What do Pope Francis and Cuban Revolutionary, Ernesto Che Guevara, have in common?

They both hail from Argentina.

They also seem to come from the same kinda grit: the supreme pontiff actually worked as a bar bouncer in Buenos Aires back in the day. No record of him ever bouncing Che.

Golden Arrow’s (GRG.V) heart is in Argentina—the breeding ground of great revolutionaries and spiritual leaders—though the company is not opposed to testing the under-explored subsurface layers of other South American jurisdictions.

The company is backed by the Grosso Group—pioneers in the Argentine mineral exploration arena since the region was opened up in the early 1990s.

The Grosso Group has a solid track record of discovery success in Argentina.

A few examples: The world-class Gualcamayo gold mine (currently operated by Mineros S.A.), the Navidad Silver project (one of the world’s largest undeveloped silver deposits currently held by Pan American Silver (PAAS.T)), and the Chinchillas Mine that was recently put into production by SSR Mining (SSRM.T).

Having monetized its stake in the Chinchillas asset roughly one year back, the company has its sights set on yet another significant South American discovery as a burgeoning bull market in mining stocks is looking for a whole new gear.

That Chinchillas monetization event put the company in an enviable position. Golden Arrow has roughly $28M in cash and equivalents in its coffers, ample funds to explore its current project portfolio, and pounce on any new acquisition opportunity it deems a worthy fit.

On the subject of acquisitions… the company is actively in pursuit of an advanced stage project.

On September 14th, 2020, Golden Arrow provided shareholders with an exploration update. First, let’s review what’s at stake.

The company has three main projects in its portfolio, one in Argentina (Flecha de Oro), one in Paraguay (Tierra Dorada), one in Chile (Rosales), and the way I see it, all three are vying for flagship status.

All three of these projects are near-surface and should the surface grades extend to depth, they’ll be advanced quickly.

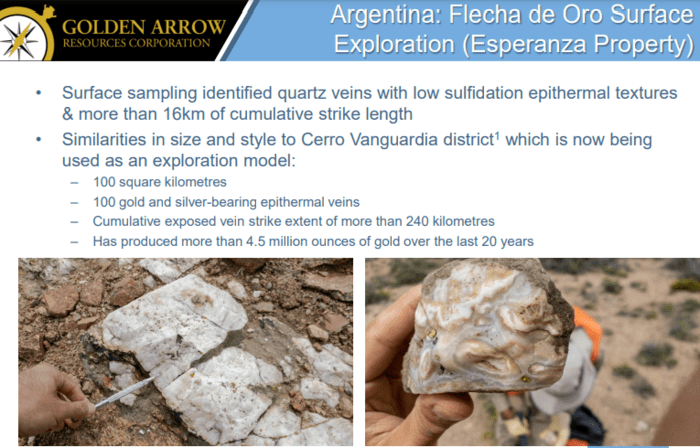

The Flecha de Oro Gold Project, Rio Negro Province, Argentina

The Flecha de Oro Project encompasses three properties including Puzzle (1,952 hectares), La Esperanza (9,968 hectares), and Maquinchao (2,000 hectares). All three enjoy easy road access and are located below 1,000 meters elevation allowing for year-round exploration.

Highlights:

- Nearly 120 square kilometers of mineral rights in an area known for its high and low-sulphidation epithermal gold mineralization;

- Due diligence sampling included 5 meters grading 13.1 g/t gold and 0.2 meters grading 11.2 g/t gold from chip samples across two parallel quartz veins located 600 meters apart (La Esperanza property);

- Ground Magnetic surveying successfully delineated a mineralized vein corridor coincident with a magnetic low (Puzzle property).

Highlights from a March 2, 2020, exploration update include:

- four chip samples across quartz veins ranging from 0.15 to 0.70 meters in width returning values of 18.00 (visible gold), 5.05, 4.12, and 4.10 g/t gold.

On June 8th, the company reported results from a mapping and surface sampling campaign—an effort that successfully delineated a new high-grade gold target on the Esperanza property.

Highlights:

- 24.4 g/t gold and 13.6 g/t silver from a float/boulder sample;

- 5.23 g/t gold and 32.3 g/t silver over 0.30 meters from a vein chip sample;

- 4.3 g/t gold and 2.3 g/t silver over 0.30 meters from a vein chip sample.

The company is eager to push this project further along the curve, but C-19 travel restrictions are currently in force. Once the restrictions are lifted, the company plans to drill.

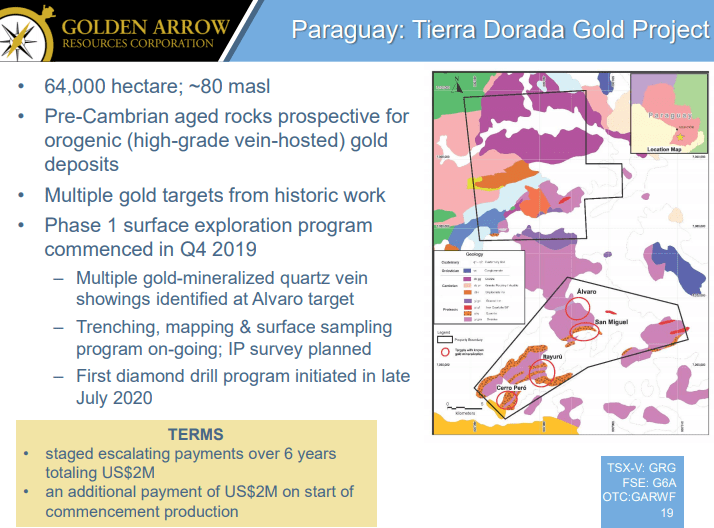

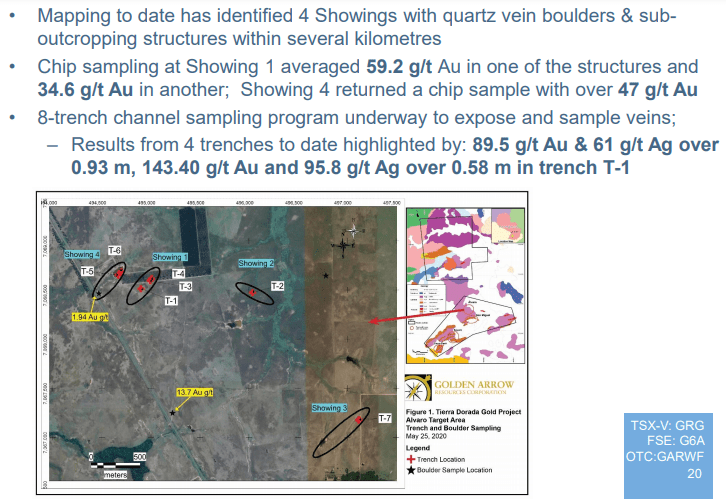

The Tierra Dorada Project, Paraguay

Tierra Dorada consists of two separate property blocks—34,566 hectares and 29,288 hectares—positioned six kilometers apart. Flat topography, road-accessible, powerlines cross both properties.

Highlights:

- District-scale high-grade gold project in one of the last frontiers of mineral exploration in South America;

- Under-explored, with characteristics similar to those of orogenic-type gold deposits;

- Multiple gold targets defined in an area dominated by flat topography and sparse outcrop;

- Due diligence sampling included rock chip assays of 3.3 g/t to 15.1 g/t gold from a 2.5 km trend of sub-outcropping quartz veins;

- visible gold locally observed.

The southern property block has been the focus of most of the historical exploration work to date in the area, with four main target areas delineated. The most advanced of the four targets, San Miguel, includes two parallel northeast trends approximately three km in length, with iron rich laterites developed in quartzites and gneisses. Previous work at San Miguel included soil and rock sampling, and pan concentrate collection from stream sediments. Previous operators included The Anschutz Co. in the late 1970´s and early 1980´s, and Yamana Gold Inc. in the 1990´s. Yamana carried out trenching and drilled six shallow reverse circulation holes along the eastern trend defining gold mineralization in laterites. There is no public report available for this work, however drilling sections have been obtained showing geology and assays from four vertical holes up to 88 m deep.

Historic drilling highlights include:

- 6.1 meters @ 1.12 g/t Au, including 1.5 meters @ 3.32 g/t Au in SM-H3 starting at 12.2 meters depth;

- 3.05 meters @ 2.87 g/t Au, including 1.5 meters @ 3.74 g/t Au in SM-H4 starting at 19.8 meters depth;

- 4.57 meters @ 1.72 g/t Au, including 1.5 meters @ 2.85 g/t Au in SM-H5 starting at 9.2 meters depth;

- 3.05 meters @ 1.35 g/t Au, including 1.5 meters @3.6g/t Au in SMH6 starting at 27.5 meters depth.

On May 27th, the company released results from a Tierra Dorada trenching campaign (map here):

Golden Arrow Reports High-Grade Gold from Trenching at its Tierra Dorada Gold Project, Paraguay

Highlights:

- 89.5 g/t gold and 61 g/t silver over 0.93 meters, including 143.40 g/t gold and 95.8 g/t silver over 0.58 meters, in Trench 1;

- Over one kilometer to the south of Trench 1, a boulder sample returned 13.7 g/t Au;

- Subsequent tench sample assays yielded 11.4 g/t Au over .78 meters and 6.36 g/t Au over .78 meters.

Satisfied they have a prospective target in their crosshairs at Tierra Dorada, the company dropped the following headline on August 28th:

Golden Arrow Starts Diamond Drilling at the Tierra Dorada Gold Project, Paraguay

This is a modest drilling campaign—500 meters—one that will test the Alvaro target area.

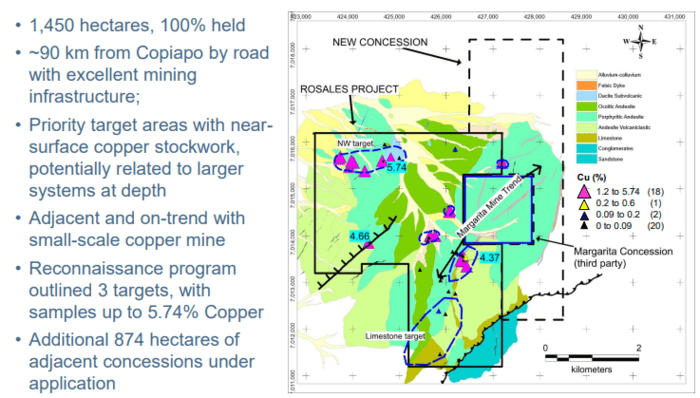

The Rosales Copper Project, Atacama Region, Chile

Rosales is a recent acquisition:

July 20, 2020 news: Golden Arrow Acquires Rosales Copper Project, Chile

This wholly-owned project has several high priority targets characterized by zones of near-surface copper stockwork mineralization, with the potential for a larger mineralized system at depth. The area is surrounded by infrastructure.

The prolific Atacama mining region is host to numerous large precious and base metal mines and deposit types—iron-oxide copper-gold (Candalaria, Mantos Verde), porphyry copper-gold (Inca del Oro), epithermal gold-silver (El Peñon, Guanaco), and Maricunga type gold deposits (Cerro Casale-Caspiche, Refugio, Marte, Maricunga).

Project highlights:

- Situated on-trend with a small-scale underground copper mine, with mineralized occurrences returning up to 4.37% copper in reconnaissance sampling;

- Additional target 3 kilometers to the northwest with up to 5.74% copper in reconnaissance sampling.

Rosales has high-grade, near-surface copper. Should the surface grades extend to depth, the project can be advanced swiftly. High-grade rock requires fewer tonnes to pile on the pounds. These high-grade vein settings DO require more drilling though.

A phase one exploration program will include detailed mapping, surface sampling, and property-wide geophysics.

The September 14th exploration update

Rosales Copper Project, Chile

The first detailed fieldwork at the Rosales Project (in Region III, Chile) is now underway, including a soil sampling and geological mapping campaign. Several hundred soil samples will be taken, as well as detailed mapping of the Margarita Trend and the NW targets.

Brian McEwen, Golden Arrow’s VP Exploration and Development:

“It’s very exciting to have boots on the ground for the first time at our new Rosales Project, particularly as we see the price of copper continuing its upward trend over the $3.00 mark. Golden Arrow remains primarily focused on precious metals, but this project was too good an opportunity to pass up, providing 100% ownership at a very low entry cost, with excellent exploration, and market, upside. We look forward to advancing this project, while our team continues to look throughout Chile for additional precious and base metal opportunities.”

Tierra Dorada Gold Project, Paraguay

A 500-meter shallow-hole diamond drilling program initiated in late August at the Alvaro target is ongoing, with approximately 13 holes (180 meters) completed as of September 8th. The drilling is expected to continue until month-end—assays will follow.

“Golden Arrow has mainly focused its activities to date at one of four previously-identified target areas known as Alvaro in the southern property block, but also has a team working on geological reconnaissance and stream sediment sampling in both the northern and southern block concessions to evaluate as much of the property as possible for additional targets.”

Flecha de Oro Gold Project, Argentina

You gotta know the Golden Arrow crew is champing at the bit to put boots to ground and mobilize a drill rig to Flecha de Oro.

To date the company has mainly focused on the Esperanza property, to define high-grade gold zones within the 16 kilometers of identified quartz and chalcedony veins that display banded, colloform, and crustiform epithermal textures.

“Field work at Flecha de Oro has been suspended since the spring due to COVID-19 travel and work restrictions. In anticipation of a possible prolonged suspension, Golden Arrow has negotiated amendments to the option agreements for the Esperanza and Puzzle properties that delay 50% of the upcoming September payment to July of next year, and extend the subsequent payment to July 2022. Over the last few months, the technical team has undertaken data processing of results received in the early summer to refine targets for follow-up when field work resumes. In addition, the team will soon be submitting an Environmental Impact Report (EIR) for the new Maquinchao property, a required step in the permitting process for exploration.”

There it is.

END

—Greg Nolan

Full disclosure: Golden Arrow is an Equity Guru marketing client.

Leave a Reply