On October 29, 2020 Freeman Gold (FMAN.C) provided an exploration update for its 100% owned Lemhi Gold Project, located in Idaho, USA.

Freeman Gold’s flagship property comprises 30 square kilometers of highly prospective land.

The mineralization at the Lemhi Project consists of shallow, near surface primarily oxide gold mineralization that has seen over 355 drill holes but remains open at depth and along strike.

FMAN is working towards de-risking the asset and producing a maiden NI 43-101 compliant resource estimate based on brownfield and greenfield exploration.

Objectives of Phase 1 5,000 metre, 33 priority hole diamond drill program:

- Twin certain holes,

- Complete infill drilling along sections,

- Allow interpretation of the mineralization and structural controls,

- Complete initial bench scale metallurgy,

- Complete a maiden NI 43-101 compliant resource estimate.

Should these five objectives be achieved, it is reasonable to anticipate that Freeman Gold will experience a significant upward re-rating.

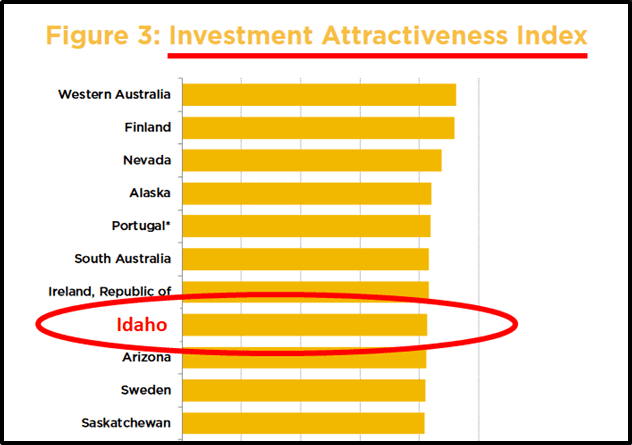

“According to the esteemed Fraser Institute, in its most recent “investment attractiveness” survey, Idaho is ranked in the top ten global jurisdictions when it comes to kicking rocks and digging desirable minerals outta the ground,” reported Equity Guru’s Greg Nolan on September 24, 2020.

A good mining jurisdiction is a significant investment de-risker. Support by local governments often flows from generational familiarity with the mining industry.

Anecdotally – if you’re doing boots-on-the-ground research – make a bee-line from the exploration camp to the local watering hole. If there’s old chap perched on stool yapping about his Grandfather hauling up buckets of mineralized ore with a windlass – that’s a good omen.

“The Boise Basin rush in southern Idaho was the largest since the California Gold Rush of 1849, and by 1864 Idaho City would become the largest city in the Pacific Northwest,” reports Western Mining History.

“Reports from the Fall of 1862 put the average value at $18 a pan, with some lucky miners taking as much as $80 per pan out of their claims.

“You could not buy any of our claims for $3,000 down, and as for mine, I would not sell for any price,” stated Miner William Pollock in the 1800s, “as I think all the money I want is in the claim.”

“NOW, more than ever, it makes sense shortlisting only those companies operating in the friendliest of mining jurisdictions,” confirmed Nolan.

“There’s always a risk in mining, no matter how friendly the jurisdiction. But taking a close look at the Lemhi project and the surrounding terrain, there are no environmental or social issues that stand out—there are no fish-bearing streams, rivers, or lakes in the region.

The project is fairly isolated—there are no communities in the immediate vicinity. And the nearby towns—Salmon, Gibbonsville, North Fork—are supportive of the mining industry.

Bottom line: permitting the project should be a walk in the park” – End of Nolan.

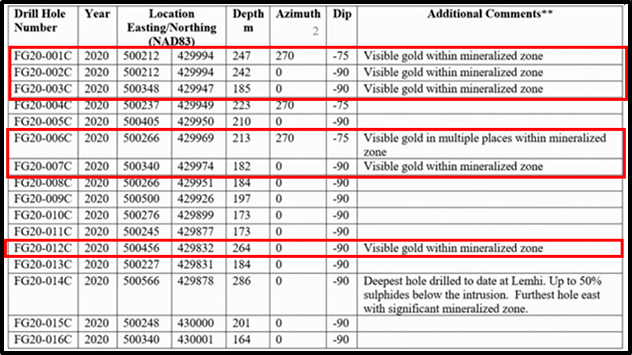

“Two diamond drill rigs are currently operating around the clock at Lemhi, with 16 cored drill holes totaling 3,328 meters completed to date (see Table 1 below),” reports FMAN.

“The on-going drilling campaign has confirmed the presence of extensive gold mineralized horizons first established by historical exploration conducted between 1984 and 2013.

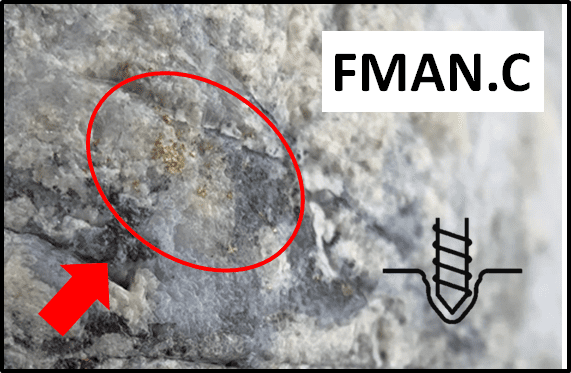

Detailed geological logging of recovered core has noted multiple occurrences of visible gold from 5 holes drilled within the 30 square kilometer property.

All drill holes to date have intersected mineralized zones of varying thickness as interpreted from historic drilling and drill sections. Samples have been sent to ALS Minerals Division, Vancouver, BC, and results are pending”.

Table 1 – Collar data for completed Phase 1 diamond drill holes with commentary

“In addition to the on-going drill program, an extensive ground exploration program is being implemented at the Project.

To date Freeman has completed 141 rock grab and channel samples, 633 soil samples, 181 line-kilometers of ground magnetics, high resolution drone photo mosaics and a 1.4 square kilometer three-dimensional (“3D”) Induced Polarization (“IP”) survey.

All drill core, rock and soil samples are sent to ALS Minerals Division, Vancouver, BC for gold analysis.

“The potential to grow this resource into a world-class ore-body is very real,” states Equity Guru’s Greg Nolan, “Deposits of this type are often part of a much larger mineralized system”.

“The deposit is open in multiple directions, including at depth where high-grade feeder zones may come into play.

Highlights from historical drilling include:

- 193.55 meters grading 1.8 g/t Au

- 179.83 meters grading 1.81 g/t Au

- 13.72 meters grading 15.19 g/t Au

- 59.44 meters grading 3.55 g/t Au

- 54.96 meters grading 4.28 g/t Au

- 152.86 meters grading 1.06 g/t Au

- 149.35 meters grading 1.06 g/t Au

- 143.26 meters grading 1.09 g/t Au

These historical values are extraordinary.

If the company is successful in tagging similar broad intervals of one-gram-plus material outside the main resource base, the ounces will begin piling up in a big way.

Importantly, much of Lemhi’s 30 square kilometers has seen little in the way of (modern) exploration.” – End of Nolan.

“Our Phase 1 drill campaign is successfully underway and is confirming our understanding of the mineralization and geology of the Lemhi Gold Project,” stated Will Randall, President & CEO of FMAN.

“Results have so far matched historical logs closely,” continued Randall, “Multiple flat lying, high grade zones, often containing visible gold, are stacked and may constitute a bulk tonnage target.”

- Lukas Kane

Full Disclosure: Freeman Gold is an Equity Guru marketing client.

Leave a Reply