On September 1, 2020 Isracann (IPOT.C) updated IPOT shareholders on its activities in Israel.

“IPOT is Israel’s first pure-play cannabis firm to list in Canada,” wrote Equity Guru’s Chris Parry last summer when IPOT first got on our radar, “It is focused on becoming a premier, low-cost cannabis producer.”

IPOT recently acquired a 50% interest in a JV called Cannation, for a phased partnership of two near-term farm operations located in the Hefer Valley region of Israel.

The Cannation farm properties are Israel Medical Cannabis (IMC) compliant and designed to EU-GMP certification standards.

Only medical cannabis from EU-GMP certified facilities can be sold in the European Union.

Hefer Valley-based Ein Hahoresh Farm update:

- Post harvest facility expanded from to servicing the expected increased Israeli cannabis demand.

- Processing can now handle all product from the full 165,000 sq. ft. of greenhouse.

- Construction of the expanded facility is on-going with additional foundation poured, the required walk-in safe installed; expected completion date: 4-6 weeks.

- Offtake partner committed to supplying seedlings, thereby reducing standard growing cycle by 2-4 weeks.

- Ministry of Security and Ministry of Health application for certification as foreign cannabis cultivation license owners has been submitted.

IPOT advises that due to COVID-19 some regulatory procedures have been re-jigged, delayed the planting of cannabis seeds.

The post-Covid-19 rules require that all physical facilities must be completed and approved prior to planting. Previously, only the greenhouse facility needed to be completed.

Isracann is confident this delay will prove “relatively insignificant”.

“Our construction team at Ein Hahoresh is moving ahead and even though timing delays due to the pandemic meant we were unable to take advantage of the previous regulations which would have allowed us to commence planting sooner,” stated Isracann COO Matt Chatterton, “our team has stepped up to minimize these delays.”

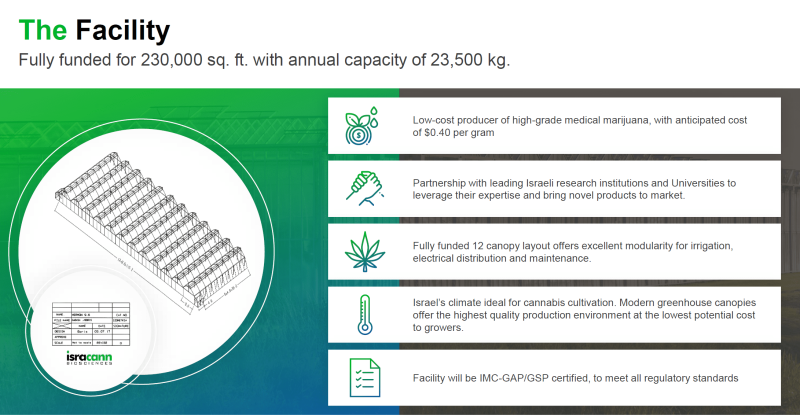

In addition to the JV, IPOT has an expected annual capacity of more than 23,000 kilograms from dried cannabis at its Cannisra farm with anticipated production costs of just $0.40 per gram-yielding attractive margins.

On August 31, 2020 The Tinley Beverage Co. (TNY.C) announced that the inaugural batches of its award-winning Tinley’s ’27 beverages have been produced at its new permanent facility in Long Beach, California.

The first batches of Tinley’s four cask-style cannabis-infused beverages have been produced and shipped to Shelf Life Distributing for distribution to dispensaries.

New product, Tinley ’27 Arabica Cask – real coffee bean extract, vanilla and Caribbean cask flavors, joins the existing lineup of Tinley’s™’27 products, which include Almond Cask, Cinnamon Cask and the award-winning Coconut Cask.

Tinley is restocking the dispensaries and online channels after depleted inventory of the prior generation products. Tinley gets paid when Shelf Life successfully completes sales to these dispensaries.

The next-generation batch of its expanded Tinley’s Tonics ready-to drink product line will include the new juniper and tonic-based “Juniper Sky™” and the grapefruit and agave-based “Flying Dove™” – in September.

Tinley Long Beach facility is located about 14 miles south of downtown Los Angeles, thereby positioning it within close proximity of North America’s largest beverage market, as well as the continent’s largest cannabis market.

In addition to the 12 new store trials in the US, TNY is completing the onboarding process for Walmart.com, Amazon.com, and for a Shopify-driven logistics platform.

According to financial documents posted on Sedar two days ago, Tinley booked modest sales of $34,747 for the three months ending June 30, 2020. Revenues were $208,000 for the six months ending June 30, 2020.

In a call with Equity Guru, Tinley CEO Jeff Maser addressed the small 3-month revenue number.

“Revenue is always choppy for new consumer products, especially beverages,” said Maser, “There are some delays in us being able to recognize revenue for infused products that shipped during the quarter too, which we don’t need to worry about for the non-infused.”

“We also reduced our cash burn to $200k, which is practically cash flow neutral,” continued Maser, “That should give people some confidence. We did run out of inventory because Long Beach took longer to commission than we thought it would when we shut down the prior bottling line, but obviously that won’t happen again given that Long Beach is already partially running and will be fully commissioned in 2 weeks”.

In this Equity Guru interview, Maser answers a series of “prickly” questions from the conflict-philic award winning journalist, Chris Parry.

Tinley’s future Canadian sales will be provided by Great North Distributors – the exclusive distributor for Aphria, Pasha Brands and other leading Canadian cannabis producers.

- Lukas Kane

Full Disclosure: Isracann and Tinley are Equity Guru marketing clients.

Leave a Reply