Two months ago, The Harris Poll and Yahoo Finance – part of the $246 billion Verizon Media (VZ.NYSE) – agreed to collaborate on a bi-weekly poll of investors, exploring different investing topics.

Headquartered in New York City, Verizon has 135,000 global employees, generating 2019 revenues of $132 billion.

“We understand the link between consumer sentiment and the market performance of brands,” stated Will Johnson, CEO of The Harris Poll. “We’re here to help Yahoo Finance readers see that link”.

Johnson speculated that the results of the polls could help investors “purchase a home, afford tuition for their children or launch a new business.”

According to the latest Yahoo-Harris poll published on Sept. 9, 2020 – an astonishing 43% of retail investors said they are “using options, margin, or both.”

Buying “on margin” means you are investing with borrowed money. This amplifies gains – and losses. If your account falls below the maintenance margin, your broker will start selling-off your portfolio.

Options investing is like regular investing, except there is a time-decay factor. You have to get the direction of the stock movement right – and it has to happen within a specified time-frame.

That’s a big constraint.

I owned gold stocks in 2013 – when they were almost worthless – but I stubbornly hung onto them until they became profitable.

That’s a luxury an options-trader does not have.

A put option is an option contract giving the owner the right, but not the obligation, to sell a specified amount of an underlying security at a specified price within a specified time frame.

This is the opposite of a call option, which gives the holder the right to buy an underlying security at a specified price, before the option expires.

Buying put option is like shorting a stock with a ticking clock in the background.

It’s not an easy game to win.

When options trading goes wrong, it can destroy lives.

On June 12, 2020 some shit went horribly wrong when a 20-year-old options trader opened his Robinhood app – saw a negative account balance of – $730,000 – and promptly killed himself.

Robinhood recently raised $280 million, valuing the company at $8 billion.

“We are personally devastated by this tragedy,” Vlad Tenev and Baiju Bhatt, Robinhood’s co-CEOs, assured everyone in a blog post, and then announced a whopping $250,000 donation to the American Foundation for Suicide Prevention.”

The donation was 1/32,000th of Robinhood’s valuation – so it’s like somebody worth a $100,000 sending a grieving mother a cheque for $3 for accidentally causing the death of their child.

Tenev and Bhatt considered the possibility that flogging options to newbie investors was unethical but after careful reflection, they decided – nah – everyone should have options.

“Twenty-three percent of respondents are just using options and 10% are just using margin,” confirmed Yahoo-Harris, “33% of people holding stock indicated they’ve been trading more since the pandemic began”.

Thirty-six percent of investors indicated they’ve increased the amount of stock exposure in their portfolio, since the pandemic began.

Respondents with household income less than $50,000 said they traded more frequently since the pandemic and had more stock exposure.

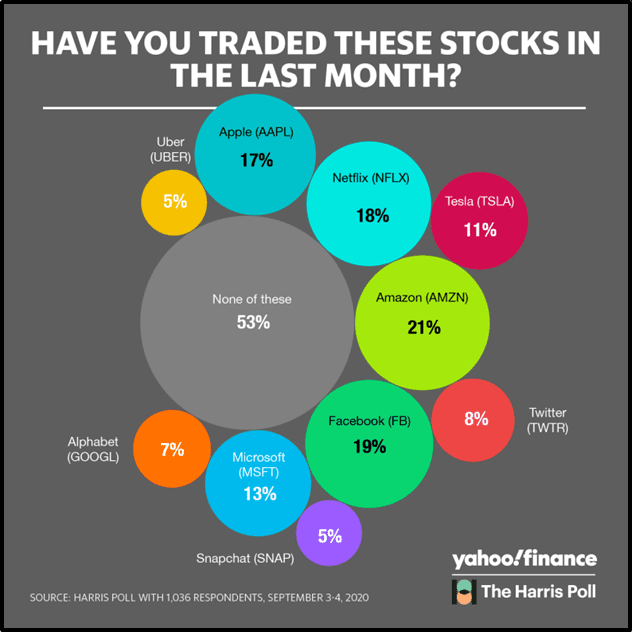

The Yahoo-Harris poll also revealed that pandemic-investors are piling into FAANG stocks.

“FAANG” is an acronym that refers to the stocks of five mega U.S. tech companies: Facebook (FB.Q), Amazon (AMZN.Q), Apple (AAPL.Q), Netflix (NFLX.Q); and Alphabet (GOOG.Q) – formerly known as Google.

More than one in five (21%) respondents with stock positions own Amazon, with 19% owning Facebook, 18% owning Netflix, 17% owning Apple, and 11% owning Tesla.

“Just under half (44%) of the survey respondents said they have been trying to time the market — a fairly high number,” reported the Yahoo-Harris poll, “And for those investors actively trying to take advantage of the market’s moves, the average number of trades per month is 4.5.”

An August 13, 2020 Yahoo-Harris poll revealed that:

- The COVID-19-triggered recession is hitting women harder than men.

- 47% of women still have their pre-pandemic job.

- 63% of men have hung onto their job.

- 19% of Gen X women (35-44) stated that they had been laid off

- Only 2% of Gen X men have been laid off.

The poll further revealed that “about 10% of people over the age of 45 are likely to want to get out of the city for the suburbs, while 44% of respondents between the ages of 18 and 34 say they’d move now or are at least considering it”.

Thirty percent of Gen Xers are interested in moving away from the city now following the arduous lockdowns and restrictions.

Income levels also play a factor on this big life decision.

About 35% who make at least $100,000 a year say they’d consider moving out of the city now. That’s about twice as many (19%) who make $50,000 or less and want to move.

Summary: stock markets are flooded with dumb money. When the Dow crashes, there’s gunna be more dead options-traders. Houses in the suburbs may currently be overpriced.

- Lukas Kane

Full Disclosure: Equity Guru has no financial relationship with the stocks mentioned in this article.

Leave a Reply