UK-based commodities reporter Pratima Desai appears to have either been a useful idiot or a willing accomplice to a stock price run and subsequent insider sell-off of Canadian smallcap mining explorer Giga Metals (GIGA.V) after a false story based on unnamed sources suggesting the company was ‘in discussions’ to partnering with Tesla (TSLA.Q).

LONDON (Reuters) – Tesla is in discussions with Canadian miner Giga Metals about helping to develop a large mine that would give the electric carmaker access to low carbon nickel for its batteries, three sources familiar with the matter said.

Standard journalism practice would suggest those sources be named, or at least quoted, with information confirming the opening sentence of the story. But nowhere in the story did anyone say words that confirmed – or even suggested – that Tesla was indeed in talks with the company about helping to develop their proposed billion dollar nickel mine.

In fact, the President of Giga declined to comment on Tesla for the story, instead explaining, “Giga is actively engaged, and has been for some time, with automakers regarding our ability to produce carbon neutral nickel.”

As soon as the story was posted, GIGA stock went on a rampage. The Globe and Mail repeated the fake story, being as Reuters is a trusted syndication partner, which added to the interest levels.

This forced the CEO of the company to issue a note reminding folks there was no material information on the way.

GIGA METALS PROVIDES UPDATE ON RECENT TRADING ACTIVITY

Giga Metals Corp. has provided an update regarding recent media reports.

“Giga Metals has been mentioned in recent media articles as they pertain to ongoing efforts to advance the Turnagain deposit to commercialization,” said Martin Vydra, president. “What I can say is that there is no material announcement forthcoming and we will keep regulators and investors informed of any material changes that require disclosure in accordance with securities regulations.”

Where things get suspect is what happened a month earlier, when company director Anthony Milewski executed 1.5 million stock options at $0.08 per, for $120,000, despite the stock having been illiquid for over a year.

A week after that, GIGA’s long dormant stock suddenly took off, from around $0.30 to near $0.75, in a single day.

Milewski’s timing was impeccable. Desai’s story was posted on September 11 and it took the GIGA market cap from $38 million to over $150 million.

The day after the story, with the stock hitting $2.40 early, Milewski dropped the hammer and dumped 3 million shares at an average of $1.86, for $5.57 million, with the stock going as low as $1.40 during his sell-off.

Two days later he sold another 450,000 shares for an average of $1.61, bringing him another $724,000.

Milewski’s selling was so intense and sudden, it tripped circuit breakers that halted the stock several times in a day.

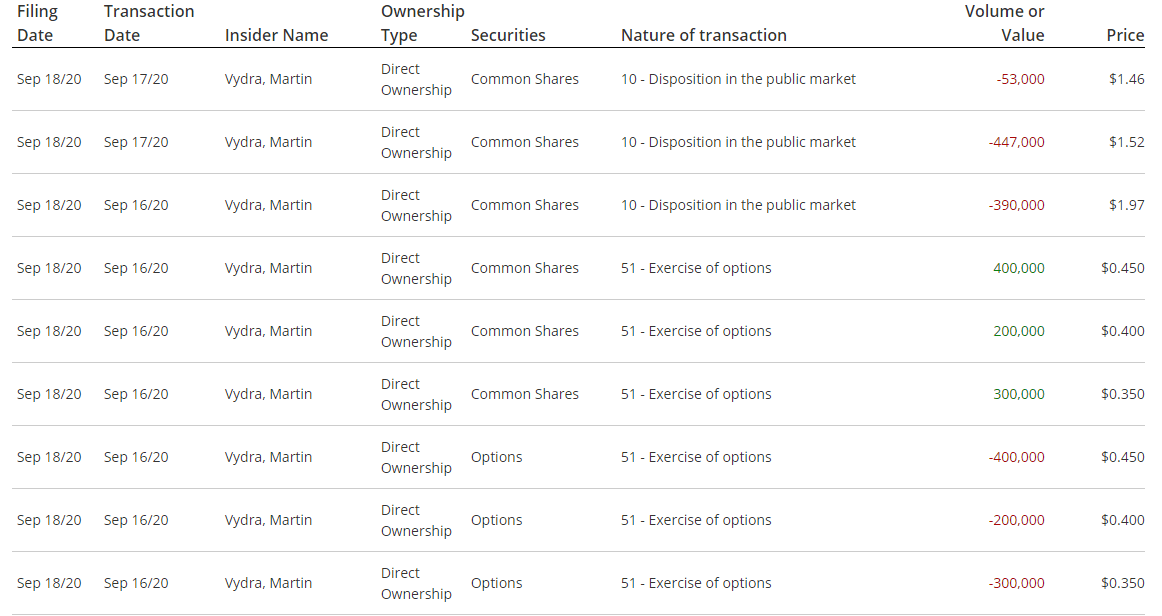

But Milewski wasn’t alone in his pillaging of his own company. Here’s Giga President Martin Vydra following suit, exercising 900,000 options at around $0.40, and immediately dumping them over two days at a price of $1.97 down to $1.46. good for $1.5 million stuffed into his back pocket.

- UPDATE: Since this story was written, Vydra has sold another $750,000 worth of company stock.

Worth noting Vydra KNEW THE REUTERS STORY WAS COMING because he was quoted in it.

Giga Metals’s President Martin Vydra declined to comment on any talks with Tesla, but said: “Giga is actively engaged, and has been for some time, with automakers regarding our ability to produce carbon neutral nickel.

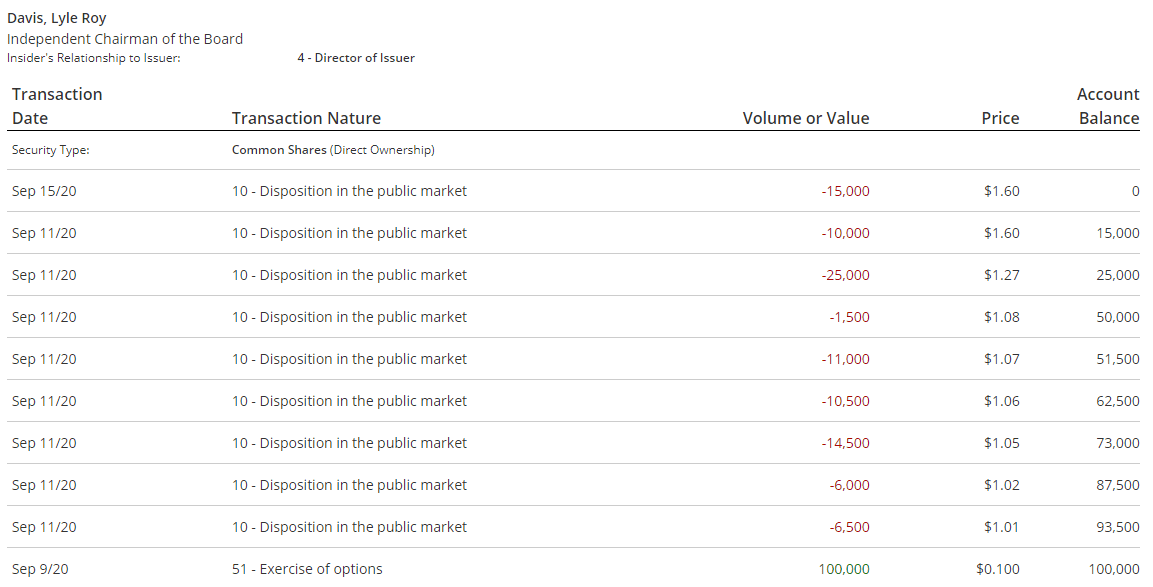

This is important because Giga Metals chairman Lyle Davis executed his options TWO DAYS BEFORE DESAI’S STORY DROPPED. He was in such a rush to profit, he didn’t even wait for the stock to finish rising before dumping his stake for whatever he could get.

Poor unsophisticated Lyle never even got to see the top before his portfolio was emptied.

$1.01, Lyle? You fucking rube.

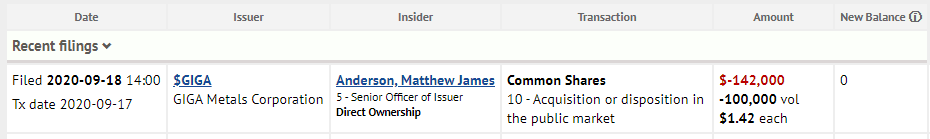

Late today, the Giga Metals CFO Matt Anderson began his own sell-off, following the execution of his options.

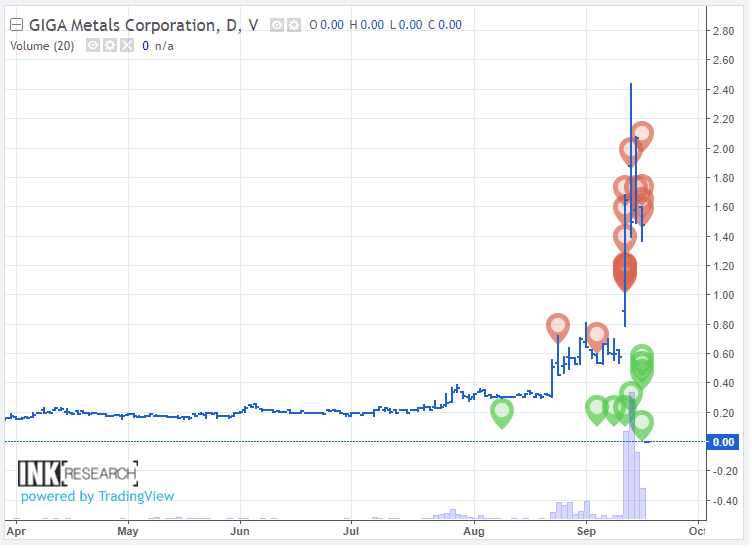

If that’s all too much information to process in text form, here’s the chart with all the insider moves highlighted.

To be clear, there is no Tesla deal with Giga.

- We know this because, if there was, the President and the Chairman and their Director would hold on to every share like it was their firstborn.

- We also know this because the company CEO said in the article there’s no deal coming.

- We also know this because, if a deal was coming, directors exercising options would be an insider trading violation.

There’s no deal coming, and these guys made bank because a false story set them up to do so.

The CEO of the company has thus far avoided scrutiny, because he said in the Reuters story there was no news coming, and repeated that when the stock was on a run.

Good job. Except for the image of the Tesla Gigafactory on the company website a few days ago, and this:

Screenshot of a deleted tweet from the Giga account earlier this week. pic.twitter.com/QcNZO8Ztsx

— Brown (@lifeofbrown) September 18, 2020

INCRIMINATING.

So the question now moves to, is Desai just terrible at her job, which led to GIGA’s head honchos having an opportunity to massively profit from options they coincidentally executed days and weeks earlier, or did Desai intentionally set GIGA up for a run so that insiders could benefit while retail shareholders got ravaged?

In short: Did Desai sell access to her position at Reuters willingly, or did she get used?

Looking at her story history at Reuters, it’s clear exclusive stories about Canadian smallcaps are few and far between. In fact, between the Giga story’s posting and last April, she only wrote about one other smallcap, a benign story (again quoting unnamed sources, but at least with accurate information) about First Cobalt (FCC.V).

Most of her work is about commodity prices at the London Metal Exchange and is standard vanilla journalism workhorse stuff.

So why write about a Canadian company, completely out of the blue, when that company is saying there’s no story here, and your ‘three sources familiar with the matter’ aren’t even quoted as saying what your opening line suggests they’re saying?

Our digging suggests Desai has a tendency to occasionally drop a story based on certain companies, often with the ‘exclusive’ tag, where she always seems to find ‘sources familiar with the deal.’

Like these stories, about the trading firm Traxys, that seem to pump that company pretty hard.

September 4, 2020

LONDON (Reuters) – Trading firm Traxys has won a tender to sell cobalt metal for Wheaton Precious Metals, two sources familiar with the matter said, in a deal that propels it into the big league to rival the likes of Glencore in the valuable commodity.LONDON/MOSCOW (Reuters) – Commodity trading firm Traxys has agreed to market large amounts of Norilsk Nickel’s production of battery metal cobalt for up to three years, effective immediately, three sources familiar with the matter said.

In both instances, the companies in question declined to confirm the story.

Wheaton declined to comment on the result of the tender, but said in a statement: “We are still in the process of determining a suitable marketing/sales program to ensure we maximize the value we receive from the metal.”

“Not a single one of our contracts can affect any other contract. We do not have exclusivity in our relationship with any of our counterparts,” Nornickel told Reuters, when asked whether it had signed the contract with Traxys and whether the contract would affect the deal with BASF.

Also in both stories, Traxys ‘declined to comment.’

Now, I couldn’t tell you whether it’s true that Traxys got those deals or not because commodities trading works in private for the most part. Nobody can, because Wheaton doesn’t comment on such things one way or another, and Traxys can’t comment publicly or it would never get another deal again.

So it’s probably useful to Traxys that there’s a journalist out there that will do their bidding for them, based on ‘unnamed sources’, and that her story will go everywhere because she’s working out of Reuters which is, you know, respected.

You know when Pratima is doing someone else’s bidding when she opens with ‘EXCLUSIVE‘ and makes a grand claim based on unnamed sources.

Here’s a sampling:

LONDON (Reuters) – The London Metal Exchange’s gold and silver futures are being thrown into doubt, with the imminent resignation of Societe Generale as a market maker threatening to deepen a decline in trading activity, three sources said.

LONDON/SINGAPORE, July 5 (Reuters) – Tsingshan and other firms investing in an electric vehicle battery chemical plant in Indonesia will have to pay significantly more than a $700 million price tag estimated last year, three sources familiar with the matter said.

LONDON (Reuters) – The London Metal Exchange (LME) has dismissed a complaint from miner and commodity trader Glencore over its inability to take fast delivery of aluminum from warehouses owned by ISTIM UK in Port Klang, Malaysia, two sources familiar with the matter said on Monday.

LONDON, Feb 26 (Reuters) – Glencore has lodged a complaint with the London Metal Exchange (LME) about the company’s inability to take speedy delivery of aluminium from warehouses owned by ISTIM UK in Port Klang, Malaysia, two sources familiar with the matter said.

LONDON, Feb 18 (Reuters) – Mining giant Glencore has bought 200,000 tonnes of aluminium on the London Metal Exchange and will take delivery of the metal from warehouses owned by ISTIM UK in Port Klang, Malaysia, five sources familiar with the matter said.

LONDON (Reuters) – Years after sweeping reform aimed at eliminating logjams in warehouses that collect rent for storing metal, a firm is preventing companies from getting material when they need it from a Malaysian port, five sources close to the matter said.

Five sources! And not one will be named?

I’ve worked at large news organizations and if I tried to sneak that past my editors, they’d have hauled me into the managing editor’s office to explain myself.

Why are Pratima’s sources never named? And why does she not write about individual companies – unless they’re Praxys, Glencore, or ISTIM (or, more recently, seemingly at random – Giga Metals)?

If you’re unconvinced there’s a smoking gun here, let’s travel back to 2017, when Pratima dropped a story about the market debut of a company called Cobalt 27.

LONDON (Reuters) – Minerals company Cobalt 27 Capital Corp KBLT.V made its debut on Canada’s Venture Exchange on Friday, raising C$200 million ($150.7 million) in a listing that offers investors exposure to cobalt, a key metal for batteries in electric cars.

No big deal? Seems a pretty straight news story, no ‘unnamed sources’ necessary, though it’s also REALLY short on actual news and reads like paid media.

So why am I noting this?

It’s not the what, it’s the who.

“We’re a pure play on cobalt and a thematic play on electric vehicles,” Cobalt 27 Chief Executive Anthony Milewski told Reuters. “Our cobalt can be traced back to the producer. It hasn’t been produced by child labor.”

What in the actual fuck?

How is Pratima Desai getting away with slipping news stories out on to the Reuters newswire that involve either her friends or paid clients without making disclosures? Why does she give Anthony Milewski stories column inches, even printing disinformation, while he’s cashing out stock and making millions?

The Reuters brains trust needs to ask Pratima for her sources, verify she’s actually engaging in honest journalism, and that she’s not selling access to Reuters to individual companies because it REALLY SEEMS LIKE SHE IS.

Because the Giga Metals story is not just false, it appears to be deliberately so, written to work around the fact, and has cost retail investors millions of dollars that appear to have gone into the pocket of company insiders. If nothing else, this leaves Reuters in a legally precarious position, with class action lawsuit potential.

Oh, you’ll enjoy the punchline to this dirty little episode in smallcap market manipulation, posted yesterday:

GIGA METALS ADDS TO WORKING CAPITAL

Due to the exercise of various warrants and options, $3,190,158 in new capital has come into the treasury of Giga Metals Corp. over the past two weeks. The working capital of the company is approximately $4,057,500 as of today’s date.

Whatever Pratima was paid for her time, reputation, and access, it was absolutely worth it to whoever paid her.

And I think we know who paid her.

Side note: News out today from Conic Resources (NKL.V):

Conic Metals Corp. has added $6.9-million of cash to its balance sheet by, after approval of its independent board members, monetizing the 3.98 million shares that the company owned in Giga Metals Corp.

“Conic has significantly improved its balance sheet with the execution of this sale,” stated Justin Cochrane, Conic’s president and chief executive officer.

- Conic’s Chairman is Anthony Milewski.

- Conic’s Executive VP in charge of Strategy is Martin Vydra.

Haul these motherfuckers in, regulators. Show the market that someone is paying attention beyond me.

UPDATE: Reuters tells me they’re looking into the story.

UPDATE: A Reuters spokesperson tells me, “We have not seen any facts that contradict our story. We stand by our reporter and our reporting.”

I mean…

— Chris Parry

FULL DISCLOSURE: No commercial connection to any company or person mentioned.

Leave a Reply