When conducting due diligence on a prospective company in the junior exploration arena, the crew behind the enterprise needs to be examined with great rigor.

I can’t stress this enough.

Again, at the risk of sounding like a stuck record… you can have a great project, but without the right team in place, shareholder-value-creation is often compromised.

Let’s face it, management is everything in this arena (okay, nearly everything). You can have a great, company-maker of a project in the friendliest jurisdiction, but without the right crew—a combination of gifted rock kickers and savvy business types— things can fly apart at the seams. And fast.

Operational inefficiencies often create a processional effect that can lead to an erosion in shareholder value via reckless spending and an endless cycle of heavily dilutive raises (PPs).

Moving along…

Two strategic deposits—Two strategic hires

Arizona Metals (AMC.V)

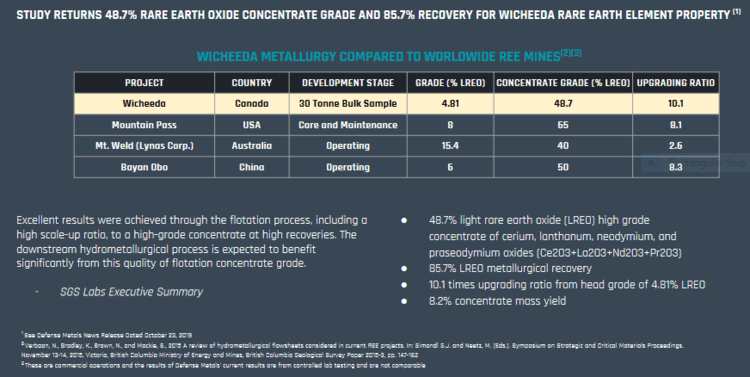

AMC is exploring its flagship Kay Mine project, located in a prolific mining district in Arizona, host to 60 past-producing underground Cu-Au-Zn VMS mines, all within a 150-kilometer radius of this flagship asset.

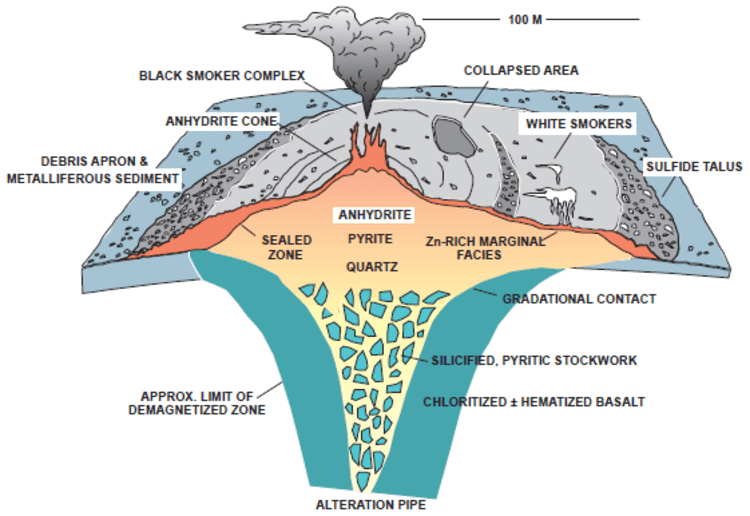

The Kay Mine is a volcanogenic massive sulphide (VMS) deposit, and for those who know their rocks, where there’s one deposit (or lens), there are almost always others.

And these polymetallic lenses, though often modest in size, can hold huge concentrations of metals due to their rich nature.

This VMS district is credited with ~4 billion pounds of copper production over its century-long run. The average grade was 3.5%.

The past-producing United Verde Mine was a real standout in the neighborhood having produced 30Mt at a grade of 5% Cu via open pit. The mine also produced 3.5Mt at 10% Cu from underground. This underground portion also carried significant gold and silver credits—roughly 1.3 g/t Au and 55 g/t Ag.

The historic resource

The historic resource

In the early 1980s, Exxon Minerals delineated 5.8 million tonnes grading 2.2% Cu, 3.03% Zn, 55 g/t Ag, and importantly… 2.8 g/t Au for a CuEq grade of 5.8%.

Without taking into account recovery rates, the precious metals component of this historic resource represents 52% of the total contained metals.

As per an in-depth piece published here on October 5th—Arizona Metals (AMC.V) homes in on gold-copper-rich VMS targets in mining-friendly Arizona—the following excerpt adds another layer to this compelling story…

The geological model at Kay is that of an isoclinal folded VMS deposit.

The analog here might be the uber-rich VMS deposits that straddle the provinces of Ontario and Quebec, along the prolific Abitibi Greenstone Belt. The world-class Kidd Creek mine in the Timmins Camp and the Horne mine in Rouyn-Noranda (Quebec), come to mind.

Previous Kay operator, Exxon Minerals, reported 18 vertically stacked lenses that range from 5 meters to 25 meters in thickness.

Exxon reported that Kay’s tightly folded hinges within these lenses demonstrate superior grades and widths (the video linked further down the page demonstrates this folding sequence).

One of the objectives of currently drilling is to delineate these unique (high-grade) geological features and grow Kay beyond its current 5.8M tonnes.

The Kay deposit starts at a depth of 120 meters. The company believes mineralization extends to depths greater than one kilometer.

Previous operators sunk roughly US$75M into Kay (a ‘today’s dollars’ estimate).

This historic work included 5,000 meters of underground drilling, two access shafts driven down to 450 meters, and 4,600 meters of underground drifts.

The real kicker here is the exploration upside. It’s substantial.

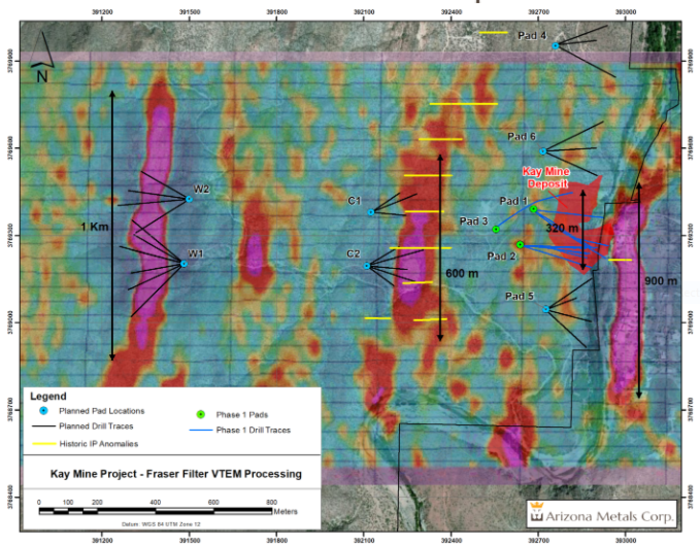

According to a Nov. 9th press release, permitting is currently underway to test high-priority targets on strike 500 meters to the north, and 300 meters to the south.

The Company also has the previously undrilled Central and Western targets in its crosshairs.

This Phase 2 drilling campaign is an aggressive push along the curve—up to 11,000 meters in 29 core holes.

The following map shows the proposed drill plan for this upcoming campaign…

That’s the skinny on Arizona Metals.

Today (December 2nd, 2020), the Company announced a strategic hire:

Arizona Metals Corp Appoints Michael Gentile, CFA as Strategic Advisor

Here, the Company appointed one Michael Gentile as Strategic Advisor.

Gentile and Arizona Metals will work to create shareholder value through the exploration and development of the Kay Mine project.

As per this Dec. 2nd press release…

From 2003 to 2018 he worked as a professional money manager at Formula Growth Ltd., an independent investment management firm established in Montreal in 1960 with a long-term track record of creating investor wealth. While at Formula Growth, Mr. Gentile’s main sector focuses were in mining and natural resources. In 2012 he became the co-manager, with his partner Charles Haggar, of the Formula Growth Alpha Fund, a market neutral hedge fund focused on small to mid-cap equities. From 2012 to 2018 the Formula Growth Alpha fund became one of the most successful market neutral funds in Canada, growing its AUM from $ 15 million to over $ 650 million by the end of 2018.

While at Formula Growth, Michael was an early-stage investor in very successful mining and natural resource investments returning multiples of their original investments for their investors. In October 2018, Mr. Gentile retired from full time money management in order to be able to spend more time with his family. Subsequently, he has remained a very active investor in the mining space owning significant top 5 stakes in over 10 several small cap-mining companies. Michael is currently one of the largest shareholders and a strategic advisor of Radisson Mining Resources (RDS-V) since May 2019. In addition, Michael is the largest shareholder and has been a board member of Northern Superior Resources (SUP-V) since December 2019. He has been a director and major shareholder of Roscan Gold (ROS-V) since January 2020, and of Solstice Gold (SGC-V) since June 2020. Michael is currently one of Arizona Metal’s largest individual shareholders owning over 5 million shares of the company.

Marc Pais, Arizona Metals President & CEO:

“We are thrilled to have Michael on board as a strategic advisor to help more investors discover this exciting investment opportunity and also help Arizona Metals move the Kay Mine project forward. The upcoming Phase 2 drill program will target expanding the size of the Kay Mine deposit, and also discovering additional deposits on our claims; 2021 is shaping up to have the potential to be a transformational year for Arizona Metals.”

For a deeper delve into the Arizona Metals story, hit the following link…

Arizona Metals (AMC.V) homes in on gold-copper-rich VMS targets in mining-friendly Arizona

Defense Metals (DEFN.V)

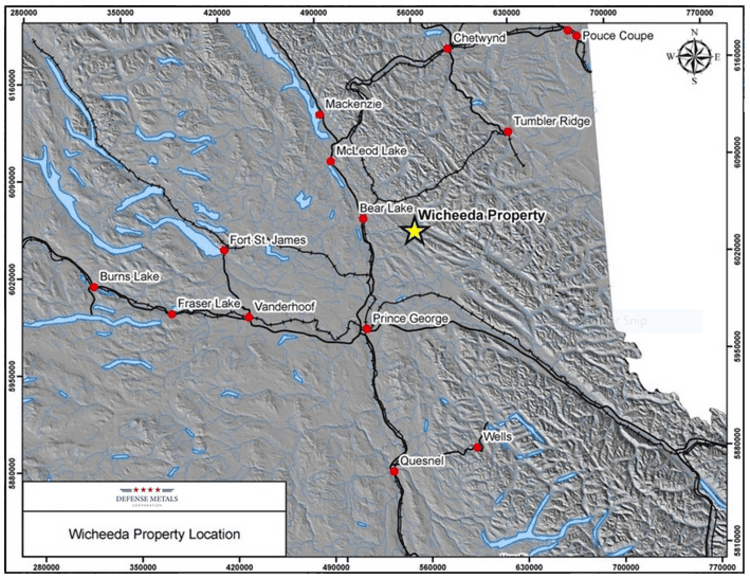

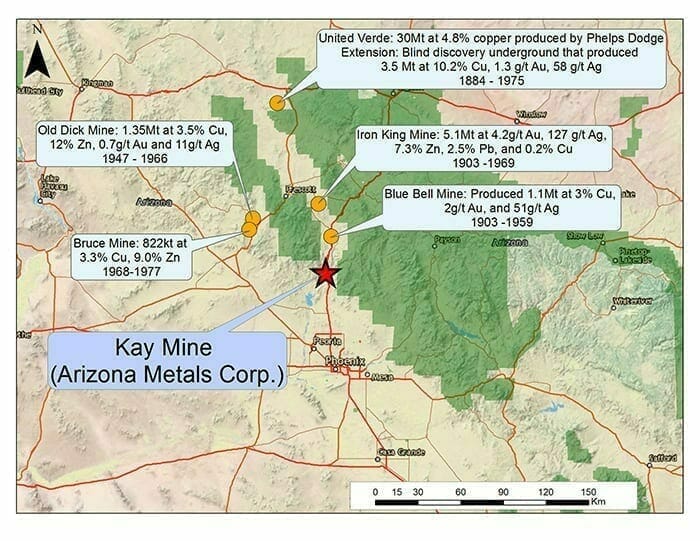

DEFN is pushing its wholly-owned Wicheeda REE project further along the development curve.

This 1,708-hectare chunk of REE-rich terra firma is located in the mining-friendly region of Prince George, B.C.

This road accessible project is within easy reach of all the necessary infrastructure required to develop a mineral deposit—H2O, hydroelectric power, gas pipelines, and a well traveled railway line.

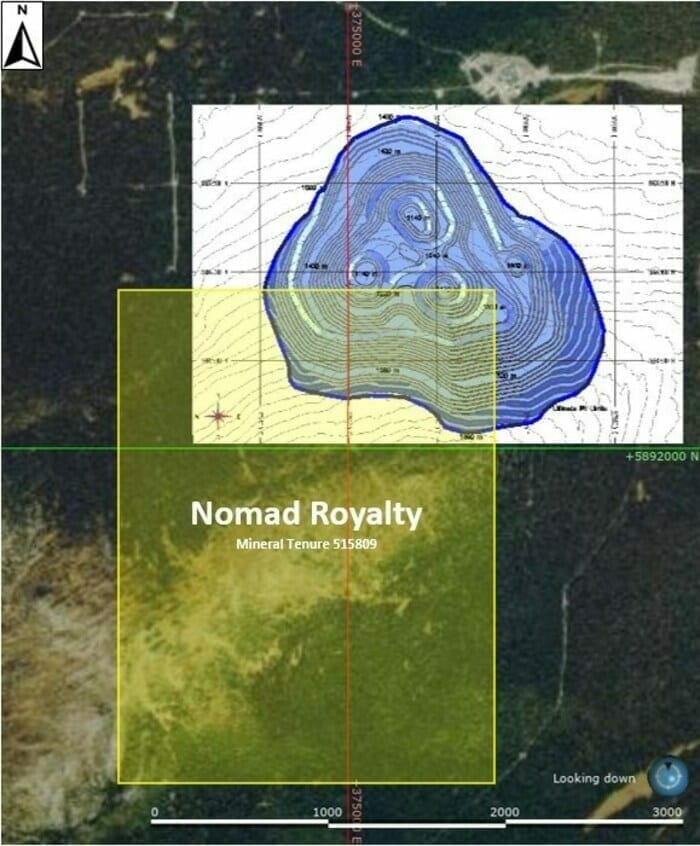

The Whicheeda property holds a high-grade REE resource in its subsurface stratum…

4,890,000 tonnes averaging 3.02% LREO (Light Rare Earth Oxide) in the Indicated category, and 12,100,000 tonnes averaging 2.90% LREO counted as Inferred.

Everything appears to be lining up for this highly strategic REE deposit. Note the grades / widths and the mineralization tagged beyond the current resource base (gray rubber ducky image – above map).

The metallurgy looks good. Great, actually.

The Company has demonstrated positive results at a pilot (flotation) plant level. This, in conjunction with SGS Canada’s metallurgical test facility in Lakefield, Ontario.

And the underlying fundamentals supporting firmer REE prices really couldn’t be better.

The following interview with CEO Craig Taylor lays it all out…

Today (December 2nd 2020), the Company announced a strategic hire:

Defense Metals appoints Jamie Spratt as strategic advisor

Here, Defense announced the appointment of Jamie Spratt as a Strategic Advisor.

Mr. Spratt is Principal at Walmsley Capital Inc., a focused mining corporate finance and advisory business that he founded in 2019. Over the past 14 years, Jamie has developed extensive mining capital markets and investment sector experience. He has built a strong reputation as an analyst and advisor having built deep partnerships with mining CEOs and institutional investors. Jamie was a Partner and Equity Research Analyst at Clarus Securities Inc., a small and mid capitalization focused boutique investment bank for 10 years, where he was instrumental in building one of the leading mining practices in Canada.

Based on his track record, Jamie became a highly rated mining analyst and attracted top institutional investors to many of his investment ideas. Jamie started his career in investment banking at an independent investment bank where he advised on M&A, merchant banking and corporate finance mandates primarily in the metals and mining sector and achieved valuable transaction experience. He has an MBA from the Rotman School of Management, a B.A. in Applied Economics from Queen’s University and a CFA Charterholder. He is also a registered dealing representative at Belco Private Capital Inc., an exempt market dealer.

CEO Taylor:

“Mr. Spratt brings a wealth of corporate finance, capital markets, and M&A experience to bear on Defense Metals efforts to advance the Wicheeda REE Deposit. We look forward to Mr. Spratt’s contributions in light of sustained upward price pressures on critical magnet metals, principally neodymium and praseodymium. Over the past six months we have seen an 80% increase in neodymium oxide spot prices from approximately USD$40/kg in early June to most recently USD$72/kg as of December 1, 20201. Defense Metals believes these price increases represent real future demand trends triggered as a result of the beginning of a fundamental shift towards the green energy-electric vehicle sector”

END

—Greg Nolan

Full disclosure:Arizona Metals and Defense Metals are Equity Guru marketing clients.

Leave a Reply