemical and geophysical— ahead of the next round of drilling.

A detailed ground-based IP survey was launched last week to further prioritize targets for a phase-two drilling campaign scheduled for Q4 of 2020.

To date, the Grog area has only been tested by three diamond drill holes totaling 600 meters drilled on one section. The gold bearing structure was intersected by hole GRG-20-012 with a result of 0.46 g/t over 31 meters. Geological interpretation and the geophysical signature of the Grog area identified targets which are parallel to the GRG-20-012 discovery. The exploration footprint of the Grog system corresponds to an area extending approximately 2 kilometers following an east-west trend.

Grog is located in close proximity to the Bathurst Mining Camp in the Northern Appalachian Belt.

The analog for the Grog project is the producing Haile gold deposit located in South Carolina (currently operated by OceanaGold (OGC.T)).

Haile—4.22 million ounces in all resource categories—presents a number of similarities which serve as a geological model for the target at Grog.

Michael Ferreira, X-Terra CEO:

“Since the COVID pandemic began in March, we have been preparing to move the Grog project forward towards the second phase of drilling which will allow us to finally follow up on the initial discovery made earlier this year. The soil geochemistry and pending IP survey are concentrated to validate targets that have already been identified throughout our exhaustive compilation and our 3D magnetic modeling.”

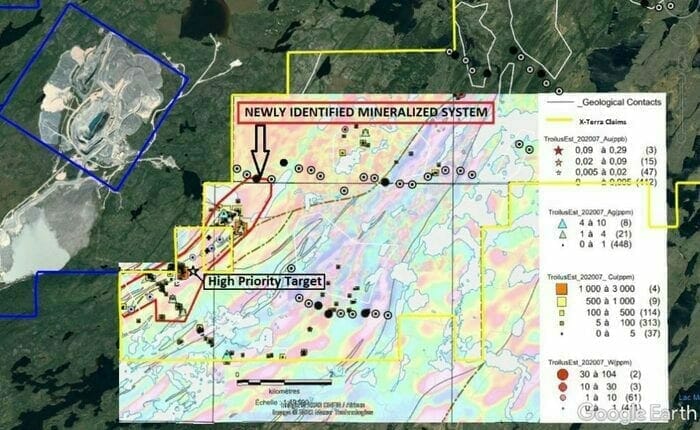

More recently, on August 13th, X-Terra announced the discovery of a new mineralized zone at their Troilus East project, located along the Frotet-Evans greenstone belt in Northern Québec.

X-Terra Resources identifies a new mineralized system at Troilus East

Troilus East shares a common border with Troilus Gold’s (TLG.T) Troilus Gold-Copper project which boasts a current resource of 8.11 million gold equivalent ounces (AuEq)—4.96 million ounces of Indicated AuEq and 3.15 million ounces of Inferred AuEq.

As per the August 13th press release:

The newly identified “Smoke” showing is located in the southwest portion of the property three kilometres directly south east of the former Troilus open pit. The new system identified covers a strike length of approximately 2.2 kilometres where polymetallic sulfides were sampled. X-Terra noted that sporadic samples over this area returned copper grades up to 0.25% Cu, silver grades up to 8.0 g/t Ag, zinc grades up to 0.7% Zn and 0.11 g/t Au, or 0.42g/t AuEq.

CEO Ferreira again:

“Being able to define gold, silver and copper mineralization with varied geological features consistent with the Troilus deposit is a remarkable achievement from the first prospecting program. Considering that the cut-off grade of the Troilus Gold resource calculation is 0.30 g/t AuEq (see Troilus Gold press release dated July 28, 2020), the X-Terra exploration team considers these results more than encouraging as we advance towards the next step of exploration. In addition, the mineralized system identified correlates to a series of historical electromagnetic anomalies that have never been drill tested. The teams have already begun planning the next phase of work which should commence shortly.”

Expect steady newsflow out of X-Terra over the balance of 2020.

END

—Greg Nolan

Full disclosure: we have a marketing relationship with all of the companies featured above.

Leave a Reply