Let’s face it, management is everything in the junior exploration arena (okay, nearly everything). You can have a great, company-maker of a project in the friendliest jurisdiction, but without the right team in place—a combination of gifted rock kickers and enterprising business types— things can fly apart at the seams.

Operational inefficiencies often create a processional effect that can lead to an erosion in shareholder value via reckless spending and an endless cycle of heavily dilutive raises (PPs).

A solid crew, a solid project(s), a solid plan

At the helm of Arizona Metals (AMC.V) are seasoned mining pros Marc Pais and Paul Reid.

A bit of background: back in 2011, Pais (AMC President and CEO) and Reid (AMC Chairman) founded Telegraph Gold which went on to acquire the Castle Mountain Mine from Sprott Resource Lending Corp. one year later. Castle Mountain is now operated by Ross Beaty’s Equinox Gold (EQX.T).

In 2014 Pais and Reid formed Arizona Metals, tasking themselves with acquiring undervalued assets during a brutal bear market in the mining sector. They were successful (x 2) in their acquisition endeavors.

The first key hire to come on board with Pais and Reid was Colin Sutherland who previously served as President of McEwen Mining (MUX.T), as well as CEO and Managing Director of Archipelago Resources Plc, where he grew production to 200,000 ounces per year.

Sutherland also ran a company called Capital Gold which got taken out by Gammon Gold for approximately US$288 million back in 2010. This open pit development experience made Sutherland a strategic hire when AMC acquired its near-surface Sugarloaf Peak project.

Rick Vernon (AMC director) has 30 years of experience as a mining finance professional. Vernon’s contacts in the industry led to the introduction of Dr. Mark Hannington (AMC Technical Advisor).

Hannington has 35 years of experience as a research geologist, specializing in volcanogenic massive sulfide (VMS) deposits and the metallogeny of modern and ancient volcanic belts. Hannington’s depth of knowledge in this area lends itself well to the company’s flagship asset (KAY), a VMS deposit with two hefty geophysical/geochemical drill targets Hannington helped delineate.

This is a solid crew. Super solid.

The Flagship Asset

The Kay Mine project is located in a prolific mining district in Arizona, host to 60 past-producing underground Cu-Au-Zn VMS mines, all within a 150-kilometer radius of this flagship asset.

During its 100 year history, the district produced roughly 4 billion pounds of copper at an average grade of 3.5%.

Location, Location, Location.

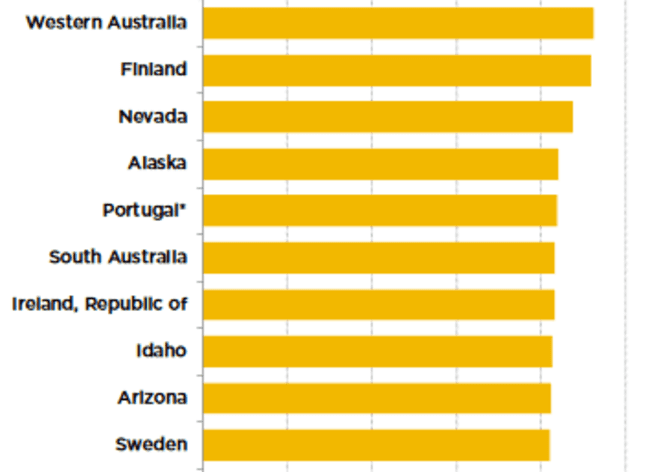

In terms of a mining-friendly jurisdiction, Arizona is ranked in the Top Ten according to the Fraser Institute’s most recent investment attractiveness survey.

As I stated in a recent Guru offering on the subject, this is a hugely important consideration…

There’s much to be said for choosing a safe mining-friendly destination when compiling a shortlist, especially in this era of global economic uncertainty.

Resource-rich countries getting their asses kicked during this economic rout, particularly those with twitchy policy-makers at the helm, might be pondering a revision of their mining codes—raising taxes on foreign entities operating mines within their borders, bullying their way in for a larger piece of the action, or even outright expropriation.

This whole ‘jurisdictional risk’ thing is a weighty consideration. Downplay it at your peril.

A standout in this Cu-rich district—the United Verde Mine operated by Phelps Dodge back in the day (center top on the above map)—produced 30Mt at 5% Cu from an open pit, and 3.5Mt at 10% Cu from underground. There were gold and silver credits attached to the underground portion of United Verde—approx 1.3 g/t Au and 55 g/t Ag.

Open pit copper mines sporting grades of 5% Cu are exceedingly rare this day and age—the average grade for the vast majority of open pit scenarios, particularly those located in mining friendly jurisdictions, are in the 0.5% range.

If you’re a quick study with maps, you will have noted Kay’s proximity to two US National Forest boundaries (above map). But there are no issues here. The Kay Mine project has a good 9-10 kilometer buffer on both sides of these sensitive areas.

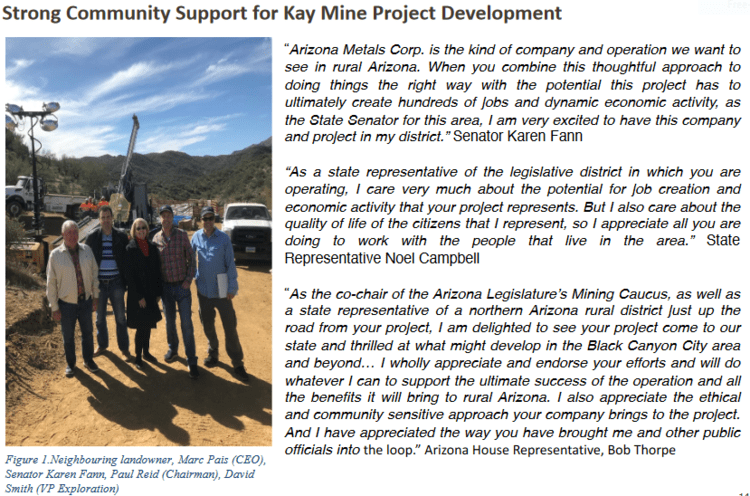

The project enjoys strong support from local landowners and elected representatives alike…

Permitting is not an issue here.

This is a VMS type setting

… and where there’s one VMS deposit (or lens), there are often others, hence the 100 years of production history in the region, and the 4 billion lbs of Cu produced.

The allure of VMS deposits is the large concentration of metals that can occur in a very small area.

The historic resource at Kay:

In the early 1980s, Exxon Minerals delineated 5.8 million tonnes grading 2.2% Cu, 3.03% Zn, 55 g/t Ag, and importantly… 2.8 g/t Au (for a CuEq grade of 5.8%).

Without taking into account recovery rates, the precious metals component of this historic resource represents 52% of the total contained metals.

You might characterize Kay as a gold-silver rich deposit with a high-grade copper kicker.

On the subject of recovery rates (metallurgy), back in the early 1950s, 1,000 tonnes of material were extracted from Kay’s underground workings and shipped to a local smelter where Cu recoveries were reported at 95%. An additional 4,000 tonnes was subjected to flotation testing where reported recoveries were 90% for Cu, and 68 to 70% for Au and Ag.

These recovery rates were achieved using seven-decade-old technology. Today’s technology could—should—exact better recoveries. Keep in mind that these numbers and values are historical in nature.

Roughly US$75M (a ‘today’s dollars’ estimate) has been sunk into the project by previous operators. This includes 5,000 meters of underground drilling, two access shafts driven down to 450 meters, and 4,600 meters of underground drifts. The company also benefits from an extensive database of some 10,000 assays where the mineralized areas along the 12 levels of underground workings were sampled approx every 4 feet.

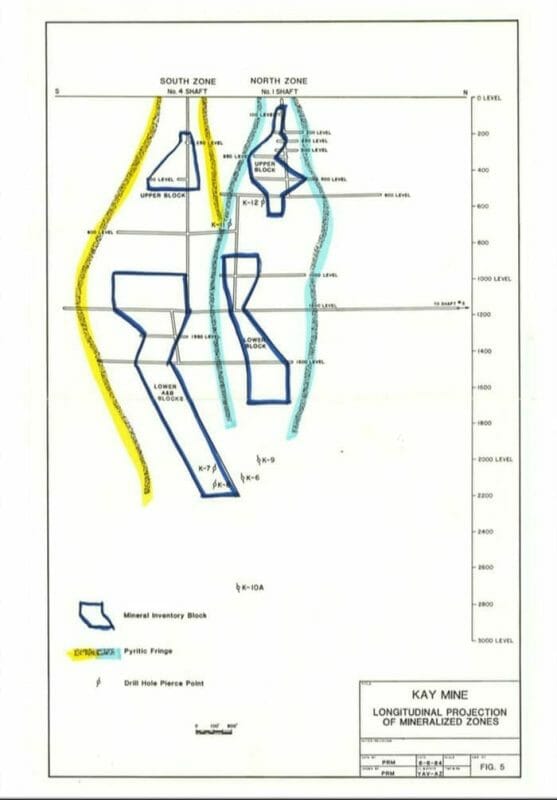

There are currently two defined zones—the North Zone and the South Zone—that host the historic resource at Kay (said resource is outlined in dark blue – map below).The geological model at Kay is that of an isoclinal folded VMS deposit.

The analog here might be the uber-rich VMS deposits that straddle the provinces of Ontario and Quebec, along the prolific Abitibi Greenstone Belt. The world-class Kidd Creek mine in the Timmins Camp and the Horne mine in Rouyn-Noranda (Quebec), come to mind.

Previous Kay operator, Exxon Minerals, reported 18 vertically stacked lenses that range from 5 meters to 25 meters in thickness.

Exxon reported that Kay’s tightly folded hinges within these lenses demonstrate superior grades and widths (the video linked further down the page demonstrates this folding sequence).

One of the objectives of currently drilling is to delineate these unique (high-grade) geological features and grow Kay beyond its current 5.8M tonnes.

The Kay deposit starts at a depth of 120 meters. The company believes mineralization extends to depths greater than one kilometer.

Recent drilling at the Kay Mine project

Launched earlier this year, the first seven holes of a 7,000-meter drilling campaign probed the shallowest resource blocks of the Kay deposit.

This initial probe with the drill bit was designed to calibrate drilling and test the current geological model.

Below are the highlights from the first twenty…

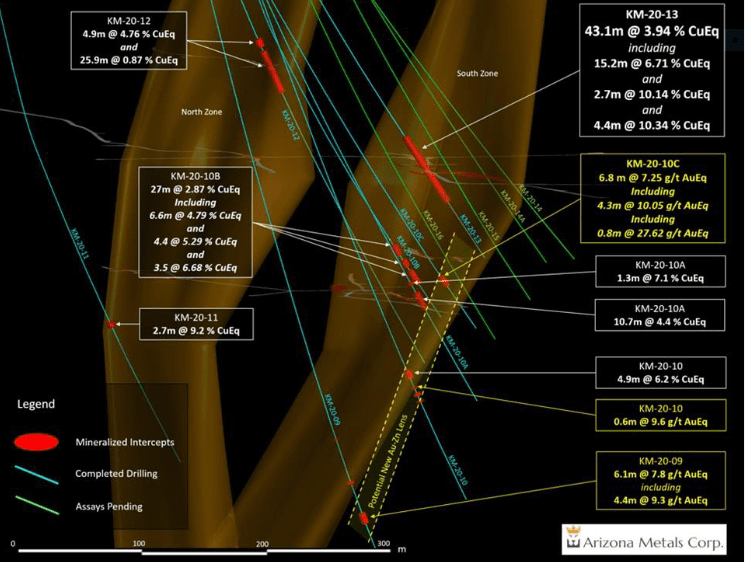

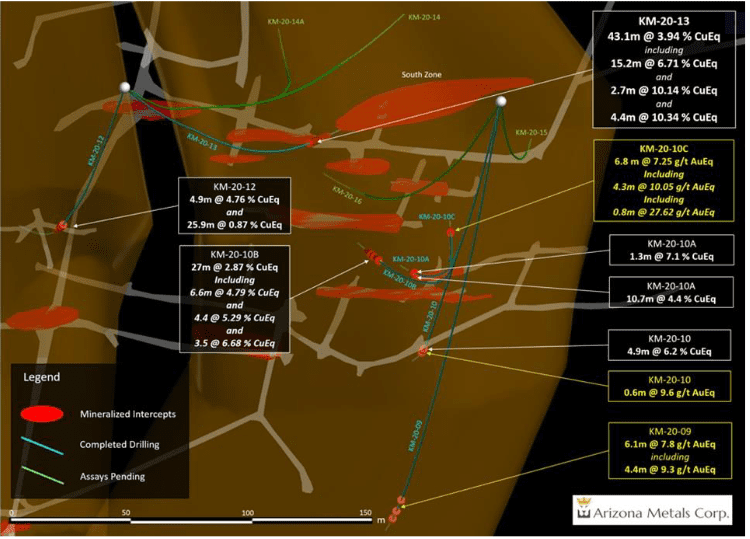

Hole KM-20-13—43.1 meters grading 3.94% CuEq (incl. 15.2m of 6.7% CuEq)—was the first welcome indication that they tagged a fat high-grade fold hinge in the South Zone. This adds validity to the geological model that Kay is a steeply dipping VMS Au-Cu-Zn deposit with isoclinal tight folds.

Interestingly, holes KM-20-09, KM-20-10, and KM-20-10C tagged mineralization outside the historic resource block on the southern edge of the South Zone. This could be a new lens (yellow dotted line – above map):

- KM-20-09 – 6.1 meters grading 7.8 g/t AuEq (including 4.4 meters of 9.3 g/t AuEq and 1.1 meters of 16.0 g/t AuEq) from a depth of 575 meters;

- KM-20-10 – 4.9 meters grading 6.24% CuEq (including 3.0 meters of 7.78% CuEq and 1.2 meters of 5.33% CuEq) from 563.6 meters depth;

- KM-20-10 also tagged slighter deeper intervals of mineralization including 0.6 meters grading 10.09% CuEq, 1.6 meters grading 3.09% CuEq, and 0.8 meters grading 2.42% CuEq beginning at a depth of 574.2 meters;

- KM-20-10C – 6.8 meters grading 7.3 g/t AuEq (including 4.3 meters of 10.1 g/t AuEq and 0.8 meters of 27.6 g/t AuEq) from a depth of 422 meters.

Note the elevated gold values in holes 9 and 10C. This change in mineralization (rich in zinc and gold), is typical of a VMS deposit—the closer to the heat source, the richer the copper values. The further away you travel from the heat, the richer the gold-zinc values.

Hole KM-20-15—3.3 meters grading 11.3% ZnEq from a depth of 402 meters—is also outside the main resource block but represents a bigger step out of roughly 30 meters to the south.

The high-grade values highlighted in the above chart, both within and outside the historic resource block, represents zone and resource expansion. Translation: more tonnes, more copper, more gold, etc.

The next phase of drilling

Finding another Kay—a new VMS lens— is the prime objective for this next round of drilling.

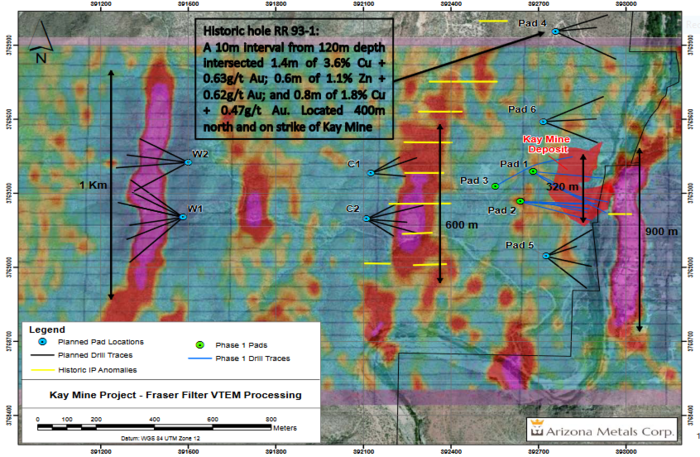

Last year the company completed a heli VTEM (electromagnetic) survey and discovered two key conductors to the west of the Kay Mine.

These geophysical anomalies correlate well with a recent geochemical (soil) survey that was performed right on top of these conductors.

Note the drill pad locations for this next round of drilling (both maps).

Good (stackable) science led to the delineation of two distinct, high-priority targets within one kilometer of Kay: the Central Target and the Western Target.

An aggressive phase two drilling campaign of up to 11,000 meters, in 29 holes, is set to commence in the coming weeks.

High-Priority targets in the crosshairs

North of Kay

A historic drill hole (RR93-1) located 400 meters north of the Kay resource tagged a 10-meter interval which included 1. 4 meters of 3. 6%Cu + 0. 63g/t Au; 0. 6 meters of 1. 1% Zn + 0. 62g/t Au; and 0. 8 meters of 1.8% Cu + 0.47g/t Au.

Six holes, 500 meters to the north and along strike of the Kay deposit, are planned for this Phase 2 campaign.

South of Kay

Coincident geophysical and geochemical anomalies extend 300 meters to the south of the Kay deposit. No historic drilling has been conducted in this area. Four holes are planned for this Phase 2 campaign.

The real potential to build tonnage at Kay lies in the discovery of additional VMS lenses.

The Central Target

A strong EM and coincident soil anomaly over 40 meters thick. Eight holes are planned for this Phase 2 campaign.

The Western Target

A strong EM and coincident soil anomaly over 70 meters thick. This is a fat target. Ten holes are planned for this Phase 2 campaign.

The above maps show the surface dimensions of these two high-priority drill targets.

Interestingly, historical adits, likely dating back to the 1950s, can be found at both the Central and Western target areas, a clear indication that the oldtimers suspected they were onto something there.

These areas have never been probed with a drill bit.

Permitting is currently underway for this aggressive Phase 2 drilling campaign.

The following video offers a good, albeit slightly dated overview of the Kay deposit. There’s also a good demonstration of the folding sequence that defines these isoclinal folded VMS deposits…

Sugarloaf Peak

The company’s 4 x 6 kilometer Sugarloaf Peak Gold project located in La Paz County, Arizona has a historic resource of some 1.5M ounces of gold at a grade of 0.5 g/t.

To be clear, Sugarloaf is 2nd in line in AMC’s project pipeline. The Kay Mine project takes up 90% of the 2020 exploration budget—Sugarloaf gets 10%.

This secondary status doesn’t diminish its value though. The grade may not be sexy, but the mineralization is near surface—from 0 to 70 meters depth. The exploration upside, as defined by geophysics, is open along strike for one kilometer to the southeast, and one kilometer to the northeast (above map).

The key to the success here will be a low strip ratio and high recovery rates. Initial metallurgical testing (bottle roll) by Kinross (K.T) and Agnico (AEM.T) in 2009 and 2013 respectively, achieved gold recoveries of up to 73% (in line with heap-leach mines currently in operation).

The company recently completed a 1,700-meter drilling program at Sugarloaf in four holes. It’ll likely take another 30k meters of drilling to bump these 1.5 million ounces into 43-101 compliant categories. At the same time, the global resource at Sugarloaf could increase markedly.

On August 11th, assays were released for hole #1—137 meters of 0.53 g/t gold from surface, including 99 meters of 0.62 g/t Au, and 30 meters of 0.90 g/t Au. From 179.7 meters to 218.5 meters, the same hole also intersected 38.8 meters of 0.32 g/t gold. The hole ended in mineralization.

Holes 1 and 2 were infill holes that will also undergo bottle-roll and column testing to determine gold recoveries by leaching. Assays are pending for hole #2.

Holes 3 and 4 were extended to depths of 572 meters and 581 meters respectively, to probe a large untested geophysical target that the company believes has the potential to host a higher grade feeder zone—the source of the disseminated mineralization identified at surface (hole #2 was also extended to test this geophysical anomaly).

Assays are pending for holes 3 and 4.

We may see a spin-out of the Sugarloaf Peak project in the coming months. Details pending.

A look under the hood

The company’s cap structure shows roughly $5M in cash, 63.8 million shares outstanding (86.5M f/d).

Of the 12M warrants on the books, 6.8M warrants are currently ITM (in-the-money) at $0.51 and represent an additional $3.5M injection into company coffers if/when exercised (the remaining warrants have a strike of $0.85, good until November 29, 2021).

Always a positive indicator when shortlisting companies in the junior exploration arena… management and insiders hold 25% of AMCs common shares.

The structure is tight.

Final thoughts

The company’s recent success with the drill bit is geological sleuthing at its very best.

The two geophysical anomalies at the Kay Mine project, should the company hit during the upcoming drilling campaign, could really move the needle for this play.

The goal at the Kay Mine project is achieving scale.

If the company can delineate, say, 20-plus million tonnes of Au-Cu rich material… this could turn into a serious home run for the company, and its shareholders.

END

—Greg Nolan

Please note: The historic estimates at the Sugarloaf Peak Property and Kay Mine were reported by Westworld Resources (1983) and Exxon Minerals (1982), respectively. The historic estimates have not been verified as current mineral resources. None of the key assumptions, parameters, and methods used to prepare the historic estimates were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a Qualified Person before the historic estimates can be verified and upgraded to current mineral resources. A Qualified Person has not done sufficient work to classify them as current mineral resources, and Arizona Metals is not treating the historic estimates as current mineral resources.

Full disclosure: Arizona Metals is an Equity Guru marketing client.

Leave a Reply