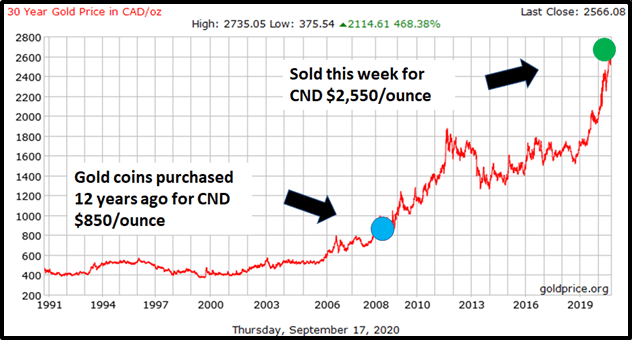

This week, two of my relatives liquidated a collective 105 ounces of bullion.

The 1-ounce Canadian Maple Leaf gold coins were purchased twelve years ago at the Vancouver Bullion Exchange on Pender Street.

We believe the U.S. dollar is going to weaken.

If gold goes up 30% in USD, and the U.S. dollar weakens 30% against the CND, that’s a net gain of zero for Canadian bullion-holders.

Selling an asset for a profit when it’s trading at historical highs, is not a terrible idea.

This week, my financial advisor suggested selling some of my gold equities.

Not gonna happen.

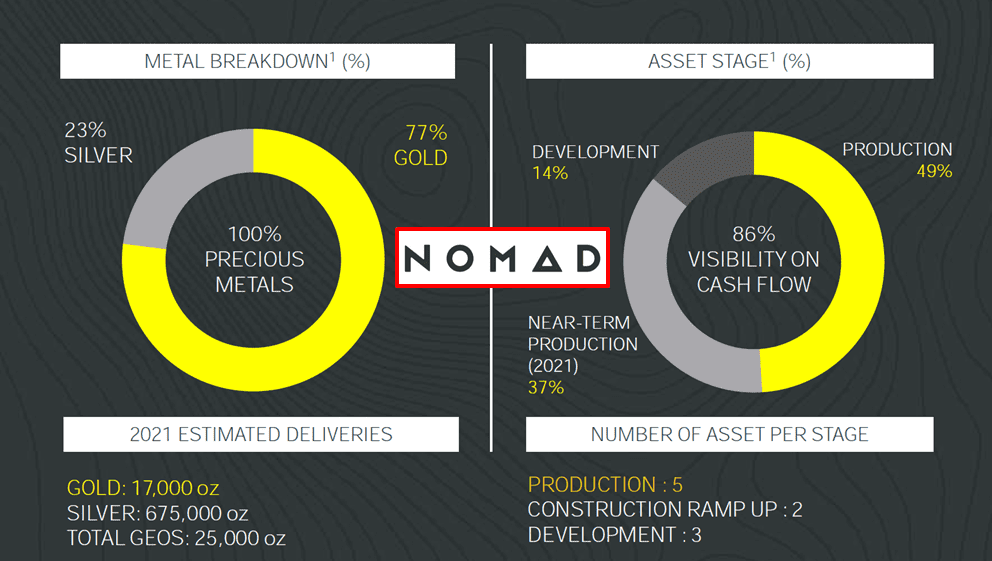

One of the precious metal companies I’ve invested in is Nomad Royalty (NSR.T) that owns a portfolio of 11 royalty, stream, and gold loan assets, of which 5 are on currently producing mines.

When Nomad launched three months ago, it stated that it “plans to grow and diversify its low-cost production profile through the acquisition of additional producing and near-term producing gold & silver streams and royalties.”

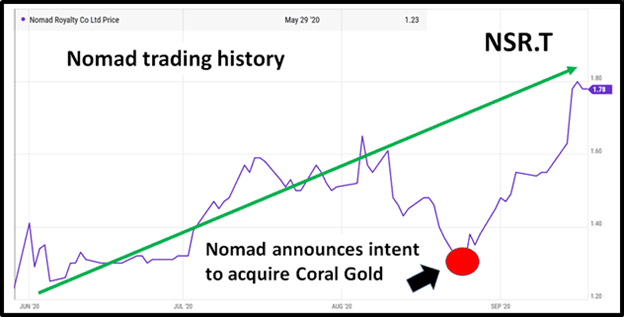

Three weeks ago, Nomad entered into a definitive Arrangement Agreement to acquire all of the outstanding common shares of Coral Gold.

Acquisition Highlights

- Premier, uncapped sliding-scale 1.00% to 2.25% net smelter return (NSR) royalty on Robertson property which forms part of the greater Cortez & Pipeline mining complex.

- Premier gold mining operator in the world on the tier 1 Cortez & Pipeline mine complex

- The Robertson development project contains an historical Inferred mineral resource estimate (MRE) in excess of 2.7 million ounces Au in total oxide and sulphide materials.

“When we created Nomad, we set the objective to become a catalyst for sector consolidation,” stated Nomad CEO Vincent Metcalf, “Today’s announcement marks the first step of our consolidation strategy and follows our desire to become the best global acquisition-driven precious metals royalty company in the sector.”

The acquisition catalysed a jump in Nomad’s share price:

“As many of you are aware, one of the companies in my Top Three Picks for 2020—Coral Gold Resources (CLH.V)—just got taken out by a bigger fish, one Nomad Royalty Company (NSR.T),” stated Equity Guru’s Greg Nolan on August 26, 2020.

“When I first featured Coral Gold back in January of 2020, the stock was trading at roughly $0.44,” continued Nolan.

“Based on its most recent close at $1.09, we’re looking at a potential gain of 149%, or more if you caught the lows back in mid-March of this year.

Here’s the acquisition headline:

Quoting from the August 24th press release:

Pursuant to the Transaction, Coral shareholders will be entitled to receive, for each Coral share held, consideration consisting of C$0.05 in cash and 0.80 of a unit of Nomad, as described below.

The consideration payable to Coral shareholders by Nomad represents total value of approximately C$1.21 per Coral share, based on the closing price of C$1.37 of Nomad common shares on the TSX on August 21, 2020 and including the C$0.06 estimated value per Coral share of the one-half common share purchase warrant included in each Unit. Based on Nomad’s and Coral’s August 21, 2020 closing prices on the TSX and TSX Venture Exchange respectively, the Transaction represents a premium of approximately 45% to Coral shareholders.

So, the transaction is valued at roughly $1.21 and Coral Gold common shares are currently trading at $1.09. There could be an arbitrage opportunity here, especially if Nomad rallies from current trading levels.

If you’re unfamiliar with Nomad, I cover the company, as a client, over at Equity Guru. My most recent Nomad coverage was just yesterday…

The question many of you are asking is, “should I sell my Coral Gold into this recent strength, or hold on and take the Nomad paper (common shares and warrants)”.

I’m biased. You need to conduct your own due diligence, but from where I sit, I’m happy to take the Nomad paper. That’s my plan for the Coral Gold shares I control.” – End of Nolan.

Like my relatives, I purchased 1-ounce Canadian Maple Leaf gold coins in 2008. If you’re wondering if I’m selling – here’s what’s in my hand:

On Wednesday, September 16, 2020 the U.S. Fed announced that it plans to keep U.S. short-term interest rate near zero for the next three years to help the economy recover from the coronavirus.

“We are very bullish on gold,” stated Swiss Banking giant UBS today , “We think that the prices will go higher and what is interesting is we think it will stay higher for longer than expected.

“With a goal of attaining a $3 to $5B market cap in the medium to long term, Nomad should begin commanding the multiples that the very largest entities in the space enjoy,” stated Nolan.

Full Disclosure: Nomad is an Equity Guru marketing client.

Leave a Reply