Last Mile Holdings (MILE.V) is a new U.S. micro-mobility ride-share company focusing on university campuses and small to midsize municipalities.

Since many U.S. universities are shuttered, and the core of the business involves sharing e-bikes and scooters, you could forgive MILE if it decided to hunker down, warehouse the inventory and wait (pray) for the current pandemic to pass.

But that’s not what’s happening.

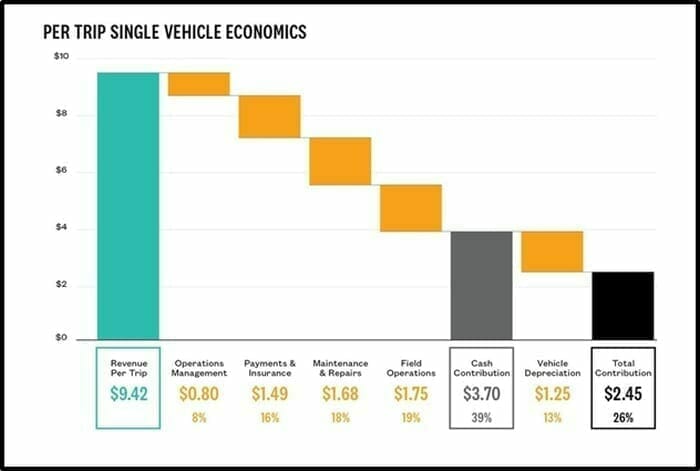

“In the first five months of 2020 Gotcha has driven industry-leading and month-by-month improved single vehicle unit economics,” stated Last Mile three months ago.

With an average profit of $2.45 per trip, Gotcha’s results year-to-date represent a nearly 93% premium when compared to the latest publicly available data for its peers.

Note: more on the financials later.

On October 5, 2020 Last Mile announced Q4, 2020 plans to launch 2,500 new e-bikes, 1,000 new e-scooters and 400 cruisers across 10 cities and four universities in the United States via its Gotcha Mobility operating subsidiary.

Gotcha will expand and launch exclusive e-mobility systems in cities and universities throughout the remainder of 2020.

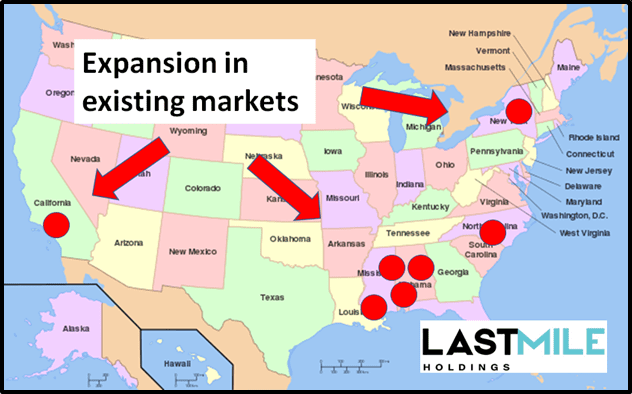

Expansion in existing markets include:

- Auburn University, AL

- Baton Rouge, LA

- Mobile, AL

- San Gabriel Valley, CA

- Syracuse, NY

- University of Alabama

- University of North Carolina at Charlotte

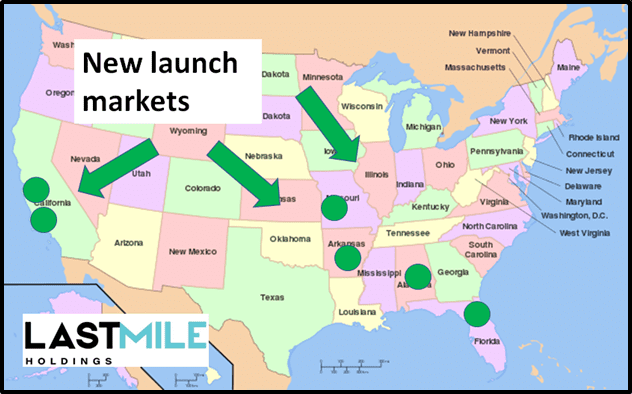

New launch markets include:

- Birmingham, AL

- Little Rock, AR

- Richmond, CA

- Sonoma and Marin Counties, CA

- Springfield, MO

- Missouri State University

- St. Augustine, FL

“Our ambitious cross-country expansion plans will allow us to materially increase the size and scope of our new and existing mobility systems, all in a highly-targeted fashion,” stated Last Mile Holdings CEO Max Smith. “Most notably, we’re looking forward to establishing a base of operations in California, which will provide us with an attractive west coast foothold to be built upon in subsequent months.”

Smith explained that the e-bikes, e-scooters and cruisers were purchased directly with funds from Last Mile’s recent financing and will be deployed in markets where it already has agreements in place, allowing it to grow quickly.

“We remain focused on driving incrementally positive unit economics in all of our markets,” added Smith, “which will ultimately allow us to achieve EBITDA profitability in the relatively near future.”

Last Mile’s next financials are expected on October 15, 2020.

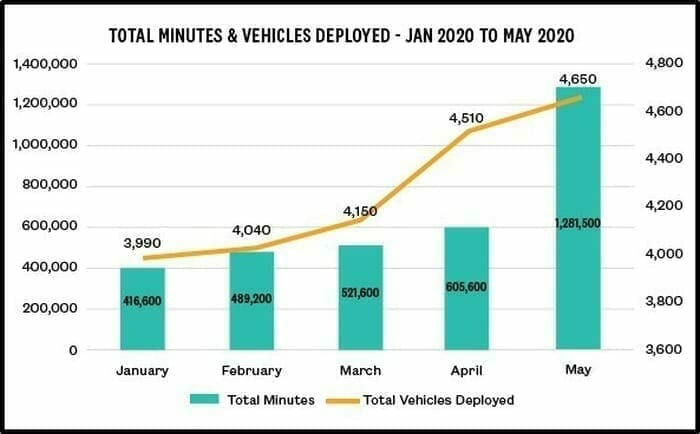

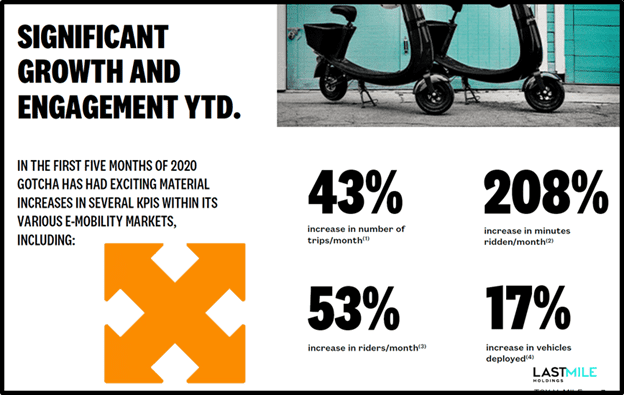

Two months ago, Last Mile provided an update on certain key performance indicators (KPIs) and new market launches.

MILE’s subsidiary, Gotcha has secured permits to deploy approximately 20,000 vehicles, 80% of which are exclusive.

With 80 combined locations, MILE is the third largest micro-mobility company by location in North America, after Lime and Bird.

Gotcha reported increases in profitability across its various end markets, driven by increases of 208% in minutes-ridden-per-month.

Young companies have the advantage of low baseline revenues to improve upon. That said – Last Mile’s ridership surge is a counter-example to the diminishing returns of other ride share companies.

“Scooter-sharing service Lime is considering further cuts to its workforce in the U.S. as sales and scooter trips plummeted with the coronavirus pandemic,” reported Bloomberg on March 21, 2020.

“As recently as January, Lime had about $50 million of cash,” reported Bloomberg, “But with a monthly burn rate of about $22.5 million,” Lime is under financial pressure.

August 4, 2020 highlights:

- Launched micromobility systems in Galveston, Texas (e-scooters and cruisers), South El Monte, California (e-bikes), St. Clair Shores, Michigan. (e-scooters)

- Consistent revenue driven by high ridership in key markets, such as: Memphis, Tennessee (cruisers); Baton Rouge, Louisiana. (e-bikes); and Charleston, S.C. (pedal bikes).

- After a contract renewal, Gotcha is relaunching its exclusive e-scooter program at Michigan State University in early August as students return for the fall semester.

- Average ride times have remained at consistent levels since early May and continue to represent significant increases across the board from pre-COVID-19 pandemic averages.

- Outperformance within the higher margin cruiser and scooter products in the summer months contributing to attractive unit economic profile.

- In early August, Gotcha surpassed 86,000 unique riders across its multimodal fleet and has logged more than 260,000 trips year to date.

On July 30, 2020 Last Mile announced amended the terms of a previously announced Private Placement, for proceeds of up to $7 million – priced at CND $0.075 per Unit.

“This financing enables us to effectively double our outstanding vehicles for deployment from 4,000 to 8,000,” stated MILE CEO Max Smith, “fueling the increased demand we’re seeing in many of our markets.”

In this pt.1 Last Mile Podcast, Equity Guru’s Guy Bennett talked to Last Mile CEO Max Smith about the importance of “exclusive contracts”, the company’s prestigious seed investors – and how innovative technologies create new revenue streams.

In this p.2 Last Mile Podcast, Mr. Bennett talks to Mr. Smith about insurance, app functionality, retail partnerships, manufacturing, expansion capital and 2020 milestones. “The Service today is to move people,” explains Smith, “The service tomorrow is a lot more.”

“MILE is expanding existing mobility fleets in markets like Baton Rouge,” stated the October 5, 2020 press release, “Where demand for Gotcha’s services has risen significantly, and working alongside university and municipal partners to implement new, exclusive systems”.

Several of the Last Mile’s newer systems will qualify for private and federal subsidies per regional regulations and incentives.

Last Mile is “focused on ensuring each of its markets are profitable and meeting or exceeding utilization goals,” stated CEO Smith.

– Lukas Kane

Full Disclosure: Last Mile is an Equity Guru marketing client.

Leave a Reply