On October 19, 2020 Harborside (HBOR.C) announced that it has reached a definitive agreement to acquire 50.1% of FGW Haight – a California co. that has the “conditional-use approval” to operate a cannabis dispensary and related businesses in the iconic Haight Ashbury area of San Francisco, Calif.

There’s many a slip twist cup and lip, but this approval pushes the SF dispensary aggressively along the development route to a cash-generating retail business.

To gain conditional use approval, FGW Haight submitted these documents to the City of San Francisco:

- Two copies of Plan Set Drawings which meet the Plan Submittal Guidelines and provide all information needed to certify a project as compliant with the Planning Code13.

- An Authorization Letter from the Office of Cannabis.

- An Authorization Letter from the Property Owner.

- Pre-Application Meeting materials.

- A Projection Application form.

- A CUA Supplemental form.

- Current and historic Photographs of the property and space.

California is the closest thing we have to a “mature cannabis industry”.

Medical cannabis has been legal in CA since 1996, and recreational has been legal since late 2016.

Borrowing from Napa Valley, California’s new “appellations law”, Senate Bill 67, affords outdoor marijuana growers the right, “to establish reputations for quality and distinct characteristics of products from specific regions.”

In San Francisco, “cannabis Retailers and Medical Cannabis Retailers may not be located within a 600-foot radius of any parcel containing an existing public or private K-12 School.”

“Cannabis Retailers and Medical Cannabis Retailers also may not be located within a 600-foot radius of any parcel containing another Cannabis Retailer or Medical Cannabis Dispensary”.

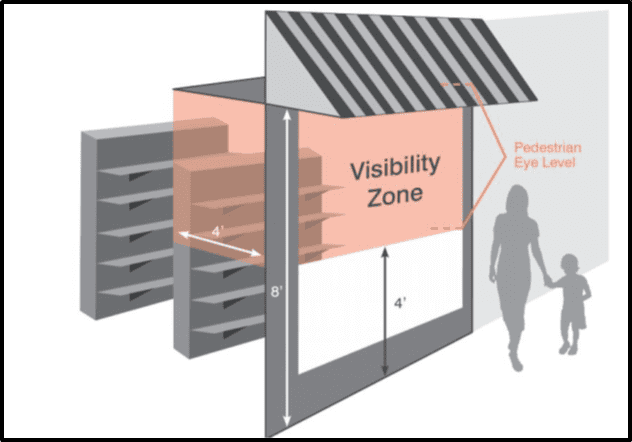

Another part of the code ensures that children do not have a direct sight line into the interior of the retail cannabis outlet.

The acquisition of FGW Haight, “expands Harborside’s footprint in the state of California, solidifying a strong presence in the historical and culturally-significant Haight-Ashbury district of San Francisco”.

“We’re thrilled to be bringing Harborside’s reputation for high-quality products and excellent retail experiences to the iconic Haight-Ashbury district,” stated Peter Bilodeau, Chairman and Interim CEO of Harborside. “Upon completion of the acquisition, build-out and receipt of all necessary approvals, our latest retail location will seamlessly blend elevated, contemporary-industrial architecture with the best-in-class service and unbeatable product selection that Harborside has become famous for.”

Harborside will pay USD $2,179,350 (subject to purchase price adjustments) based on a post build-out and proforma working capital enterprise value of USD $4,350,000.

The Purchase Price will be comprised of:

(a) USD $1,265,000 as consideration for convertible notes of FGW entitling the Company to such number of underlying Shares equal to 29.1% of the Shares

(b) the balance of the Purchase Price in multiple voting shares (“MVS”) valued at CAD $125 per MVS as consideration to certain selling shareholders of FGW for 21% of the issued and outstanding Shares.

Harborside has also agreed to purchase an additional 29.9% of the issued and outstanding Shares to get to an 80% ownership of FGW, subject to regulatory approvals.

The aggregate purchase price for these additional shares will be USD $1,300,650, which will be satisfied in MVS valued at the greater of: (i) the 30 day VWAP of the subordinate voting shares of the Company on the Canadian Securities Exchange (“CSE”) at the time of issuance less a discount multiplied by 100; (ii) C$150 per MVS; or (iii) such other price as may be approved by the CSE .

Lastly, Harborside will have a right of first refusal to purchase, in its discretion, in whole or in part and in one or more closings, the remaining 20% of the remaining shares, subject to regulatory approvals.

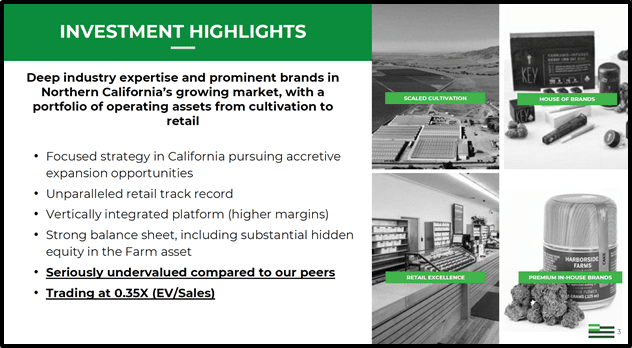

HBOR is a $34 million company that operates three big dispensaries in the San Francisco Bay Area (FGW Haight would be the 4th) a dispensary in the Palm Springs, a dispensary in Oregon and a cultivation/production facility in Salinas, California.

Harborside generated Q2, 2020 net retail revenue of $10.9 million and net wholesale revenue of approximately $5.2 million, for total gross revenue of $16.1 million in Q2 2020, compared to $12.5 million in Q2 2019, a 28.8% increase year-over-year.

The 142% year-over-year increase in wholesale revenues was driven by improved harvest yields and higher average prices per pound at HBOR’s Salinas Farm.

Last quarter’s gross revenue was 73% of the company’s current market cap.

In 2019, the global cannabis market was $14.9 billion. California accounted for $3.1 billion in legal cannabis sales. Illegal cannabis in CA is estimated at $6 billion.

According to the LA Times, licensed cannabis sales in California are projected to total US$7.2 billion by 2024.

The announced October 19, 2020 acquisition of FGW Haight is subject to “certain material closing conditions, including approvals from regulatory authorities and the CSE”.

There can be no assurance that the transaction will be completed on the current terms or at all.

As of June 30, 2020, Harborside had about $13.6 million in cash.

- Lukas Kane

Full Disclosure: Harborside is an Equity Guru marketing client

Leave a Reply