All lucky people think they are smart.

Most smart people will cop to being lucky.

Over the decades, Globex Mining (GMX.T) has invested in a matrix of mineral properties with such sharply appreciating valuations, it is impossible to unravel the company’s savvy from its good fortune.

Case in point: on September 16, 2020 Globex announced that it has acquired 15 manganese claims in New Brunswick, Canada.

Manganese is the hottest commodity on the planet.

Hotter than silver.

Hotter than gold.

Hotter than heat itself.

Buying manganese shares today is like trying to secure tickets for the Tragically Hip’s 2016 farewell tour.

The ticket holders don’t want to sell.

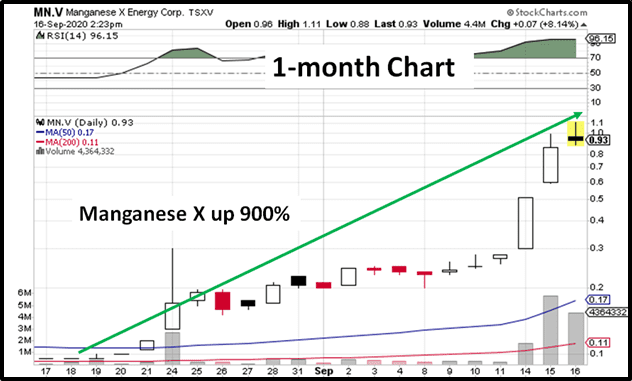

In September 14, 2020 – two hours after the market closed, Equity Guru client Manganese X put out a press release announcing that it is prepping a drill program at the Battery Hill project located near Woodstock, New Brunswick.

“Manganese is beginning to play a critical role in the evolution of new off-grid power storage systems, and cutting edge solar energy (storage) technologies,” reported Equity Guru’s Greg Nolan two weeks ago when Manganese X stock could be purchased for .20 (it closed at .96 today).

It’s important to know that Manganese X acquired the Battery Hill project from Globex – Globex now holds a 1% Gross Metal Royalty on the project and roughly 1.3 million shares of Manganese X. That share position is good for nearly a 10-bagger in just the last few weeks.

Globex’s new acquisition

In 1954, Globex’s New Brunswick manganese claims were mapped, gravity surveyed, and drilled (7 holes/590 metres).

A 1954 geological document published by K.O.J. Sidwell, reported 453,500 tonnes of manganese mineralization grading 11.0% manganese and 8.45% iron to a depth of 80 metres “in a body 250 metres long and approximately 10 metres wide”.

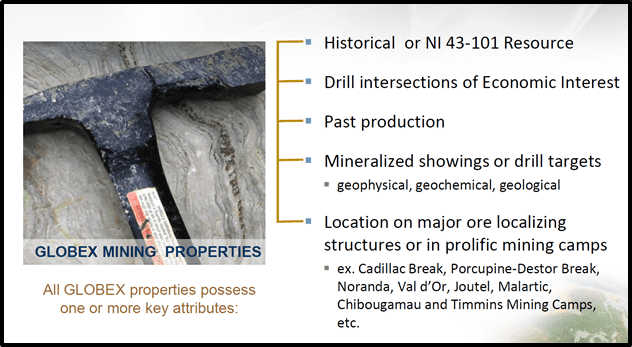

Globex presently holds more than 170 land packages all of which have resources or reserves (both NI 43-101 and non-NI 43-101), mineralized drill intersections, mineral showings, untested geophysical targets or a combination thereof, and are located in Quebec, Ontario, Nova Scotia, New Brunswick, Tennessee, Nevada and Washington.

In this informative Proactive interview, Globex CEO Jack Stoch explains the company’s manganese acquisition strategy, and the importance of the Tesla’s (TSLA.Q) Sept 22, 2020 “Battery Day”.

“Management’s specialty is acquiring high-quality assets in well established mining-friendly jurisdictions, upgrading the asset by way of exploration and intellectual input, and monetizing said asset via options, outright sales, and royalties,” wrote Equity Guru’s Greg Nolan five days ago.

“With a total of 188 properties in the company’s project portfolio, 95 are prospective for precious metals, 60 for base metals, and 33 for specialty metal metals (lithium, manganese, scandium, and the like).” – End of Nolan.

With a portfolio this wide and deep, it’s not surprising that Globex has two significant news events in one day.

Background: on April 15, 2019, NSGold (NSX.V) announced that it acquired 100% ownership of the Mooseland Gold Property and certain secondary properties from Globex.

At the time, Globex was awarded a Gross Metal Royalty of 2%, while NSGold handed over about 10% of its stock to Globex (1.75 million shares).

Today, September 16, 2020 – NSGold received a “43-101 Resource Update on the Mooseland Gold Property” located in Halifax County, Nova Scotia.

Total inferred mineral resources for the Mooseland Gold Property are estimated at 3,454,000 tonnes with an average diluted grade of 4.71 grams per tonne containing 523,000 ounces of gold.

At today’s spot price of $1,967 the inferred resource is valued at $11/ounce, based on NSGold’s current market cap of $6 million.

A company called VHIH owns 50.7% of NSGold’s outstanding shares. VHIH is a controlled by Johannes H. C. van Hoof, Chairman, CEO of NSGold.

The Board of Directors and VHIH agree that this is an appropriate time to address the steep discount in NSGold’s market value compared to its asset value.

A major cause of the steep discount is NSGold’s concentrated shareholder base, with its five largest shareholders owning approximately 80% of NSGold’s outstanding shares, resulting in illiquidity in the shares.

NSGold is actively seeking offers for 100% of NSGold’s outstanding shares from prospective purchasers other than VHIH.

On September 16, 2020 NSGold share price rose 73% – from .22 to .37 on 150,000 shares traded.

“A lot of CEOs in this arena claim to have aligned their values alongside those of their shareholders,” states Equity Guru’s Greg Nolan, “Talk is cheap in this Wild West of a sector. The proof is in the share structure.

Get this: there are currently 54.63 million Globex shares outstanding (57.5 fully diluted). Since Stoch took over the company in 1983, he has kept the dilutive financings to an absolute minimum and he has never engineered a share rollback.

If you’ve been following the junior exploration sector for as long as I have, you know how remarkable a feat this is. I know of companies who are rolling back their shares within their first year of operation.” – End of Nolan.

“The addition of another manganese property will allow Globex to take further advantage of the current interest in manganese as a potentially important battery metal by seeking to option this new asset.” – Jack Stoch, Geo., President and CEO of Globex.

Smart?

Lucky?

Or both?

Take your pick.

News update: On September 17, 2020 Globex announced that is has started a five-hole drill program on its 100-per-cent-owned Laguerre-Knutson-Raven River gold property in Ontario.

The drill program will consist of three holes to test beneath the Knutson gold zone where previous trenching returned the following:

- Vein 1: 0.42 oz. /ton gold over a width of 5.3 feet and a length of 160 feet;

- Vein 2: 0.25 oz. /ton gold over a width of 5.9 feet and a length of 90 feet.

Two additional holes will be drilled at the north end of the Laguerre gold zone where Sudbury Contact Mines Ltd. reported a historical non-NI 43-101 resource of 56,680 tons grading 0.128 oz/ton gold.

In the 1940’s, Laguerre Gold Mines sank a 778-foot shaft with 3 levels on the gold zone. In addition, they undertook 2,443 feet of drifting on several levels along with 4,240 feet of diamond drilling. Subsequent drilling by Sudbury Contact in the late 1970’s and early 1980’s extended the zone to depth, intersecting erratic gold mineralization.

The property also includes the Raven River gold zone where Raven River Gold Mines (1939) reported a historical non-National Instrument 43-101 resource of 11 million tons grading 0.05 oz/ton gold. The current drilling will not test this zone.

- Lukas Kane

Full Disclosure: Globex Mining is an Equity Guru marketing client

Leave a Reply