Mexico is currently ranked the 9th largest gold producer and THE largest silver producing nation on the planet.

The country is mining-friendly. Where it can take up to a decade to get the green light to break ground in other jurisdictions, it can take as little as a year in Mexico.

Canadian juniors represent 75% of mining sector investment in the country and will likely boast the vast majority of significant new discoveries.

Speaking of discoveries, Vizsla Resources (VZLA.V) made headlines when it dropped the following drill hole assays from its Panuco Project in Sinaloa State on June 24th:

- 1,544 g/t silver equivalent {AgEq} (738.9 g/t silver and 11.06 g/t gold over 8.2 meters from 108.6 meters, including 3,348 g/t silver equivalent (1,527.5 g/t silver and 24.9 g/t gold) over 2.0 meters from 108.6 meters;

- 1,133 g/t AgEq (453.8 g/t silver and 9.20 g/t gold) over 2.5 meters from 76.0 meters, and…

- 905 g/t AgEq (309.3 g/t silver and 8.00 g/t gold), 2.22% lead and 4.75% zinc over 5.1 meters from 102.4 meters, including 1,375 g/t AgEq (186.3 g/t silver and 15.63 g/t gold), 1.12% lead and 7.73% zinc over 1.8 meters from 103.5 meters.

Solid hits, these.

A couple weeks later, Vizsla wowed the crowd with the following highlight intercept…

- 8,078 g/t AgEq (1,808.2 g/t silver, 66.8 g/t gold, 2.99% lead and 3.30 % zinc) over 6.0 meters from 69.0 meters, including 12,992 g/t AgEq (2,889.2 g/t silver, 107.9 g/t gold, 4.80% lead and 4.56 % zinc) over 3.7 meters from 69.5 meters, including 21,034 g/t AgEq (2,240.0 g/t silver, 199.0 g/t gold, 12.85% lead and 3.27% zinc) over 0.85 meters from 72.35 meters.

Vizsla went on a tear.

This is the kind of price trajectory we’re all looking for in the junior arena…

In the same region, GR Silver (GRSL.V) announced a high-grade discovery at its Plomosas Silver Project on June 22nd:

- 1,235 gpt Ag over 11.0 meters, including 2,600 gpt Ag over 2.3 meters and 4,209 gpt Ag over 1.7 meters;

- 1,469 gpt Ag over 3.7 meters, including 2,827 gpt Ag over 1.8 meters;

- 3.6 gpt Au over 23.9 meters, including 43 gpt Au over 1 meter.

In subsequent weeks, it tabled the following assays…

- 1,723 gpt AgEq over 2.7 meters (15.1 gpt Au, 45 gpt Ag, 3.1% Pb and 0.9% Zn) including 5,055 gpt AgEq over 0.9 meters (46.9 gpt Au, 76 gpt Ag, 3.3% Pb and 2.2% Zn);

- 1,112 gpt AgEq1 over 5.4 meters (1,096 gpt Ag, 0.3% Pb and 0.2% Zn) including 2,498 gpt AgEq over 2.0 meters (2,484 gpt Ag, 0.7% Pb and 0.3% Zn).

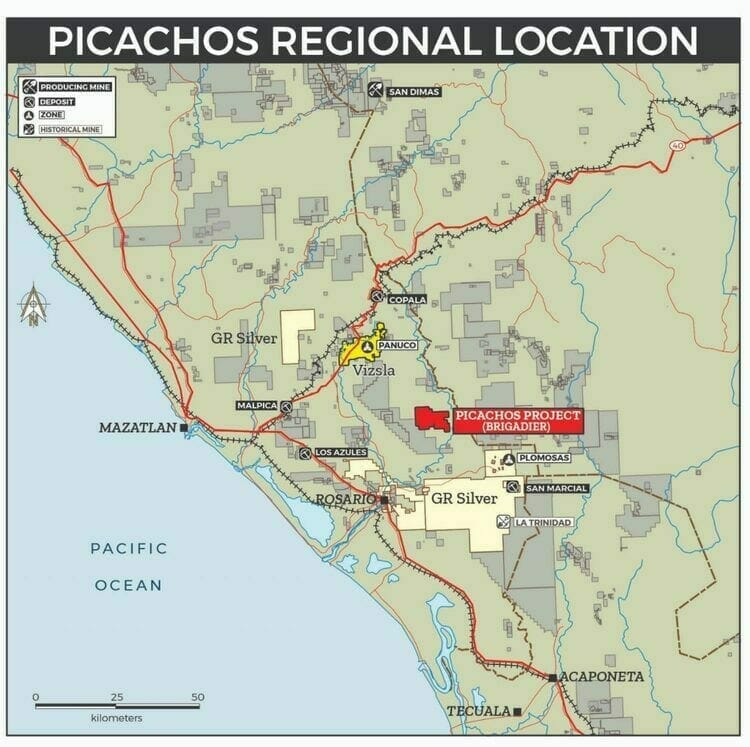

In a remarkably well timed push, Brigadier Gold (BRG.V) secured a project in the region—the 3,954 hectare Picachos Gold-Silver Property—just as these two discoveries came to light.

Brigadier is flanked on both ends, to the northwest and southeast, by Vizsla and JR.

Note Picachos’ location on the map below (note the scale)…

Brigadier’s entry into the fray involves more than mere closeology—it’s positioned on-trend, and in a similar geological setting to both discoveries.

With Vizsla and GR’s results to date, this is shaping up to be a productive mineral belt.

Brigadier’s July 7th Picachos acquisition headline:

Project Highlights:

- Located in the Sierra Madre Occidental (SMO) Baluarte watershed, between the Panuco Project of Vizsla Resources and the Plomosas Project of GR Silver Mining;

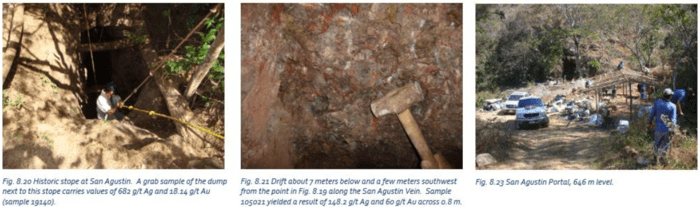

- San Agustin Mine underground channel sampling by prior operator returned average grade of 81.22 g/t gold and 73.36 g/t silver across 1.2 meters (Thunderbird Projects news release dated 18 June 1997);

- Values of 185 g/t Au were cut across the bottom of a production shaft (sample HBM-73175). The San Agustin vein has never been tested with diamond drilling;

- More than 160 known historic underground mines, workings and prospects at Picachos are on gold-rich veins;

- Recently identified, large copper porphyry prospect in northern area of Picachos;

- Drill / exploration permits are in place as well as recently renewed surface access agreement with local community.

The Picachos property has production history. The San Agustin mine has roughly 670 meters of historic underground development.

The historic workings range from shallow pits measuring a few meters across to tunnels hundreds of meters long, driven at several levels on some of the larger vein systems.

In the mid-1990s, previous owner Minas de Picacho S.A. de C.V. began mining and milling ore—their underground sampling implied an average grade of 81.2 g/t Au and 73 g/t Ag across 1.2 meters.

Two decades later, in June of 2014, Vane Minerals test mined three rounds from San Agustin’s south face. “The average assay values of muck piles from each of these three rounds were 15.8 g/t Au and 63 g/t Ag across a mined width of 2.5 meters.”

Vale achieved very decent recovery rates during its short run—90% plus recoveries—using simple gravity, flotation, and cyanidation.

“The San Agustin Gold Mine exploits a gold-rich shear zone hosted in basaltic andesite that may be as old as Jurassic. Mineralization consists of sulfide in a quartz-calcite gangue. It is heavily oxidized even as deep as 100 meters below surface. The shear zone trends northeasterly and dips steeply northwesterly. On surface, quartz veining occurs in a foliated zone that is poorly exposed over a 400 meters strike length. Extraction adits intercept the vein at 695 meters elevation, 670 meters elevation, and 646 meters elevation. Within the lowermost adit, some slots are mined as deep as 45 meters (601 meters elevation).”

The operator and vendor of Picachos is one Michelle Robinson.

Robinson is a member of working groups organized by the Mexican Mining Chamber (CAMIMEX), speaks fluent Spanish and English, and is a Qualified Person as defined by NI 43-101. She has authored more than 20 technical reports and has published several papers for the Society of Economic Geologists. She won First Prize in both the Graduate and Undergraduate categories from the Society for Mining, Metallurgy and Exploration in 1994 and 1995. She is a member of the Association of Professional Engineers and Geoscientists of British Columbia; a Core Member of the Prospectors and Developers Association of Canada; a Fellow of the Society of Economic Geologists; a Member of the Geological Society of America; and a Member of the Asociación de Ingenieros de Minas, Metalurgistas y Geólogos de México, Asociación Civil.

To say that Robinson knows her Picachos rocks would be an understatement. She’s held the project for a solid decade and is well aware of what may ultimately lie within its subsurface layers.

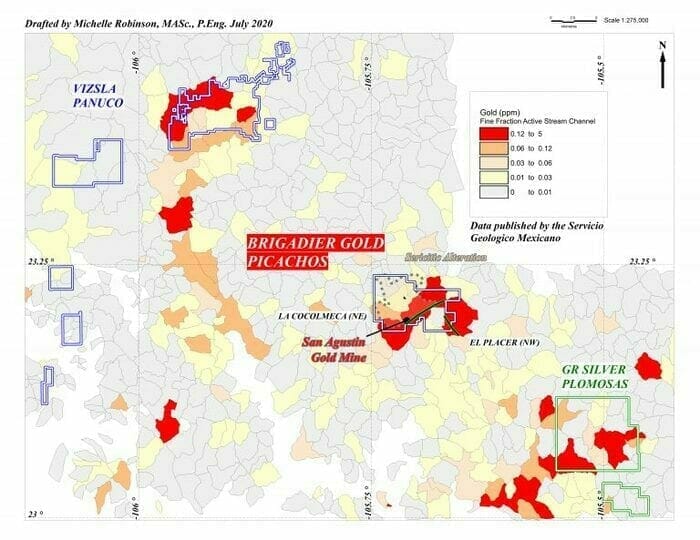

It states on Brigadier’s corp presentation (slide 6) that the Picachos project “overlaps one of the largest, most contiguous and highest amplitude anomalies for gold, silver, and base metals in the Western Sierra Madre.”

When I asked Robinson to amplify the significance of this anomaly, she stated:

“Specifically, all seventeen drainage basins that underlie the Picachos Property contain anomalous copper values of 49 to 299 ppm, nine basins contain anomalous gold values of 0.1 to 2.6 ppm, 3 basins contain anomalous molybdenum values of 3.2 to 13.9 ppm, fifteen basins contain anomalous lead values ranging from 53 to 639 ppm, and eight basins contain anomalous zinc values that range between 233 and 1716 ppm. Nine of the seventeen basins contain detectable silver ranging from 1 to 1.9 ppm. Collectively, this anomaly is 8232 hectares in size.

For comparison, the anomaly that underlies Vizsla’s Panuco Project is defined by maximum values of 97 ppm copper, 0.4 ppm gold, 5.3 ppm molybdenum, 219 ppm lead, 366 ppm zinc and 12.6 ppm silver in fourteen basins. The anomaly under GR Silver’s Plomosas Project has maximum values of 134 ppm copper, 0.7 ppm gold, 1.3 ppm molybdenum, 1078 ppm lead, 1580 ppm zinc and 10.8 ppm silver in twenty-eight basin.”

Prepping to drill

The company didn’t waste any time teeing-up Picachos for its first-ever diamond drilling campaign.

On August 13th, Brigadier dropped the following headline:

A 40 hole, 5,000-meter program is expected to commence within the next week or two. Heavy equipment has been mobilized to the project. Drilling sites are being prepped.

Though there is a porphyry target along the northern reaches of the property, the focus of this phase-one campaign will be four high-grade (gold-silver) veins.

Drill Targets (as per the above press release):

- San Agustin mine: underground channel sampling by prior operator returned average grade of 81.22 grams per ton (g/t) gold (Au) and 73.36 g/t silver (Ag) across 1.2 meters (Thunderbird Projects news release dated 18 June 1997). Values of 185 g/t Au were cut across the bottom of a production shaft (sample HBM-73175);

- Mochomos vein: historic rock chip-channel (sample 26409) yielded a result of 18.5 g/t Au and 570 g/t Ag across approximately 0.5 meters;

- Los Tejones vein with values of 28.6 g/t Au, and 114 g/t Ag across approximately a meter (historic rock chip-channel sample 17873);

- Fermin vein with values of 268 ppm Ag and 0.3 g/t Au across 1 meter.

Though the company already has multiple high-priority drill targets in its crosshairs, they’re currently trenching and systematically sampling several veins and associated geochemical anomalies to further refine their drilling plans.

In many cases, the vein structures are already well-understood from the underground workings—drilling will give them a better geochemical profile across the full width of each vein system.

The company’s 3D model suggests a potential gold-rich resource under the San Agustin mine itself—this target will see the first probe with the drill bit.

As stated above, the Los Tejones and Mochomos targets will also see drilling. The drill holes will range from 90 meters to 300 meters in length.

San Agustín is the best understood of these veins, mainly because it has been historically exposed underground by approximately 670 line meters of tunnels, stopes and shafts. Geologically, it appears to be disrupted by the NW trending Genardo Fault. On the northeast side of the fault, the Tejones veins might correlate to San Agustín. Collectively, this first round of drilling is designed to test approximately 1 kilometer of vein strike between the past-producing San Agustín Mine and the Tejones Prospects.

Michelle Robinson:

“Geologically, we think the San Agustín Vein is displaced on the late northwesterly-trending Don Genardo Fault, and daylights again as an ore chute in the Tejones Prospect area about 800 meters northeast of the Mine.”

To gain a broader understanding of the geological setting (porphyry as well as the veins structures), Brigadier is considering a helicopter airborne geophysical survey followed up by ground geophysical surveys.

Robinson again:

“Specifically, a helicopter airborne magnetic survey flown at 50 meter line spacing is planned. At the same time, radiometrics and very-low frequency electromagnetics will be surveyed. The magnetic data will identify plutonic complexes related to the porphyry, as well as areas of magnetite metasomatism that might reflect potassic alteration zones associated with the porphyry. The radiometric survey will help identify minerals with potassium such as potash feldspar, biotite and muscovite, all minerals that are in porphyry-style veinsand veinlets. The VLF survey will help identify conductive zones that might contain anomalous clay or sulfide concentrations. Ground geophysical surveys, probably induced polarization and resistivity, will be designed based on the airborne response and the alteration model.”

This is a good example of data stacking—using good science (geochemical and geophysical) to establish the deepest levels of correlation to zero in on the highest priority targets.

Ranjeet Sundher, Brigadier CEO:

“Brigadier’s multi-talented team has been able to identify and complete the Picachos acquisition, close $4.2 million in financings and initiate exploration on this compelling gold-silver target all within a 4-week period. We are fortunate that Brigadier’s core leadership now includes our partner Michelle Robinson who together with her team, residing in Sinaloa, are intimately familiar with Picachos, the local community, and how to shape a sustainable and beneficial presence in the region.”

Final thoughts

The company is about to kick off an aggressive drilling campaign.

A lot of eyes will be on this play.

Newsflow will be steady.

Vizsla, Brigadier’s neighbor to the north has a market cap of $135M. GR Silver, Brigadier’s neighbor to the south, has a market cap of $96M.

We’re now in a market that rewards success with the drill bit.

Brigadier has a market cap of < $18M based on its 56.3 million shares outstanding and recent $0.315 close.

END

—Greg Nolan

Full disclosure: Brigadier is an Equity Guru marketing client.

Leave a Reply