On September 14, 2020 Brigadier Gold (BRG.V) published sampling results from two major vein systems in the northeastern part of the Picachos gold-silver property in Sinaloa, Mexico.

The Picachos asset contains four mining concessions in Mexico, covering 3,954 hectares of land. That’s about 80 X the size of Vancouver’s Stanley Park.

In the southeastern region of Sinaloa state, Mexico, the Picachos mine workings are accessed by approximately 20 km of roads internal to the property.

The vein systems related to the sampling results are called Garabato and El Pino.

Garabato: early exploration is limited to a few geological traverses, sparse rock chip-channel samples and a widely spaced soil geochemical grid (100 meters by 100 meters).

Garabato: early exploration is limited to a few geological traverses, sparse rock chip-channel samples and a widely spaced soil geochemical grid (100 meters by 100 meters).

El Pino: Historic workings at El Pino expose four quartz-sulphide veins. El Pino West is the largest vein in this group.

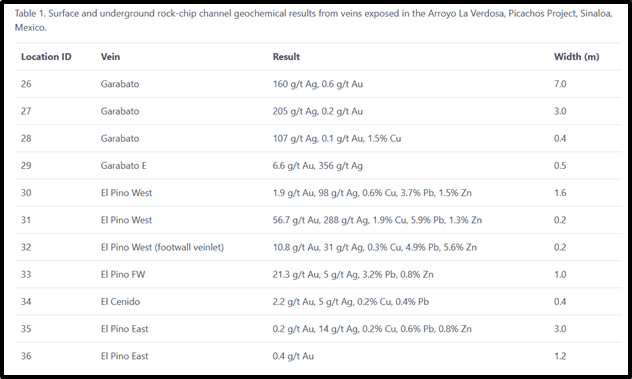

Garabato Highlights from in-situ rock chip-channel samples are summarized in the table included (locations 26 to 29), while El Pino’s highlights are summarized in locations 30 to 36.

“Significant values include 160 grams per tonne silver across seven metres at Garabato, and 21.3 g/t Au across one meter at El Pino,” stated BRG President and CEO Ranjeet Sundher, “Further work including trenching and soil sampling followed by drilling is clearly warranted.”

“Significant values include 160 grams per tonne silver across seven metres at Garabato, and 21.3 g/t Au across one meter at El Pino,” stated BRG President and CEO Ranjeet Sundher, “Further work including trenching and soil sampling followed by drilling is clearly warranted.”

“The Picachos property has never been diamond drill tested and boasts over 160 historic workings and mines,” states BRG, “Recent and continuing bonanza grade discoveries produced by neighbouring explorers to the north (Vizsla Resources) and south (GR Silver Mining) underscore the untapped potential of this particular region of Sierra Madre Occidental epithermal belt.

“Vizsla Resources (VZLA.V) made headlines when it dropped the following drill hole assays from its Panuco Project in Sinaloa State on June 24th,” confirmed Equity Guru’s Greg Nolan on August 31, 2020.

- 1,544 g/t silver equivalent {AgEq} (738.9 g/t silver and 11.06 g/t gold over 8.2 meters from 108.6 meters, including 3,348 g/t silver equivalent (1,527.5 g/t silver and 24.9 g/t gold) over 2.0 meters from 108.6 meters

“In the same region,” continued Nolan, “GR Silver (GRSL.V) announced a high-grade discovery at its Plomosas Silver Project on June 22nd:

- 1,235 gpt Ag over 11.0 meters, including 2,600 gpt Ag over 2.3 meters and 4,209 gpt Ag over 1.7 meters;

- 1,469 gpt Ag over 3.7 meters, including 2,827 gpt Ag over 1.8 meters;

- 3.6 gpt Au over 23.9 meters, including 43 gpt Au over 1 meter.

“In a remarkably well timed push, Brigadier Gold (BRG.V) secured a project in the region—the 3,954 hectare Picachos Gold-Silver Property—just as these two discoveries came to light.” – End of Nolan.

It’s early days for BRG:

Looking at the demand side, September Comex silver is trading at USD $27, up 2% today on safe-haven and industrial demand, and “green energy” stimulus.

Silver is used as conductive layer in solar panels.

“More than $50 billion of green stimulus has been approved by governments thus far this year,” states BMO Capital Markets. “The recent Biden campaign Clean Energy plan, most notably a zero-carbon power grid by 2035 would see new wind and solar capacity built to displace thermal generation.”

Gold is trading today at USD $1,964.

In Canadian dollars, gold is up $17 to CND $2,575.

TSI Wealth Daily lists investment criteria for junior metal companies: jurisdiction, geology, closeology, cash-on-hand, low debt and share-structure.

There’s another important criterion that can have a radical impact on shareholder value: the ability of management to create a concise message.

At Equity Guru, we do not give client companies editorial control of the articles we publish.

Not because we are control freaks – but because typically – management’s first editorial instinct is to try to strengthen a story by adding subplots.

It never works.

When retail investors are bombarded with technical minutiae, they tune out.

A good message is: we do this.

Not – we do this and this and this – and sometimes a bit of that.

I mention this, because Brigadier Gold is blessed with a CEO, Ranjeet Sundher, who knows exactly how to tell BRG’s story.

Exhibit A: in this “Ahead of The Herd” video, Sundher explains his acquisition strategy and exploration objectives. It’s a clinic in how to communicate without smothering the narrative in metallurgical subplots.

“Brigadier is preparing to initiate a maiden 5,000-metre drill program targeting the high-grade historic San Agustin mine and surrounding prospects,” stated Sundher in the September 14, 2020 PR, “In order to better understand the depth, strike length and continuity of the veins.”

- Lukas Kane

Full Disclosure: Brigadier Gold is an Equity Guru marketing client.

Leave a Reply